Canadian Investment In US Stocks: A New High Amidst Trade Tensions

Table of Contents

The Rise of Canadian Investment in US Equities

Canadian portfolio diversification has long included US equities, but recent figures reveal a significant upswing in Canadian investment in the American stock market. This surge isn't simply a matter of increased investment; it represents a notable shift in investment strategies. Several factors contribute to this compelling trend:

-

Quantitative Data: Data from [insert reputable source, e.g., Statistics Canada, a major financial institution] shows a [insert percentage]% increase in Canadian investment in US stocks year-over-year, reaching a total of [insert dollar figure] in [insert year]. This represents a substantial increase compared to previous years.

-

US Market Outperformance: Over the past [insert time period, e.g., five years], the performance of US stocks has, on average, outpaced Canadian equities, offering attractive investment returns for Canadian investors despite market volatility. This strong performance has undoubtedly influenced investment decisions.

-

Currency Exchange Rates: Favorable currency exchange rates between the Canadian dollar (CAD) and the US dollar (USD) have also played a significant role. Periods of CAD weakness relative to the USD can make US stocks appear more attractive to Canadian investors, boosting investment flows.

Specific sectors like technology and healthcare within the US stock market have attracted significant Canadian investment. Companies like [insert examples of specific US companies popular with Canadian investors] have seen increased Canadian ownership. The diversification benefits for Canadian investors are clear, reducing reliance on the Canadian market's performance and mitigating potential risks associated with a single-country investment strategy.

Navigating Trade Tensions: Investor Confidence and Resilience

The ongoing trade tensions between Canada and the US, including past disputes and the complexities of the USMCA (United States-Mexico-Canada Agreement), might seem counterintuitive to this increased investment. However, investor confidence and sophisticated risk mitigation strategies are at play.

-

Impact of Trade Tensions: While trade policy uncertainty and geopolitical risk are real concerns, their impact on investor sentiment seems to be less significant than the other factors driving investment. Many investors view trade tensions as manageable risks rather than insurmountable obstacles.

-

Risk Mitigation Strategies: Sophisticated investors employ various risk mitigation strategies, such as hedging against currency fluctuations and diversifying across different sectors and asset classes within the US market. This approach reduces the overall impact of potential negative consequences from trade disputes.

-

CUSMA's Influence: The USMCA provides a framework for trade between the countries, offering some degree of stability and predictability. While not eliminating all risk, the agreement likely contributes to investor confidence, making cross-border investment less daunting.

Investors appear to be viewing the current level of trade tensions as a short-term concern, rather than a long-term impediment to profitable investment in US equities.

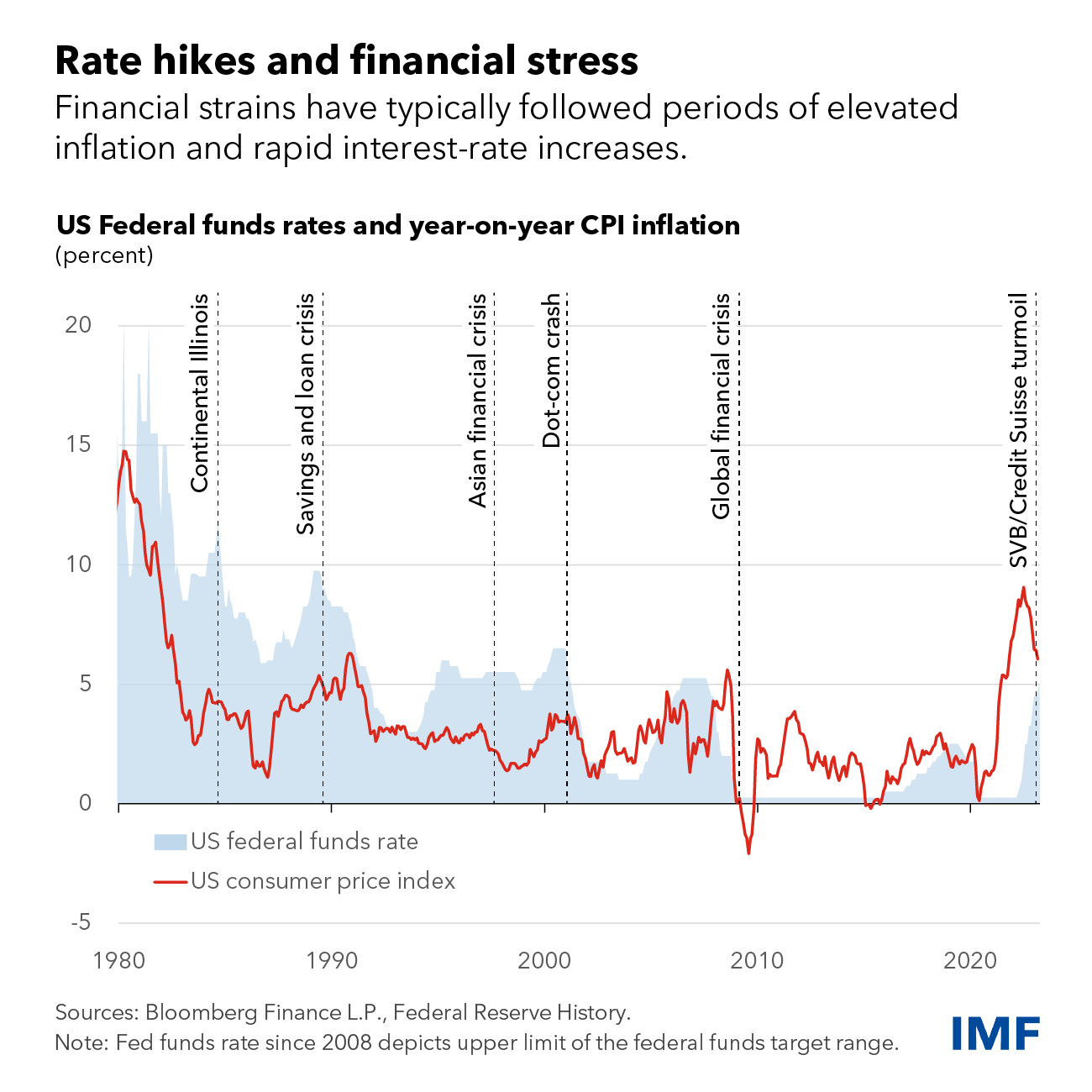

The Role of Low Interest Rates and Economic Factors

Macroeconomic factors significantly influence investment decisions. The current interest rate environment plays a crucial role in the surge of Canadian investment in US stocks.

-

Low Interest Rates in Canada: Low interest rates in Canada reduce the returns on traditional savings and fixed-income investments. This pushes investors towards higher-yield opportunities in the US stock market, where they can potentially achieve better returns despite the associated risks.

-

Economic Growth: Relative economic growth in both countries also plays a significant role. Stronger growth in the US compared to Canada could attract investment due to better prospects for company performance and capital appreciation.

-

Monetary Policy: Monetary policy decisions by both the Bank of Canada and the Federal Reserve influence investor behaviour. Expansionary monetary policies can encourage investment in riskier assets like equities.

In essence, low interest rates in Canada are driving investors towards higher-yield opportunities, particularly in the robust US market, even amid potential trade uncertainties.

Future Outlook for Canadian Investment in US Stocks

Predicting future trends is inherently challenging, but based on current patterns, several factors point toward a continued, albeit potentially fluctuating, level of Canadian investment in US stocks.

-

Investment Forecast: Given continued low interest rates in Canada, robust growth in specific sectors of the US economy, and sophisticated risk management techniques employed by Canadian investors, a continuation of the current trend is plausible. However, significant shifts in trade policy or unexpected economic downturns could alter this forecast.

-

Risks and Opportunities: The biggest risks remain linked to trade policy uncertainty, macroeconomic shocks, and general market volatility. Opportunities exist in sectors experiencing robust growth, such as technology and renewable energy.

-

Portfolio Management: Canadian investors should diversify their portfolios, carefully consider risk tolerance, and seek professional financial advice to navigate the complexities of the US stock market and mitigate potential risks associated with cross-border investments.

Potential changes in US and Canadian economic policies, including shifts in monetary policy or significant alterations to trade agreements, will greatly influence future investment flows. The long-term sustainability of this trend depends on the continuing relative attractiveness of US equities in comparison to Canadian investment opportunities and the evolution of the geopolitical landscape.

Conclusion

The significant increase in Canadian investment in US stocks represents a remarkable trend, occurring despite ongoing trade tensions between the two countries. This surge is driven by a confluence of factors, including the outperformance of US equities, favourable currency exchange rates, low interest rates in Canada, and sophisticated risk management strategies employed by Canadian investors. While trade policy uncertainty remains a factor, it appears to be less impactful than the other driving forces. To make informed decisions, Canadians considering investment in US stocks should carefully assess their risk tolerance and seek professional advice. Understanding the risks and opportunities associated with cross-border investment in the current climate is crucial for successful portfolio management. Further research into specific sectors within the US market and the nuances of USMCA can help you optimize your Canadian investment in US stocks.

Featured Posts

-

Marches Parisiens Decryptage Fdj Et Schneider Electric Semaine Du 17 Fevrier

Apr 23, 2025

Marches Parisiens Decryptage Fdj Et Schneider Electric Semaine Du 17 Fevrier

Apr 23, 2025 -

7 Nisan Pazartesi Bu Aksam Hangi Diziler Var

Apr 23, 2025

7 Nisan Pazartesi Bu Aksam Hangi Diziler Var

Apr 23, 2025 -

350 Kata Inspirasi Hari Senin Motivasi Untuk Memulai Pekan Kerja

Apr 23, 2025

350 Kata Inspirasi Hari Senin Motivasi Untuk Memulai Pekan Kerja

Apr 23, 2025 -

Asear Alktakyt Alywm Alathnyn 14 Abryl 2025 Fy Msr Thdyth Jdyd

Apr 23, 2025

Asear Alktakyt Alywm Alathnyn 14 Abryl 2025 Fy Msr Thdyth Jdyd

Apr 23, 2025 -

Global Financial Instability The Impact Of Trumps Trade War According To The Imf

Apr 23, 2025

Global Financial Instability The Impact Of Trumps Trade War According To The Imf

Apr 23, 2025