Hudson's Bay Sees Robust Interest In 65 Leaseholds

Table of Contents

Strategic Location and Prime Retail Space Drive Demand

The key to understanding the high demand lies in the strategic locations and desirable characteristics of these 65 Hudson's Bay Company leaseholds. These aren't just any retail spaces; they are situated in high-traffic areas, often within vibrant city centers or established shopping malls, ensuring high foot traffic and visibility.

- Prime Locations: Many leaseholds are located in bustling downtown cores across Canada, benefiting from excellent accessibility via public transportation and proximity to other businesses and amenities. Others are situated within high-performing shopping malls, further amplifying their appeal.

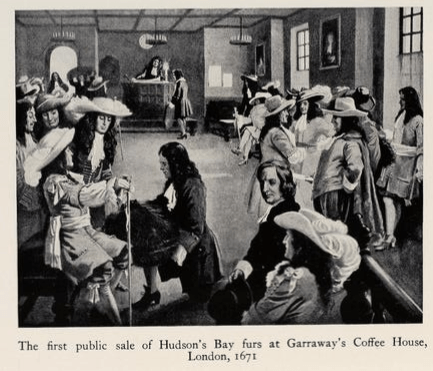

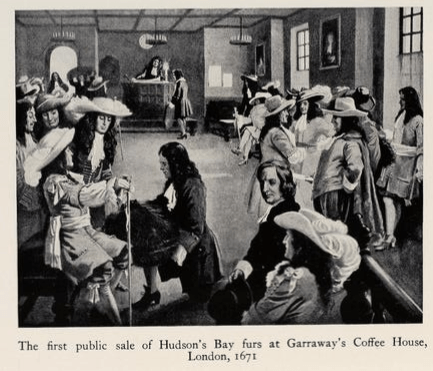

- Desirable Retail Spaces: The properties themselves offer a range of sizes and layouts, catering to various business needs. Many boast modern amenities and updated interiors, while others present exciting redevelopment potential, allowing investors to tailor the spaces to specific tenant requirements. Some properties even carry the added allure of historical significance, adding value and character.

- Potential for Growth: The strategic locations and desirable features of these retail properties translate into significant potential for increased rental income and property value appreciation. Investors are keen to capitalize on the strong existing performance and future growth prospects.

Diversified Portfolio Attracts a Wide Range of Investors

The diversity within the portfolio of 65 Hudson's Bay Company leaseholds is another crucial factor driving investor interest. This isn't a monolithic offering; it's a carefully curated collection of assets that caters to a broad spectrum of investment strategies.

- Diverse Asset Types: The leaseholds encompass a range of property types, including large department stores, smaller retail units, and even some office spaces, creating a diversified portfolio that minimizes risk.

- Attracting Various Investor Profiles: This diversity attracts a wide array of investors, from large Real Estate Investment Trusts (REITs) and private equity firms seeking sizable acquisitions to high-net-worth individuals interested in smaller, individual investments.

- Risk Mitigation Through Diversification: The inherent diversification within the portfolio offers investors the benefit of risk mitigation. A downturn in one sector or location is unlikely to significantly impact the overall performance of the entire investment.

Strong Financial Performance and Growth Potential

The robust interest in these Hudson's Bay Company leaseholds is further fueled by the company's relatively strong financial performance and the projected growth potential of the properties themselves. Investor confidence is underpinned by the belief in a stable and profitable future for these assets.

- Solid Financial Foundation: While specific financial data may require further investigation, the overall health and stability of the Hudson's Bay Company contribute to investor confidence in the long-term value of these leaseholds.

- Future Development Opportunities: Many of these properties present significant opportunities for future development, including renovations, expansions, or even conversions to alternative uses, maximizing returns for investors.

- Rental Income and Capital Appreciation: Investors are drawn to the potential for substantial increases in rental income and significant capital appreciation over the long term, driven by the prime locations and ongoing demand for retail space.

The Impact of the Hudson's Bay Company Leaseholds on the Real Estate Market

The significant transaction involving the 65 Hudson's Bay Company leaseholds is poised to have a notable impact on the broader real estate market, setting a precedent for future investment strategies.

- Ripple Effects on Property Values: The sale of these prominent properties is likely to drive up property values in surrounding areas, benefiting local businesses and property owners.

- Influence on Retail Sector Investments: This transaction will undoubtedly influence future investment strategies in the retail sector, attracting further investment and potentially leading to renewed development and revitalization efforts.

- Positive Economic Impact: The influx of investment capital associated with this transaction has the potential to stimulate local economies and generate job opportunities, further enhancing the overall positive impact.

Conclusion: Investing in Hudson's Bay Company Leaseholds: A Promising Opportunity

The robust interest in these 65 Hudson's Bay Company leaseholds is easily explained: prime locations, a diversified portfolio, and a strong financial outlook combine to create a highly attractive investment opportunity. These leaseholds offer the potential for significant returns on investment for a diverse range of investor profiles, from individual investors to large institutional players. Learn more about these lucrative Hudson's Bay Company leasehold opportunities and consider investing in the future of Canadian retail real estate.

Featured Posts

-

Eu Targets Russian Gas Spot Market Phaseout Discussions

Apr 24, 2025

Eu Targets Russian Gas Spot Market Phaseout Discussions

Apr 24, 2025 -

B And B Spoilers Thursday February 20 Steffy Liam And Poppys Impact On Finn

Apr 24, 2025

B And B Spoilers Thursday February 20 Steffy Liam And Poppys Impact On Finn

Apr 24, 2025 -

California Wildfires Celebrity Home Losses In The Palisades Complete Report

Apr 24, 2025

California Wildfires Celebrity Home Losses In The Palisades Complete Report

Apr 24, 2025 -

Microsoft Activision Deal Ftc Files Appeal

Apr 24, 2025

Microsoft Activision Deal Ftc Files Appeal

Apr 24, 2025 -

Us Stock Futures Jump After Trumps Powell Statement

Apr 24, 2025

Us Stock Futures Jump After Trumps Powell Statement

Apr 24, 2025