Did Warren Buffett Time His Apple Stock Sale Perfectly?

Table of Contents

Keywords: Warren Buffett, Apple stock, Berkshire Hathaway, stock sale, stock market, investment strategy, timing the market, Apple stock price, Buffett's Apple investment, value investing, intrinsic value

Warren Buffett, the Oracle of Omaha, and his investment vehicle, Berkshire Hathaway, have long been synonymous with shrewd investment decisions. However, recent sales of Apple stock by Berkshire Hathaway have sparked intense debate: Did Warren Buffett time his Apple stock sale perfectly? This article delves into the details surrounding these sales, examining the timing, the rationale, and the potential long-term implications for both Berkshire Hathaway and Apple.

The Apple Stock Sales: A Timeline and Breakdown

Berkshire Hathaway's divestment from Apple wasn't a single event but a series of sales spread across several quarters. Understanding the timeline and the context surrounding each sale is crucial to assessing their strategic significance.

-

Timeline: [Insert a detailed timeline here, specifying dates and the number of Apple shares sold on each occasion. Include a visually appealing chart showing the sales overlaid on the Apple stock price chart for those periods. Data sources should be clearly cited.]

-

Stock Price Analysis: [Analyze the Apple stock price on each sale date. Were the sales made at a peak, a trough, or somewhere in between? Discuss the price fluctuations leading up to and following each sale. Again, use charts to illustrate your points.]

-

Public Statements: [Summarize any public statements made by Warren Buffett or Berkshire Hathaway regarding the rationale behind these stock sales. Were there any press releases or interviews that shed light on their decision-making process?]

The context surrounding these sales is also critical. Were there specific market conditions, economic indicators, or industry trends that influenced Berkshire Hathaway's decision? [Discuss factors such as interest rate hikes, inflation concerns, potential economic downturns, or shifts in the tech sector that could have impacted the decision.]

Buffett's Investment Philosophy and Its Relevance

Warren Buffett is renowned for his long-term value investing approach. He famously focuses on companies with strong fundamentals, a durable competitive advantage, and a management team he trusts. But do the Apple stock sales align with this philosophy?

-

Value Investing Principles: [Explain Buffett's core tenets of value investing: intrinsic value, margin of safety, and long-term perspective. Provide examples from his past investments to illustrate these principles.]

-

Deviation from the Norm?: [Analyze whether the Apple sales represent a departure from Buffett's typical long-term holding strategy. Consider the duration of Berkshire Hathaway's Apple investment and the reasons behind the eventual sale. Did something change within Apple's fundamentals or competitive landscape?]

-

Outlook on Apple's Future: [Explore whether the sales suggest a change in Buffett's outlook on Apple's long-term prospects. Has his assessment of Apple's intrinsic value changed? This section should offer a reasoned interpretation, not speculation.]

Market Analysis and Expert Opinions

The market's reaction to Berkshire Hathaway's Apple stock sales, and the subsequent expert analyses, offer valuable insights into the perceived wisdom of the timing.

-

Expert Opinions: [Gather and summarize opinions from reputable financial analysts and commentators on the sales. Include quotes and cite sources to support your points. Were the sales seen as a strategic move, a sign of market pessimism, or something else entirely?]

-

Alternative Explanations: [Consider alternative explanations beyond market timing, such as tax implications, portfolio rebalancing for diversification, or the need to free up capital for other investment opportunities. Discuss the possibility of these factors influencing the decision.]

-

Market Reaction: [Detail the market's reaction to the news of the sales. Did the Apple stock price drop significantly? How did the market interpret the sales—as a negative signal or simply as portfolio management?]

The Potential Long-Term Impact on Berkshire Hathaway and Apple

The Apple stock sales have significant potential implications for both Berkshire Hathaway and Apple.

-

Berkshire Hathaway's Portfolio: [Analyze the impact of the sales on Berkshire Hathaway's portfolio diversification and overall financial performance. How did the divestiture affect its risk profile and overall investment strategy? This requires comparing it to the rest of the Berkshire Hathaway portfolio.]

-

Apple's Stock Price: [Discuss the potential impact of the sales on Apple's stock price and market capitalization in the short-term and long-term. Did the sales create a ripple effect, or was the impact minimal?]

-

Future Investment Moves: [Speculate on future investment moves by Berkshire Hathaway based on the Apple stock sales. Will they look to replace the Apple investment with another technology company or shift towards a different sector entirely? ]

Conclusion: Did Warren Buffett Perfectly Time His Apple Stock Sale?

Determining whether Warren Buffett's timing was "perfect" is complex. The sales weren't made at a clear market bottom, nor at a sky-high peak. The analysis suggests a multifaceted rationale encompassing long-term investment strategy, diversification, and possibly unforeseen market factors. While some experts see it as a strategic move, others remain uncertain. More time will likely be needed for a clearer picture to emerge.

Call to Action: Did Warren Buffett perfectly time his Apple stock sale, or is it still too early to tell? Stay informed about future investment moves by subscribing to our newsletter for updates on Warren Buffett and his investment strategy, or continue reading our other articles analyzing key stock movements. Follow our analysis on future Warren Buffett investment decisions related to Apple stock and other key holdings.

Featured Posts

-

Dates Des Vacances Scolaires 2025 Federation Wallonie Bruxelles

Apr 23, 2025

Dates Des Vacances Scolaires 2025 Federation Wallonie Bruxelles

Apr 23, 2025 -

Depozite Bancare Martie 2024 Top Banci Cu Cele Mai Mari Dobanzi

Apr 23, 2025

Depozite Bancare Martie 2024 Top Banci Cu Cele Mai Mari Dobanzi

Apr 23, 2025 -

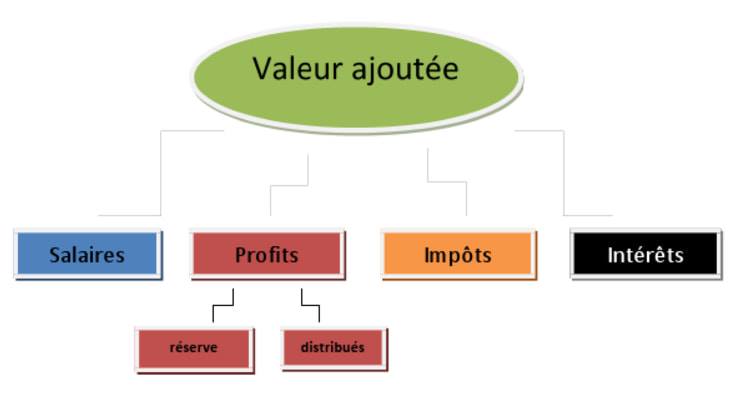

Valeur Ajoutee D Infotel Temoignages Clients Du 17 Fevrier

Apr 23, 2025

Valeur Ajoutee D Infotel Temoignages Clients Du 17 Fevrier

Apr 23, 2025 -

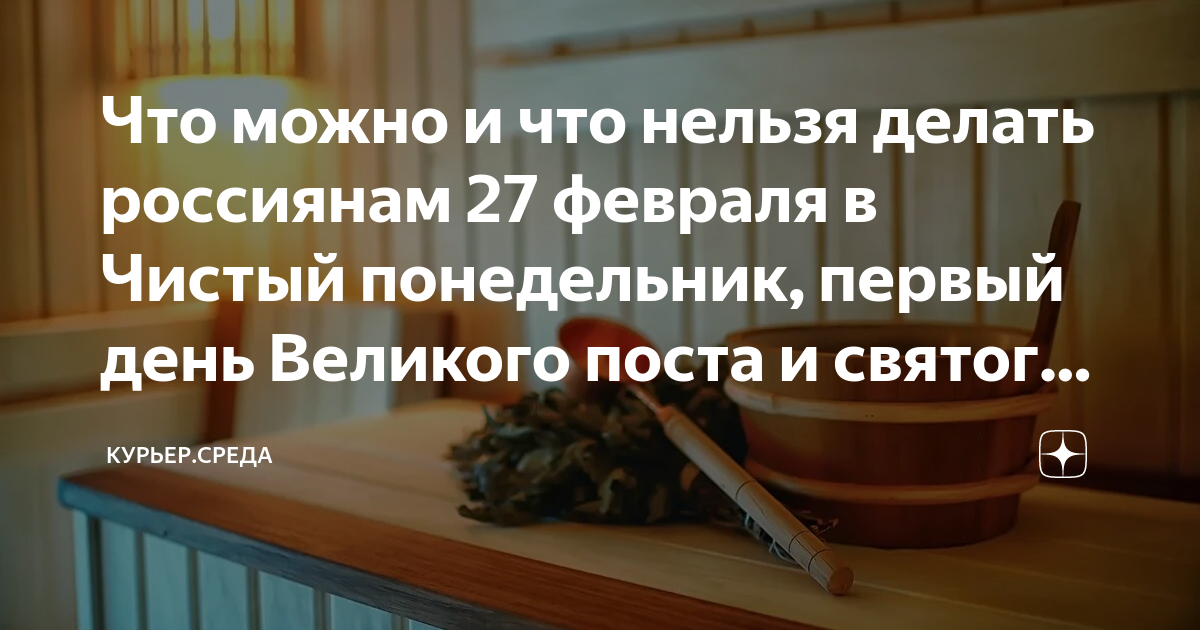

Nachalo Velikogo Posta Chistiy Ponedelnik 3 Marta 2025 Goda Pravila I Obryady

Apr 23, 2025

Nachalo Velikogo Posta Chistiy Ponedelnik 3 Marta 2025 Goda Pravila I Obryady

Apr 23, 2025 -

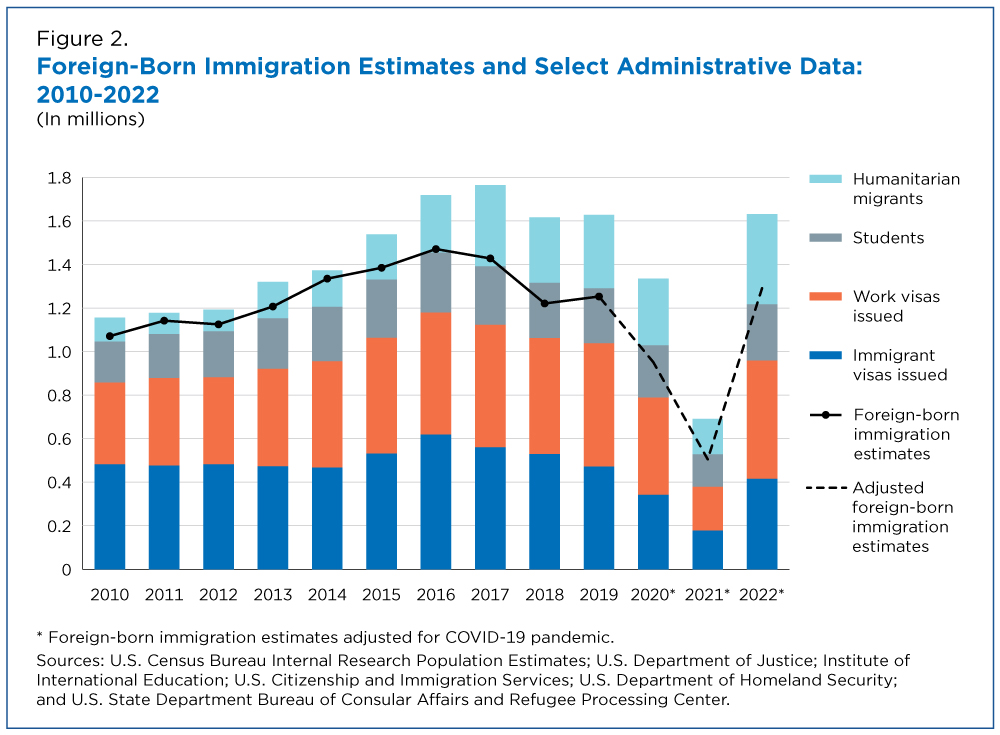

The Trump Presidency And Its Effect On Canadian Immigration To The Us A Recent Survey

Apr 23, 2025

The Trump Presidency And Its Effect On Canadian Immigration To The Us A Recent Survey

Apr 23, 2025