Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Key Arguments Against Excessive Valuation Concerns

BofA's assessment centers around several crucial factors that mitigate concerns about inflated stock market valuations. Let's examine these in detail.

The Role of Low Interest Rates

Historically low interest rates play a significant role in justifying current stock market valuations. These low rates directly impact discount rates used in financial modeling to determine the present value of future cash flows.

- Lower discount rates lead to higher present values of future earnings. A lower discount rate means future profits are worth more today, leading to higher valuations.

- This justifies higher P/E ratios in the current environment. The higher present value of future earnings supports higher P/E ratios, which are often used as a measure of stock market valuation.

- Low interest rates make bonds less attractive, pushing investors towards equities. When bond yields are low, investors seek higher returns elsewhere, leading to increased demand for stocks. This increased demand can further support higher valuations. This interplay between bond yields and stock market valuation is crucial to understand.

Strong Corporate Earnings and Profit Growth

Robust corporate earnings and a positive outlook for future profit growth are key pillars supporting BofA's argument. Recent years have witnessed impressive performance across various sectors.

- Examples of strong-performing sectors include technology, healthcare, and consumer staples. These sectors have shown consistent growth, bolstering overall market performance.

- Factors contributing to this positive growth include technological advancements, global expansion, and increased consumer spending. These trends suggest continued growth potential.

- Strong earnings directly support current valuations. Healthy profits justify higher stock prices and P/E ratios. Earnings per share (EPS) growth is a key indicator that investors closely monitor.

Long-Term Investment Horizon

BofA emphasizes the critical importance of adopting a long-term investment strategy. Short-term market fluctuations are inevitable.

- Market corrections are a natural part of the investment cycle. History shows periods of both growth and decline are to be expected.

- The historical performance of the stock market over the long term demonstrates consistent growth. While short-term volatility exists, long-term investors generally see positive returns.

- Focus on long-term growth potential rather than short-term volatility. A long-term perspective minimizes the impact of market corrections and allows investors to ride out short-term downturns. This long-term investment strategy is crucial for long-term success.

Addressing Potential Counterarguments and Risks

While BofA presents a positive outlook, it's essential to acknowledge potential risks associated with high valuations.

Acknowledging Valuation Risks

High valuations in specific sectors or individual stocks remain a valid concern. Careful analysis and risk management are crucial.

- Diversification is key to mitigating risk. Don't put all your eggs in one basket; spread investments across different sectors and asset classes.

- Conduct thorough due diligence before investing in any stock. Understand the company's fundamentals, including its financial health, competitive landscape, and growth prospects.

- Consider seeking professional financial advice. A financial advisor can help you create a personalized investment strategy tailored to your risk tolerance and financial goals. This is especially important in navigating complex market conditions.

Conclusion: Maintaining a Balanced Perspective on Stock Market Valuations

BofA's analysis highlights several factors supporting current stock market valuations: low interest rates, robust corporate earnings, and the potential for long-term growth. While valuations may appear high, these factors offer a counterbalance. A balanced perspective is necessary, acknowledging both opportunities and risks. Don't let concerns over stock market valuations deter you from a well-researched investment strategy. Consult with a financial advisor to understand how to navigate the current market and achieve your long-term financial goals. Proper stock market valuation analysis, combined with a long-term approach, can help you weather market fluctuations and achieve your financial objectives.

Featured Posts

-

Fsu Security Breach Swift Police Response Fails To Quell Student Fears

Apr 22, 2025

Fsu Security Breach Swift Police Response Fails To Quell Student Fears

Apr 22, 2025 -

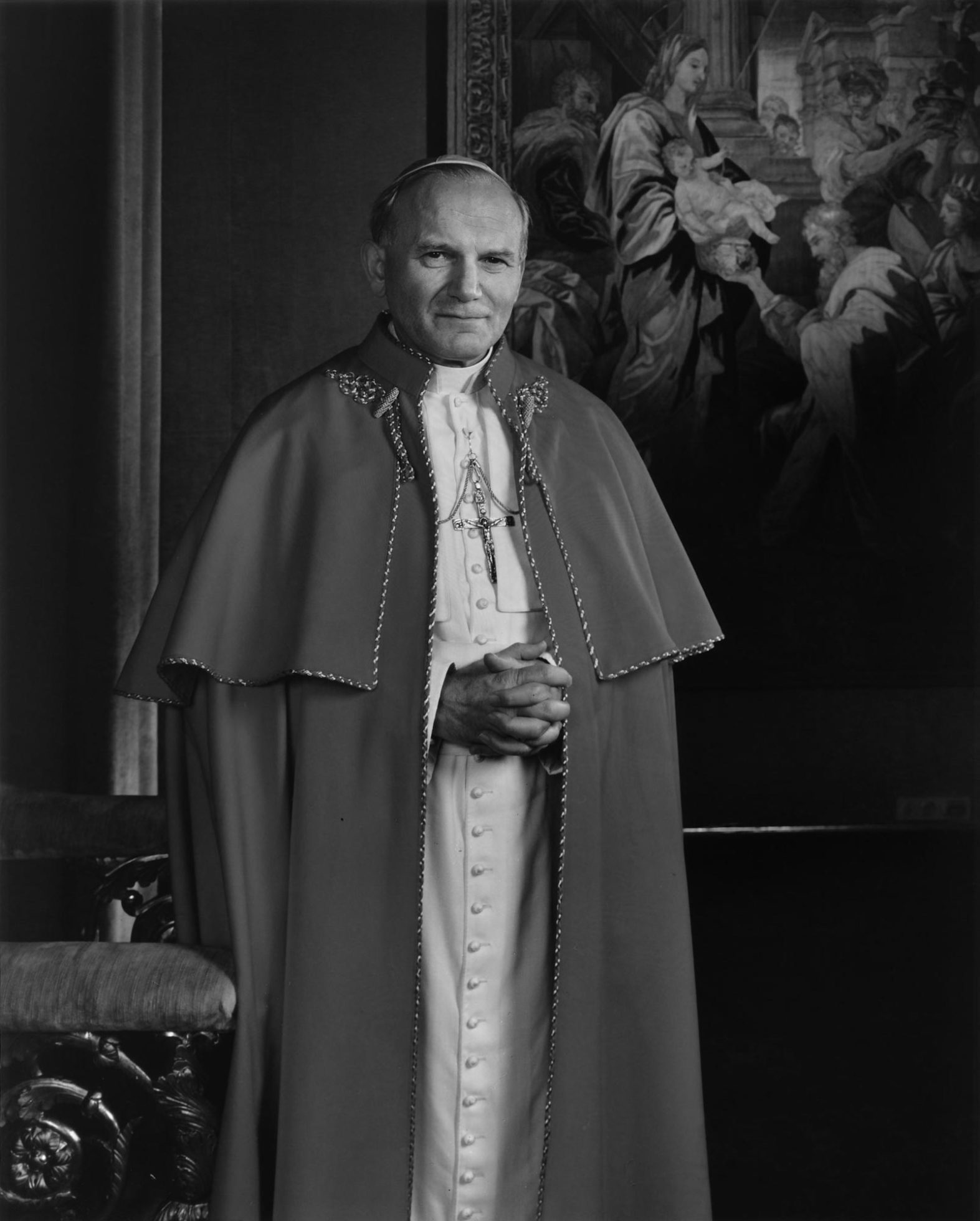

The Passing Of Pope Francis A Global Mourning

Apr 22, 2025

The Passing Of Pope Francis A Global Mourning

Apr 22, 2025 -

The Next Pope How Franciss Legacy Will Shape The Conclave

Apr 22, 2025

The Next Pope How Franciss Legacy Will Shape The Conclave

Apr 22, 2025 -

Anti Trump Protests Hear Their Stories

Apr 22, 2025

Anti Trump Protests Hear Their Stories

Apr 22, 2025 -

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 22, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 22, 2025