Microsoft-Activision Deal: FTC Files Appeal

Table of Contents

Initially, Microsoft's proposed acquisition of Activision Blizzard, valued at a staggering $68.7 billion, seemed like a done deal. However, the FTC raised significant concerns, arguing that the merger would stifle competition and grant Microsoft undue market dominance. Their appeal directly challenges the initial approval, setting the stage for a protracted legal battle.

The FTC's Core Arguments Against the Merger

The FTC's core argument centers on the potential creation of a monopoly in the gaming market, particularly concerning console gaming and cloud gaming services. They fear that Microsoft's acquisition of Activision Blizzard, home to iconic franchises like Call of Duty, World of Warcraft, and Candy Crush, would give Microsoft an unfair advantage, stifling competition and harming consumers.

- Loss of competition in console gaming: The FTC argues that Microsoft could leverage its ownership of Activision Blizzard's titles, particularly Call of Duty, to gain an insurmountable lead over competitors like Sony's PlayStation. This could lead to PlayStation losing market share and potentially forcing consumers to switch to Xbox.

- Potential for higher game prices and reduced innovation: A lack of competition often leads to higher prices and less innovation. The FTC fears that Microsoft could raise prices on Activision Blizzard games or limit their availability on competing platforms.

- Concerns regarding the accessibility of Activision Blizzard's games: The FTC is concerned about the potential for Microsoft to restrict access to Activision Blizzard's popular game titles on rival platforms, reducing consumer choice.

- Impact on cloud gaming services: The FTC also expresses concern about Microsoft's potential to leverage its control over Activision Blizzard's games to dominate the burgeoning cloud gaming market, potentially excluding competitors and limiting consumer options.

This antitrust lawsuit highlights significant competition concerns and the potential for Microsoft to exert significant monopoly power within the gaming sector.

Microsoft's Defense and Proposed Remedies

Microsoft vehemently denies the FTC's claims, arguing that the merger will ultimately benefit consumers through increased innovation and broader access to games. They've presented counterarguments and proposed remedies to address the FTC's concerns.

- Microsoft's commitment to maintaining "Call of Duty" on PlayStation: A central point of Microsoft's defense is its commitment to keeping Call of Duty available on PlayStation for at least the next 10 years, ensuring that PlayStation users won't lose access to this beloved franchise.

- Arguments regarding the competitive landscape of the gaming industry: Microsoft highlights the already competitive nature of the gaming market, arguing that the merger won't significantly alter the balance of power. They point to the existence of other major players like Nintendo and other game developers.

- Claims that the merger will benefit consumers through innovation: Microsoft insists that the merger will fuel innovation by combining resources and expertise, leading to better games and a richer gaming experience for consumers.

These arguments, combined with the proposed Call of Duty licensing deal, form the backbone of Microsoft's response to the FTC's concerns.

The Appeal Process and Potential Outcomes

The FTC's appeal initiates a complex legal process that could take months, even years, to resolve. The appeals court will carefully review the evidence and arguments presented by both sides.

- Potential for lengthy legal battles: Antitrust cases are notoriously complex and drawn-out, involving extensive legal proceedings and potentially multiple appeals.

- The role of the courts in deciding the fate of the merger: The court's decision will ultimately determine whether the merger is allowed to proceed as planned, is blocked entirely, or is modified to address the FTC's concerns.

- Impact of the decision on future mergers and acquisitions in the tech industry: The outcome of this case will set a significant precedent, shaping the regulatory landscape for future mergers and acquisitions within the tech industry, particularly in the gaming sector.

International Regulatory Scrutiny

The Microsoft-Activision deal isn't just facing scrutiny in the US. Regulatory bodies in other countries, such as the European Union (EU), are also conducting their own reviews. While some approaches mirror the FTC's concerns, others might differ based on their specific regulations and market analyses. This global competition review adds another layer of complexity to the situation and underscores the international implications of the merger. The EU’s regulations, for example, could lead to different outcomes or additional requirements before the deal is approved.

The Future of the Microsoft-Activision Deal Remains Uncertain

The FTC appeal against the Microsoft-Activision deal presents a compelling case, highlighting legitimate concerns regarding potential monopolies and market dominance within the gaming industry. Microsoft's counterarguments and proposed remedies aim to mitigate these concerns, but the ultimate outcome remains uncertain. The potential impact on gamers and the competitive landscape is significant. The decision will not only shape the future of this specific merger but could also significantly influence future mergers and acquisitions in the tech sector. To stay abreast of the latest developments in this crucial case, follow reputable news sources covering antitrust law and the gaming industry for updates on the Microsoft-Activision merger update and the FTC appeal outcome. The future of gaming, and the application of antitrust law to massive tech mergers, depends on the final decision.

Featured Posts

-

Teslas Q1 Earnings Decline Musks Political Involvement Takes A Toll

Apr 24, 2025

Teslas Q1 Earnings Decline Musks Political Involvement Takes A Toll

Apr 24, 2025 -

India Market Trends Niftys Upward Momentum And Its Implications

Apr 24, 2025

India Market Trends Niftys Upward Momentum And Its Implications

Apr 24, 2025 -

T Mobile Data Breaches Result In 16 Million Fine A Three Year Timeline

Apr 24, 2025

T Mobile Data Breaches Result In 16 Million Fine A Three Year Timeline

Apr 24, 2025 -

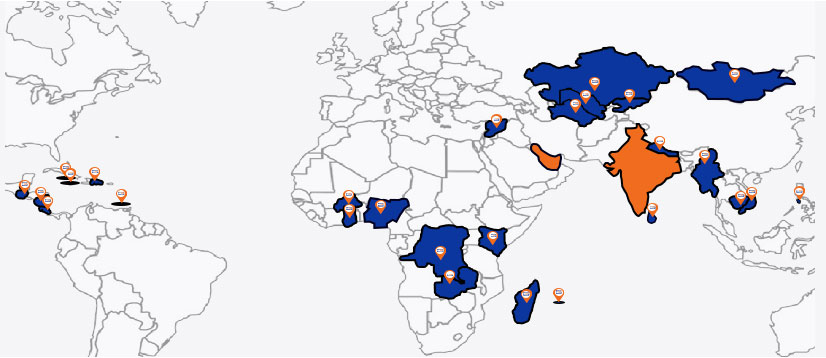

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025 -

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025