A Side Hustle: Access To Elon Musk's Private Company Stakes

Table of Contents

Understanding the Appeal of Investing in Private Companies

Private companies, particularly those helmed by visionary entrepreneurs like Elon Musk, often offer significantly higher growth potential than publicly traded companies. This is because their valuations aren't subject to the daily fluctuations of the stock market. However, this high-growth potential comes with substantially higher risk. Thorough due diligence is absolutely crucial before investing in any private company.

- Potential for significant ROI: Private companies can experience explosive growth, leading to massive returns on investment (ROI) for early investors.

- Early access to disruptive technologies: Investing in private companies gives you access to groundbreaking technologies and innovations before they hit the public market.

- Portfolio diversification beyond public equities: Private investments can significantly diversify your portfolio, reducing overall risk by lessening your dependence on publicly traded stocks.

- Higher risk tolerance required: Investing in private companies carries a higher level of risk. There's less liquidity, and the potential for complete loss is greater.

- Liquidity limitations: Unlike publicly traded stocks, private company shares aren't easily bought or sold. You may have to wait years, or even decades, before realizing your investment.

Navigating the Complexities of Accessing Private Investments

Gaining access to private company investments, especially those connected to high-profile figures like Elon Musk, is notoriously challenging. It’s a world largely restricted to accredited investors. This designation requires significant financial resources – typically a net worth exceeding $1 million (excluding your primary residence) or an annual income exceeding $200,000 ($300,000 for joint filers) for the past two years.

- Accreditation requirements and verification: Meeting the accreditation requirements is only the first step. You'll need to provide documentation to verify your financial status.

- Finding reputable investment platforms: Several platforms specialize in connecting accredited investors with private investment opportunities. Due diligence is crucial in selecting a trustworthy platform.

- Understanding legal and regulatory frameworks: Navigating the legal and regulatory landscape surrounding private investments can be complex. Seek professional guidance.

- Due diligence on private companies and their offerings: Before investing, rigorously research the company's financials, management team, and market position.

- The importance of seeking professional financial advice: Consulting a financial advisor experienced in private investments is essential to make informed decisions.

Strategies for Gaining Exposure to Elon Musk's Private Companies (Without Direct Investment)

While direct investment in Elon Musk's private companies is often out of reach for most investors, there are alternative routes to benefit from their potential growth. These strategies offer a less risky, albeit less direct, path to participation.

- Analyzing publicly traded companies in related industries: Companies supplying SpaceX or benefiting from Tesla's success (e.g., battery manufacturers, charging station providers) offer indirect exposure.

- Researching ETFs with exposure to space exploration or electric vehicles: Exchange-Traded Funds (ETFs) provide diversified exposure to sectors related to Musk's ventures.

- Understanding the indirect benefits and associated risks: While less risky than direct private investment, indirect exposure still carries market risk.

- Diversification to mitigate risk: Spread your investment across several companies and ETFs to reduce overall risk.

The Role of Venture Capital and Private Equity

Venture capital (VC) and private equity (PE) firms play a significant role in funding private companies like SpaceX and The Boring Company. These firms invest large sums of capital in exchange for equity, often holding a substantial stake in the company. Access to these investments is almost exclusively limited to accredited investors and institutional investors due to the high minimum investment amounts and the complex nature of these deals.

- Understanding the VC/PE investment process: VC and PE investments are typically long-term, with limited liquidity and high risk.

- The limited partnership structure and its implications: VC and PE investments often involve limited partnerships, which carry specific legal and financial implications.

- The high barriers to entry for individual investors: The high minimum investment amounts and complex legal structures effectively exclude most individual investors from direct participation.

Conclusion

Accessing investment opportunities in Elon Musk's private companies requires careful consideration of significant risks and regulatory hurdles. While direct investment is usually restricted to accredited investors, alternative strategies exist to indirectly benefit from their growth. This side hustle, though challenging, presents substantial potential rewards for those who successfully navigate the complexities. Remember that this is not financial advice.

Call to Action: Don't miss out on the potential of this unique side hustle. Start your research today and explore the various avenues for gaining exposure to Elon Musk's private company stakes. Remember to always conduct thorough due diligence and seek professional financial advice before making any investment decisions.

Featured Posts

-

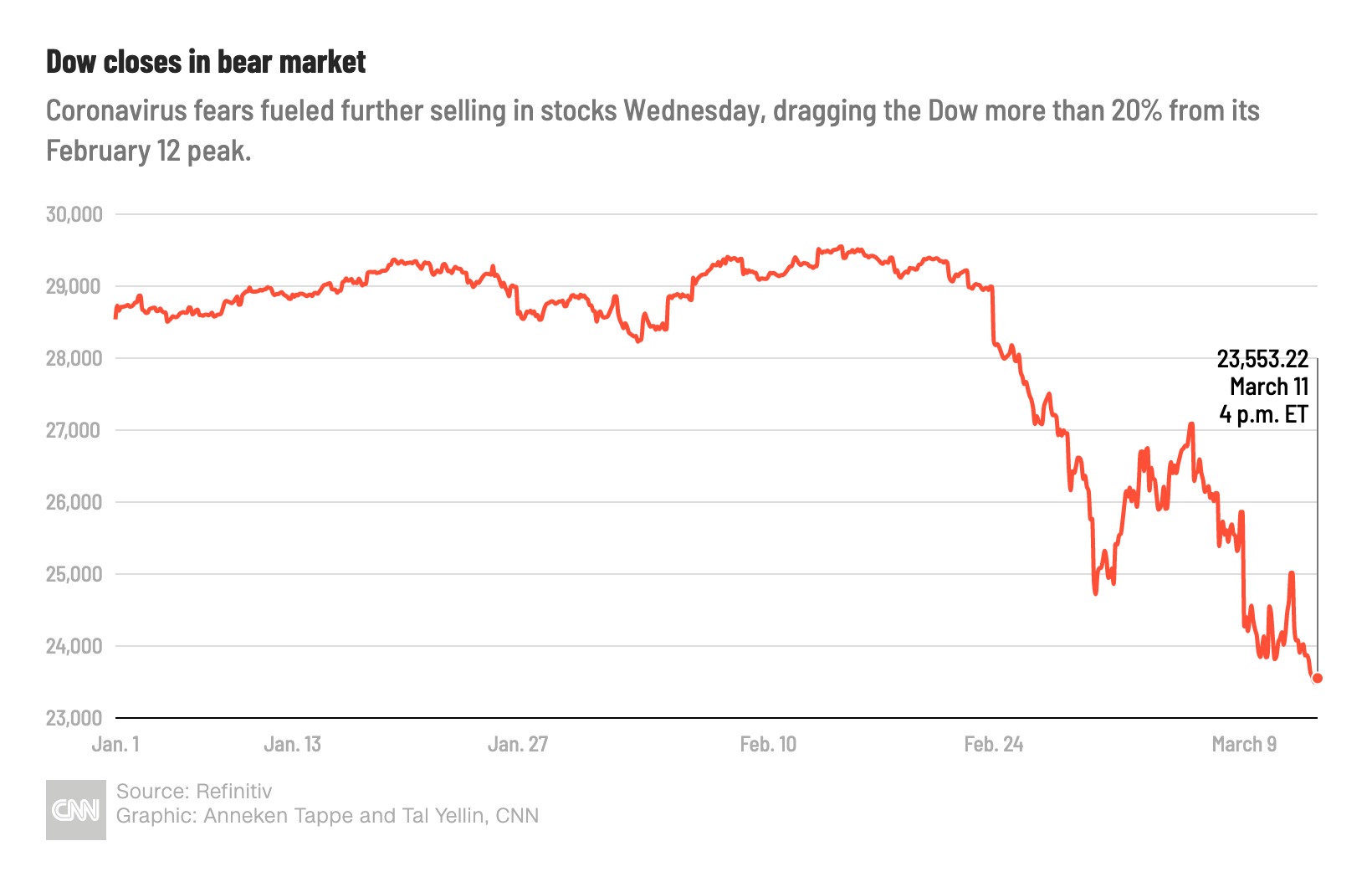

Dow Futures And Chinas Economy Todays Stock Market Update

Apr 26, 2025

Dow Futures And Chinas Economy Todays Stock Market Update

Apr 26, 2025 -

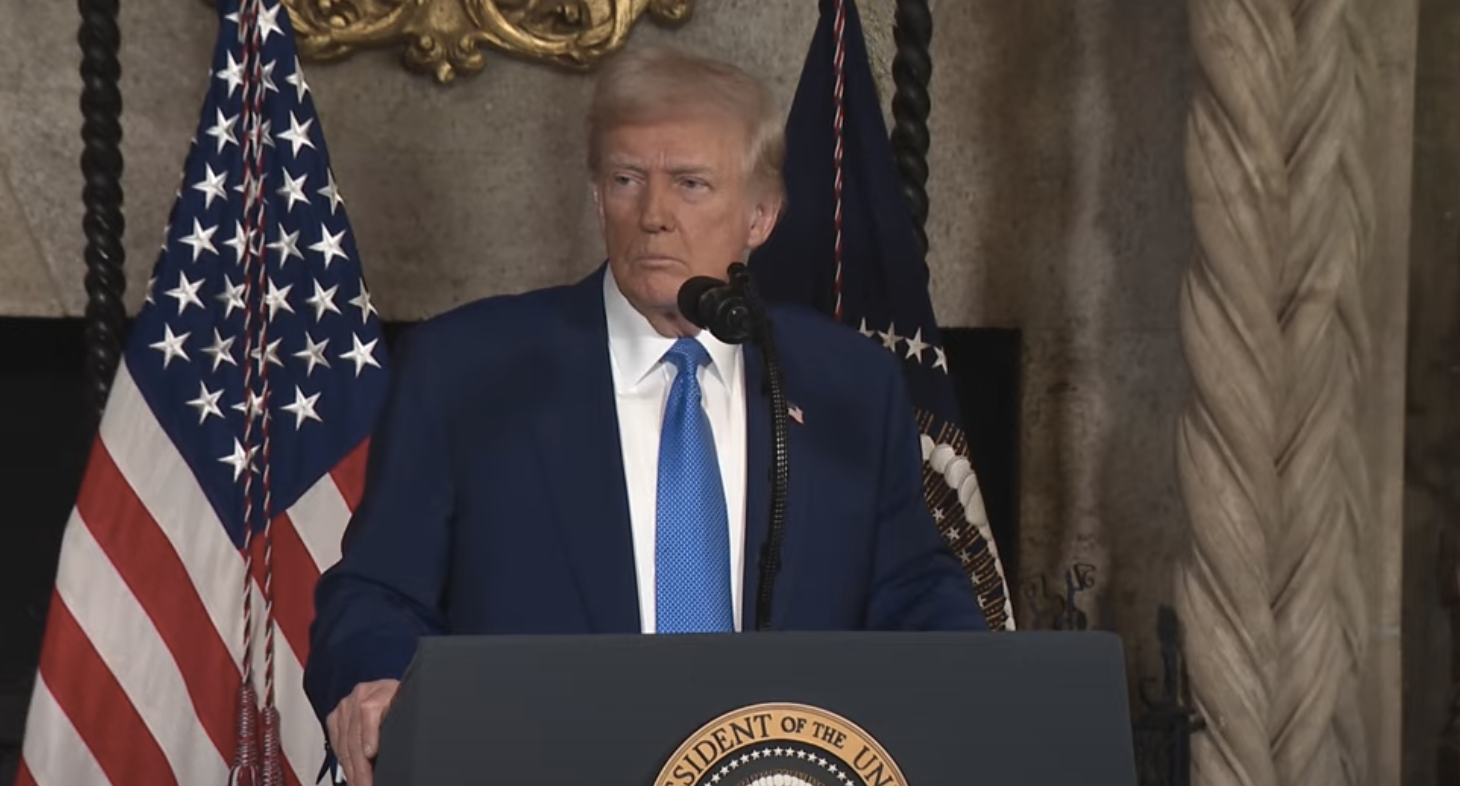

The Impact Of Trump Tariffs Ceos Express Deep Concerns

Apr 26, 2025

The Impact Of Trump Tariffs Ceos Express Deep Concerns

Apr 26, 2025 -

Closure Of Point72s Emerging Markets Trading Unit

Apr 26, 2025

Closure Of Point72s Emerging Markets Trading Unit

Apr 26, 2025 -

Geopolitical Showdown A Key Military Base And The Us China Power Struggle

Apr 26, 2025

Geopolitical Showdown A Key Military Base And The Us China Power Struggle

Apr 26, 2025 -

Unlocking Podcast Potential Ais Role In Transforming Repetitive Scatological Documents

Apr 26, 2025

Unlocking Podcast Potential Ais Role In Transforming Repetitive Scatological Documents

Apr 26, 2025