Trump's Economic Agenda: Who Pays The Price?

Table of Contents

Tax Cuts and Their Impact

The Tax Cuts and Jobs Act of 2017, a cornerstone of Trump's economic policy, significantly altered the US tax code. The Act dramatically reduced the corporate tax rate from 35% to 21%, a move lauded by proponents as stimulating economic growth through increased investment. Simultaneously, individual income tax rates were also adjusted, with varying impacts across different income brackets.

- Significant reduction in corporate tax rates: This led to increased profits for many corporations, fueling arguments about a "trickle-down" effect benefiting the broader economy. However, critics argued that these benefits primarily accrued to shareholders and executives, exacerbating income inequality.

- Changes to individual income tax brackets: While some tax brackets saw reductions, the overall impact varied considerably. Higher-income earners generally received larger tax cuts than lower-income earners, further widening the wealth gap.

- Increased national debt due to revenue shortfall: The substantial tax cuts led to a significant reduction in government revenue, contributing to a substantial increase in the national debt. This raised concerns about long-term fiscal sustainability.

- Debate over the trickle-down effect: The efficacy of the trickle-down effect, the theory that tax cuts for corporations and the wealthy would eventually benefit everyone, remains a contentious issue. Empirical evidence supporting this theory remains inconclusive, with some studies suggesting minimal impact on wages and employment for low and middle-income earners.

Trade Wars and Their Consequences

Trump's administration initiated several trade wars, most notably with China. These trade wars involved imposing significant tariffs on imported goods, aiming to protect American industries and reduce the trade deficit. However, these actions had far-reaching consequences.

- Increased prices for imported goods: Tariffs directly increased the cost of imported goods for American consumers, leading to higher prices for various products.

- Retaliatory tariffs from other countries: Other countries retaliated by imposing their own tariffs on American goods, negatively impacting American exporters and specific industries like agriculture and manufacturing.

- Disruption to global supply chains: The trade wars disrupted global supply chains, creating uncertainty for businesses and increasing production costs.

- Impact on specific sectors like farming and manufacturing: Certain sectors, such as agriculture and manufacturing, were disproportionately affected by the trade wars, facing reduced exports and increased competition. Farmers, in particular, faced significant challenges due to retaliatory tariffs imposed by China.

Deregulation and its Economic Fallout

Trump's administration pursued a significant deregulation agenda, rolling back environmental regulations, financial regulations, and labor laws. While proponents argued that deregulation would boost economic growth and efficiency, critics expressed concerns about potential negative consequences.

- Rollback of environmental protection measures: The easing of environmental regulations raised concerns about potential damage to the environment and public health.

- Changes to financial regulations: Changes to financial regulations sparked debate about the potential for increased financial risk and instability.

- Impact on worker safety and labor standards: Rollbacks of certain labor laws raised concerns about potential negative impacts on worker safety and labor standards.

- Long-term sustainability concerns: The long-term economic and environmental sustainability of the deregulation policies remains a subject of ongoing discussion and research.

The Impact on Different Demographics

Trump's economic policies had varying impacts on different demographic groups. While some benefited significantly, others faced negative consequences.

- Changes in the Gini coefficient (measure of income inequality): The Gini coefficient, a measure of income inequality, provides a quantitative assessment of the distributional impact of Trump's economic policies. The extent to which income inequality changed under his administration is a subject of ongoing debate among economists.

- Impact on poverty rates: The effect of Trump's economic policies on poverty rates requires careful analysis, considering various economic factors and their interplay.

- Effect on economic mobility: The impact on economic mobility, the ability of individuals to improve their economic standing, is another crucial aspect to consider when assessing the overall success of his economic agenda.

- Regional disparities in economic growth: Economic growth under Trump's administration exhibited regional disparities, with some regions experiencing more significant benefits than others.

Conclusion

Trump's economic agenda, characterized by significant tax cuts, trade wars, and deregulation, had a complex and multifaceted impact on the American economy. While some groups, particularly high-income earners and corporations, benefited substantially from the tax cuts, others faced negative consequences from increased prices and disrupted supply chains resulting from the trade wars. The long-term effects of his deregulation policies remain uncertain, but concerns persist about potential environmental damage and the erosion of worker protections. Understanding the full ramifications of Trump's economic legacy requires ongoing analysis. Further research on the long-term effects of his economic policies is crucial for informed discussion and policy-making. Continue to explore the ongoing debate surrounding Trump's economic agenda and its lasting consequences. Learn more about the impact of the Tax Cuts and Jobs Act and how it continues to shape the American economy today.

Featured Posts

-

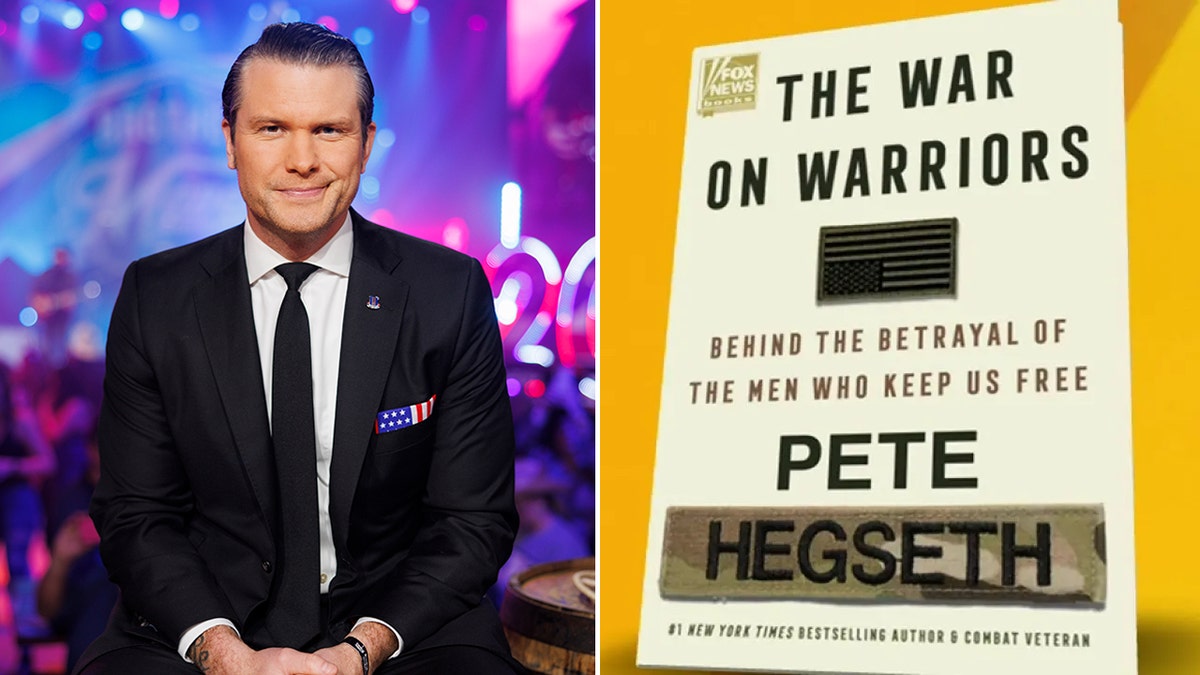

Military Plan Disclosure Hegseths Signal Chat Controversy

Apr 22, 2025

Military Plan Disclosure Hegseths Signal Chat Controversy

Apr 22, 2025 -

Chainalysis And Alterya Merge Boosting Blockchain Security With Ai

Apr 22, 2025

Chainalysis And Alterya Merge Boosting Blockchain Security With Ai

Apr 22, 2025 -

500 Million Settlement Looms In Canadian Bread Price Fixing Case May Hearing Date Confirmed

Apr 22, 2025

500 Million Settlement Looms In Canadian Bread Price Fixing Case May Hearing Date Confirmed

Apr 22, 2025 -

Where To Invest Mapping The Countrys Hottest Business Locations

Apr 22, 2025

Where To Invest Mapping The Countrys Hottest Business Locations

Apr 22, 2025 -

Wga And Sag Aftra Strike The Impact On Hollywood Production

Apr 22, 2025

Wga And Sag Aftra Strike The Impact On Hollywood Production

Apr 22, 2025