AbbVie (ABBV) Stock Rises On Exceeded Sales Expectations And Increased Profit Forecast

Table of Contents

AbbVie's Exceeded Sales Expectations

AbbVie's recent earnings report revealed sales figures that significantly surpassed analysts' predictions, fueling the surge in ABBV stock. This robust sales growth can be attributed to several factors, primarily the strong performance of key products and expanding market share within crucial therapeutic areas.

-

Specific sales figures and percentage growth: AbbVie reported [Insert specific sales figures and percentage growth compared to the previous quarter and year]. This represents a substantial increase compared to analyst projections of [Insert analyst projections].

-

Breakdown of sales performance by key product: The success was largely driven by the continued strong performance of Humira, despite facing biosimilar competition. However, newer products like Rinvoq and Skyrizi also demonstrated impressive sales growth, showcasing the company's success in developing and launching innovative treatments. Rinvoq's sales increased by [Insert percentage] and Skyrizi by [Insert percentage].

-

Analysis of market trends contributing to the strong sales performance: The favorable market trends in [mention specific therapeutic areas like immunology, oncology etc.] have also played a role in AbbVie's success, indicating strong demand for their products and highlighting their strategic positioning in growing markets.

-

Comparison with analyst predictions and competitor performance: AbbVie significantly outperformed analyst expectations, exceeding the consensus forecast by [Insert percentage]. This positions AbbVie favorably against its competitors in the pharmaceutical sector.

Increased Profit Forecast: A Positive Outlook for Investors

The exceeding sales expectations translated directly into a significant upward revision of AbbVie's profit forecast, further bolstering investor confidence. This increased profitability reflects not only strong revenue generation but also efficient cost management and operational effectiveness.

-

The specific revised profit forecast: AbbVie increased its earnings per share (EPS) forecast for [Specify time period, e.g., the full year] to [Insert revised EPS forecast], a significant improvement over the previous guidance of [Insert previous EPS forecast].

-

Factors contributing to the increased profitability: This improvement is attributed to a combination of factors including higher-than-anticipated sales, successful cost-cutting measures, and enhanced operational efficiency.

-

Analysis of long-term growth prospects based on the updated forecast: The revised profit forecast suggests a positive outlook for AbbVie's long-term growth, reinforcing the attractiveness of ABBV stock for long-term investors.

-

Comparison with previous profit forecasts and analyst consensus: This revised forecast substantially exceeds previous expectations and comfortably surpasses the analyst consensus, indicating a strong belief in AbbVie’s future performance.

Market Reaction and Investor Sentiment

The market reacted swiftly and positively to AbbVie's impressive earnings announcement. The ABBV stock price experienced a notable increase, reflecting strong investor confidence and a bullish outlook for the company.

-

Percentage change in AbbVie stock price following the announcement: Following the announcement, AbbVie's stock price increased by [Insert percentage], demonstrating the market's enthusiastic response.

-

Trading volume data reflecting investor activity: Trading volume significantly increased, indicating heightened investor interest and activity surrounding AbbVie.

-

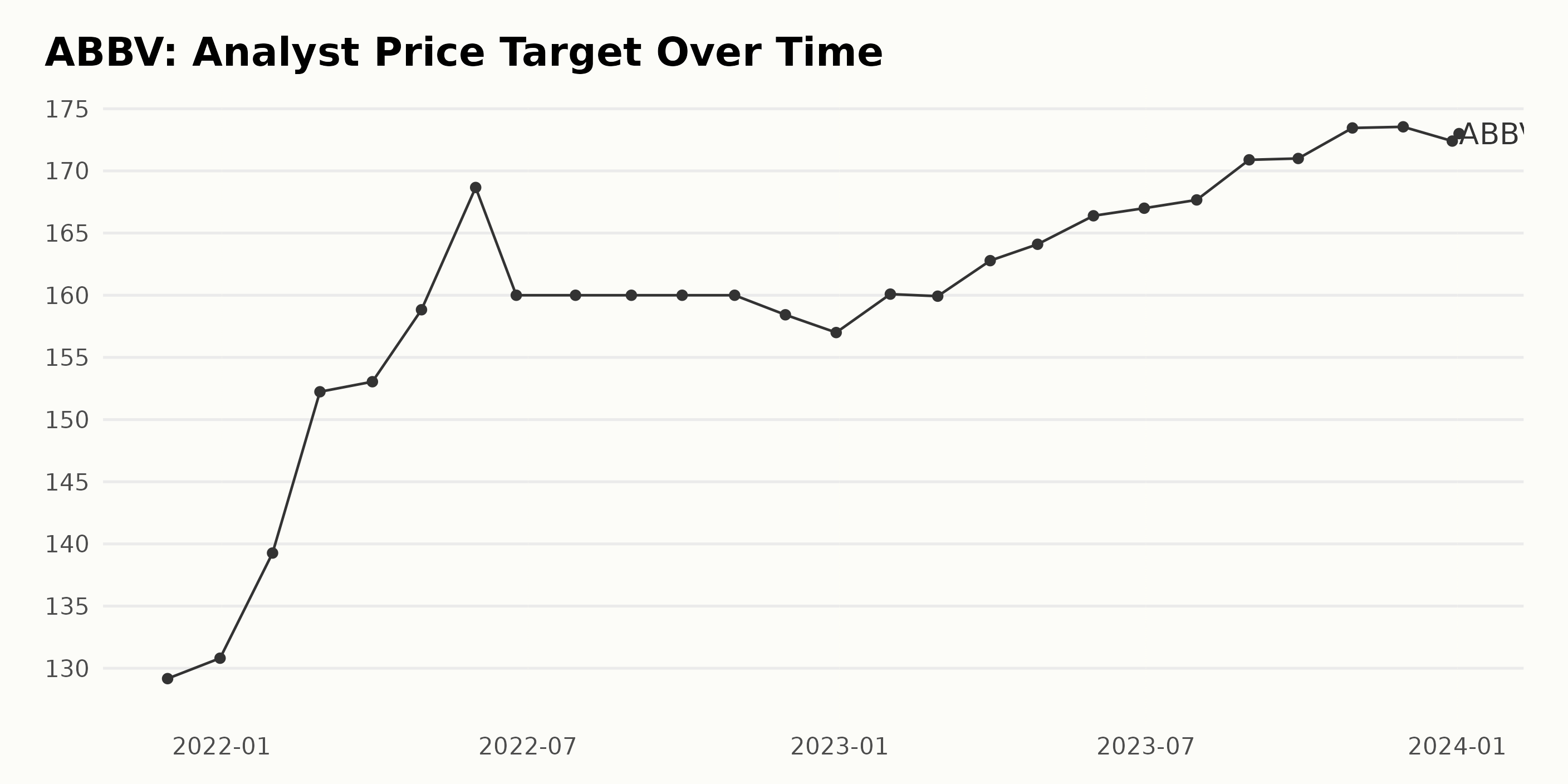

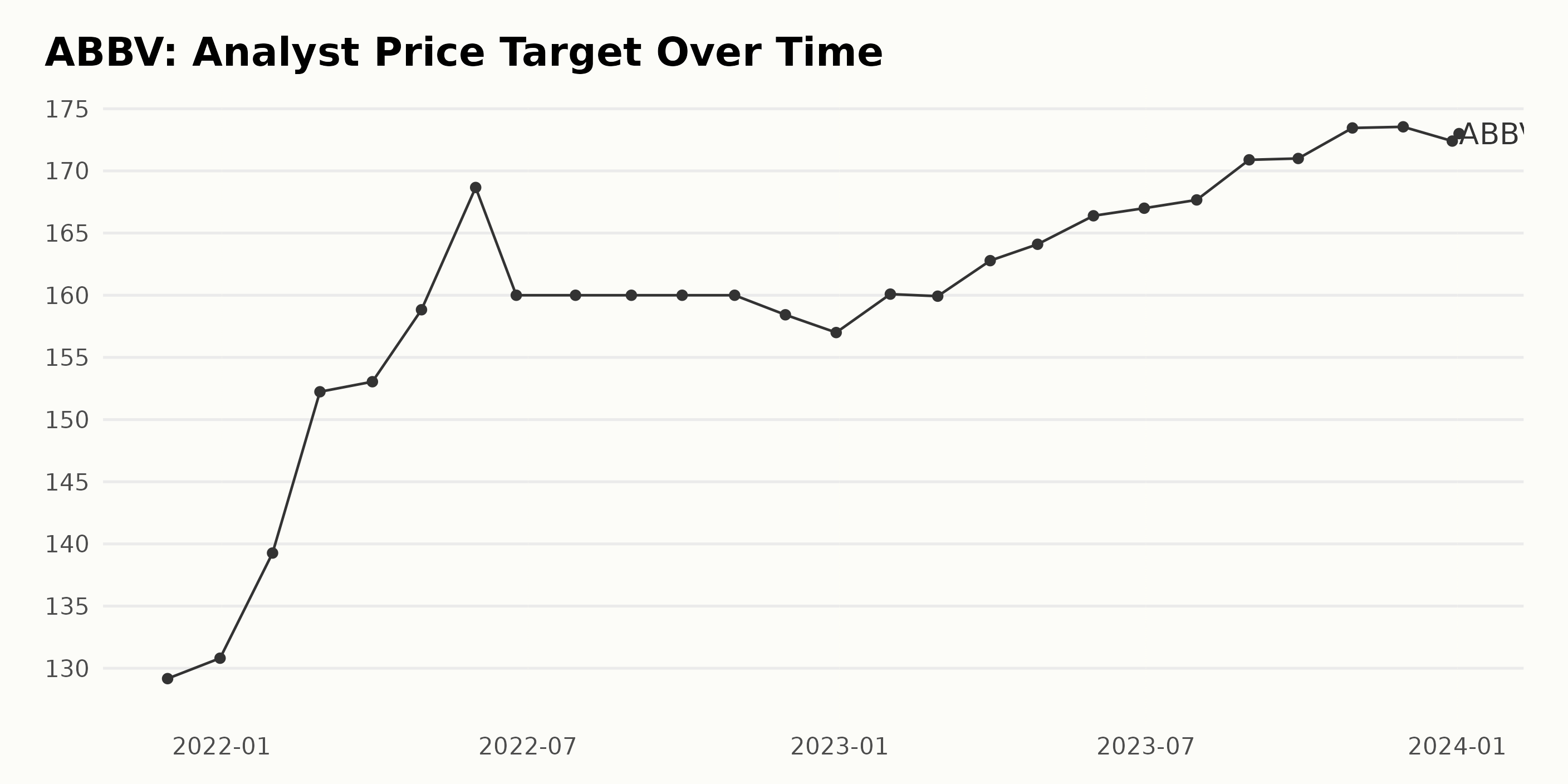

Summary of analyst ratings and price target adjustments: Several analysts have upgraded their ratings and price targets for AbbVie stock, reflecting the positive sentiment surrounding the company's performance and outlook.

-

Discussion of overall investor sentiment: Overall investor sentiment towards AbbVie is highly optimistic, suggesting a continued upward trend for the stock price.

Conclusion: AbbVie Stock Outlook and Investment Strategy

In summary, AbbVie's exceeded sales expectations and significantly increased profit forecast have undeniably contributed to the recent surge in its stock price. The company's strong performance across key products, coupled with positive market trends and efficient operations, paints a positive picture for the future. This makes ABBV stock an attractive prospect for investors looking for long-term growth opportunities within the pharmaceutical sector.

Are you interested in learning more about the investment potential of AbbVie (ABBV) stock? Conduct thorough research and consult with a financial advisor before making any investment decisions. Consider adding ABBV to your portfolio for potential long-term growth. Remember to always diversify your investments and assess your own risk tolerance before committing any capital.

Featured Posts

-

Us Port Fees To Hit Auto Carrier With Up To 70 Million

Apr 26, 2025

Us Port Fees To Hit Auto Carrier With Up To 70 Million

Apr 26, 2025 -

Point72s Emerging Markets Investment Strategy Shift

Apr 26, 2025

Point72s Emerging Markets Investment Strategy Shift

Apr 26, 2025 -

Congressional Stock Trading Ban Trumps Position And The Time Interview

Apr 26, 2025

Congressional Stock Trading Ban Trumps Position And The Time Interview

Apr 26, 2025 -

The Karen Read Murder Trials A Year By Year Account

Apr 26, 2025

The Karen Read Murder Trials A Year By Year Account

Apr 26, 2025 -

Green Bay Welcomes The Nfl Drafts First Round

Apr 26, 2025

Green Bay Welcomes The Nfl Drafts First Round

Apr 26, 2025