BofA On Stock Market Valuations: Why Investors Shouldn't Panic

Table of Contents

BofA's Valuation Methodology and Key Findings

BofA employs a multi-faceted approach to assessing market valuations, incorporating various metrics and models. Their analysis goes beyond simple price-to-earnings (P/E) ratios, incorporating discounted cash flow (DCF) analysis, sector-specific comparisons, and a thorough evaluation of macroeconomic factors. This holistic view provides a more nuanced understanding of market health than relying on any single indicator.

BofA's recent findings suggest a more measured outlook than some headlines might suggest. While acknowledging the challenges posed by current economic conditions, their analysis doesn't signal an impending crash.

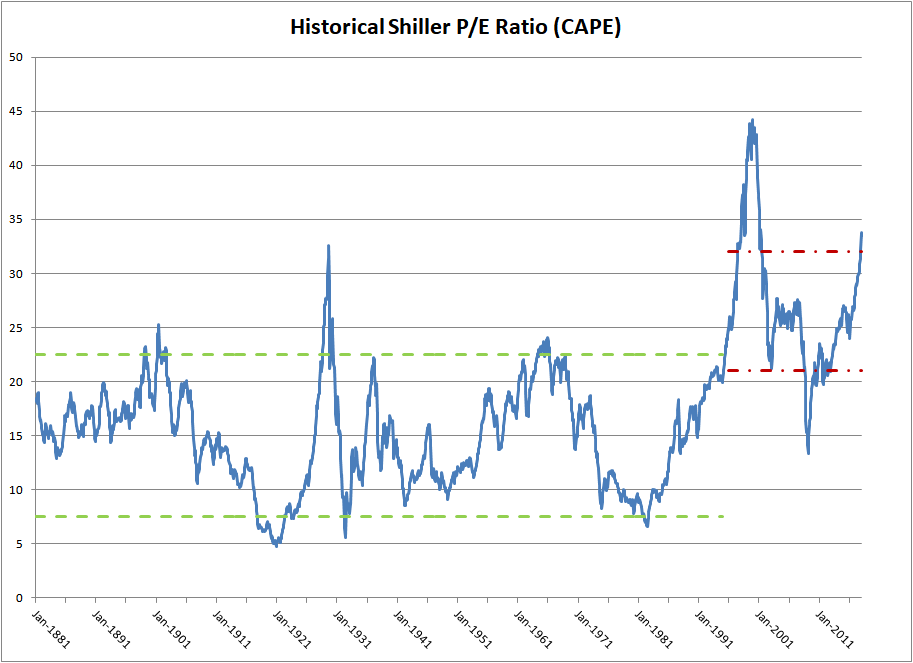

- Specific Metrics: BofA's analysis may indicate that current P/E ratios are, for example, at 20x, which is historically higher than the long-term average of 15x but lower than the peak seen during previous market bubbles. This requires further context within their full report.

- Valuation Assessment: Based on their comprehensive analysis, BofA might classify current market valuations as "fairly valued" or even slightly "overvalued" in certain sectors, but not excessively so as to warrant panic selling. This assessment is always subject to change with market fluctuation.

- Sector-Specific Highlights: BofA's research often identifies specific sectors or asset classes showing stronger fundamentals and potential for growth even within a less-than-ideal macroeconomic environment. For example, they may highlight the technology sector's resilience or the potential for growth in renewable energy.

Addressing Investor Concerns: Why Panic is Unwarranted

The current market climate understandably fuels investor anxiety. Inflation, rising interest rates, and ongoing geopolitical uncertainty are all contributing factors. However, BofA's analysis attempts to contextualize these concerns within a broader framework.

- Inflation Concerns: BofA may argue that while inflation remains a concern, its impact on corporate earnings is likely to be less severe than initially feared, particularly for companies with strong pricing power.

- Interest Rate Hikes: BofA's perspective on interest rate hikes might focus on their impact on corporate borrowing costs, balancing this against the potential for stronger economic growth and positive impacts on bank profitability.

- Geopolitical Risks: While acknowledging geopolitical risks, BofA's analysis likely emphasizes the market's capacity to absorb shocks, particularly given the resilience demonstrated in recent years.

Long-Term Growth Prospects and Investment Strategies

Despite the short-term challenges, BofA often maintains a positive long-term outlook for the stock market. They highlight the potential for sustained economic growth driven by technological innovation, demographic shifts, and emerging market expansion.

Based on their valuation analysis, BofA might recommend the following investment strategies:

- Sector Selection: Invest in sectors identified by BofA as undervalued or poised for growth, balancing risk and potential return.

- Diversification: Maintain a diversified portfolio across various asset classes to mitigate risk and reduce exposure to market volatility.

- Long-Term Horizon: Adopt a long-term investment strategy, focusing on consistent investing rather than reacting to short-term market fluctuations. This is key to weathering market corrections.

Comparing BofA's View with Other Market Analysts

It's crucial to compare BofA's perspective with other prominent financial analysts. While BofA's analysis offers valuable insight, it's only one perspective. Other analysts may hold differing views on market valuations and investment strategies.

- Other Analysts' Valuations: Goldman Sachs, JP Morgan, and other major investment banks may offer contrasting views on valuation levels and future market performance.

- Consensus View: The general consensus amongst analysts might vary significantly, providing a broader context for understanding market sentiment and risk.

- External Resources: Review reports and analysis from other reputable financial institutions to gain a more comprehensive understanding of the market.

Conclusion: BofA's Valuation Analysis and Your Investment Plan

BofA's analysis of stock market valuations suggests that while challenges exist, a market crash isn't necessarily imminent. Their findings highlight the importance of a balanced perspective, considering both risks and opportunities. While BofA's analysis provides valuable insight into current stock market valuations, remember to conduct your own due diligence before making any investment decisions. Use this information to inform your strategy and avoid unnecessary panic. Maintaining a long-term investment horizon and a well-diversified portfolio remains crucial for navigating market uncertainty. Remember that expert opinions, including BofA's valuation analysis, should be one factor among many in your overall investment strategy.

Featured Posts

-

Understanding High Stock Market Valuations A Bof A Perspective

Apr 24, 2025

Understanding High Stock Market Valuations A Bof A Perspective

Apr 24, 2025 -

Restoring Fiscal Responsibility In Canada An Alternative Economic Vision

Apr 24, 2025

Restoring Fiscal Responsibility In Canada An Alternative Economic Vision

Apr 24, 2025 -

Instagram Launches Rival Video App To Attract Tik Tok Creators

Apr 24, 2025

Instagram Launches Rival Video App To Attract Tik Tok Creators

Apr 24, 2025 -

Millions In Losses Fbi Investigates Widespread Office365 Executive Email Compromise

Apr 24, 2025

Millions In Losses Fbi Investigates Widespread Office365 Executive Email Compromise

Apr 24, 2025 -

Cassidy Hutchinson Key Witness To Publish Memoir On January 6th Hearings

Apr 24, 2025

Cassidy Hutchinson Key Witness To Publish Memoir On January 6th Hearings

Apr 24, 2025