BofA's View: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Current Market Context

BofA's bullish stance on the market, despite high valuations, is rooted in a careful analysis of the current economic and market landscape. Several key factors underpin their view.

Low Interest Rates and Abundant Liquidity

The current low interest rate environment, fueled by years of quantitative easing (QE) and accommodative monetary policy, has significantly impacted asset prices.

- Impact on bond yields: Low interest rates have depressed bond yields, making stocks, with their potential for higher returns, a more attractive investment.

- Increased investor appetite for riskier assets: The search for yield has pushed investors toward riskier assets, including equities, further driving up valuations.

- Effect on corporate earnings: Low borrowing costs have allowed companies to increase investments, leading to stronger earnings and supporting higher stock prices. This low interest rate environment, characterized by abundant liquidity, has created a favorable backdrop for stock market growth.

Strong Corporate Earnings and Profitability

Despite high valuations, many companies are reporting robust earnings. This strong performance is a critical element of BofA's positive outlook.

- Examples of strong-performing sectors: Technology, healthcare, and consumer staples have consistently shown strong earnings growth, contributing to overall market strength.

- Factors contributing to profitability: Efficient operations, cost-cutting measures, and increased demand for goods and services have fueled corporate profitability.

- Future earnings projections: BofA's analysts generally project continued strong earnings growth for many companies, supporting their belief that current valuations are justified. This sustained corporate profitability is a key pillar supporting the argument that high stock market valuations are not necessarily a cause for alarm.

Long-Term Growth Potential

BofA emphasizes the significant long-term growth potential of the global economy, fueling their belief in the sustainability of high stock valuations.

- Technological advancements: Rapid technological innovation across various sectors is expected to drive significant economic growth and create new investment opportunities.

- Demographic shifts: Changing demographics, particularly in emerging markets, present considerable opportunities for businesses and investors.

- Emerging markets growth: The continued growth of emerging markets offers significant potential for long-term investment returns.

- Potential for innovation: Continued innovation across various sectors offers the potential for disruptive technologies and market-leading companies, further supporting long-term growth. This long-term growth perspective is crucial to understanding BofA’s positive assessment of the current market climate.

Addressing Investor Concerns: Debunking Common Myths

While BofA's outlook is positive, it acknowledges prevalent investor concerns. Let's address some common myths surrounding high stock market valuations.

The "Overvalued" Argument

Many argue that high valuations inherently signal an impending market crash. BofA counters this by providing a more nuanced perspective.

- Historical context of high valuations: Historically, periods of high valuations have not always resulted in immediate market crashes. Context matters.

- Discussion of valuation metrics (P/E ratio, Shiller PE): While metrics like the price-to-earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (CAPE) are important, they shouldn't be considered in isolation.

- Importance of considering other factors: Factors such as interest rates, economic growth, and corporate earnings must be considered alongside valuation metrics to gain a comprehensive picture. Simply focusing on high P/E ratios without considering the broader context can be misleading.

Inflation and Interest Rate Hikes

Concerns exist about inflation's impact and the Federal Reserve's (Fed) potential interest rate hikes.

- BofA's forecast for inflation: BofA's economists generally predict that inflation will remain relatively controlled, mitigating its negative impact on the market.

- Analysis of the Federal Reserve's policy: BofA analyzes the Fed's actions and anticipates a measured approach to interest rate increases, minimizing the risk of a significant market downturn.

- Potential impact on stock valuations: While interest rate hikes can impact stock valuations, BofA believes the impact will be manageable, considering the underlying strength of the economy and corporate earnings.

Geopolitical Risks

Geopolitical risks are undeniable, yet BofA maintains a relatively optimistic outlook.

- Examples of geopolitical risks: Trade wars, political instability, and international conflicts pose potential risks to the market.

- BofA's assessment of their impact: BofA assesses the impact of these risks as potentially manageable, given the market's resilience and diversification.

- Diversification strategies to mitigate risk: BofA emphasizes the importance of diversification as a strategy to mitigate geopolitical risk. Investors should diversify their portfolios across different asset classes and geographic regions to reduce their exposure to specific events.

Conclusion

BofA's analysis suggests that while stock market valuations are high, several factors support continued growth, mitigating concerns of an imminent market crash. Low interest rates, strong corporate earnings, and significant long-term growth potential all contribute to a positive outlook. Furthermore, the bank addresses common investor concerns surrounding inflation, interest rate hikes, and geopolitical risks, offering a reasoned counter-argument to widespread anxieties. Don't let high stock market valuations deter you. Understand BofA's perspective and make informed investment decisions. For further insights into BofA's market forecasts and investment strategies, explore their research and resources [link to BofA resources, if permissible].

Featured Posts

-

Chinas Byd And Saudi Aramco Team Up On Ev Technology Development

Apr 22, 2025

Chinas Byd And Saudi Aramco Team Up On Ev Technology Development

Apr 22, 2025 -

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 22, 2025

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 22, 2025 -

Toxic Chemicals From Ohio Train Derailment A Building Contamination Investigation

Apr 22, 2025

Toxic Chemicals From Ohio Train Derailment A Building Contamination Investigation

Apr 22, 2025 -

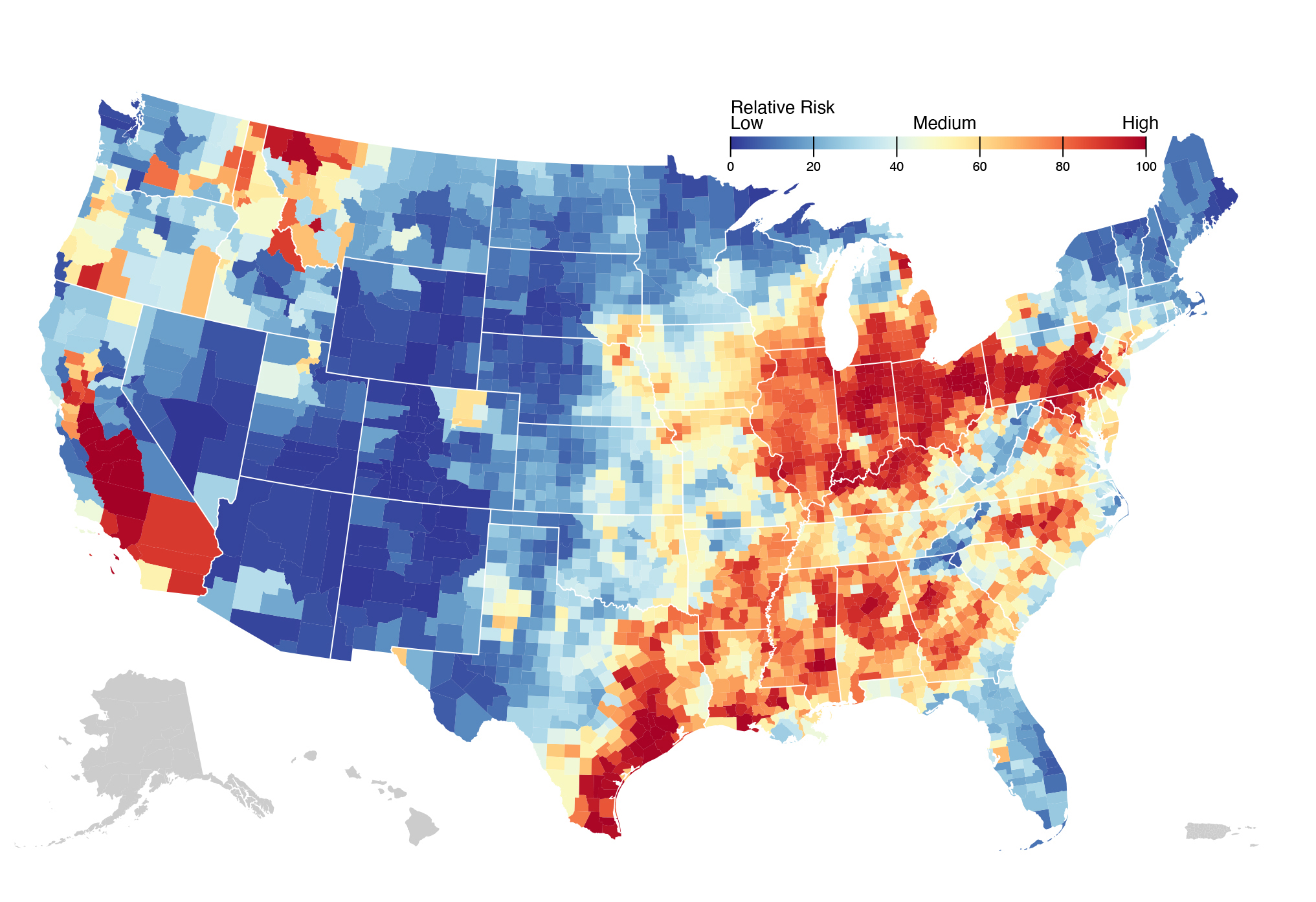

The Countrys New Business Hot Spots A Geographic Analysis

Apr 22, 2025

The Countrys New Business Hot Spots A Geographic Analysis

Apr 22, 2025 -

The End Of An Era Pope Francis Death And Its Significance

Apr 22, 2025

The End Of An Era Pope Francis Death And Its Significance

Apr 22, 2025