Microsoft-Activision Deal: FTC's Appeal And Its Implications

Table of Contents

The FTC's Case Against the Merger

The FTC's core argument against the Microsoft-Activision merger hinges on antitrust concerns and the potential for monopolistic practices. Keywords: Antitrust concerns, monopolistic practices, market dominance, competitive harm, Call of Duty exclusivity

- Unfair Advantage: The FTC argues the merger would grant Microsoft an unfair competitive advantage, particularly within the console gaming market. This dominance could stifle innovation and harm consumers.

- Call of Duty Exclusivity: A central concern revolves around Microsoft's potential to make popular franchises like Call of Duty exclusive to the Xbox ecosystem. This move would severely disadvantage competitors like Sony PlayStation, potentially harming competition and consumer choice.

- Historical Precedent: The FTC points to Microsoft's history of acquiring game studios, suggesting a pattern of consolidating power within the industry. This acquisition history, coupled with the Activision Blizzard merger, raises serious concerns about the potential for future anti-competitive behavior.

- Lessened Competition: The FTC's appeal argues that the merger would ultimately lessen competition, leading to higher prices for consumers and reduced innovation in the gaming market. This is a key argument in their case against the merger.

The FTC's legal challenge rests on substantial evidence, citing specific examples of Microsoft's past acquisitions and their potential impact on the competitive landscape. They are leveraging established legal precedents in antitrust law to support their case.

Microsoft's Defense and Proposed Solutions

Microsoft has vigorously defended the merger, presenting counterarguments and proposing solutions to address the FTC's concerns. Keywords: Competitive landscape, cloud gaming, market share, consumer benefits, regulatory compliance

- Consumer Benefits: Microsoft contends the merger will ultimately benefit consumers by expanding access to a wider range of games through various platforms, including cloud gaming services.

- Call of Duty's Continued Availability: A key element of Microsoft's defense is their commitment to maintaining Call of Duty availability on PlayStation and other competing platforms, ensuring fair competition and access for gamers.

- Cloud Gaming's Significance: Microsoft highlights the burgeoning cloud gaming market as a factor that diminishes the significance of traditional console exclusivity, arguing it opens access across various devices.

- Developer Benefits: They also stress the positive impact for game developers, arguing increased resources and opportunities will foster innovation and the creation of better games.

Microsoft's defense involves offering concessions to regulators and actively engaging in negotiations to alleviate concerns about potential anti-competitive practices. This proactive approach aims to secure regulatory approval for the deal.

The Role of International Regulators

The Microsoft-Activision deal is not solely subject to US regulatory scrutiny. Keywords: Global competition, regulatory approvals, European Union, UK CMA, international implications

- Differing Regulatory Decisions: Regulators in other key markets, such as the European Union and the UK's Competition and Markets Authority (CMA), have taken different approaches to evaluating the merger. The EU has already conditionally approved the deal, while the UK CMA initially blocked it but recently allowed an appeal.

- Impact of Diverging Stances: These varying regulatory stances significantly impact the overall outcome. A negative decision in the US could still be overridden by approvals in other major markets, while a unified rejection would likely lead to the deal's collapse.

- Global Strategic Implications: The inconsistent regulatory landscape necessitates a flexible global strategy for Microsoft, requiring them to navigate the complexities of varying international legal frameworks.

The interplay between the FTC appeal and international regulatory decisions creates a complex and multifaceted legal battle with wide-ranging consequences.

Potential Outcomes and Implications

The FTC appeal presents two main potential outcomes: either the appeal succeeds and the merger is blocked, or the appeal is dismissed and the merger proceeds. Keywords: Merger approval, blocked merger, legal precedents, gaming industry future, market impact

- Successful Appeal: A successful FTC appeal would block the merger, potentially reshaping the competitive landscape of the gaming industry and setting a precedent for future mergers and acquisitions in the tech sector.

- Appeal Dismissal: A dismissal of the appeal would allow the merger to proceed, potentially leading to increased market consolidation and raising concerns about future dominance.

The outcome will impact various stakeholders, including Microsoft, Activision Blizzard, competitors like Sony, and ultimately, the gaming consumer. The impact on competition, innovation, and consumer prices will be substantial, regardless of the outcome. This case sets a critical legal precedent for future tech mergers, influencing how regulators approach similar deals going forward.

Conclusion

The FTC's appeal against the Microsoft-Activision deal presents profound implications for the future of the gaming industry. The outcome will significantly influence the competitive landscape, affecting game prices, innovation, and access for consumers. This high-stakes legal battle sets a crucial precedent for future mergers within the tech sector.

Call to Action: Stay informed about the ongoing legal battles surrounding the Microsoft-Activision deal. Further developments in this high-stakes case could reshape the gaming landscape. Continue to follow updates on the Microsoft-Activision merger for the latest news and analysis.

Featured Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The January 6th Claims

Apr 22, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The January 6th Claims

Apr 22, 2025 -

Signal Chat Reveals Hegseths Detailed Military Plans Shared With Family Members

Apr 22, 2025

Signal Chat Reveals Hegseths Detailed Military Plans Shared With Family Members

Apr 22, 2025 -

Toxic Chemicals From Ohio Train Derailment A Building Contamination Investigation

Apr 22, 2025

Toxic Chemicals From Ohio Train Derailment A Building Contamination Investigation

Apr 22, 2025 -

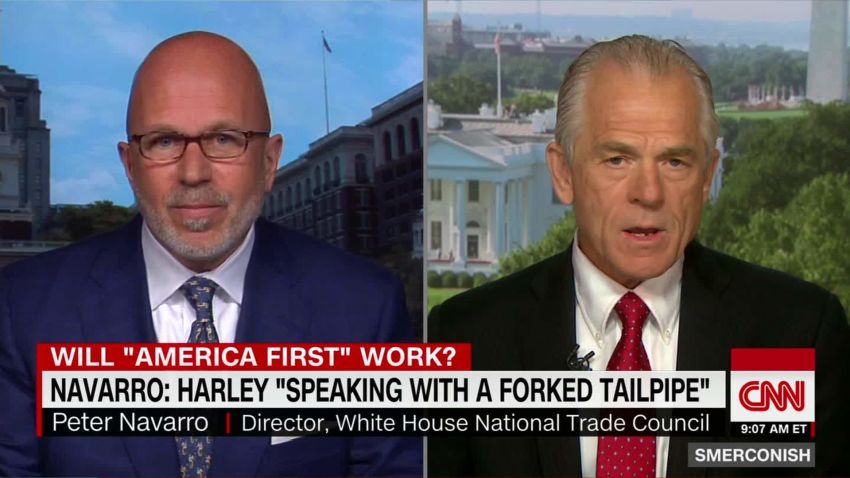

Is Trumps Trade Policy Undermining American Financial Dominance

Apr 22, 2025

Is Trumps Trade Policy Undermining American Financial Dominance

Apr 22, 2025 -

Analysis The Anti Trump Protests Sweeping The Us

Apr 22, 2025

Analysis The Anti Trump Protests Sweeping The Us

Apr 22, 2025