India Market Update: Tailwinds Driving Nifty Gains

Table of Contents

H2: Robust Economic Growth Fuels Nifty Performance

India's consistently strong GDP growth is a primary driver of the Nifty's recent performance. This robust expansion creates a fertile ground for increased investment and higher stock valuations.

H3: Strong GDP Growth:

India's GDP has shown impressive growth in recent quarters, exceeding expectations and outperforming many other major economies.

- Strong Services Sector: The services sector, a significant contributor to India's GDP, has shown remarkable resilience and growth.

- Manufacturing Sector Expansion: The manufacturing sector is also experiencing a period of expansion, driven by increased domestic demand and government initiatives.

- Government Initiatives and Infrastructure Spending: The government's focus on infrastructure development, including projects like the Bharatmala project and the development of smart cities, is fueling economic activity and boosting GDP. This infrastructure spending creates jobs, stimulates demand for goods and services, and enhances overall productivity.

The positive impact of these factors is evident in the consistently high GDP growth figures, which in turn translates into increased corporate profits and a more positive outlook for the stock market, contributing significantly to Nifty gains.

H3: Increased Domestic Consumption:

Rising disposable incomes and the expansion of India's burgeoning middle class are significantly boosting consumer spending. This increased consumer demand fuels growth across various sectors.

- High Consumer Confidence: Surveys indicate high consumer confidence levels, suggesting sustained spending in the coming quarters.

- Robust Retail Sales: Retail sales figures reflect a significant increase in consumer spending across various categories, from FMCG goods to automobiles.

- Positive Impact on Sectors: This increased consumption positively impacts sectors like Fast-Moving Consumer Goods (FMCG), automobiles, and consumer durables, driving further economic growth and boosting the Nifty 50 index.

H2: Foreign Institutional Investor (FII) Inflows

Significant Foreign Institutional Investor (FII) inflows are injecting considerable liquidity into the Indian stock market, further propelling the Nifty's upward trend.

H3: Positive Global Sentiment:

Global factors play a crucial role in attracting FII investments.

- Global Economic Recovery: A recovering global economy reduces risk aversion among international investors, making emerging markets like India more attractive.

- Reduced Global Risk Aversion: Decreased geopolitical uncertainty and stability in global financial markets encourage FII investment in India.

- Attractive Investment Destination: India’s long-term growth potential and its position as a relatively stable emerging market continue to attract substantial foreign investment.

H3: Attractive Valuation:

Compared to other emerging markets, India offers attractive valuations, making it a compelling investment destination.

- Favorable Price-to-Earnings Ratios: India's stock market valuations, particularly the Nifty 50, often show relatively lower price-to-earnings (P/E) ratios compared to global benchmarks.

- Demographic Dividend: India's young and growing population represents a significant demographic dividend, fueling future economic growth and contributing to the attractiveness of its stock market.

- Structural Reforms: The Indian government's ongoing structural reforms, aimed at improving the ease of doing business and attracting foreign direct investment, further enhance India's appeal to FIIs.

H2: Government Policies and Reforms

Positive government policies and reforms are creating a favorable investment climate, encouraging both domestic and foreign investment and contributing to Nifty gains.

H3: Infrastructure Development:

Government initiatives aimed at boosting infrastructure development are key to long-term economic growth.

- Major Infrastructure Projects: The government's focus on building roads, railways, ports, and other crucial infrastructure facilitates economic activity and improves connectivity.

- Positive Impact on Related Sectors: Increased infrastructure spending boosts related sectors like construction, cement, and steel, contributing to overall economic growth and stock market performance.

H3: Ease of Doing Business:

Reforms aimed at simplifying business regulations attract both domestic and foreign investment.

- Regulatory Reforms: Measures to streamline business regulations, reduce bureaucratic hurdles, and improve transparency are making India a more attractive investment destination.

- Attracting FDI: The improvement in the ease of doing business in India makes it more attractive to Foreign Direct Investment (FDI), further supporting economic growth and stock market performance.

3. Conclusion:

The Nifty's recent gains are a result of a confluence of positive factors: robust economic growth, strong FII inflows, and supportive government policies. These tailwinds suggest a continued positive outlook for the Indian stock market, although inherent market risks should always be considered. However, it's crucial to remember that market conditions can change rapidly, and potential investors should always conduct thorough due diligence before making any investment decisions.

Call to Action: Stay informed on the latest developments in the Indian market to capitalize on these opportunities. Continue following our updates on the Nifty and other key Indian market indicators for further insights into the driving forces behind its performance. Learn more about how to invest wisely in the Indian market and benefit from the ongoing positive Nifty gains.

Featured Posts

-

Trump Lawsuit Prompts 60 Minutes Executive Producers Exit

Apr 24, 2025

Trump Lawsuit Prompts 60 Minutes Executive Producers Exit

Apr 24, 2025 -

Rep Nancy Mace And Constituent Spar In Heated Public Exchange

Apr 24, 2025

Rep Nancy Mace And Constituent Spar In Heated Public Exchange

Apr 24, 2025 -

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025 -

Will Liam Survive His Collapse On The Bold And The Beautiful

Apr 24, 2025

Will Liam Survive His Collapse On The Bold And The Beautiful

Apr 24, 2025 -

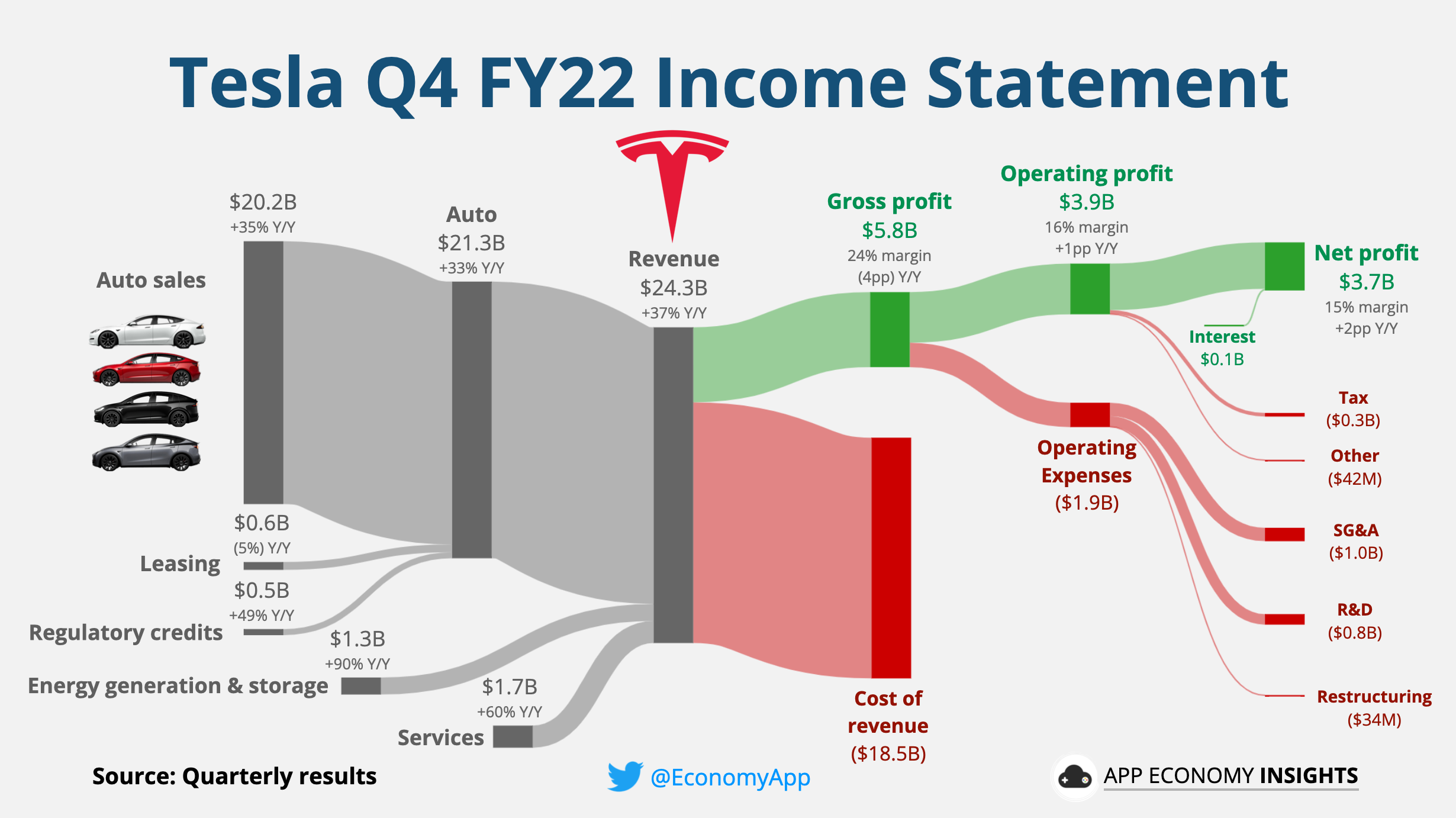

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025