Musk's X: Debt Sale Impacts And The Company's Financial Future

Table of Contents

The Debt Sale Itself: Details and Rationale

The specifics of X's debt sale are crucial to understanding its implications. While precise figures may vary depending on the reporting source, it involved a substantial amount of capital raised through various financial instruments.

Size and terms of the debt sale:

The exact amount of debt raised, the interest rates applied, and the maturity dates are not always publicly disclosed in full detail. However, reports suggest a substantial sum borrowed to address various financial needs. The interest rates likely reflect the perceived risk associated with lending to X, potentially falling into the category of high-yield debt.

- Sources of funding: The debt was likely sourced from a mix of financial institutions, including banks and perhaps private equity firms willing to take on higher risk for potentially higher returns.

- Purpose of the debt: The funds raised were likely used for a combination of purposes, potentially including refinancing existing debt, covering operational expenses, or funding ongoing projects and initiatives. The exact allocation remains largely undisclosed.

- Market reaction to the announcement: The market's reaction to the news of the debt sale was likely varied. While some investors might have viewed it negatively, adding to the already considerable financial risk associated with the company, others may have perceived it as a necessary step to ensure short-term financial stability.

Short-Term Impacts on X's Financial Health

The immediate impact of X's debt sale is a significantly increased level of financial leverage. This has several immediate consequences.

Increased Leverage and Interest Payments:

The higher debt levels will inevitably impact key financial ratios, such as the debt-to-equity ratio. A higher debt-to-equity ratio indicates increased financial risk.

- Analysis of interest expense and its potential impact on profitability: The interest expense associated with this new debt will directly reduce X's profitability, potentially pushing the company into losses unless it can significantly increase its revenues.

- Potential strain on cash flow: Meeting the interest payments on the newly acquired debt will place a significant strain on X's cash flow, potentially limiting its ability to invest in growth opportunities or handle unexpected expenses.

- Credit rating implications: Rating agencies will likely reassess X's creditworthiness, potentially downgrading its credit rating. A lower credit rating will make it more expensive for X to borrow money in the future.

Long-Term Implications for X's Financial Future

The long-term implications of this debt sale for X are complex and uncertain, but they paint a picture of potential challenges and opportunities.

Impact on Investment and Growth Strategies:

The increased debt burden might severely constrain X's ability to pursue ambitious investment and growth strategies.

- Potential impact on innovation and new product development: Limited financial resources could stifle innovation and new product development, potentially hindering the company's ability to compete effectively in the dynamic tech landscape.

- Risk of debt default if revenue projections are not met: If X fails to meet its revenue projections, it faces a significant risk of debt default, which could lead to bankruptcy or forced restructuring.

- Attractiveness to potential investors and acquirers: The high debt levels might make X less attractive to potential investors or acquirers, potentially limiting its options for future funding or sale.

Potential for Restructuring or Refinancing:

The future may necessitate debt restructuring or refinancing to manage the debt burden more effectively.

- Scenarios of successful and unsuccessful restructuring: Successful restructuring involves renegotiating terms with creditors, possibly extending maturity dates or lowering interest rates. Unsuccessful restructuring could lead to bankruptcy.

- Impact of economic conditions on refinancing opportunities: Favorable economic conditions with low interest rates would improve refinancing opportunities, whereas adverse conditions could make it more difficult and expensive.

- Effect on shareholder value: The overall outcome of debt management strategies will directly impact shareholder value, either positively through stability or negatively through losses or bankruptcy.

Comparison to Other Tech Companies’ Debt Strategies:

Understanding X's debt strategy requires benchmarking it against other prominent tech companies.

Benchmarking X's approach to debt against other large technology companies:

Many tech giants utilize debt financing, but their approaches vary significantly. Some manage debt conservatively, while others embrace higher leverage.

- Examples of successful and unsuccessful debt management in the tech sector: Numerous case studies exist, illustrating both the benefits and pitfalls of different debt strategies. These studies highlight the crucial role of effective financial planning and risk management.

- Differences in the risk profiles of these companies: The risk profiles of these companies vary due to factors such as revenue streams, market position, and business models. X’s unique situation warrants special attention.

- Lessons learned from comparative analysis: Studying successful strategies adopted by other tech companies offers valuable insights into potential best practices for managing debt and navigating financial challenges.

Conclusion: Musk's X: Navigating the Debt Landscape

The debt sale undertaken by Musk's X presents both short-term and long-term financial implications. Increased leverage, higher interest expenses, and a potential strain on cash flow are immediate concerns. Long-term, the company faces challenges in investment, growth, and the risk of default. The success of X’s navigation of this financial landscape depends heavily on its ability to generate sufficient revenue to service its debt, maintain its credit rating, and adapt to evolving market conditions. Understanding the nuances of "Musk's X: Debt Sale Impacts" requires continued monitoring of financial news sources and X's official statements. Stay informed to gain a comprehensive understanding of this ongoing financial narrative.

Featured Posts

-

Canadian Energy Exports Southeast Asia Trade Mission Success

Apr 28, 2025

Canadian Energy Exports Southeast Asia Trade Mission Success

Apr 28, 2025 -

Silent Divorce How To Spot The Early Warning Signals

Apr 28, 2025

Silent Divorce How To Spot The Early Warning Signals

Apr 28, 2025 -

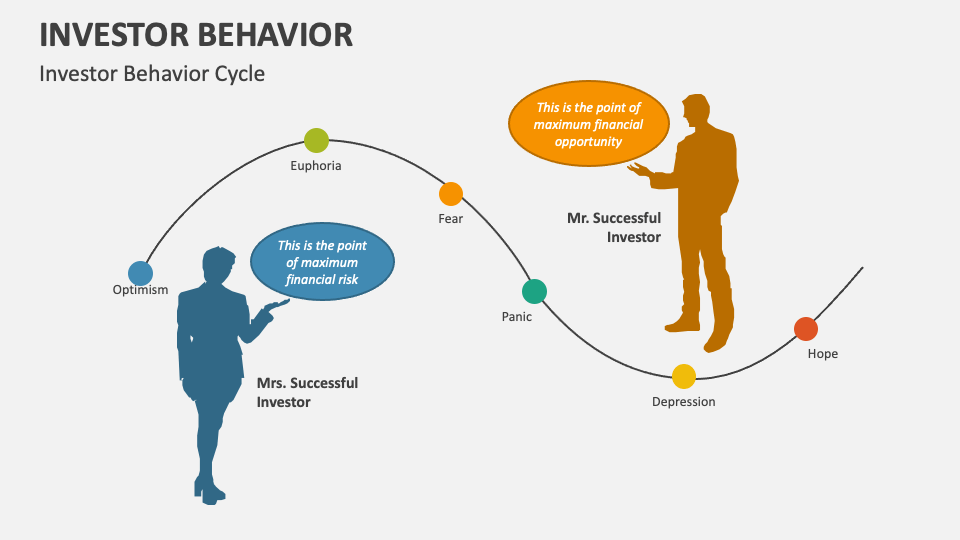

Analyzing Market Swings Professional Vs Individual Investor Behavior

Apr 28, 2025

Analyzing Market Swings Professional Vs Individual Investor Behavior

Apr 28, 2025 -

Will Aaron Judge Lead Off Boones Comments And Lineup Construction

Apr 28, 2025

Will Aaron Judge Lead Off Boones Comments And Lineup Construction

Apr 28, 2025 -

Michael Jordan And Denny Hamlin A Partnership Fueled By Criticism

Apr 28, 2025

Michael Jordan And Denny Hamlin A Partnership Fueled By Criticism

Apr 28, 2025