Bank Of Canada's Rate Pause: Expert Analysis From FP Video

Table of Contents

Reasons Behind the Bank of Canada's Rate Pause

The Bank of Canada's decision to pause interest rate increases wasn't arbitrary. Several factors contributed to this pivotal shift in monetary policy. Understanding these reasons is key to grasping the implications for the Canadian economy.

-

Slower-than-expected inflation: Recent inflation data shows a deceleration in the rate of price increases. While still above the Bank of Canada's target of 2%, the slowing trend suggests the current interest rate level is having the desired effect, albeit slowly. This cooling inflation provided some breathing room for the Bank to pause and assess the situation.

-

Cooling economy: The Canadian economy is showing signs of slowing growth. Indicators such as reduced consumer spending in certain sectors and a slight dip in business investment point towards a less robust economic performance than previously anticipated. This decreased economic momentum influenced the Bank's decision to avoid further aggressive interest rate hikes.

-

Employment figures: While the unemployment rate remains relatively low, recent employment data indicates a possible softening in the job market. This suggests that the economy might be approaching a more sustainable equilibrium, reducing the immediate need for further interest rate hikes to cool down an overheated labor market.

-

Potential recessionary risks: Raising interest rates too aggressively carries the significant risk of triggering a recession. The Bank of Canada carefully weighed the benefits of further tightening against the potential harm of pushing the economy into a downturn. The pause reflects a cautious approach to avoiding such a scenario.

-

Global economic uncertainty: The global economic climate remains volatile, with ongoing geopolitical tensions and persistent supply chain disruptions. The Bank of Canada considered these global uncertainties when making its decision, opting for a more cautious approach in the face of external headwinds.

Expert Opinions from FP Video

FP Video's expert analysis provides valuable insights into the Bank of Canada's rate pause and its implications. Their commentary offers diverse perspectives and detailed forecasts.

-

Key insights: FP Video's experts largely agree that the rate pause is a strategic move to assess the effectiveness of previous interest rate hikes. They emphasize the need to carefully monitor inflation and economic growth data before making further decisions.

-

Differing opinions: While there's a general consensus on the rationale behind the pause, some FP Video experts express differing views on the timing of future rate adjustments. Some suggest a potential rate hike later in the year if inflation remains stubbornly high, while others anticipate a prolonged pause or even potential rate cuts if the economy weakens significantly.

-

Predictions for future interest rate changes: FP Video's analysis provides various scenarios, ranging from a resumption of rate hikes to a period of sustained low rates. The predicted trajectory largely depends on the forthcoming economic data, particularly inflation and employment figures.

-

Inflation outlook: Experts on FP Video predict a gradual decline in inflation throughout the year, although the speed of this decline remains a point of contention.

-

Economic growth predictions: The experts' forecasts for economic growth are generally cautious, with predictions ranging from modest growth to a slight contraction depending on various economic factors.

Implications for Consumers and Businesses

The Bank of Canada's rate pause has significant implications for both consumers and businesses.

-

Impact on mortgage rates and borrowing costs: While the immediate impact on mortgage rates is limited by the pause, the overall trajectory of interest rates will continue to influence borrowing costs for both consumers and businesses.

-

Effect on consumer spending: Consumer confidence and spending patterns will be affected by the overall uncertainty surrounding future interest rate movements.

-

Implications for business investment: Businesses will carefully consider the economic outlook and interest rate environment when making investment decisions. The pause provides a temporary reprieve, but uncertainty remains.

-

Potential influence on the Canadian housing market: The housing market, already sensitive to interest rate changes, will continue to be closely watched. The pause could offer temporary stability but long-term trends will depend on future rate decisions.

-

Adapting to the current economic environment: Businesses need to closely monitor economic indicators and develop strategies to manage risks and adapt to potential economic shifts.

Potential Future Scenarios Based on FP Video Analysis

FP Video's analysis presents several potential future scenarios regarding interest rates and the Canadian economy.

-

Further rate hikes: If inflation proves more persistent than anticipated, the Bank of Canada could resume rate hikes to bring inflation back to its target.

-

Prolonged pause: A sustained pause is possible if inflation continues to decelerate and economic growth remains moderate.

-

Rate cuts: If the economy weakens significantly, the Bank of Canada might opt for rate cuts to stimulate economic activity.

-

Risk assessment: Each scenario carries its own risks and uncertainties. FP Video's analysis helps assess the likelihood of each outcome based on available data and expert opinions.

-

Canadian economic forecast: The overall forecast suggests a cautious approach, with a focus on monitoring economic indicators and adapting policy as needed.

Conclusion

The Bank of Canada's decision to pause interest rate increases is a significant development with far-reaching implications for the Canadian economy. FP Video's expert analysis offers valuable insights into the reasoning behind the pause, its potential consequences, and possible future scenarios. Understanding this analysis is crucial for navigating the current economic climate.

Call to Action: Stay informed about the evolving economic landscape and the impact of the Bank of Canada's decisions by watching FP Video's expert analysis on the Bank of Canada rate pause and subscribe to their channel for further updates on interest rate changes and the Canadian economy. Learn more about the latest updates on the Bank of Canada interest rate decisions.

Featured Posts

-

South Sudan Us Collaboration Streamlining The Return Of Deportees

Apr 22, 2025

South Sudan Us Collaboration Streamlining The Return Of Deportees

Apr 22, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 22, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 22, 2025 -

Ftc Investigates Open Ais Chat Gpt What It Means For Ai

Apr 22, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai

Apr 22, 2025 -

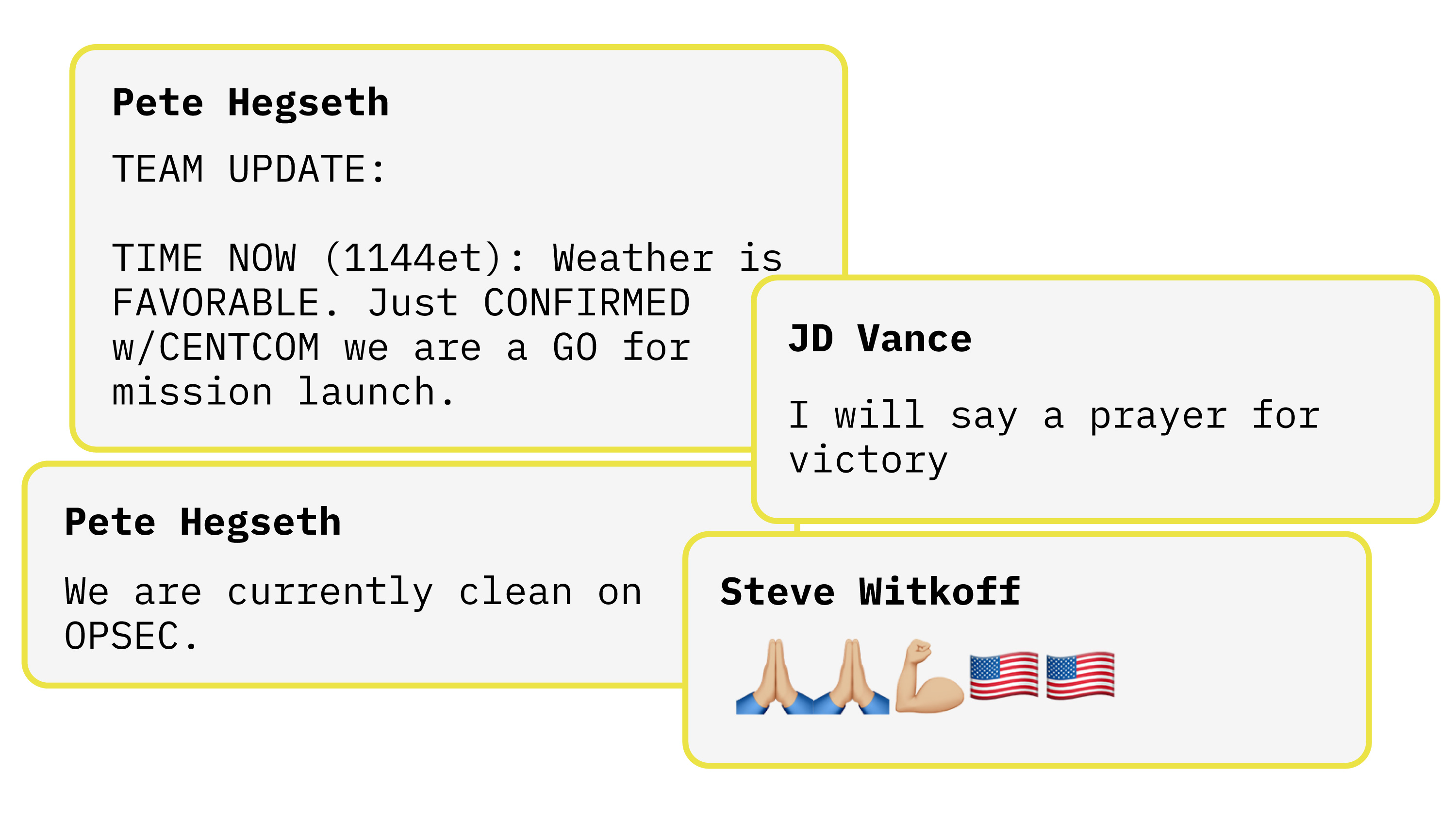

Pentagon Chaos Claims And Leaked Signal Chat The Hegseth Controversy

Apr 22, 2025

Pentagon Chaos Claims And Leaked Signal Chat The Hegseth Controversy

Apr 22, 2025 -

Trump Protests 2024 A Look At The Nationwide Demonstrations

Apr 22, 2025

Trump Protests 2024 A Look At The Nationwide Demonstrations

Apr 22, 2025