Trump On Powell: Confirmation Of Continued Fed Chairmanship

Table of Contents

President Trump's decision regarding Jerome Powell's continued tenure as Federal Reserve Chairman was a pivotal moment in American economic and political history. This high-stakes decision, laden with implications for the nation's financial future, sparked considerable debate and analysis. This article dissects President Trump's decision to confirm Jerome Powell, exploring the political climate, assessing Powell's performance, and examining the broader implications for the US economy.

The Political Landscape Surrounding the Decision

The confirmation of Jerome Powell as Federal Reserve Chairman was far from a simple formality. President Trump, known for his often-critical stance on the Federal Reserve's actions, faced significant political pressure leading up to his decision. This pressure stemmed from various sources and influenced the ultimate outcome.

- Internal Republican Party Divisions: Differing opinions within the Republican party regarding monetary policy created internal friction. Some factions advocated for more aggressive economic stimulus, contrasting with Powell's more cautious approach. This internal debate significantly influenced the political landscape surrounding the decision.

- The Looming Election: The 2020 presidential election loomed large, casting a shadow over every decision made by the administration. Economic conditions, including job growth and inflation, were paramount concerns. A strong economy was essential for Trump's reelection prospects, influencing his assessment of Powell's performance.

- Global Economic Uncertainty: The global economic climate, characterized by trade wars and growing uncertainty, further complicated the decision-making process. Navigating these complex international factors weighed heavily on Trump's consideration of Powell's suitability for another term.

Powell's Performance and Economic Indicators Under His Leadership

Analyzing Jerome Powell's performance requires examining key economic indicators during his chairmanship. His tenure encompassed periods of significant economic growth, followed by the unprecedented challenges posed by the COVID-19 pandemic.

- Pre-Pandemic Growth: Before the pandemic struck, the US economy experienced a period of moderate growth, with relatively low unemployment and stable inflation. Powell's policies during this time contributed to this economic stability, although their effectiveness remains a subject of ongoing debate.

- The COVID-19 Response: The pandemic brought about an unprecedented economic crisis, requiring immediate and decisive action from the Federal Reserve. Powell's leadership during this period involved aggressive monetary easing measures, including significant interest rate cuts and quantitative easing, aiming to mitigate the economic fallout. The success and long-term consequences of these interventions are still being assessed.

- Inflation and Interest Rates: The management of inflation and interest rates under Powell's leadership was another key aspect of his performance. The rate of inflation increased significantly in the wake of the pandemic, presenting a challenge that required careful monetary policy adjustments.

Implications of Powell's Continued Chairmanship

The continuation of Jerome Powell's chairmanship carries substantial implications for the future direction of the US economy and its financial markets.

- Monetary Policy Trajectory: Powell's reappointment suggests a continuation of his existing monetary policy approach, which emphasizes a data-driven approach to interest rate decisions. This approach is generally favored by investors seeking predictability and stability in the financial markets.

- Impact on Financial Markets: The news of Powell's confirmation generally had a positive effect on financial markets, indicating confidence in his economic management expertise. However, the impact may vary depending on future economic data and policy decisions.

- Long-Term Economic Outlook: Powell’s continued leadership provides a sense of stability and predictability, which is vital for long-term economic planning and investment. His actions will significantly influence the trajectory of the US economy in the coming years.

Conclusion:

President Trump's decision to confirm Jerome Powell as Federal Reserve Chairman was a complex one, influenced by political considerations, economic realities, and global uncertainties. Powell’s performance, marked by periods of economic growth and the challenges of the COVID-19 pandemic, shaped the President’s decision. The implications of this decision will continue to unfold, impacting monetary policy, financial markets, and the long-term economic outlook for the United States. Share your thoughts on Trump's decision regarding Powell's continued Fed Chairmanship in the comments below. Let's discuss the future implications of this crucial appointment and stay updated on the latest developments related to Trump on Powell and the Federal Reserve.

Featured Posts

-

Teslas Q1 2024 Financial Results Significant Impact Of Political Factors On Net Income

Apr 24, 2025

Teslas Q1 2024 Financial Results Significant Impact Of Political Factors On Net Income

Apr 24, 2025 -

7

Apr 24, 2025

7

Apr 24, 2025 -

How Instagrams New Video Editor Plans To Disrupt Tik Toks Dominance

Apr 24, 2025

How Instagrams New Video Editor Plans To Disrupt Tik Toks Dominance

Apr 24, 2025 -

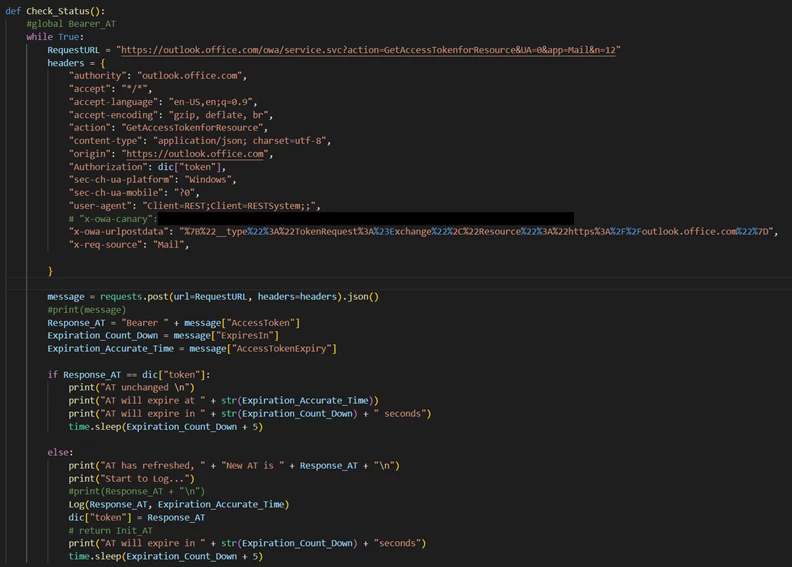

Cybercriminal Accused Of Millions In Office365 Executive Email Account Breaches

Apr 24, 2025

Cybercriminal Accused Of Millions In Office365 Executive Email Account Breaches

Apr 24, 2025 -

Us Tariffs Drive Chinas Lpg Imports Towards The Middle East

Apr 24, 2025

Us Tariffs Drive Chinas Lpg Imports Towards The Middle East

Apr 24, 2025