Global Financial Instability: The Impact Of Trump's Trade War, According To The IMF

Table of Contents

IMF Assessment of the Trade War's Economic Impact

The IMF consistently assessed the Trump administration's trade war as a significant drag on global economic growth. Their reports painted a bleak picture, highlighting the considerable damage inflicted by these protectionist policies. The organization's analysis consistently showed that the trade war's negative consequences far outweighed any potential short-term benefits.

-

Decreased global GDP growth projections: The IMF repeatedly downgraded its global GDP growth forecasts throughout the period of escalating trade tensions, citing the trade war as a primary factor. These downward revisions reflected the tangible impact on global economic output.

-

Disruptions to global supply chains: The imposition of tariffs and trade restrictions led to significant disruptions in global supply chains. Businesses faced increased costs and delays, impacting production and ultimately consumer prices. This complexity added to the overall global financial instability.

-

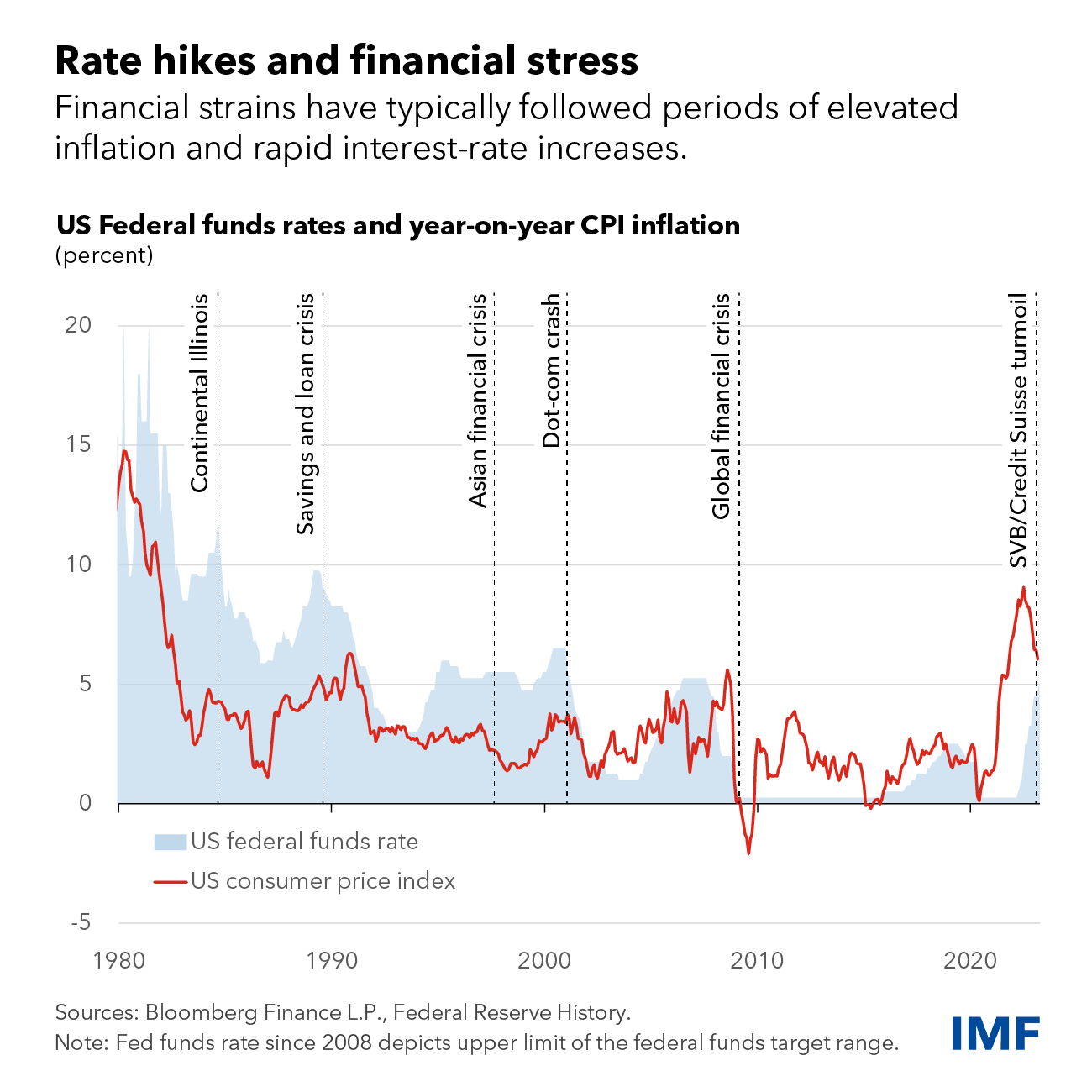

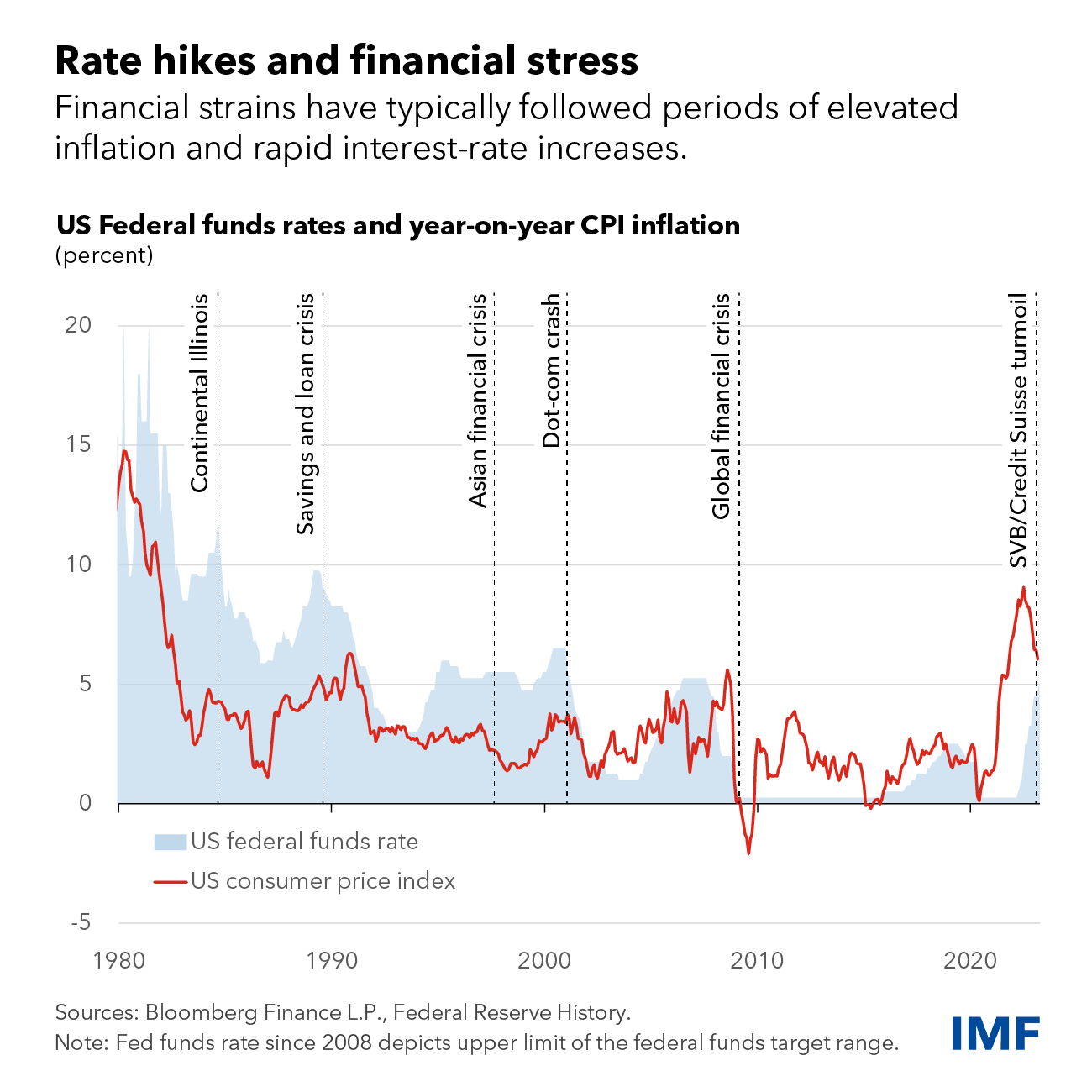

Increased uncertainty in financial markets: The unpredictable nature of the trade war fueled considerable uncertainty in financial markets. Investors struggled to assess the long-term implications of the escalating trade disputes, leading to increased volatility and risk aversion.

-

Negative impacts on specific sectors: Certain sectors, particularly agriculture and manufacturing, were disproportionately affected. Farmers faced reduced export opportunities and depressed prices, while manufacturers grappled with higher input costs.

-

Citation of relevant IMF reports and publications: The IMF's World Economic Outlook (WEO) reports from 2018-2020 contain detailed analyses of the trade war's impact, providing quantifiable evidence of its negative effects on global growth and financial stability. These reports serve as critical sources for understanding the extent of the global financial instability.

Increased Market Volatility and Investor Sentiment

The trade war significantly fueled market uncertainty and volatility. The constant threat of new tariffs and retaliatory measures created a climate of fear and uncertainty, impacting investor confidence and leading to significant market fluctuations.

-

Fluctuations in currency exchange rates: Currency markets reacted sharply to trade policy announcements, experiencing considerable volatility as investors adjusted their positions in response to changing economic prospects.

-

Stock market downturns and corrections: Stock markets around the world experienced downturns and corrections as investors reacted to the escalating trade tensions, reflecting a general decrease in global investor confidence.

-

Increased risk aversion among investors: Uncertainty surrounding trade policy led to increased risk aversion among investors, causing them to shift investments towards safer assets like government bonds, further impacting market liquidity and stability.

-

Impact on foreign direct investment (FDI): The trade war negatively impacted foreign direct investment (FDI) flows as businesses became hesitant to commit capital in an environment characterized by high uncertainty and protectionist policies, contributing to global financial instability.

-

Examples of specific market reactions: Specific examples, such as the sharp declines in stock markets following major trade policy announcements, can be found in financial news archives and market data reports to illustrate the immediate impact on market sentiment and investor behavior.

The Impact on Developing Economies

Developing economies were disproportionately affected by the trade war, facing significant challenges due to their increased reliance on international trade and their often limited capacity to absorb economic shocks.

-

Reduced export opportunities for developing countries: Many developing countries experienced reduced export opportunities due to increased tariffs and trade restrictions imposed by major economies. This hampered their economic growth and development prospects.

-

Increased import costs for essential goods: Higher import costs for essential goods, particularly food and energy, placed additional strain on households and governments in developing countries.

-

Strain on government budgets and development programs: Reduced export revenues and increased import costs placed significant strain on government budgets and hampered the implementation of crucial development programs.

-

Potential for social unrest and political instability: The economic hardship caused by the trade war increased the potential for social unrest and political instability in vulnerable developing countries.

-

Specific examples of countries significantly affected: Case studies of specific developing countries that suffered particularly severe economic consequences due to the trade war can effectively demonstrate the disproportionate impact on these nations.

Long-Term Consequences and Policy Recommendations

The Trump administration's trade war had long-lasting consequences for the global economy, highlighting the fragility of the international trading system and the importance of international cooperation. The IMF's policy recommendations emphasized the need for a rules-based multilateral trading system.

-

IMF recommendations for mitigating future trade conflicts: The IMF advocated for strengthening multilateral institutions and promoting dialogue to resolve trade disputes peacefully, emphasizing the dangers of unilateral protectionist measures.

-

The importance of multilateralism and international cooperation: The IMF stressed the critical role of multilateralism and international cooperation in maintaining global economic stability and fostering sustainable growth.

-

Potential for trade wars to lead to long-term economic stagnation: The IMF warned that repeated instances of protectionist policies could lead to long-term economic stagnation, underlining the risks of escalating trade conflicts.

-

The need for reforms in the global trading system: The IMF's analysis underscored the need for reforms in the global trading system to address its shortcomings and prevent future trade conflicts.

-

Discussion of potential future risks related to protectionist policies: The IMF regularly publishes analyses assessing the continuing risks associated with protectionist trade policies and their potential impact on global financial stability.

Conclusion

The IMF's analysis unequivocally demonstrates the significant negative impacts of the Trump administration's trade war on global financial stability. The decreased global growth, increased market volatility, and the disproportionate burden on developing economies underscore the detrimental effects of protectionist trade policies. The IMF's findings highlight the interconnectedness of the global economy and the importance of multilateral cooperation in maintaining stability.

Understanding the consequences of global financial instability, as analyzed by the IMF in relation to the Trump-era trade war, is crucial for policymakers and investors alike. Further research into the impact of protectionist policies on global financial instability is necessary to prevent future economic crises. Stay informed about the latest developments in global trade and the IMF's ongoing analysis to mitigate the risks of future global financial instability and build more resilient economies.

Featured Posts

-

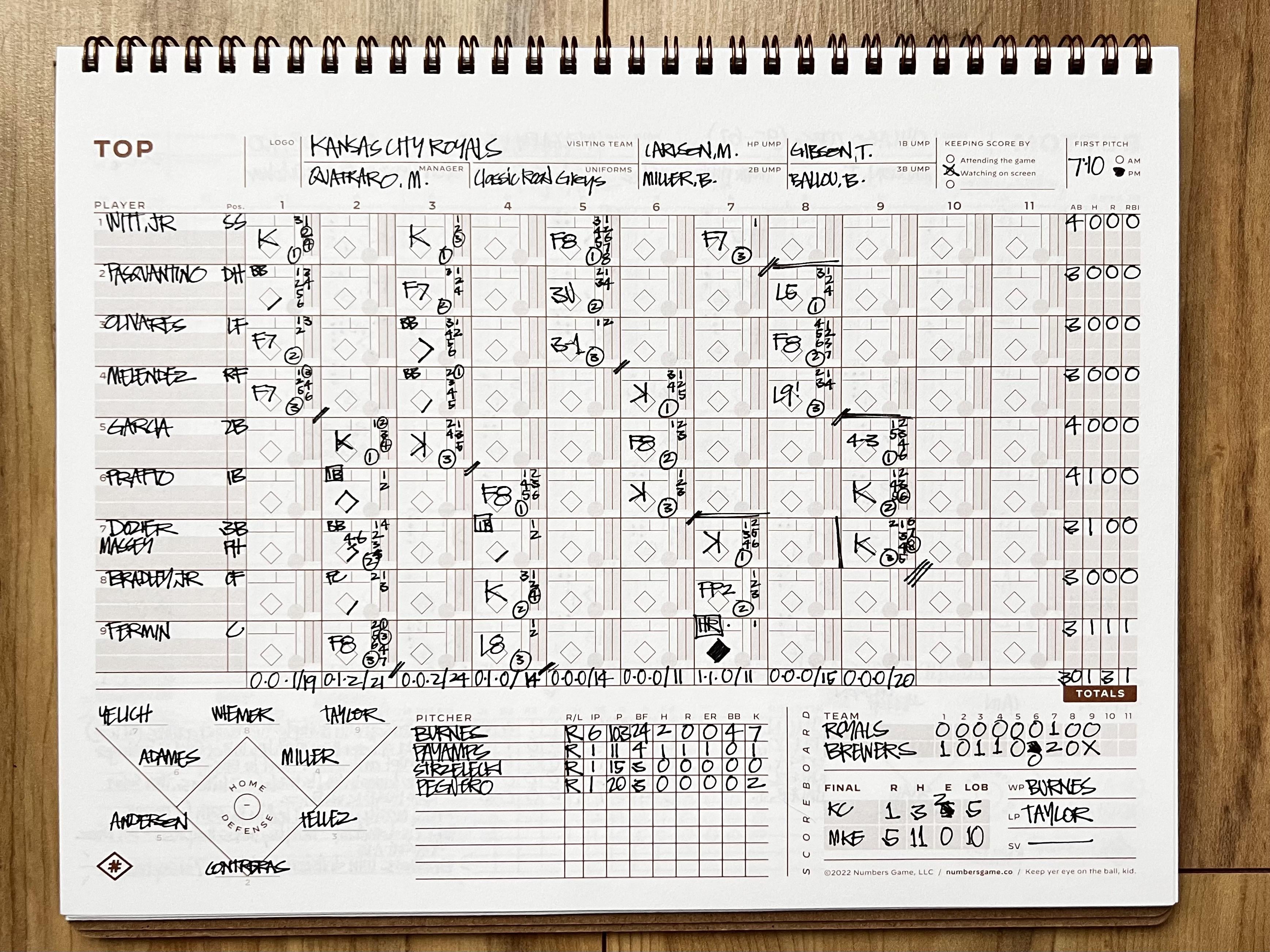

Royals Strong Performance Leads To 11 1 Win Over Brewers

Apr 23, 2025

Royals Strong Performance Leads To 11 1 Win Over Brewers

Apr 23, 2025 -

Nine Stolen Bases Brewers Rout As In Commanding Victory

Apr 23, 2025

Nine Stolen Bases Brewers Rout As In Commanding Victory

Apr 23, 2025 -

Ices Denial Of Release Prevents Mahmoud Khalil From Meeting His Son

Apr 23, 2025

Ices Denial Of Release Prevents Mahmoud Khalil From Meeting His Son

Apr 23, 2025 -

Two Homers By Jackson Chourio Brewers Dominate Reds 8 2

Apr 23, 2025

Two Homers By Jackson Chourio Brewers Dominate Reds 8 2

Apr 23, 2025 -

Analyzing The Brewers Batting Order Adjustments

Apr 23, 2025

Analyzing The Brewers Batting Order Adjustments

Apr 23, 2025