Gold Price Soars To $3,500, Dow Futures Higher: Market Analysis And Live Updates

Table of Contents

Factors Contributing to the Gold Price Surge

Several interconnected factors have contributed to the dramatic increase in the gold price. Understanding these underlying forces is crucial for comprehending the current market dynamics and predicting future trends.

Inflation and Economic Uncertainty

The current inflationary environment and growing concerns about a potential global recession are key drivers behind the gold price surge. High inflation erodes the purchasing power of fiat currencies, making gold a more attractive store of value. Investors are seeking refuge in tangible assets like gold to protect their wealth from the devaluation of paper money.

- High inflation: The Consumer Price Index (CPI) continues to rise, exceeding expectations in many countries. This erodes purchasing power, pushing investors towards inflation hedges like gold.

- Recession fears: Slowing GDP growth projections and rising interest rates are fueling concerns about a looming recession. Gold's historical performance during economic downturns makes it a desirable safe haven asset.

- Reduced confidence in fiat currencies: The instability of many national currencies adds to gold's appeal as a stable, long-term investment.

Geopolitical Instability

Global geopolitical tensions and uncertainty are significant contributors to the increased demand for gold. Conflicts, political instability, and international sanctions often trigger a flight to safety, boosting gold prices.

- Ongoing conflicts: The ongoing war in Ukraine and other geopolitical hotspots contribute to global uncertainty and increase investor demand for safe-haven assets like gold.

- Political risks: Political instability in various regions creates uncertainty and pushes investors toward the perceived stability of gold.

- Sanctions and trade wars: Geopolitical tensions often lead to sanctions and trade wars, creating economic instability and driving investors towards gold as a safe haven.

Weakening US Dollar

The gold price is inversely correlated with the US dollar. A weakening US dollar typically results in a stronger gold price, as gold is priced in USD. The recent decline in the US dollar's value is, therefore, a contributing factor to the current gold price surge.

- US Dollar Index (DXY): The recent decline in the DXY, a measure of the US dollar against other major currencies, indicates a weakening dollar, bolstering gold prices.

- Interest rate hikes: While interest rate hikes typically support a stronger dollar, the current rate hikes haven't been as effective as expected due to other global economic pressures. This continued weakness contributes to the higher gold price.

- Quantitative easing: Past periods of quantitative easing have been correlated with rising gold prices. Any future rounds of easing could further contribute to gold price increases.

Impact on the Dow Futures Market

The surge in the gold price has notable implications for the Dow Futures market and overall investor sentiment.

Correlation between Gold Prices and Dow Futures

While not always directly correlated, the rise in gold prices and the increase in Dow futures can indicate a shift in investor behavior. The rise in Dow Futures might reflect investors anticipating increased demand for certain sectors due to inflation. However, the simultaneous increase in gold prices could indicate cautiousness or a shift away from riskier assets.

- Portfolio rebalancing: Investors may be shifting funds from equity markets to safer assets like gold, impacting the Dow futures market.

- Hedging strategies: Investors are using gold as a hedge against potential losses in the equity market, causing upward pressure on both markets.

- Market uncertainty: The simultaneous movements in both markets reflect heightened uncertainty and volatility in the global financial landscape.

Investor Sentiment and Market Volatility

The gold price increase reflects a shift in investor sentiment toward caution and risk aversion. Increased market volatility often drives investors towards the perceived stability of gold.

- Flight to safety: Investors are moving away from riskier assets and towards safe-haven assets like gold.

- Market uncertainty: Uncertainty about future economic conditions and geopolitical events is fueling the demand for gold.

- Increased volatility: The gold price surge is a reflection of increased market volatility, highlighting the heightened uncertainty that is affecting investor confidence.

Live Updates and Market Predictions

(This section would need to be updated frequently with real-time gold price data from reputable sources such as Bloomberg, Reuters, or Kitco.)

Real-time Gold Price Tracking

[Insert live gold price feed here]

Analyst Forecasts and Expert Opinions

Financial analysts offer differing views on the future direction of gold prices. Some predict further increases, driven by persistent inflation and geopolitical concerns. Others believe the price may consolidate or even experience a correction, as interest rates remain high. It is crucial to assess multiple perspectives before making any investment decisions.

- Bullish forecasts: Many analysts believe that the gold price will continue to rise due to long-term inflationary pressures and geopolitical instability.

- Bearish forecasts: Others suggest that the gold price could experience a correction due to factors like rising interest rates.

- Neutral forecasts: Some analysts remain neutral, suggesting a consolidation phase before any major price movements occur.

Charts and graphs visualizing gold price predictions from various sources should be incorporated here.

Conclusion

The unprecedented surge in the gold price to $3,500, coupled with rising Dow futures, represents a significant turning point in the market. Several factors, including inflation, geopolitical uncertainty, and a weakening US dollar, have converged to drive this remarkable increase. Understanding these contributing elements and monitoring live updates is crucial for investors navigating this dynamic market environment. Stay informed on the evolving gold price and adjust your investment strategy accordingly to mitigate risk and capitalize on potential opportunities. Keep checking back for the latest gold price updates and analysis. Regularly reviewing the gold market and understanding the factors influencing the gold price today is key to effective investment strategies.

Featured Posts

-

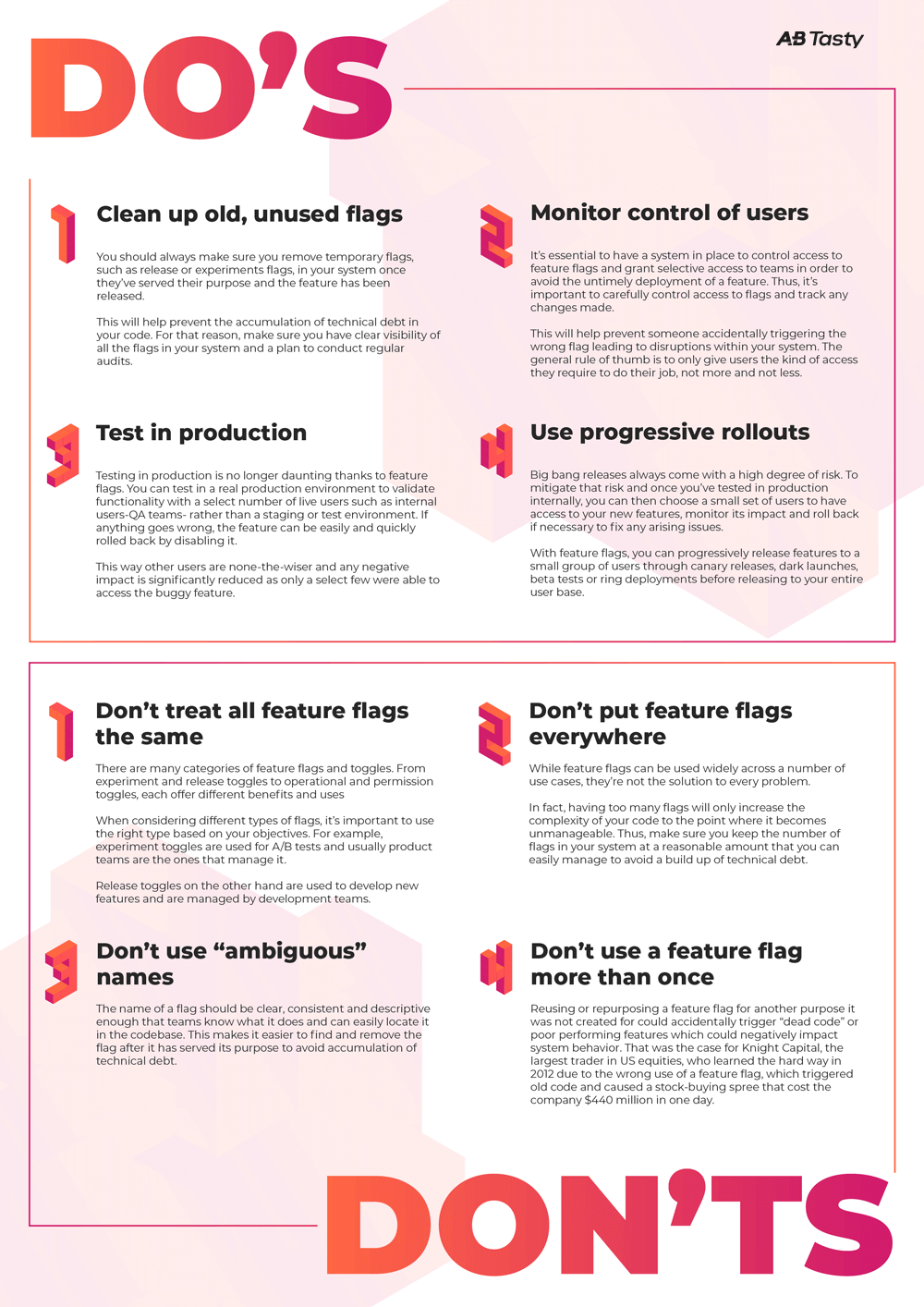

Navigate The Private Credit Job Market 5 Essential Dos And Don Ts

Apr 23, 2025

Navigate The Private Credit Job Market 5 Essential Dos And Don Ts

Apr 23, 2025 -

Future Of Microsoft Activision Merger Uncertain After Ftc Appeal

Apr 23, 2025

Future Of Microsoft Activision Merger Uncertain After Ftc Appeal

Apr 23, 2025 -

Turning Trash To Treasure An Ai Powered Podcast From Scatological Documents

Apr 23, 2025

Turning Trash To Treasure An Ai Powered Podcast From Scatological Documents

Apr 23, 2025 -

Yankees Opening Day Success Deconstructing Their Winning Play

Apr 23, 2025

Yankees Opening Day Success Deconstructing Their Winning Play

Apr 23, 2025 -

Illness Keeps Francona From Brewers Game

Apr 23, 2025

Illness Keeps Francona From Brewers Game

Apr 23, 2025