BofA's View: Are High Stock Market Valuations A Cause For Concern?

Table of Contents

BofA's Current Assessment of Stock Market Valuations

BofA currently maintains a cautiously optimistic stance on high stock market valuations. While acknowledging the significant gains, they emphasize the need for careful consideration of the underlying factors and potential risks. Their analysis isn't simply a blanket statement of bullishness or bearishness but rather a nuanced evaluation based on a range of key metrics.

-

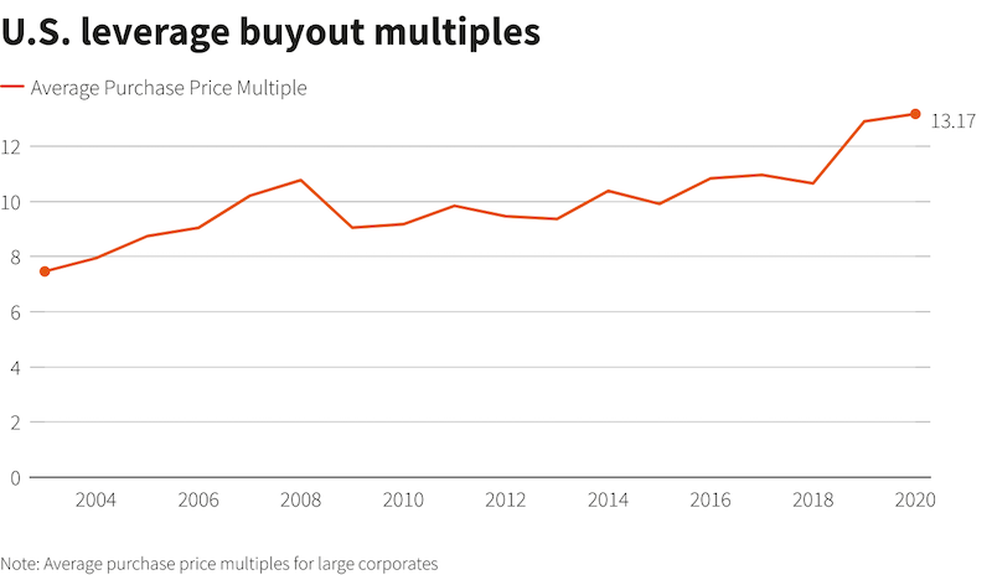

Key Valuation Metrics: BofA utilizes a variety of metrics to assess valuations, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and cyclically adjusted price-to-earnings (CAPE) ratios. They compare these ratios to historical averages and industry benchmarks to determine whether current valuations are justified.

-

BofA Reports and Analyst Statements: Recent BofA reports highlight concerns about certain sectors being overvalued, while others appear more reasonably priced. Specific analyst statements often emphasize the need for diversification and a long-term investment horizon. (Note: For precise citations, you would need to consult the actual BofA reports.)

-

Data Points: BofA’s research may indicate a certain percentage of overvaluation in specific market segments, potentially predicting a correction in certain sectors but not necessarily a complete market crash. (Again, you'd need to reference specific BofA data here).

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current high stock market valuations, creating a complex interplay of economic and psychological elements. Understanding these factors is crucial for assessing the sustainability of the current market conditions.

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies and incentivized investors to seek higher returns in the stock market, pushing up valuations.

-

Strong Corporate Earnings (or Anticipated Growth): Strong corporate earnings reports, coupled with positive forecasts for future growth, fuel investor optimism and drive up stock prices. This is especially true in sectors experiencing rapid technological advancements.

-

Investor Sentiment and Market Psychology: Factors like Fear Of Missing Out (FOMO) and widespread speculation contribute to the upward momentum, potentially creating a self-fulfilling prophecy.

-

Government Stimulus Packages: Government interventions, such as stimulus checks and infrastructure spending, can inject liquidity into the market and support higher valuations.

-

Technological Advancements and Disruptive Innovation: The emergence of new technologies and innovative business models frequently attracts substantial investment, boosting valuations in related sectors.

Potential Risks Associated with High Valuations

While high stock market valuations can signal economic prosperity, they also carry significant risks. Investors must carefully consider these potential downsides.

-

Increased Market Volatility and Potential for Corrections: High valuations often precede periods of increased volatility and potential market corrections. A sudden shift in investor sentiment could trigger a sharp downturn.

-

Impact on Investor Portfolios and Potential Losses: A market correction can lead to significant losses for investors, particularly those heavily invested in overvalued sectors.

-

Risk of Inflation: High inflation can erode the purchasing power of returns, negating the benefits of high stock prices. BofA’s analysis may include inflation predictions and their impact on valuations.

-

Geopolitical Uncertainties: Global events and geopolitical instability can significantly impact market sentiment and trigger volatility, leading to valuation adjustments.

-

Market Bubble Possibility: The possibility of a market bubble always exists when valuations are significantly inflated. BofA's analysis likely addresses this risk, offering perspectives on the likelihood and potential consequences.

BofA's Recommendations for Investors

Navigating the complexities of high stock market valuations requires a well-defined investment strategy. BofA typically recommends a cautious approach, emphasizing diversification and risk management.

-

Diversification Strategies: BofA likely advises investors to diversify their portfolios across different asset classes and sectors to mitigate risks. This might involve reducing exposure to overvalued sectors and increasing exposure to more defensive investments.

-

Sector-Specific Recommendations: BofA's analysts often provide sector-specific recommendations, suggesting which sectors are more resilient to market corrections or offer better long-term growth prospects.

-

Adjusting Portfolios Based on Risk Tolerance: The recommendation will likely involve adjusting investment portfolios based on individual risk tolerance and investment goals. Conservative investors may be advised to reduce equity exposure.

-

Hedging Strategies: Depending on the market outlook, BofA might suggest hedging strategies to protect against potential market downturns.

-

Long-Term Investment Planning: BofA consistently emphasizes the importance of long-term investment planning. Short-term market fluctuations should not dictate long-term investment decisions.

Conclusion

BofA's assessment of high stock market valuations is one of cautious optimism, acknowledging the significant gains while highlighting potential risks. Several factors, including low interest rates, strong corporate earnings, and investor sentiment, contribute to these high valuations. However, risks such as increased market volatility, inflation, and geopolitical uncertainty remain. BofA's recommended investor strategies emphasize diversification, sector-specific analysis, risk management, and long-term planning. Understanding BofA's perspective on high stock market valuations is crucial for informed investment decisions. Visit BofA's website to access their latest research and explore how you can effectively manage your portfolio in this dynamic market environment. Careful analysis of market valuation analysis and the implementation of sound stock market valuation strategies are key to navigating the current market successfully.

Featured Posts

-

Le Pitch Hipli Des Emballages Reutilisables Pour Un E Commerce Durable

Apr 23, 2025

Le Pitch Hipli Des Emballages Reutilisables Pour Un E Commerce Durable

Apr 23, 2025 -

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 23, 2025

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 23, 2025 -

Le Parcours Inspirant De Christelle Le Hir Dans Le Secteur Bio

Apr 23, 2025

Le Parcours Inspirant De Christelle Le Hir Dans Le Secteur Bio

Apr 23, 2025 -

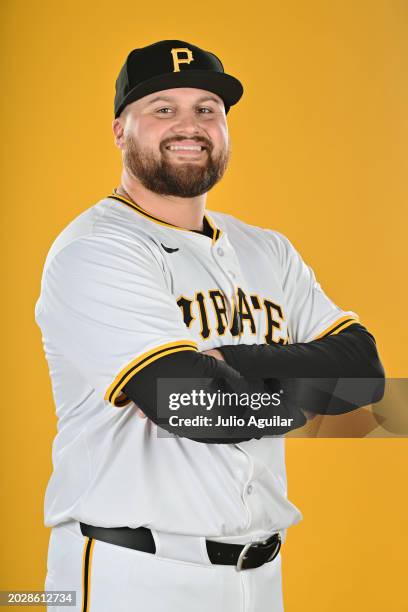

Rowdy Tellez Revenge Watch His Performance Against Former Team

Apr 23, 2025

Rowdy Tellez Revenge Watch His Performance Against Former Team

Apr 23, 2025 -

Finding The Best And Worst Diy Stores In The Uk

Apr 23, 2025

Finding The Best And Worst Diy Stores In The Uk

Apr 23, 2025