CAAT Pension Plan Seeks Increased Canadian Private Investment

Table of Contents

The CAAT Pension Plan's Investment Strategy and Need for Diversification

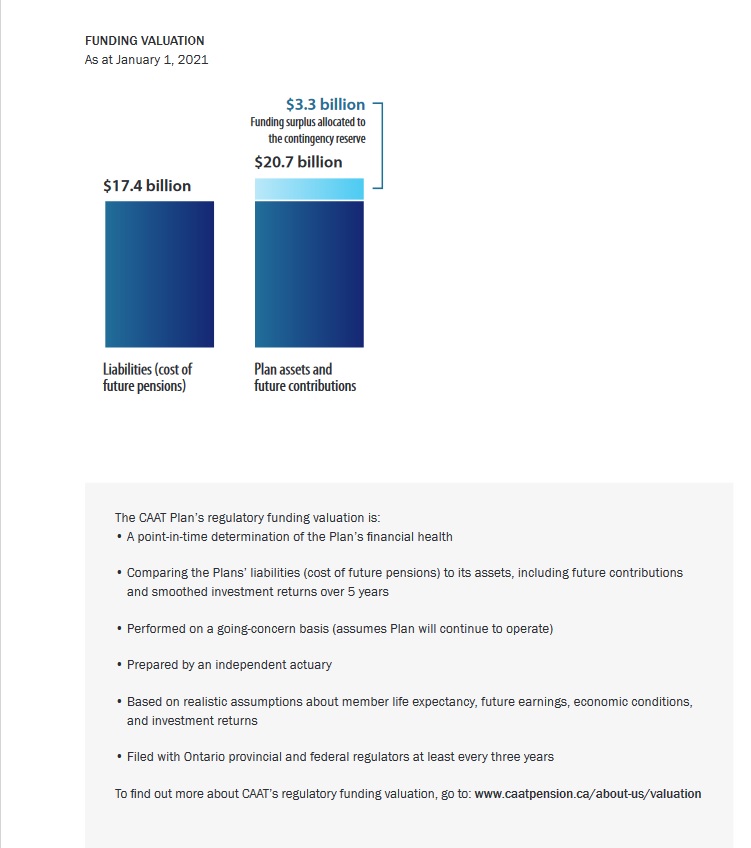

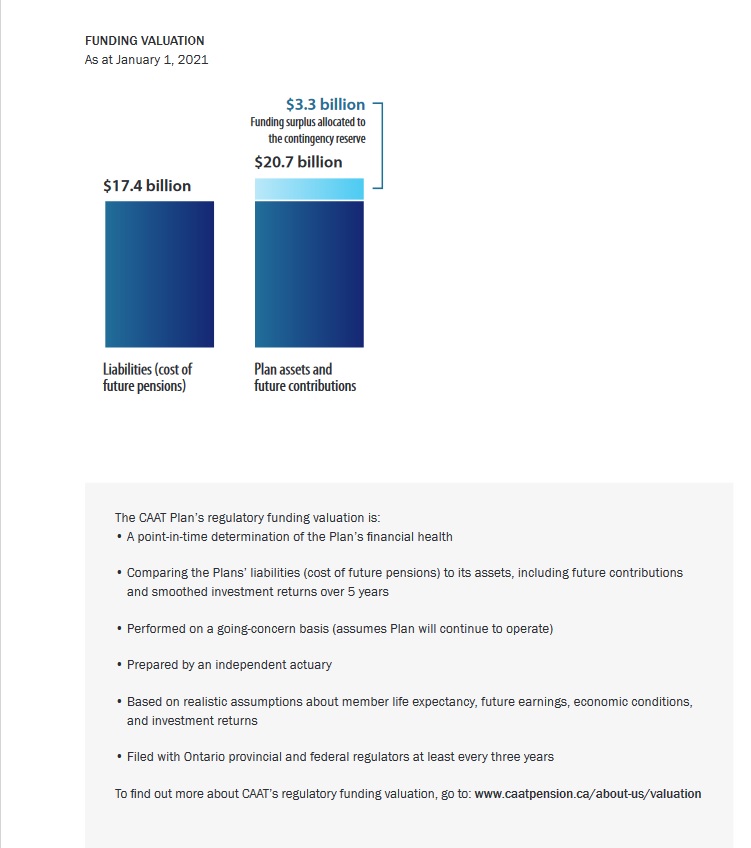

The CAAT Pension Plan, a defined benefit pension plan, manages the retirement savings of a large number of Canadian employees. Its investment mandate is to responsibly generate long-term returns to ensure the plan can meet its future obligations to its members. A core principle of sound pension fund management is diversification – spreading investments across various asset classes to mitigate risk and maximize returns. This approach reduces the impact of underperformance in any single sector and enhances the overall stability of the portfolio.

-

Current Investment Portfolio Breakdown: The CAAT Pension Plan's portfolio traditionally includes a mix of public equities, fixed income, real estate, and alternative investments. However, to further strengthen its position and capitalize on growth opportunities, the plan is strategically increasing its allocation to Canadian private investments.

-

Reasons for Seeking Increased Canadian Private Investment: The CAAT Pension Plan's pursuit of increased Canadian private investment is driven by several factors:

- Significant Growth Potential: The Canadian private sector offers exciting growth opportunities across various sectors.

- Economic Impact: Investing in domestic private companies directly contributes to Canadian economic growth and job creation.

- Long-Term Value Creation: Private investments often offer the potential for long-term value creation, aligning with the plan's long-term investment horizon.

-

Specific Sectors Targeted for Investment: The CAAT Pension Plan is focusing its private investment strategy on sectors showing strong potential, such as technology, infrastructure (including green infrastructure), and renewable energy. These sectors are expected to drive significant growth and contribute to a sustainable future.

Attracting Canadian Private Investment: Strategies and Challenges

To successfully attract Canadian private investment, the CAAT Pension Plan is employing a multi-pronged approach:

-

Marketing and Outreach Initiatives: The plan is actively engaging with potential investors through targeted marketing campaigns, industry conferences, and direct outreach to private companies. This involves highlighting the advantages of partnering with a long-term, responsible investor like the CAAT Pension Plan.

-

Competitive Advantages: The CAAT Pension Plan offers several compelling advantages to potential investors:

- Long-Term Commitment: The plan provides a long-term, stable source of capital, allowing businesses to focus on growth without the pressure of short-term market fluctuations.

- Stable Returns: The CAAT Pension Plan's investment strategy prioritizes stable, long-term returns, making it an attractive partner for businesses seeking dependable capital.

- Expertise and Resources: The plan leverages its substantial expertise and resources to support the growth and development of its portfolio companies.

-

Addressing Concerns: The CAAT Pension Plan is actively addressing concerns related to regulatory hurdles and market volatility through transparent communication and proactive risk management strategies. Building trust and maintaining open communication with investors is paramount to success.

Economic Impact of Increased Canadian Private Investment in the CAAT Pension Plan

The CAAT Pension Plan's increased investment in Canadian private companies will have significant positive ripple effects across the Canadian economy:

-

Job Creation: Direct investment in Canadian businesses translates to the creation of jobs in various sectors, from construction and manufacturing to technology and professional services. Indirect job creation will also occur as these businesses expand and their supply chains grow.

-

Economic Growth: Increased private investment stimulates economic activity, boosting overall GDP growth and strengthening the Canadian economy.

-

Innovation and Technological Advancement: Investments in innovative companies, particularly in the technology sector, will foster technological advancement and enhance Canada's competitiveness on the global stage.

-

Long-Term Economic Stability: A strong and diversified CAAT Pension Plan contributes to Canada's overall economic stability and reduces the burden on the public sector in supporting retirees.

Government Policy and its Role in Supporting Increased Private Investment

Government policies play a crucial role in fostering private sector investment in pension plans. Several measures could further encourage this vital investment:

-

Tax Incentives: Targeted tax incentives for private investors who commit capital to Canadian pension plans could significantly increase investment flows.

-

Regulatory Streamlining: Streamlining regulatory processes and reducing bureaucratic hurdles would make it easier for private companies to access capital from pension plans.

-

Government Support for Infrastructure Projects: Government support for infrastructure projects and other large-scale investment opportunities will create further incentives for private investment.

Conclusion

The CAAT Pension Plan's initiative to attract increased Canadian private investment is a strategic move with far-reaching benefits. By diversifying its investment portfolio and leveraging the potential of the Canadian private sector, the CAAT Pension Plan strengthens its financial position, secures the retirement income of its members, and contributes significantly to the Canadian economy. This initiative will create jobs, drive economic growth, and foster innovation. It's a crucial step towards ensuring a secure and prosperous future for all Canadians.

Call to Action: Learn more about how you can participate in the growth of the CAAT Pension Plan and contribute to a stronger Canadian economy by exploring investment opportunities in the CAAT Pension Plan. Contact us today to discuss CAAT Pension Plan investment options and how you can be a part of this important initiative.

Featured Posts

-

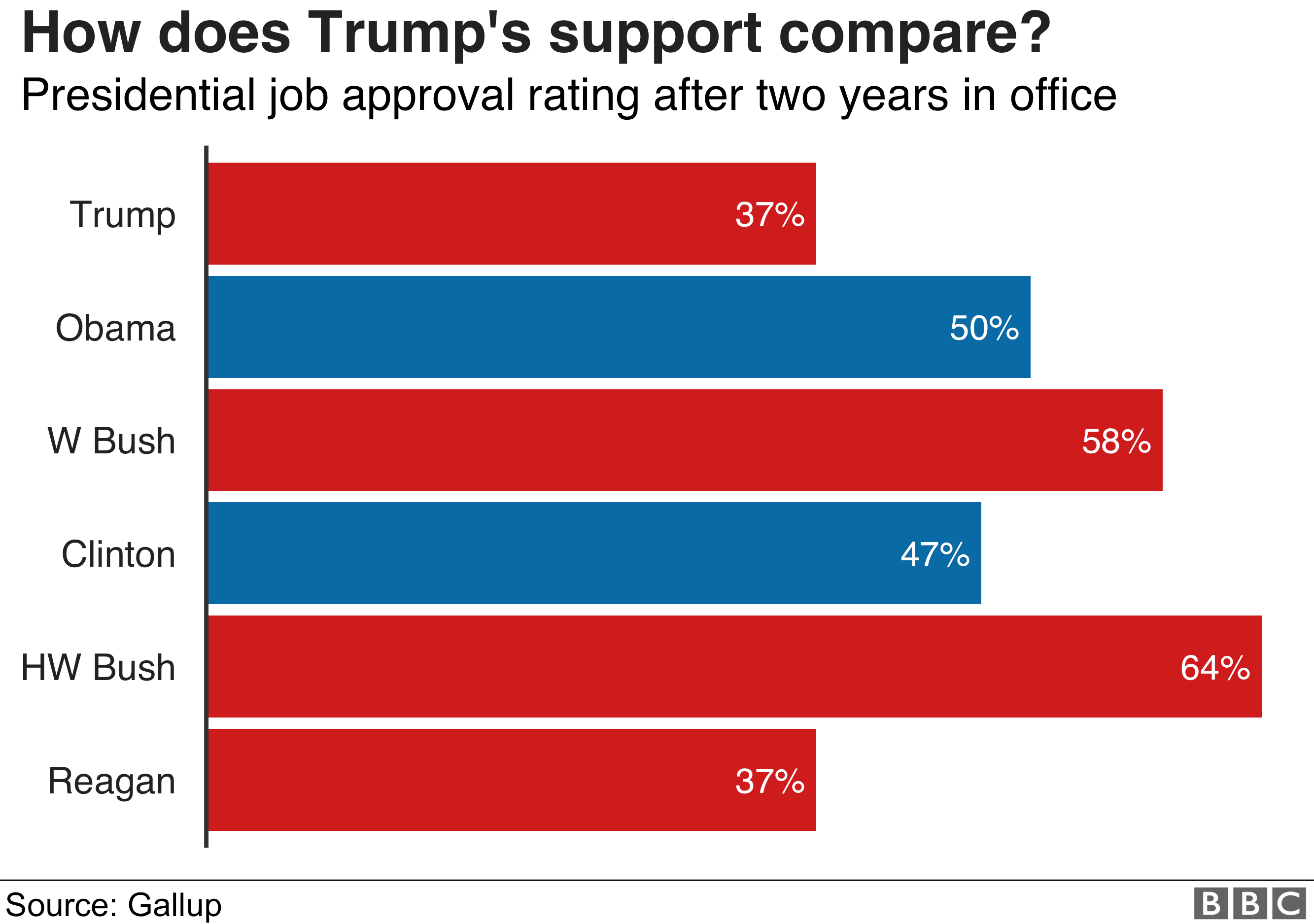

The Truth About The Trump Economy What The Data Reveals

Apr 23, 2025

The Truth About The Trump Economy What The Data Reveals

Apr 23, 2025 -

Lg C3 77 Inch Oled My Honest Review After Number Months

Apr 23, 2025

Lg C3 77 Inch Oled My Honest Review After Number Months

Apr 23, 2025 -

Did Warren Buffett Time His Apple Stock Sale Perfectly

Apr 23, 2025

Did Warren Buffett Time His Apple Stock Sale Perfectly

Apr 23, 2025 -

Actualites Economiques Du 18h Eco Lundi 14 Avril

Apr 23, 2025

Actualites Economiques Du 18h Eco Lundi 14 Avril

Apr 23, 2025 -

On Refait La Seance Paris Fdj Schneider Electric Et Les Meilleures Publications De La Semaine 17 02

Apr 23, 2025

On Refait La Seance Paris Fdj Schneider Electric Et Les Meilleures Publications De La Semaine 17 02

Apr 23, 2025