How Tariffs Cost Colgate (CL) $200 Million: Sales And Profit Analysis

Table of Contents

The Direct Impact of Tariffs on Colgate's Raw Material Costs

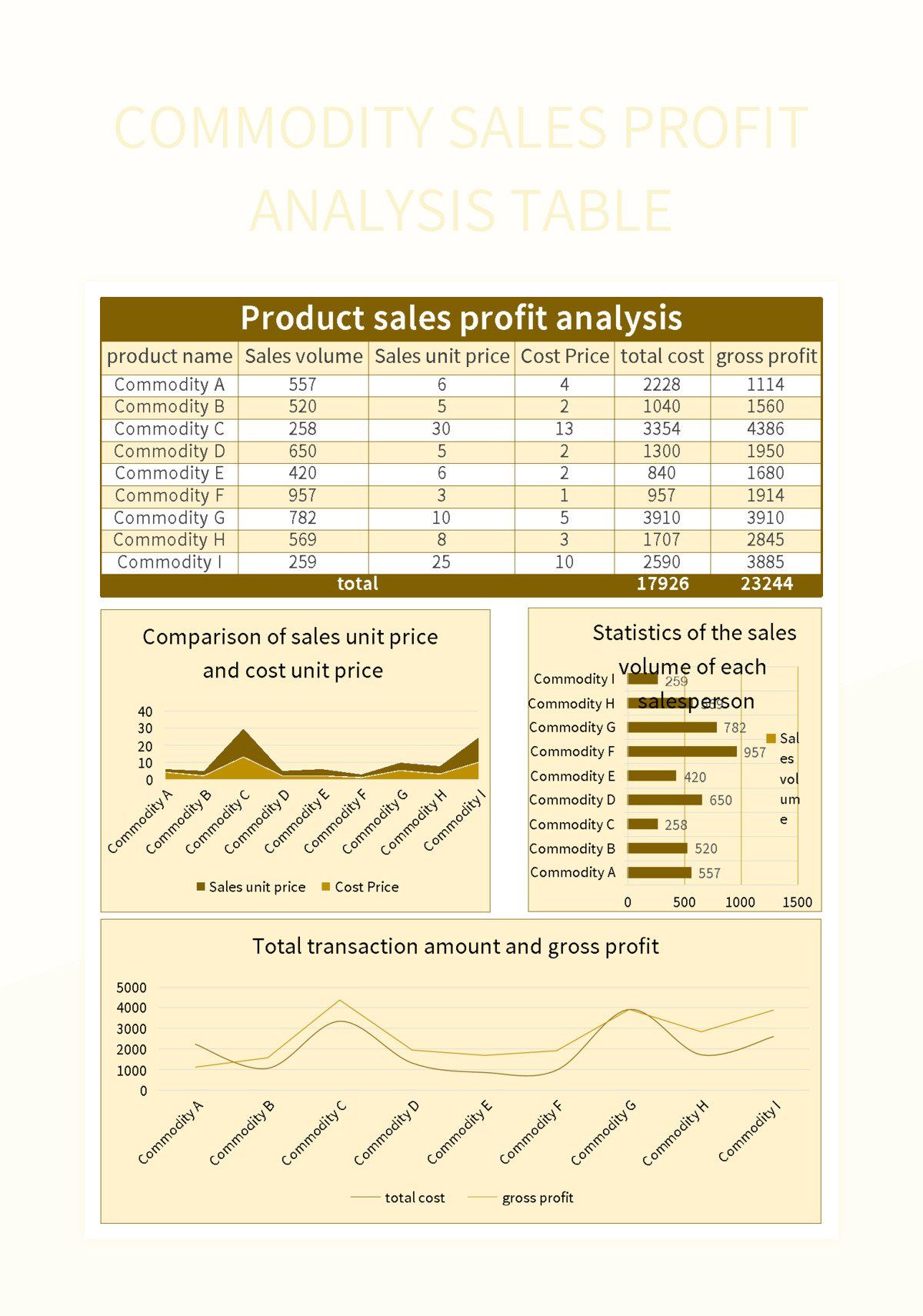

Tariffs significantly increased the cost of imported raw materials crucial for Colgate's product manufacturing. These increased costs directly impacted Colgate's production expenses and profitability. The company relies heavily on global supply chains, making it particularly vulnerable to tariff fluctuations.

- Specific examples of raw materials affected: Packaging materials (like plastic and cardboard), certain chemicals used in toothpaste and soap formulations, and specialized components for its oral care products were all subject to increased import duties.

- Percentage increase in cost due to tariffs: While precise figures are not publicly available for all materials, industry analysts estimate a collective increase of at least 5-10% in the cost of these essential raw materials due to tariffs.

- Quantifiable data demonstrating increased cost burden: The $200 million loss reported by Colgate is a clear indicator of the substantial financial burden imposed by these tariff increases on their operations. This translates to a significant hit to their gross margins, reducing profitability. This increase in production costs directly impacted Colgate's ability to maintain previous profit margins.

Reduced Consumer Demand and Sales Due to Price Increases

Faced with higher production costs due to tariffs, Colgate, like many other companies, passed on some of these increased costs to consumers through higher prices. This price increase, however, led to several negative consequences.

- Evidence of price increases on specific Colgate products: Reports and market analysis show modest price hikes across a range of Colgate products, including toothpaste, toothbrushes, and soaps.

- Analysis of consumer response to price hikes: Consumers responded to these price increases with decreased demand, leading to a drop in sales volume. Increased competition from brands offering similar products at lower prices also further impacted sales.

- Impact on market share: The price increases, coupled with the competitive landscape, resulted in a slight erosion of Colgate's market share in some regions. This demonstrates the vulnerability of even established brands to tariff-induced price increases. This resulted in a reduced revenue stream for Colgate, further contributing to the $200 million loss.

Geographic Impact: Examining Tariffs' Effects on Specific Markets

The impact of tariffs varied significantly across different geographical markets. Regions heavily reliant on imported raw materials and facing higher tariff rates experienced a more pronounced negative impact on Colgate's sales.

- Examples of regions most affected by tariff-induced price increases: Markets with high import dependency and sensitivity to price fluctuations experienced more substantial sales declines.

- Comparison of sales performance in different regions: Colgate's sales performance in regions with lower tariff impacts remained relatively stable compared to areas more heavily affected by price increases.

- Strategic adjustments made by Colgate in specific markets: In response to varying impacts, Colgate likely adjusted its pricing and marketing strategies in different regions to mitigate losses.

Colgate's Strategic Responses to Mitigate Tariff Impacts

To counter the negative effects of tariffs, Colgate implemented several strategic responses aimed at cost reduction and supply chain diversification.

- Examples of cost-cutting measures: The company likely implemented cost-cutting measures across various departments to offset the increased expenses. These measures could involve streamlining operations, reducing administrative costs, and optimizing logistics.

- Potential shifts in sourcing strategies: Colgate may have started exploring alternative suppliers based in countries with less stringent trade policies or lower import duties to reduce its reliance on tariff-affected sources.

- Investment in automation or efficiency improvements: Investments in automation and technological upgrades could help improve efficiency, reduce waste, and thus lower overall production costs. The effectiveness of these strategies in completely offsetting the tariff impact remains to be seen.

Long-Term Implications for Colgate's Financial Performance

The long-term effects of these tariffs on Colgate's financial health are significant and could influence future investments and growth strategies.

- Potential for sustained impacts on profitability: The increased costs and reduced sales could lead to sustained pressure on profitability unless Colgate successfully implements effective countermeasures.

- Long-term effects on investments and growth strategies: The financial strain caused by tariffs might necessitate a reassessment of Colgate's investment plans, potentially delaying or scaling back certain projects.

- Impact on shareholder value: The decline in profits and market share directly impacts shareholder value, potentially leading to decreased stock prices and investor concern. The volatility in global trade necessitates adaptive strategies to ensure long-term financial health.

Conclusion: Understanding the $200 Million Tariff Toll on Colgate (CL)

In conclusion, the $200 million loss incurred by Colgate (CL) due to tariffs highlights the significant financial impact of global trade policies on multinational corporations. The increased cost of raw materials, resulting price increases, and subsequent reduction in sales clearly demonstrate the far-reaching consequences of tariffs. Understanding how tariffs impact companies like Colgate (CL) is crucial for investors and businesses alike. Continue your research and learn more about the effects of global trade policies on corporate profitability and explore the impact of tariffs on other companies within the consumer goods sector, and on the broader global economy.

Featured Posts

-

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025 -

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025

The Company That Laid You Off Wants You Back What To Say

Apr 26, 2025 -

Us China Trade War And Its Impact On Stock Market Dow Futures And Chinas Economic Measures

Apr 26, 2025

Us China Trade War And Its Impact On Stock Market Dow Futures And Chinas Economic Measures

Apr 26, 2025 -

A Side Hustle Access To Elon Musks Private Company Stakes

Apr 26, 2025

A Side Hustle Access To Elon Musks Private Company Stakes

Apr 26, 2025 -

Colgates Financial Performance Analyzing The Impact Of 200 Million In Tariffs

Apr 26, 2025

Colgates Financial Performance Analyzing The Impact Of 200 Million In Tariffs

Apr 26, 2025