Grim Retail Numbers Signal Potential Shift In Bank Of Canada Monetary Policy

Table of Contents

Declining Retail Sales: A Deeper Dive into the Numbers

The latest retail sales figures paint a concerning picture for the Canadian economy. Statistics Canada recently reported a [insert percentage]% decrease in retail sales for [insert month/period], marking a significant drop compared to [previous month/period] and the same period last year. This decline represents a considerable weakening in consumer spending, a key driver of economic growth.

Several sectors experienced particularly sharp declines:

- Automotive Sales: A significant drop in vehicle sales reflects both high interest rates making financing more expensive and ongoing supply chain challenges.

- Furniture and Home Furnishings: Weakening housing market conditions and reduced consumer confidence have led to decreased spending in this sector.

- Clothing and Apparel: Inflationary pressures have significantly impacted discretionary spending on clothing.

This substantial drop in Canadian retail sales can be attributed to several converging factors:

- High Inflation: Persistently high inflation continues to erode consumer purchasing power, limiting spending capacity.

- Rising Interest Rates: The Bank of Canada's recent interest rate hikes have increased borrowing costs, making it more expensive for consumers to finance purchases. This directly impacts consumer spending and debt levels.

- Elevated Consumer Debt: Canadians are carrying a considerable amount of debt, limiting their ability to spend freely.

- Weakening Consumer Confidence: Uncertainty about the economic outlook is causing consumers to become more cautious with their spending.

Impact on Inflation and the Bank of Canada's Mandate

The significant decline in retail sales presents a complex challenge for the Bank of Canada. While high inflation remains a concern, lower consumer spending might suggest easing inflationary pressures. The Bank of Canada's mandate is to maintain price stability, typically defined by its inflation target (currently around 2%).

Several scenarios are now possible concerning the Bank of Canada interest rate:

- Continued Interest Rate Hikes: If the Bank of Canada believes that underlying inflationary pressures remain strong, further interest rate hikes might be implemented to cool the economy.

- Pause in Rate Increases: The weak retail sales data could lead the Bank to pause its rate hike cycle, allowing time to assess the impact of previous increases.

- Potential Rate Cuts: In a scenario where inflation falls significantly and economic growth weakens substantially, the Bank might even consider cutting interest rates to stimulate the economy. This is currently less likely, given ongoing inflation concerns.

The interplay between inflation and economic growth is complex, and the Bank of Canada will need to carefully weigh these factors when making its decision on Bank of Canada interest rate adjustments.

Expert Opinions and Market Reactions

Leading economists and financial analysts hold differing views on the implications of the grim retail sales data for Bank of Canada monetary policy. Some argue that the weakening consumer spending signals a need for the Bank to pause its interest rate hikes or even consider cuts to avoid a recession. Others maintain that underlying inflationary pressures persist and that further rate increases may be necessary.

"[Insert quote from a reputable economist expressing concern about the retail sales data]," stated [Economist's Name].

The market has reacted cautiously to the recent retail sales numbers. Stock market indices have shown some volatility, while bond yields have [increased/decreased], reflecting uncertainty about the future direction of interest rates. This uncertainty underscores the significant influence of the Bank of Canada's monetary policy decisions on market sentiment.

Alternative Economic Indicators to Consider

The Bank of Canada's decision-making process extends beyond retail sales data. Other crucial economic indicators will inform the upcoming monetary policy decisions, including:

- Employment Data: Strong employment numbers might suggest continued economic resilience, potentially supporting further rate hikes.

- Housing Market Trends: The housing market's performance significantly impacts consumer confidence and overall economic activity.

- Manufacturing Output: Data on manufacturing activity provides insights into the strength of the broader economy.

- Canadian GDP: Overall economic growth is a critical factor the Bank of Canada considers.

Analyzing these indicators in conjunction with the retail sales data will provide a more comprehensive picture of the Canadian economy, guiding the Bank of Canada's monetary policy decisions.

Conclusion

Weak retail sales figures significantly impact the Bank of Canada's monetary policy considerations. The potential for a shift in interest rate strategy, influenced by factors beyond retail sales, remains a significant area of discussion. The Bank will carefully weigh various economic indicators, including employment data, housing market trends, and manufacturing output, to determine the appropriate course of action. Understanding the interplay between these factors and the Bank of Canada's inflation target is crucial.

Stay informed about the evolving economic landscape and the Bank of Canada's future monetary policy decisions by regularly checking back for updates. Further research into the interplay between retail sales and Bank of Canada policy will be vital in understanding the implications of this recent downturn. Understanding the Bank of Canada monetary policy implications is essential for navigating the complexities of the current economic climate.

Featured Posts

-

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025 -

Office365 Hackers Multi Million Dollar Scheme Fbi Investigation Details

Apr 28, 2025

Office365 Hackers Multi Million Dollar Scheme Fbi Investigation Details

Apr 28, 2025 -

First Child For Aaron Judge And His Wife

Apr 28, 2025

First Child For Aaron Judge And His Wife

Apr 28, 2025 -

Global Leaders Gather To Mourn Pope Francis

Apr 28, 2025

Global Leaders Gather To Mourn Pope Francis

Apr 28, 2025 -

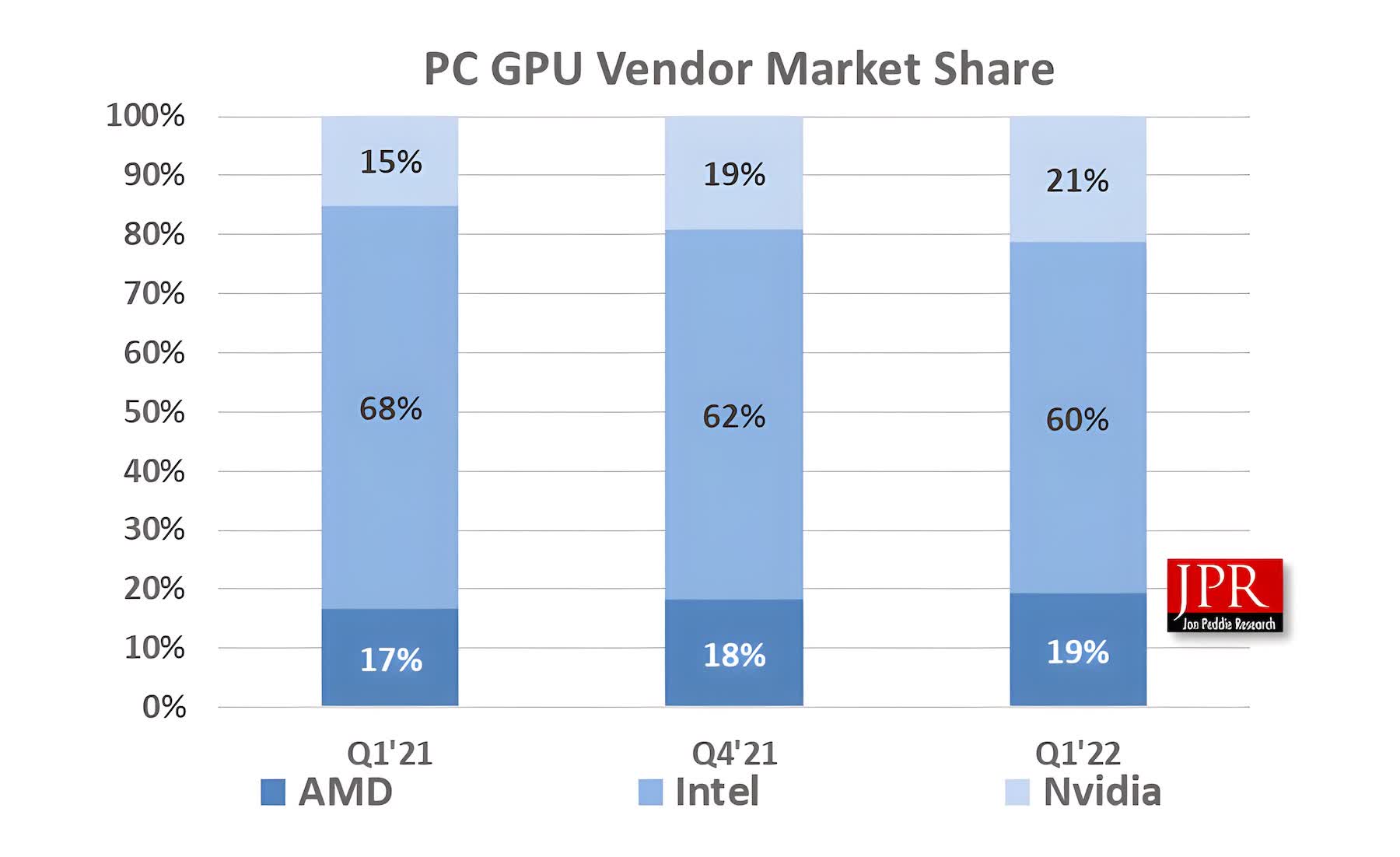

Are Gpu Prices Out Of Control Again Analyzing The Market Volatility

Apr 28, 2025

Are Gpu Prices Out Of Control Again Analyzing The Market Volatility

Apr 28, 2025