Hong Kong's Chinese Stock Market: A Renewed Bullish Trend?

Table of Contents

Economic Indicators Pointing Towards a Bullish Trend

Several key economic indicators suggest a potential bullish trend in Hong Kong's Chinese stock market. Understanding these signals is vital for investors seeking to capitalize on emerging opportunities.

Strengthening Chinese Economy

China's economic recovery is a significant factor influencing Hong Kong's market. Recent GDP growth figures, while fluctuating, show signs of resilience. The government's commitment to key economic reforms, aimed at fostering innovation and sustainable growth, is also boosting investor confidence. These reforms are gradually addressing longstanding structural issues, creating a more favorable environment for businesses and investments.

- Positive industrial production data: Several key industrial sectors show positive growth, indicating increased production and economic activity.

- Rising consumer spending: A growing middle class and increased disposable income are driving consumer spending, a crucial engine of economic growth.

- Government infrastructure projects: Massive government investments in infrastructure, such as the "Belt and Road" initiative and high-speed rail projects, are stimulating economic activity and creating related investment opportunities.

This improved Chinese economic outlook, characterized by China's economic recovery and economic stimulus measures, directly impacts the Hong Kong stock market, which is deeply intertwined with the mainland economy.

Improved Regulatory Environment

Changes in China's regulatory environment are significantly impacting investor sentiment. While past regulatory crackdowns caused market volatility, recent indications suggest a more balanced and predictable approach. This improved regulatory environment contributes to increased investor confidence in the Hong Kong market.

- Reduced scrutiny on tech companies: Easing regulatory pressures on the tech sector has led to a resurgence in the performance of several key players.

- Streamlined listing procedures: Simplifying the listing process for companies on the Hong Kong Stock Exchange makes it easier for businesses to raise capital and attract investment.

- Improved investor protection: Strengthening investor protection mechanisms fosters trust and confidence, encouraging both domestic and international investment.

This regulatory reform is a key driver of increased investor confidence in the Hong Kong stock market, signaling a more stable and predictable environment for long-term investment.

Key Market Drivers and Opportunities

Beyond the macroeconomic picture, specific market drivers are fueling the potential bullish trend in Hong Kong's Chinese stock market.

Tech Sector Recovery

The tech sector in Hong Kong is experiencing a notable recovery. After a period of regulatory uncertainty, many tech companies are demonstrating renewed growth, driven by innovation and government support.

- Resurgence of specific tech companies: Several prominent tech companies listed in Hong Kong have shown impressive performance, attracting considerable investor interest.

- Innovation in fintech and AI: Significant advancements in fintech and artificial intelligence are driving innovation and creating new investment opportunities in these burgeoning sectors.

- Government support for tech development: The Chinese government's continued commitment to supporting technological innovation provides a favorable environment for growth in the sector.

This resurgence of tech stocks Hong Kong signifies not only a recovery but also the potential for substantial long-term growth, making it an attractive sector for investors interested in Fintech investment and AI investment opportunities.

Infrastructure Investments and Development

Massive infrastructure investments, particularly those related to the "Belt and Road" initiative, are creating significant opportunities in related sectors. This initiative's far-reaching implications are having a profound impact on Hong Kong's market.

- "Belt and Road" initiative: This ambitious infrastructure project is generating significant investment opportunities in construction, materials, logistics, and related industries.

- High-speed rail projects: Expansion of high-speed rail networks is creating demand for construction materials and related services, boosting related sectors within the Hong Kong stock market.

- Smart city initiatives: Investments in smart city technologies are creating opportunities in areas like IoT, data analytics, and other related fields.

The impact of infrastructure investment China, particularly through initiatives like the Belt and Road initiative investment, is likely to continue shaping the growth trajectory of Hong Kong's stock market for years to come.

Understanding the Risks and Volatility

While the outlook appears positive, it's crucial to acknowledge the inherent risks and volatility in Hong Kong's Chinese stock market.

Geopolitical Factors

Geopolitical factors, including US-China relations and global economic instability, can significantly impact market performance. These external influences can create considerable uncertainty.

- Trade tensions: Ongoing trade tensions between the US and China can introduce volatility and uncertainty into the market.

- Political uncertainties: Political developments in both China and globally can influence investor sentiment and market stability.

- Global economic instability: Global economic downturns can significantly impact the performance of Hong Kong's stock market, which is closely linked to global economic trends.

Understanding geopolitical risk and the impact of US-China trade relations is critical for effective risk management in this market.

Market Corrections and Potential Drawbacks

The possibility of market corrections and downturns should not be ignored. Several factors could trigger a bearish trend, reminding investors of the inherent risks involved.

- Inflation concerns: Rising inflation rates can dampen investor sentiment and lead to market corrections.

- Interest rate hikes: Increased interest rates can impact borrowing costs for businesses, potentially slowing economic growth and affecting market performance.

- Unexpected economic shocks: Unforeseen economic events can trigger sudden market downturns, highlighting the importance of diversification and risk management strategies.

The potential for a market correction and the ever-present risk of a bearish trend necessitate a cautious approach to investment, requiring a thorough understanding of investment risk.

Conclusion

This article analyzed the potential for a renewed bullish trend in Hong Kong's Chinese stock market, highlighting key economic indicators, market drivers, and potential risks. The strengthening Chinese economy, improved regulatory environment, and opportunities in sectors like technology and infrastructure suggest a positive outlook. However, investors must carefully consider the inherent volatility and geopolitical factors before making any investment decisions. The interplay between China's economic recovery and the global economic landscape continues to shape the outlook.

Call to Action: Understanding the nuances of Hong Kong's Chinese stock market is crucial for successful investment. Stay informed on the latest market trends and economic data to make informed decisions about investing in Hong Kong's Chinese stock market. Further research into individual companies and sectors is advised before committing capital. Remember to always diversify your investments and consult with a financial advisor before making any major investment decisions in Hong Kong's Chinese stock market.

Featured Posts

-

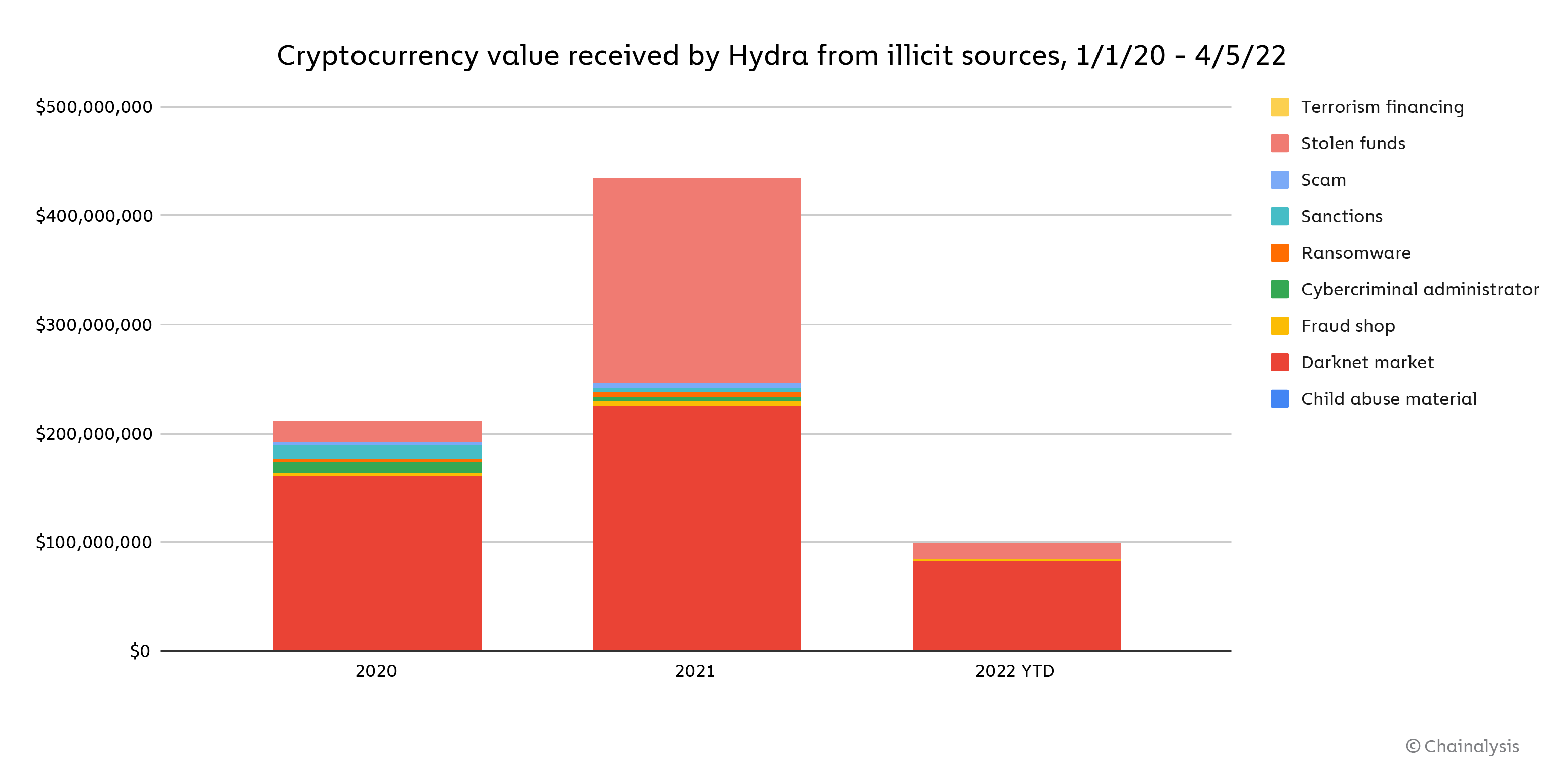

How Chainalysis Acquisition Of Alterya Will Shape The Future Of Blockchain

Apr 24, 2025

How Chainalysis Acquisition Of Alterya Will Shape The Future Of Blockchain

Apr 24, 2025 -

The China Factor Analyzing The Market Headwinds For Bmw Porsche And Beyond

Apr 24, 2025

The China Factor Analyzing The Market Headwinds For Bmw Porsche And Beyond

Apr 24, 2025 -

Goldsteins Dead Cat Metaphor Understanding Ted Lassos Revival

Apr 24, 2025

Goldsteins Dead Cat Metaphor Understanding Ted Lassos Revival

Apr 24, 2025 -

Hudsons Bay Sees Robust Interest In 65 Leaseholds

Apr 24, 2025

Hudsons Bay Sees Robust Interest In 65 Leaseholds

Apr 24, 2025 -

Instagrams Latest Move A Dedicated Video Editing App To Compete With Tik Tok

Apr 24, 2025

Instagrams Latest Move A Dedicated Video Editing App To Compete With Tik Tok

Apr 24, 2025