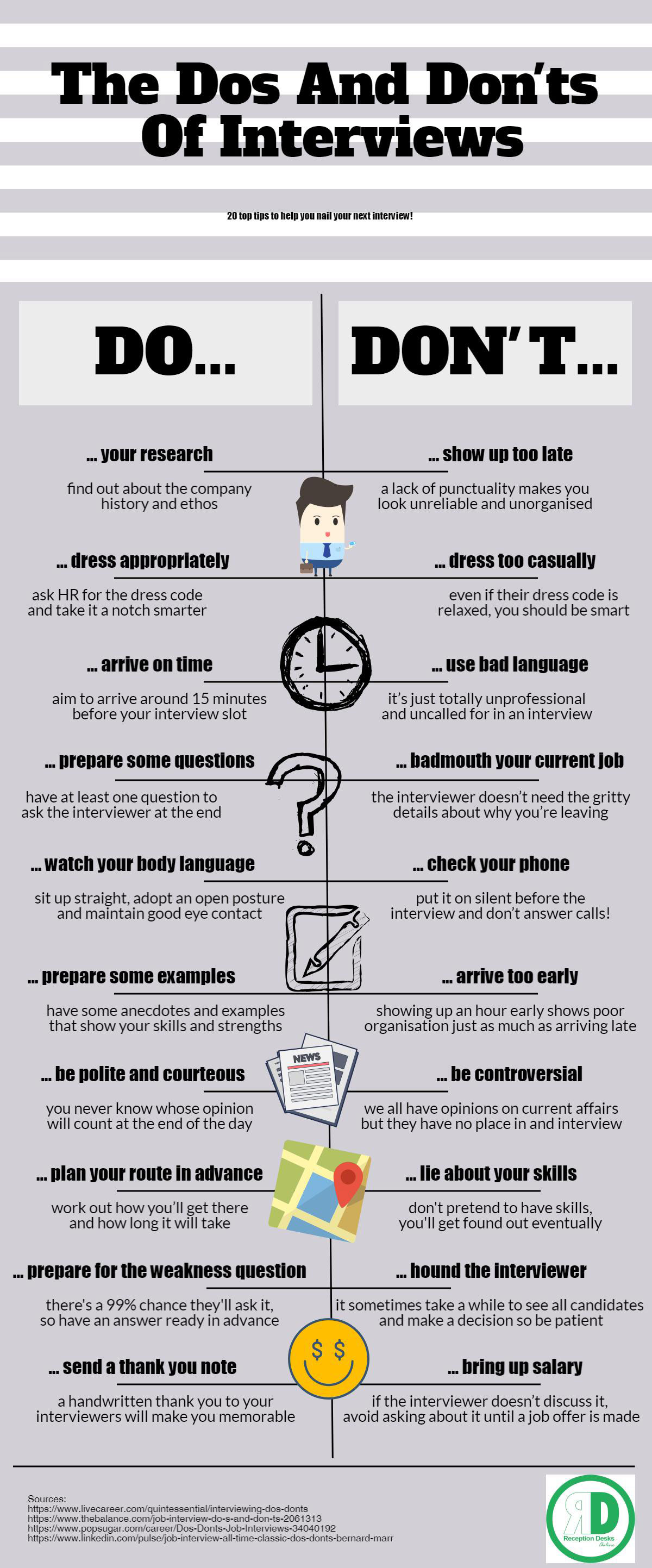

Navigate The Private Credit Boom: 5 Essential Dos And Don'ts For Job Seekers

Table of Contents

<p>The private credit market is booming, creating a surge in demand for skilled professionals. Landing a job in this lucrative and rapidly expanding sector requires careful navigation. This article outlines five essential dos and don'ts to help job seekers successfully navigate the competitive landscape of private credit jobs and secure their dream role.</p>

<h2>DO Research the Private Credit Landscape Thoroughly</h2>

<h3>Understand the Different Sectors</h3>

<p>Private credit encompasses various specializations, each offering unique career paths. Understanding these nuances is crucial for targeting your job search effectively. The field isn't monolithic; it's a diverse ecosystem with opportunities for various skill sets.</p>

<ul> <li><strong>Identify your area of interest:</strong> Do you gravitate towards distressed debt, the intricacies of real estate finance, or the complexities of mezzanine lending? Focusing your search on a specific niche increases your chances of success.</li> <li><strong>Research leading private credit firms:</strong> Familiarize yourself with the investment strategies of major players. Understanding their focus allows you to tailor your applications and highlight relevant experiences.</li> <li><strong>Understand the regulatory environment:</strong> The private credit industry is subject to specific regulations and compliance requirements. Demonstrating awareness of these factors showcases your professionalism and preparedness.</li> </ul>

<h3>Network Strategically</h3>

<p>Networking is paramount in the private credit industry. Building relationships with professionals in the field opens doors to unadvertised opportunities and invaluable insights.</p>

<ul> <li><strong>Attend industry events:</strong> Conferences and workshops focused on private credit and alternative investments provide excellent networking opportunities. Engage actively and make genuine connections.</li> <li><strong>Join professional organizations:</strong> Membership in organizations focused on finance, lending, or alternative investments expands your network and keeps you abreast of industry developments.</li> <li><strong>Leverage LinkedIn:</strong> Use LinkedIn to connect with professionals at private credit firms. Engage with their content and participate in relevant discussions.</li> </ul>

<h2>DON'T Neglect Your Financial Modeling Skills</h2>

<h3>Master Excel and Financial Modeling Software</h3>

<p>Proficiency in financial modeling is non-negotiable for most private credit jobs. Employers expect candidates to demonstrate a deep understanding of financial statements, valuation techniques, and risk assessment.</p>

<ul> <li><strong>Practice creating detailed financial models:</strong> Master discounted cash flow (DCF) analysis, leveraged buyout (LBO) models, and other relevant valuation techniques.</li> <li><strong>Highlight your modeling skills:</strong> Showcase your proficiency in Excel and any specialized financial modeling software on your resume and cover letter.</li> <li><strong>Be prepared to discuss your experience:</strong> Interviewers will likely test your modeling skills with practical questions. Be ready to explain your approach and justify your assumptions.</li> </ul>

<h3>Underestimate the Importance of Due Diligence</h3>

<p>Thorough due diligence is the cornerstone of successful private credit investing. Demonstrate your understanding of credit risk assessment and financial statement analysis to stand out from the competition.</p>

<ul> <li><strong>Demonstrate knowledge of credit metrics:</strong> Familiarize yourself with key metrics such as debt-to-equity ratio, interest coverage ratio, and leverage ratios.</li> <li><strong>Practice analyzing financial statements:</strong> Develop the ability to quickly identify key risks and opportunities within financial statements.</li> <li><strong>Be prepared to discuss your due diligence experience:</strong> Describe your approach to due diligence, highlighting your attention to detail and analytical skills.</li> </ul>

<h2>DO Tailor Your Resume and Cover Letter</h2>

<h3>Highlight Relevant Skills and Experience</h3>

<p>Generic applications rarely succeed in the competitive private credit jobs market. Tailoring your resume and cover letter to each specific application is crucial.</p>

<ul> <li><strong>Use keywords:</strong> Incorporate keywords from the job description to improve the chances of your application being noticed by Applicant Tracking Systems (ATS).</li> <li><strong>Quantify your accomplishments:</strong> Use numbers and data to demonstrate the impact of your work. "Increased efficiency by 15%" is more impactful than "Improved efficiency."</li> <li><strong>Showcase experience concisely:</strong> Present your experience in a clear and impactful manner, highlighting relevant skills and accomplishments.</li> </ul>

<h3>Showcase Your Understanding of the Target Firm</h3>

<p>Demonstrate that you've done your homework. Researching the firm's investment strategy and portfolio companies shows initiative and genuine interest.</p>

<ul> <li><strong>Demonstrate understanding of the firm's portfolio:</strong> Mention specific companies or transactions that resonate with your interests.</li> <li><strong>Highlight alignment with their strategy:</strong> Explain how your skills and experience align with the firm's investment focus and goals.</li> <li><strong>Explain your reasons for wanting to work there:</strong> Articulate why you are specifically interested in this firm and its culture.</li> </ul>

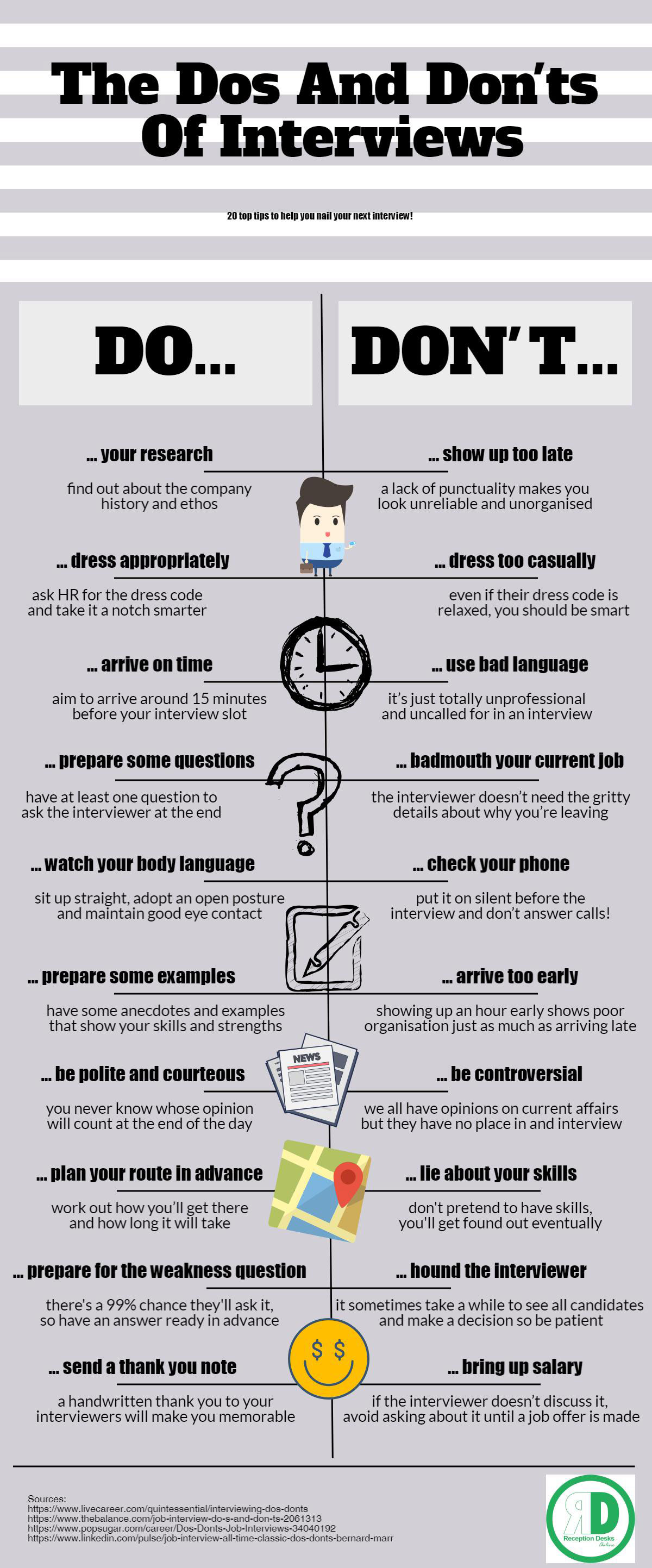

<h2>DON'T Underprepare for the Interview Process</h2>

<h3>Practice Behavioral and Technical Questions</h3>

<p>Private credit interviews assess both technical skills and cultural fit. Preparation is key to success.</p>

<ul> <li><strong>Research common interview questions:</strong> Prepare answers to typical behavioral and technical questions related to financial modeling, credit analysis, and due diligence.</li> <li><strong>Prepare examples:</strong> Use the STAR method (Situation, Task, Action, Result) to structure your answers and showcase your accomplishments.</li> <li><strong>Practice your responses:</strong> Rehearse your answers out loud to build confidence and ensure smooth delivery.</li> </ul>

<h3>Neglect Networking Before and After Interviews</h3>

<p>Networking extends beyond the initial application. Building and maintaining relationships can significantly improve your chances.</p>

<ul> <li><strong>Follow up with interviewers:</strong> Send thank-you notes and express continued interest after each interview.</li> <li><strong>Ask for feedback:</strong> Request feedback on your performance, regardless of the outcome. This valuable information can inform future applications.</li> <li><strong>Maintain your network:</strong> Continue networking even after receiving an offer. Building strong relationships is a long-term investment.</li> </ul>

<h2>DO Continuously Upskill and Stay Current</h2>

<h3>Pursue Relevant Certifications and Education</h3>

<p>The private credit market is dynamic. Continuous learning demonstrates commitment and enhances your marketability.</p>

<ul> <li><strong>Consider relevant certifications:</strong> The Chartered Financial Analyst (CFA) and Chartered Alternative Investment Analyst (CAIA) charters are highly regarded in the finance industry.</li> <li><strong>Explore online courses:</strong> Utilize online platforms to stay updated on market trends and enhance your technical skills.</li> <li><strong>Stay informed about regulatory changes:</strong> Keep abreast of changes in regulations and compliance requirements.</li> </ul>

<h3>Follow Market Trends Closely</h3>

<p>Staying informed about industry news and trends demonstrates your passion and commitment to the field.</p>

<ul> <li><strong>Read industry publications:</strong> Follow reputable financial news sources and industry publications.</li> <li><strong>Follow key influencers:</strong> Engage with thought leaders and influential figures on social media.</li> <li><strong>Attend webinars and online events:</strong> Participate in webinars and online events to stay informed about the latest developments.</li> </ul>

<h3>Conclusion</h3>

Securing a coveted position in the booming private credit job market requires a strategic and proactive approach. By following these essential dos and don'ts – including thorough research, strong financial modeling skills, tailored applications, meticulous interview preparation, and a commitment to continuous learning – job seekers can significantly increase their chances of success. Don't delay – start navigating the exciting world of private credit jobs today!

Featured Posts

-

Navigating The Trump Era The Upcoming Challenges For The Federal Reserve Chair

Apr 26, 2025

Navigating The Trump Era The Upcoming Challenges For The Federal Reserve Chair

Apr 26, 2025 -

Gambling On Tragedy Analyzing The Los Angeles Wildfire Betting Market

Apr 26, 2025

Gambling On Tragedy Analyzing The Los Angeles Wildfire Betting Market

Apr 26, 2025 -

Is Ukraines Nato Membership Doomed Trumps View

Apr 26, 2025

Is Ukraines Nato Membership Doomed Trumps View

Apr 26, 2025 -

Geopolitical Showdown A Key Military Base And The Us China Power Struggle

Apr 26, 2025

Geopolitical Showdown A Key Military Base And The Us China Power Struggle

Apr 26, 2025 -

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025