Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

BofA's Perspective on Current Stock Market Valuations

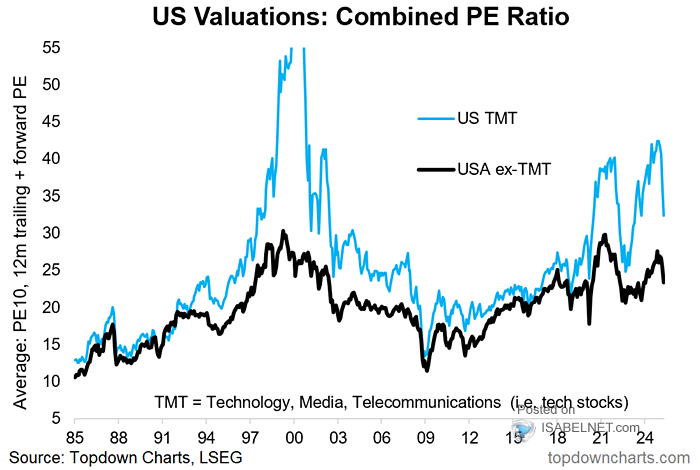

BofA's current stance on stock market valuations is nuanced. While acknowledging that valuations are not historically cheap, they argue that they aren't excessively high either, especially when considering long-term growth prospects. While specific data points fluctuate, BofA hasn't publicly released a single definitive number representing their overall valuation assessment. Instead, their analysis considers multiple metrics. They likely reference metrics like the Shiller PE ratio (cyclically adjusted price-to-earnings ratio), which smooths out short-term earnings fluctuations to provide a longer-term perspective on valuations. They also likely incorporate other key valuation multiples.

- Key arguments against panic selling: BofA emphasizes the long-term growth potential of the economy and corporate earnings. They believe that current market anxieties are overblown and that a sustained bear market is unlikely.

- Metrics and indices: While BofA doesn't publicly release all its internal models, their analysis likely incorporates various market indices (like the S&P 500 and Nasdaq Composite), sector-specific valuations, and macroeconomic indicators.

- Long-term growth projections: BofA's positive outlook is rooted in projections of continued, albeit potentially slower, economic growth in the coming years. This fuels their belief that current valuations, while not historically low, are justified by future earnings potential.

Understanding the Factors Influencing Stock Market Valuations

Several interconnected factors influence stock market valuations, making it crucial to understand their interplay.

Interest Rate Hikes and Their Impact

Rising interest rates significantly impact stock market valuations.

- Interest rates and bond yields: Higher interest rates increase bond yields, making bonds a more attractive alternative to stocks for some investors, potentially drawing capital away from the equity market.

- Impact on company borrowing costs: Higher rates increase borrowing costs for companies, potentially reducing their profitability and impacting future earnings growth.

- Discounted cash flow valuations: Higher discount rates, used in discounted cash flow (DCF) valuations, reduce the present value of future earnings, thereby lowering the perceived value of companies.

Inflation's Effect on Stock Market Valuations

Inflation is another key factor affecting stock market valuations and investor sentiment.

- Erosion of purchasing power: High inflation erodes the purchasing power of money, making future earnings less valuable in real terms.

- Impact on earnings growth expectations: Persistent inflation can squeeze corporate profit margins, potentially slowing down or even hindering earnings growth expectations.

- Influence on present value: Similar to interest rate hikes, higher inflation increases the discount rate used in valuation models, thus reducing the present value of future earnings.

Geopolitical Uncertainty and Market Volatility

Global events and geopolitical uncertainty introduce substantial risk and volatility into the stock market.

- Market impact of specific events: Events like wars, political instability, or unexpected economic sanctions can significantly impact investor sentiment and trigger market fluctuations.

- Investor reaction to uncertainty: Investors tend to become more risk-averse during periods of uncertainty, potentially leading to sell-offs and decreased market valuations.

- Uncertainty and risk premiums: Higher uncertainty leads to increased risk premiums demanded by investors, effectively lowering valuations to compensate for the added risk.

Strategies for Navigating Current Stock Market Valuations

BofA's perspective supports a long-term investment approach. Panic selling is counterproductive. Instead, focus on these strategies:

- Diversification: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce overall portfolio risk.

- Long-term investment horizon: Focus on long-term growth rather than short-term market fluctuations. Time in the market generally outweighs timing the market.

- Dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of market conditions, to mitigate the risk of buying high and selling low.

- Professional financial advice: Consult with a qualified financial advisor to create a personalized investment strategy aligned with your risk tolerance and financial goals.

Conclusion

BofA's analysis suggests that while stock market valuations aren't historically low, they are not excessively high when considering long-term growth prospects. Factors like interest rate hikes, inflation, and geopolitical uncertainty contribute to market volatility. However, panic selling is unwarranted. A long-term investment strategy, diversification, and risk management are key to navigating current market conditions. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to stock market valuations. Stay informed about market trends and economic indicators to make informed decisions about your investment portfolio. Conduct your own stock market valuation analysis and develop robust stock market valuation strategies to manage your portfolio effectively.

Featured Posts

-

Why Is Gold A Safe Haven Asset Amidst Global Trade Conflicts

Apr 26, 2025

Why Is Gold A Safe Haven Asset Amidst Global Trade Conflicts

Apr 26, 2025 -

The Impact Of Trump Administration Pressure On Eu Ai Policy

Apr 26, 2025

The Impact Of Trump Administration Pressure On Eu Ai Policy

Apr 26, 2025 -

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025 -

Colgate Cl Stock Tariff Impact And Financial Results

Apr 26, 2025

Colgate Cl Stock Tariff Impact And Financial Results

Apr 26, 2025 -

Us Port Fees To Hit Auto Carrier With Up To 70 Million

Apr 26, 2025

Us Port Fees To Hit Auto Carrier With Up To 70 Million

Apr 26, 2025