Point72's Emerging Markets Investment Strategy Shift

Table of Contents

Increased Focus on Specific Emerging Market Sectors

Point72's approach to emerging markets is moving away from broad, generalized exposure. The firm is now adopting a more targeted, sector-specific investment strategy, concentrating resources on areas with demonstrably high-growth potential and favorable risk-reward profiles. This strategic shift reflects a sophisticated understanding of the nuances within emerging markets, recognizing that not all sectors share the same growth trajectory or risk profile.

- Key Sectors: Point72 is significantly increasing investments in technology, fintech, and healthcare sectors within select emerging economies. This focus is driven by the belief that these sectors are poised for substantial growth fueled by technological advancements and increasing consumer demand.

- Examples: Specific examples might include investments in fintech startups disrupting financial services in Southeast Asia, or burgeoning healthcare technology companies in Latin America addressing unmet medical needs. Investments in technology infrastructure development in Africa are also likely to be a key area of focus.

- Rationale: The rationale behind this targeted approach is threefold: Firstly, these sectors exhibit significantly higher growth potential than more traditional industries. Secondly, favorable regulatory environments in some emerging markets are creating fertile ground for innovation. Thirdly, a thorough risk assessment suggests a positive risk-reward profile, despite inherent market volatility.

Enhanced Geopolitical Risk Management

Emerging markets are inherently susceptible to geopolitical risk. Point72 acknowledges this and has implemented robust risk mitigation strategies to navigate this complex landscape. Their enhanced approach goes beyond simple diversification; it incorporates sophisticated due diligence, scenario planning, and predictive modeling.

- Recent Events & Response: Recent geopolitical events, such as trade disputes or political instability in specific regions, have highlighted the need for proactive risk management. Point72's response includes a more granular assessment of regional and country-specific risks, allowing for a more nuanced approach to portfolio construction.

- Mitigation Techniques: The firm employs a variety of risk mitigation techniques, including rigorous due diligence, diversification across multiple emerging markets to reduce regional concentration risk, scenario planning to anticipate potential disruptions, and stress testing to assess portfolio resilience under various adverse conditions. Hedging strategies are also utilized to mitigate currency and commodity price risks.

- Data Analytics & Predictive Modeling: Data analytics and predictive modeling play a crucial role. Point72 leverages advanced technologies to analyze vast datasets, identify potential risks, and predict market movements, allowing for timely adjustments to the investment strategy.

Adaptation to Market Volatility

Emerging markets are known for their volatility. Point72's adaptation strategy involves a multi-pronged approach to navigate this inherent instability. This includes adjusting investment timelines, modifying asset allocation, and employing sophisticated risk management tools.

- Recent Volatility & Response: Recent periods of significant market volatility in emerging markets have underscored the need for flexibility. Point72's response has been to adjust investment horizons, shortening timelines for certain investments and extending them for others, based on market conditions and risk assessment.

- Investment Adjustments: This may involve increasing liquidity within the portfolio to provide greater flexibility in responding to sudden market shifts. Strategic use of options strategies to hedge against downside risk is another crucial element of their response to volatility.

- Effectiveness of Strategies: The effectiveness of these strategies is continuously monitored and refined through rigorous performance analysis and backtesting. Point72's commitment to data-driven decision making ensures that its investment approach remains dynamic and adaptable.

Leveraging Technological Advancements

Point72 is at the forefront of utilizing technological advancements to enhance its investment decisions in emerging markets. AI, machine learning, and advanced data analytics are integral parts of its investment process.

- AI/ML Applications: Specific applications include the use of AI-powered algorithms for identifying promising investment opportunities, predicting market trends, and automating parts of the investment process. Machine learning models are used for more accurate risk assessment and portfolio optimization.

- Benefits of Technology: These technologies provide several key benefits, including improved data analysis, more accurate risk assessment, better investment selection, and enhanced portfolio management. Ultimately, this translates to improved investment outcomes and more efficient allocation of capital.

- Challenges & Limitations: Despite the benefits, there are challenges. Data quality and availability can be inconsistent in some emerging markets, hindering the effective application of these technologies. Additionally, the ethical implications of AI in finance must be carefully considered.

Conclusion: Understanding Point72's Shifting Emerging Markets Investment Strategy

Point72's evolving emerging markets investment strategy reveals a clear shift towards a more targeted, technologically driven, and risk-aware approach. The firm is focusing on specific high-growth sectors, enhancing its geopolitical risk management capabilities, adapting to market volatility, and leveraging technological advancements to improve investment outcomes. Understanding these shifts is crucial for investors and market participants seeking to navigate the complexities of emerging markets. The implications for future investment opportunities are significant, highlighting the increasing importance of sophisticated strategies and technological expertise in this dynamic sector. Continue researching Point72's emerging markets investment strategy and its implications for your own investment decisions. Explore further resources and analysis to gain a comprehensive understanding of this evolving landscape.

Featured Posts

-

Elon Musks Private Companies A Side Hustle Opportunity For Select Investors

Apr 26, 2025

Elon Musks Private Companies A Side Hustle Opportunity For Select Investors

Apr 26, 2025 -

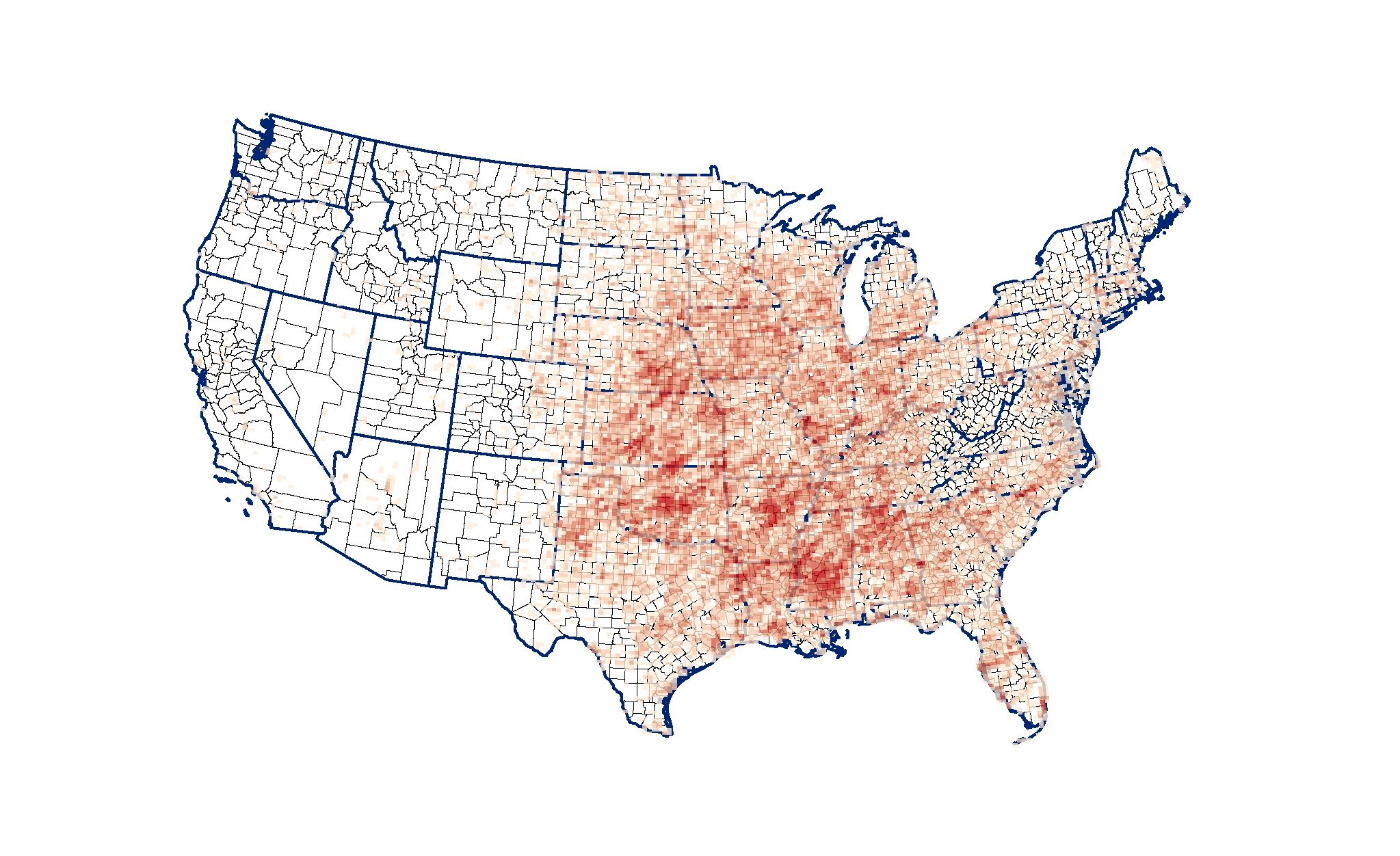

New Business Hot Spots Across The Country An Interactive Map And Analysis

Apr 26, 2025

New Business Hot Spots Across The Country An Interactive Map And Analysis

Apr 26, 2025 -

Why Is Gold A Safe Haven Asset Amidst Global Trade Conflicts

Apr 26, 2025

Why Is Gold A Safe Haven Asset Amidst Global Trade Conflicts

Apr 26, 2025 -

Exclusive Look Inside Pentagon Leaks Internal Battles And Hegseths Reaction

Apr 26, 2025

Exclusive Look Inside Pentagon Leaks Internal Battles And Hegseths Reaction

Apr 26, 2025 -

High Stock Market Valuations A Bof A Analysis For Investors

Apr 26, 2025

High Stock Market Valuations A Bof A Analysis For Investors

Apr 26, 2025