FTC Appeals Activision Blizzard Acquisition: Will The Deal Still Happen?

Table of Contents

The FTC's Argument Against the Acquisition

The FTC's core argument centers on significant antitrust concerns. They believe the merger would give Microsoft an unfair monopoly in the video game market, harming competition and ultimately, consumers. Their case rests on several key pillars:

-

Call of Duty's Dominance: The FTC argues that "Call of Duty," a massively popular franchise, is crucial to the competitive landscape. Microsoft acquiring Activision Blizzard would give them control over this title, allowing them to leverage it to stifle competitors.

-

Xbox Game Pass Exclusivity: A major point of contention is the potential for Microsoft to make "Call of Duty" and other Activision Blizzard titles exclusive to its Xbox Game Pass subscription service. This, the FTC argues, would severely disadvantage rival platforms like PlayStation and Nintendo, potentially driving them out of the market or forcing them to make significant concessions.

-

Market Power and Suppression: The FTC’s case emphasizes the combined market power of Microsoft and Activision Blizzard. They argue this combined entity would have the ability to suppress competition by raising prices, reducing innovation, and limiting consumer choice. Analysis shows that Microsoft already holds a substantial share of the gaming market, and this acquisition would significantly increase their dominance. The acquisition also encompasses other key titles beyond Call of Duty, like Candy Crush, World of Warcraft, and Overwatch, potentially impacting multiple gaming sectors.

Microsoft's Defense of the Acquisition

Microsoft vehemently defends the acquisition, arguing it will ultimately benefit consumers and foster innovation within the gaming industry. Their key arguments include:

-

Expanded Game Pass Offerings: Microsoft insists the acquisition will expand the already popular Xbox Game Pass, providing more value for subscribers and making a wider range of games accessible to a broader audience.

-

Increased Competition and Innovation: Microsoft contends that the acquisition will actually increase competition by fostering innovation and allowing them to invest more heavily in game development. They argue that their greater resources will lead to more high-quality games and a more vibrant gaming ecosystem.

-

Continued Multi-Platform Availability: A crucial element of Microsoft’s defense is their repeated pledge to keep "Call of Duty" and other key titles available on multiple platforms, including PlayStation and Nintendo Switch. They have even offered binding contractual agreements to ensure this remains the case. Furthermore, Microsoft highlights their investments in cloud gaming technology, which would benefit smaller developers and potentially increase competition.

The Role of International Regulators

The outcome of the Activision Blizzard acquisition isn't solely dependent on the FTC's appeal. International regulators play a crucial role. The UK's Competition and Markets Authority (CMA) initially blocked the deal, raising similar antitrust concerns. The EU, however, has conditionally approved the merger. These differing stances highlight the complexities of global regulatory landscapes and the varying interpretations of antitrust laws. The resolution of these international regulatory reviews could significantly influence the FTC's appeal and its eventual outcome.

The Likelihood of the Deal's Success

Predicting the outcome of the FTC's appeal is challenging. Both sides present compelling arguments, and the legal process itself is complex and lengthy. However, several factors suggest potential scenarios:

-

Strength of the FTC's Case: While the FTC's concerns regarding competition are valid, proving a direct causal link between the merger and a significant reduction in competition will be critical to their success.

-

Microsoft's Concessions: The concessions Microsoft has offered, including long-term agreements to maintain "Call of Duty" on competing platforms, could significantly influence the court’s decision.

-

Precedent and Future Implications: The outcome will set a significant precedent for future mergers and acquisitions in the tech sector, particularly within the gaming industry. This adds considerable weight to the legal battle.

Conclusion:

The FTC's appeal against the Activision Blizzard acquisition presents a significant hurdle for Microsoft. The final decision will hinge on a careful evaluation of the antitrust concerns, the potential impact on competition, and the validity of Microsoft’s proposed solutions. This legal battle’s outcome will be far-reaching, affecting not only the gaming industry but also shaping regulatory approaches to large-scale mergers and acquisitions in the technology sector.

Call to Action: Stay informed about the developments in this pivotal case. The FTC’s appeal against the Activision Blizzard acquisition is a dynamic situation with potentially significant long-term implications. Follow our updates for further analysis and insights into the future of this landmark deal. Subscribe to our newsletter for in-depth coverage and expert commentary on this and other important developments in the gaming industry.

Featured Posts

-

Insta360 X5 A Deep Dive Review

Apr 23, 2025

Insta360 X5 A Deep Dive Review

Apr 23, 2025 -

Trump Meets With Walmart And Target Executives On Rising Tariffs

Apr 23, 2025

Trump Meets With Walmart And Target Executives On Rising Tariffs

Apr 23, 2025 -

Rep Nancy Mace And Constituent Clash Details Emerge From South Carolina

Apr 23, 2025

Rep Nancy Mace And Constituent Clash Details Emerge From South Carolina

Apr 23, 2025 -

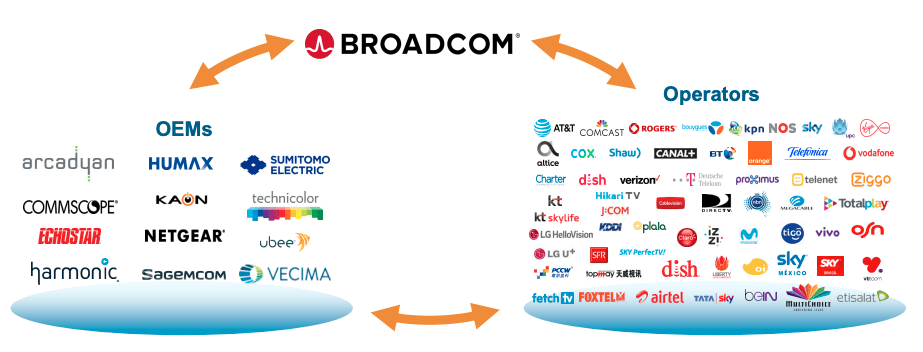

V Mware Costs To Skyrocket 1050 At And Ts Concerns Over Broadcoms Acquisition

Apr 23, 2025

V Mware Costs To Skyrocket 1050 At And Ts Concerns Over Broadcoms Acquisition

Apr 23, 2025 -

Brewers Surprise Unexpected Clutch Hitting In 2025

Apr 23, 2025

Brewers Surprise Unexpected Clutch Hitting In 2025

Apr 23, 2025