Brace For Impact: Stock Market's Uncertain Future And Investor Concerns

Table of Contents

Inflation and its Impact on Stock Market Performance

High inflation erodes purchasing power and forces central banks to raise interest rates, significantly impacting company profits and stock valuations. This creates a challenging environment for investors concerned about the stock market's future.

- Increased borrowing costs can stifle business growth. Higher interest rates make it more expensive for companies to borrow money, hindering expansion plans and potentially reducing profitability. This can lead to lower stock prices.

- Higher interest rates make bonds more attractive, diverting investment away from stocks. When bond yields rise, they become a more competitive alternative to stocks, drawing investment away from the equity market and potentially depressing stock prices.

- Inflation uncertainty creates volatility in the market, making it difficult to predict future performance. The unpredictable nature of inflation makes it hard for investors to accurately assess the value of assets, leading to increased market volatility and making investment decision-making more complex.

Strategies for mitigating inflation risk: include investing in inflation-hedged assets such as commodities (gold, oil), Treasury Inflation-Protected Securities (TIPS), and real estate. Diversifying your portfolio across different asset classes is also crucial to reduce overall risk.

Geopolitical Instability and its Ripple Effects

Geopolitical risk is another significant factor contributing to stock market uncertainty. Global events, such as wars, trade disputes, and political instability, create uncertainty and negatively impact market sentiment.

- Disruptions to supply chains lead to increased prices and shortages. Geopolitical instability can disrupt global supply chains, leading to shortages of goods and increased prices, impacting corporate profits and inflation.

- Sanctions and trade wars impact international trade and investment. Geopolitical tensions often result in sanctions and trade wars, directly impacting international trade and investment flows, causing market uncertainty.

- Uncertainty about future political developments leads to market volatility. The unpredictable nature of geopolitical events makes it hard to forecast future market trends, increasing market volatility and investor anxiety.

Diversification strategies to mitigate geopolitical risks: include investing in a mix of domestic and international assets, diversifying across different sectors, and considering investments in geographically diverse companies.

Rising Interest Rates and Their Effect on Investments

Interest rate hikes are a major driver of current stock market uncertainty. Increased interest rates impact borrowing costs for businesses and influence investor decisions, creating ripple effects across various sectors.

- Higher rates lead to reduced corporate earnings. Higher borrowing costs reduce companies' ability to invest in growth initiatives and increase their debt burden, ultimately impacting their earnings and valuations.

- Higher rates make bonds more appealing to investors compared to stocks. As bond yields rise, investors may shift their investments from stocks to bonds, seeking higher, more predictable returns.

- The impact of rising rates varies depending on the sector and individual company. Some sectors are more sensitive to interest rate changes than others. Growth stocks, for example, are often more vulnerable to rising rates than value stocks.

Adjusting investment strategies in response to rising interest rates: might involve shifting to value stocks, increasing exposure to bonds with longer maturities, or exploring alternative investments less sensitive to interest rate fluctuations.

Technological Disruption and its Uncertainties

Rapid technological disruption presents both opportunities and challenges for investors. The pace of innovation creates significant stock market technology-related uncertainties.

- Some sectors may benefit significantly from new technologies. Companies that successfully adopt and leverage new technologies often see increased profitability and growth.

- Other sectors may face disruption and decreased profitability. Established companies in sectors facing technological disruption may experience declines in revenue and profits as newer, more efficient technologies emerge.

- Investors need to carefully assess the impact of technology on their investments. Staying informed about technological advancements and their potential impact on specific companies and sectors is crucial for informed investment decisions.

Assessing Investor Sentiment and Market Psychology

Understanding investor sentiment and market psychology is crucial for navigating market volatility. Behavioral finance principles highlight the powerful influence of fear and greed on market fluctuations.

- Fear and uncertainty can lead to market sell-offs. Negative news and economic uncertainty often trigger widespread selling, leading to market declines.

- Overconfidence can create bubbles and subsequent crashes. Periods of excessive optimism and speculation can create asset bubbles that eventually burst, resulting in sharp market corrections.

- Analyzing market sentiment can help inform investment decisions. By monitoring market indicators and investor behavior, investors can gain valuable insights into potential market trends and adjust their investment strategies accordingly.

Conclusion:

The stock market's future remains uncertain, influenced by several interconnected factors including inflation, geopolitical instability, rising interest rates, and technological disruption. Investors need to adopt a cautious approach, focusing on diversification, robust risk management, and a long-term perspective. By carefully analyzing these factors and adjusting their investment strategies accordingly, investors can navigate the current uncertainty and potentially mitigate potential losses. Understanding and preparing for the challenges inherent in this climate is crucial for success. Brace for impact and develop a robust strategy to manage your investments in this uncertain stock market.

Featured Posts

-

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025 -

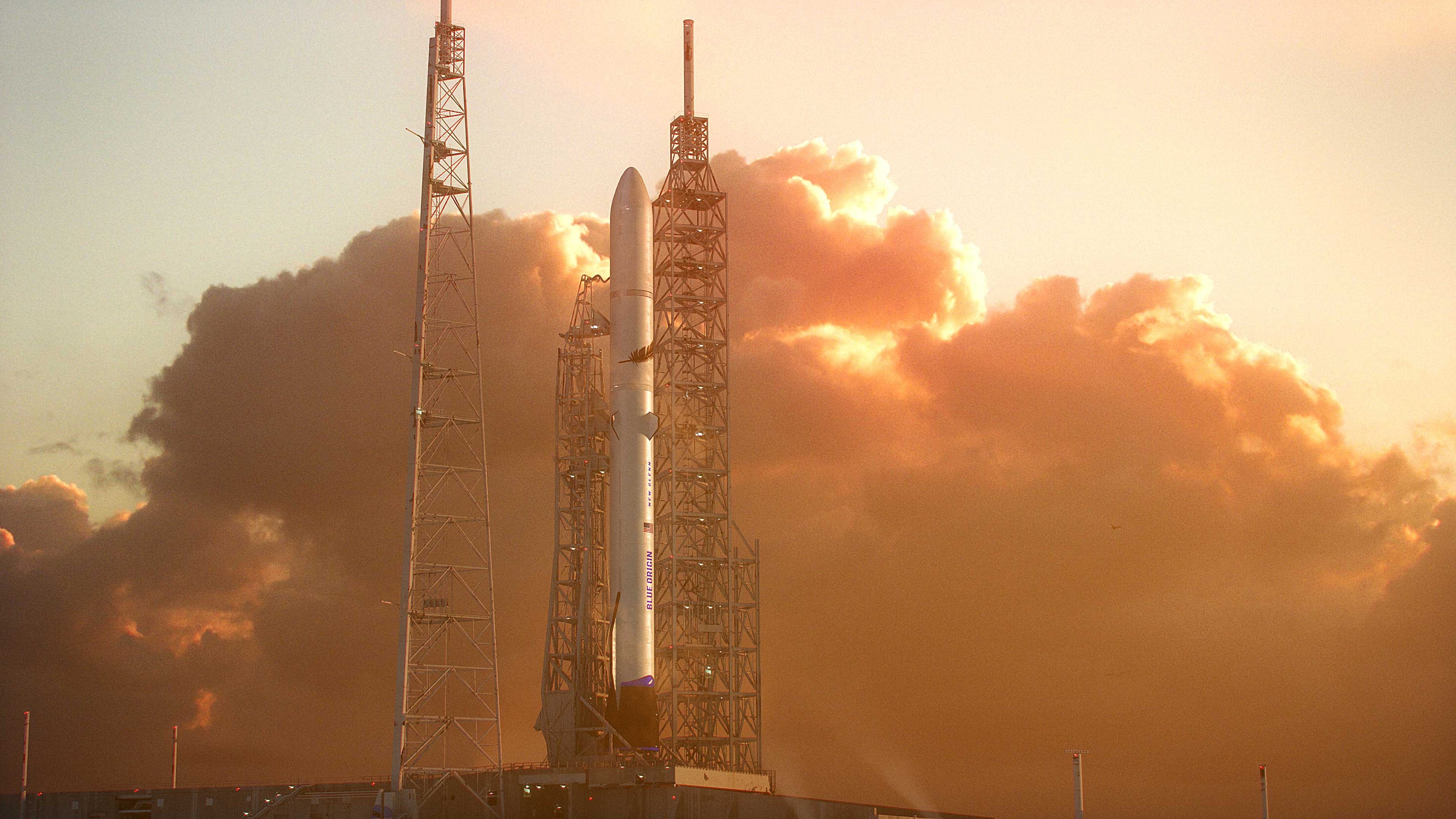

Blue Origin Rocket Launch Aborted Subsystem Problem Delays Mission

Apr 22, 2025

Blue Origin Rocket Launch Aborted Subsystem Problem Delays Mission

Apr 22, 2025 -

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 22, 2025

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 22, 2025 -

Covid 19 Testing Scandal Lab Owners Admission Of Guilt

Apr 22, 2025

Covid 19 Testing Scandal Lab Owners Admission Of Guilt

Apr 22, 2025 -

Obamacares Fate In Supreme Court Trumps Role And Rfk Jr S Potential Rise

Apr 22, 2025

Obamacares Fate In Supreme Court Trumps Role And Rfk Jr S Potential Rise

Apr 22, 2025