Equifax (EFX) Surpasses Profit Expectations, Holds Steady On Economic Outlook

Table of Contents

Equifax's Q3 Earnings Report: A Deep Dive

Equifax's Q3 2023 earnings report showcased robust financial performance across key metrics. The company significantly exceeded expectations, demonstrating its resilience and strategic effectiveness in a dynamic market.

- EPS (Earnings Per Share): Equifax reported an EPS of [Insert Actual EPS figure], surpassing the consensus analyst estimate of [Insert Analyst Estimate]. This represents a [Percentage]% increase compared to the same quarter last year.

- Revenue Growth: Total revenue reached [Insert Actual Revenue Figure], marking a [Percentage]% increase year-over-year. This growth was driven by strong performance across various segments, including [Mention specific segments like USIS, International, etc. and their contributions].

- Improved Margins: Equifax reported improved operating margins, indicating increased efficiency and cost management. This reflects the company's commitment to optimizing its operations and maximizing profitability.

Analysis of Surpassing Profit Expectations

Several factors contributed to Equifax's better-than-expected profit performance.

- Strategic Initiatives: The successful launch of new products and services, such as [Mention specific new products or services], significantly boosted revenue and market share. These initiatives demonstrate Equifax's ability to innovate and adapt to evolving customer needs.

- Effective Cost Management: Equifax implemented effective cost-cutting measures without compromising the quality of its services. This strategic approach enhanced profitability and demonstrated financial prudence.

- Growing Customer Base: The company experienced a substantial increase in its customer base across both its consumer and commercial segments. This reflects strong demand for Equifax's data and analytics solutions.

- Favorable Market Conditions: While the broader economic environment presents challenges, specific market trends, such as [Mention relevant market trends, e.g., increased demand for credit scoring solutions], positively impacted Equifax's performance.

Equifax's Economic Outlook: Maintaining a Steady Perspective

Despite potential economic headwinds, Equifax maintains a relatively positive outlook for the remainder of the year. The company acknowledges potential risks, but its strategic initiatives and diversified business model position it for continued success.

- Inflationary Pressures: Equifax acknowledges the impact of inflation on consumer spending and business investment but believes its services remain essential, mitigating potential negative effects.

- Interest Rate Hikes: The company anticipates that interest rate increases will impact certain market segments, but its diversified business model provides a buffer against significant negative consequences.

- Consumer Spending: While acknowledging some slowdown in consumer spending, Equifax's analysis suggests a degree of resilience in key areas driving its business.

- Mitigation Strategy: Equifax plans to navigate potential economic uncertainties through continued innovation, operational efficiency, and strategic investments in key growth areas.

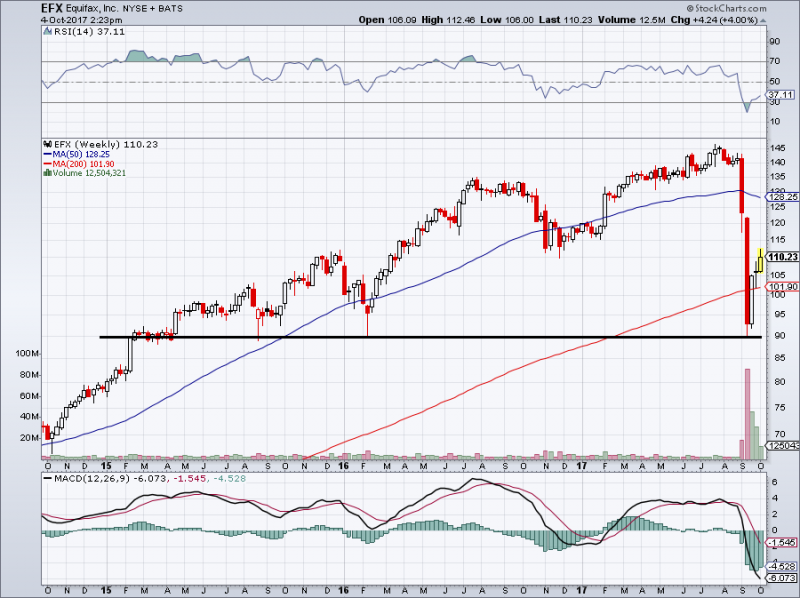

Investor Reaction and Stock Performance

The market responded positively to Equifax's strong Q3 earnings report. The EFX stock price [Describe the movement of the stock price – e.g., experienced a [Percentage]% increase] following the announcement. Analyst ratings have generally been upgraded, reflecting a renewed confidence in the company's future prospects. Long-term investors appear encouraged by the consistent financial performance and the company's positive economic outlook.

Conclusion: Equifax (EFX) Delivers Strong Results and Offers a Positive View – What's Next?

Equifax (EFX) has delivered exceptionally strong Q3 2023 results, surpassing profit expectations and demonstrating its resilience in a challenging economic environment. The company's positive economic outlook, driven by strategic initiatives, efficient cost management, and a growing customer base, provides a compelling narrative for investors. This success is a testament to Equifax's ability to adapt and thrive in a dynamic market. To stay informed on Equifax (EFX)'s performance and the latest financial news impacting the company, subscribe to our newsletter [Insert link to newsletter signup]. Learn more about investment opportunities with Equifax (EFX) by visiting [Insert link to relevant resource].

Featured Posts

-

3 Mart 2024 Pazartesi Istanbul Iftar Ve Sahur Vakitleri

Apr 23, 2025

3 Mart 2024 Pazartesi Istanbul Iftar Ve Sahur Vakitleri

Apr 23, 2025 -

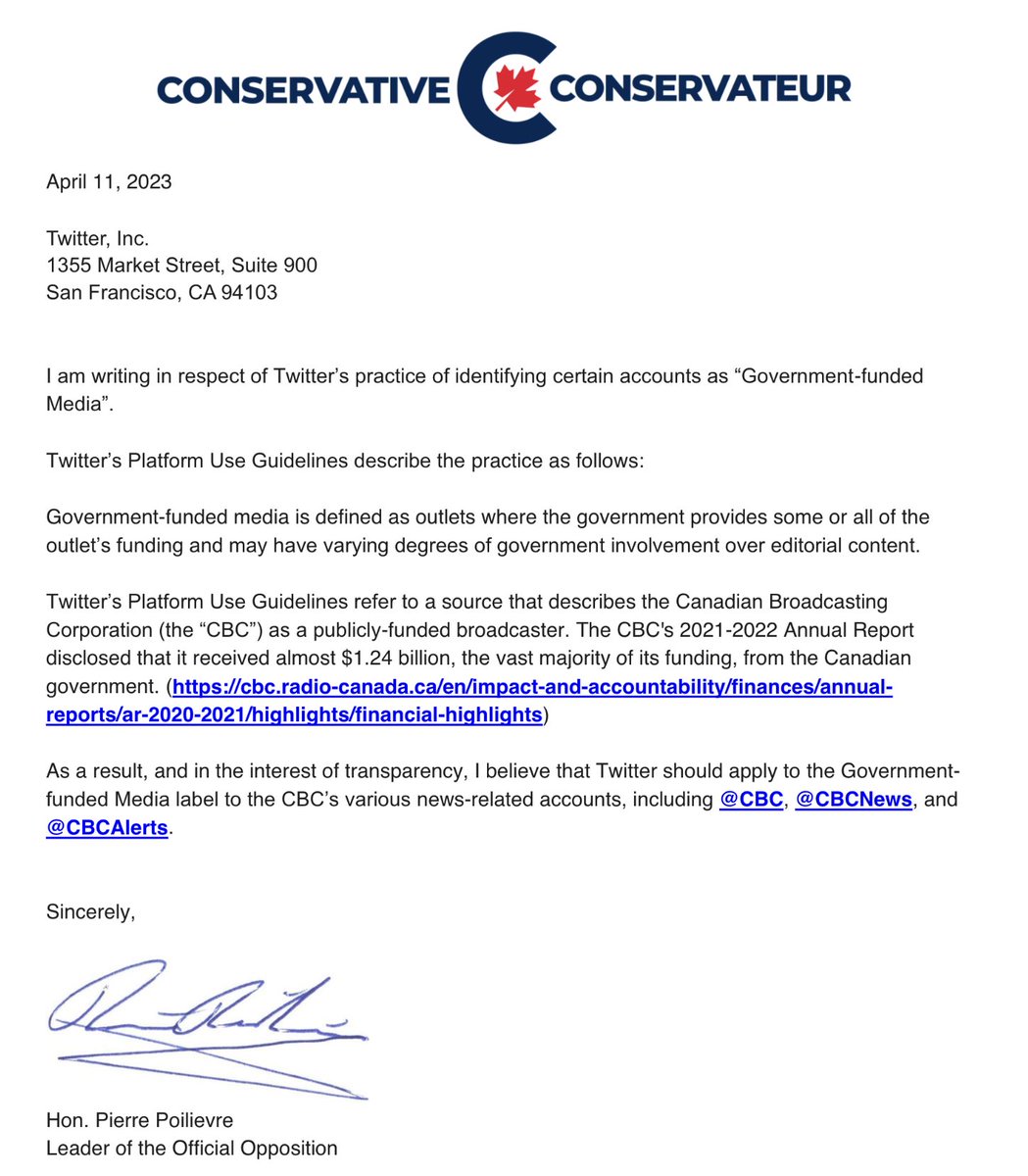

Pierre Poilievres Collapse How A 20 Point Lead Vanished

Apr 23, 2025

Pierre Poilievres Collapse How A 20 Point Lead Vanished

Apr 23, 2025 -

Reds 1 0 Loss A Peculiar Mlb Record

Apr 23, 2025

Reds 1 0 Loss A Peculiar Mlb Record

Apr 23, 2025 -

Analyzing Warren Buffetts Apple Exit Implications For Investors

Apr 23, 2025

Analyzing Warren Buffetts Apple Exit Implications For Investors

Apr 23, 2025 -

Son Dakika Erzurum Okullari Tatil Mi Degil Mi 24 Subat 2024 Guencel Bilgi

Apr 23, 2025

Son Dakika Erzurum Okullari Tatil Mi Degil Mi 24 Subat 2024 Guencel Bilgi

Apr 23, 2025