Netflix's Resilience Amidst Big Tech Downturn: A Wall Street Tariff Haven?

Table of Contents

Netflix's Recent Performance Compared to Big Tech Rivals

While many tech behemoths experienced significant stock price drops and revenue slowdowns, Netflix has demonstrated a relative strength. Let's compare key metrics:

- Revenue Growth: Unlike some Big Tech companies reporting stagnant or declining revenue, Netflix has shown consistent, albeit sometimes slower, revenue growth, fueled by subscriber additions and price increases.

- Subscriber Numbers: Although facing increased competition, Netflix continues to add subscribers globally, particularly in international markets. This contrasts sharply with some competitors experiencing subscriber loss.

- Stock Price Fluctuations: While Netflix's stock price isn't immune to market swings, its volatility has been comparatively less dramatic than that of other tech giants during the recent downturn.

- Profitability: While profitability remains a key focus for Netflix, its ability to maintain a degree of profitability even during periods of economic uncertainty sets it apart from some of its more heavily-loss-making tech rivals.

- Market Capitalization: Compared to the significant drops observed in the market capitalization of other Big Tech players, Netflix has shown greater stability in its market valuation.

This relative outperformance can be attributed to several factors: a strong and diverse content library appealing to a global audience, a proven subscription model, and diversification into advertising and gaming.

Factors Contributing to Netflix's Resilience

Several key strategies have contributed to Netflix's ability to weather the recent tech storm.

Content Strategy & Investment:

- Hit Shows: Netflix’s investment in original programming has yielded numerous global hits, driving subscriber acquisition and retention. Think "Stranger Things," "Squid Game," and "Wednesday."

- International Expansion: Netflix’s localization efforts, producing content in various languages and catering to regional tastes, have opened vast new markets.

- Licensing Deals: Strategic licensing agreements ensure a constant flow of new and popular content, complementing their original productions.

- Algorithm-Driven Recommendations: Netflix's sophisticated recommendation engine optimizes user experience, boosting engagement and reducing churn.

Subscription Model & Pricing:

- Price Increases: While price hikes can lead to subscriber churn, Netflix has demonstrated the ability to manage this effectively, balancing price increases with the value provided by its extensive content library.

- Subscription Tiers: The introduction of different subscription tiers, including ad-supported options, has broadened its appeal and allowed Netflix to capture a wider range of customers.

- Competition: While competition from other streaming services is fierce, Netflix’s brand recognition and established content library give it a strong competitive advantage.

Global Expansion and Market Diversification:

- Emerging Markets: Netflix's focus on emerging markets has provided significant growth opportunities, mitigating reliance on any single geographic region.

- Localization: Tailoring content to regional preferences has proven crucial for success in diverse markets.

- Risk Mitigation: This geographically diverse subscriber base significantly reduces risk compared to companies heavily reliant on specific regions or economic conditions.

Is Netflix a "Wall Street Tariff Haven"?

Netflix's relative stability during the recent Big Tech downturn raises the question: Is it a safe haven for investors? While its performance has been impressive, several factors need consideration:

- Increased Competition: The streaming landscape remains fiercely competitive. New entrants and the expansion of existing players pose ongoing challenges.

- Content Cost Inflation: The cost of producing high-quality content continues to rise, potentially impacting profitability.

- Regulatory Hurdles: Netflix faces regulatory scrutiny in various markets, which could impact operations and profitability.

- Macroeconomic Factors: Economic downturns can affect consumer spending, potentially impacting subscription rates.

However, comparing Netflix's risk profile to other tech giants reveals a potentially lower risk profile. Netflix has less exposure to the rapidly evolving advertising market, relatively lower debt levels, and future growth prospects potentially less tied to overall economic growth than other tech giants.

Conclusion:

Netflix's resilience amidst the broader Big Tech downturn is noteworthy. While it’s not entirely immune to market fluctuations, its diversified revenue streams, robust content library, and global reach have provided a significant buffer against the volatility affecting other tech giants. Whether it fully qualifies as a "Wall Street tariff haven" remains a nuanced question; however, its relative stability compared to its peers makes it worthy of consideration. Further investigate Netflix’s resilience in the current market and learn more about the potential of Netflix as a Wall Street tariff haven for a more comprehensive understanding of its investment potential within the current economic climate.

Featured Posts

-

Underperforming Brewers Rise Clutch Hits Define 2025 Season

Apr 23, 2025

Underperforming Brewers Rise Clutch Hits Define 2025 Season

Apr 23, 2025 -

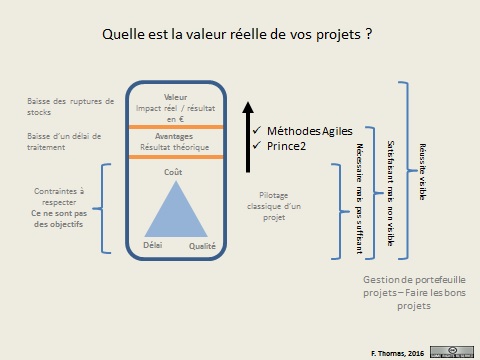

Infotel Une Valeur Ajoutee Reelle Pour Vos Projets

Apr 23, 2025

Infotel Une Valeur Ajoutee Reelle Pour Vos Projets

Apr 23, 2025 -

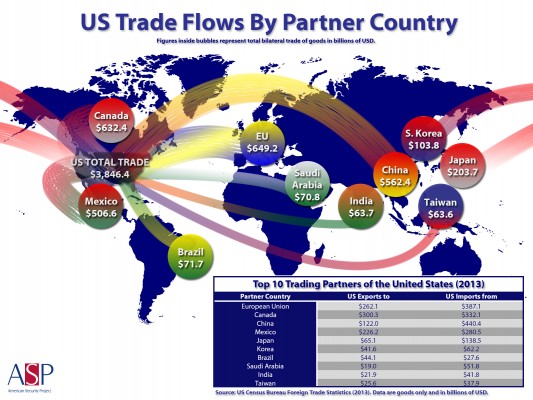

Increased Canadian Oil Exports To China A Response To Us Trade Conflicts

Apr 23, 2025

Increased Canadian Oil Exports To China A Response To Us Trade Conflicts

Apr 23, 2025 -

Nine Homers Power Yankees To Victory In 2025 Season Opener

Apr 23, 2025

Nine Homers Power Yankees To Victory In 2025 Season Opener

Apr 23, 2025 -

Actualites Economiques Du 18h Eco Lundi 14 Avril

Apr 23, 2025

Actualites Economiques Du 18h Eco Lundi 14 Avril

Apr 23, 2025