A Path To Fiscal Responsibility: Reforming Canada's Economic Approach

Table of Contents

Tackling Canada's National Debt

Canada's national debt is a pressing concern that demands immediate attention. Restoring fiscal responsibility in Canada necessitates a two-pronged strategy: reducing government spending and increasing government revenue.

Reducing Government Spending

Controlling government expenditure is crucial for achieving fiscal health. This requires a careful review of current programs and a strategic shift in priorities.

- Analyzing Non-Essential Programs: A thorough audit of all government programs is needed to identify those that are inefficient, redundant, or no longer aligned with national priorities. Cutting unnecessary spending will free up resources for more vital areas.

- Prioritizing Infrastructure Investments: Investing in infrastructure, such as roads, bridges, and public transit, is crucial for long-term economic growth. These investments stimulate the economy, create jobs, and improve the quality of life for Canadians. Focusing on high-impact projects with measurable returns on investment is paramount.

- Stricter Government Procurement Controls: Implementing stricter controls on government procurement can significantly reduce costs. This includes streamlining the bidding process, promoting competition, and enforcing anti-corruption measures.

- Public-Private Partnerships: Exploring public-private partnerships (P3s) for infrastructure development can leverage the efficiency and expertise of the private sector while sharing financial risks. However, careful oversight is necessary to ensure value for money and avoid potential pitfalls.

Increasing Government Revenue

While controlling spending is crucial, increasing government revenue is equally important for achieving sustainable fiscal responsibility in Canada. This involves a combination of strategies:

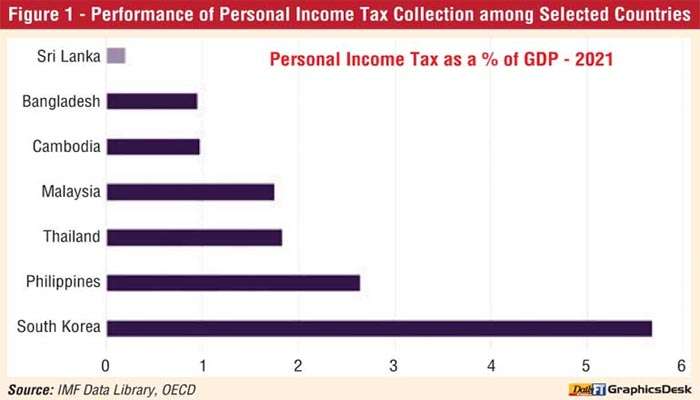

- Fair and Efficient Tax Policies: A review of existing tax policies is necessary to ensure fairness and efficiency. This includes considering progressive taxation models that place a greater burden on higher-income earners while supporting lower-income families.

- Addressing Tax Evasion and Avoidance: Strengthening enforcement mechanisms and modernizing regulations can help reduce tax evasion and avoidance, maximizing tax revenue collection. This requires increased investment in the Canada Revenue Agency (CRA) and improved data sharing with other countries.

- Exploring New Revenue Streams: Exploring potential new revenue streams, such as implementing or adjusting a carbon tax or increasing levies on luxury goods, should be carefully considered. The potential impact on consumers and the economy must be thoroughly assessed before implementation. Any new revenue generation must be balanced with fairness and economic impact analysis.

- Promoting Economic Growth: Ultimately, the most sustainable way to increase government revenue is to promote strong economic growth. This expands the tax base and generates more revenue naturally.

Improving Fiscal Transparency and Accountability

Building public trust and confidence requires increased transparency and accountability in government finances.

Strengthening Budgetary Processes

More rigorous budget oversight is essential for responsible fiscal management.

- Rigorous Budget Oversight: Independent bodies should oversee government budgeting, ensuring adherence to fiscal plans and identifying potential risks. This could involve strengthening the role of the parliamentary budget officer.

- Public Access to Financial Information: Making government financial information readily available to the public promotes transparency and allows citizens to hold their elected officials accountable.

- Independent Fiscal Agencies: Independent fiscal agencies are vital for providing unbiased evaluations of government finances and offering recommendations for improvement. Their independence must be protected from political influence.

Promoting Open Data Initiatives

Open data initiatives can significantly increase transparency and public engagement.

- User-Friendly Online Portals: Making government financial data readily available through user-friendly online portals allows citizens to easily access and understand this information.

- Independent Analysis and Reporting: Encouraging independent analysis and reporting based on open government data fosters greater scrutiny and accountability.

- Public Engagement and Discussion: Open government data should encourage public engagement and discussion around government finances, fostering a more informed and participatory democracy.

Investing in Long-Term Economic Growth

Investing in long-term economic growth is essential for creating a sustainable and prosperous future for Canada. This involves strengthening human capital and promoting sustainable development.

Strengthening Human Capital

Investing in people is investing in the future.

- Education and Skills Training: Increased investment in education and skills training is crucial to prepare the workforce for the jobs of the future. This includes addressing skills gaps in high-demand sectors.

- Research and Development: Supporting research and development fosters innovation and technological advancement, driving economic growth and creating high-paying jobs.

- Addressing Skills Gaps: Proactive measures to address skills gaps in key sectors are critical to ensure Canada remains competitive in the global economy.

Promoting Sustainable Development

Sustainable development is key to long-term prosperity.

- Renewable Energy and Green Technology: Investing in renewable energy and green technology reduces carbon emissions and creates new economic opportunities.

- Sustainable Agriculture and Resource Management: Implementing policies that support sustainable agriculture and responsible resource management ensures long-term environmental and economic health.

- Responsible Economic Development: Promoting responsible economic development that benefits both current and future generations is paramount for creating a sustainable future for Canada.

Conclusion

Achieving fiscal responsibility in Canada necessitates a comprehensive strategy encompassing reduced spending, increased revenue, enhanced transparency, and investments in long-term growth. By addressing these critical areas, Canada can build a stronger, more resilient economy. Implementing these reforms will be crucial to navigating future economic uncertainties and ensuring a financially secure future for all Canadians. Let's work together to create a path towards genuine fiscal responsibility in Canada by engaging in constructive dialogue and demanding accountable governance. Let's prioritize responsible fiscal management and build a brighter economic future for Canada.

Featured Posts

-

From Whataburger Viral Video To Uil State The Story Of An Hisd Mariachi Group

Apr 24, 2025

From Whataburger Viral Video To Uil State The Story Of An Hisd Mariachi Group

Apr 24, 2025 -

Chinese Firm Considers Offloading Chip Tester Utac

Apr 24, 2025

Chinese Firm Considers Offloading Chip Tester Utac

Apr 24, 2025 -

Living With A 77 Inch Lg C3 Oled Pros And Cons

Apr 24, 2025

Living With A 77 Inch Lg C3 Oled Pros And Cons

Apr 24, 2025 -

Examining Canadas Fiscal Health Assessing The Liberals Record

Apr 24, 2025

Examining Canadas Fiscal Health Assessing The Liberals Record

Apr 24, 2025 -

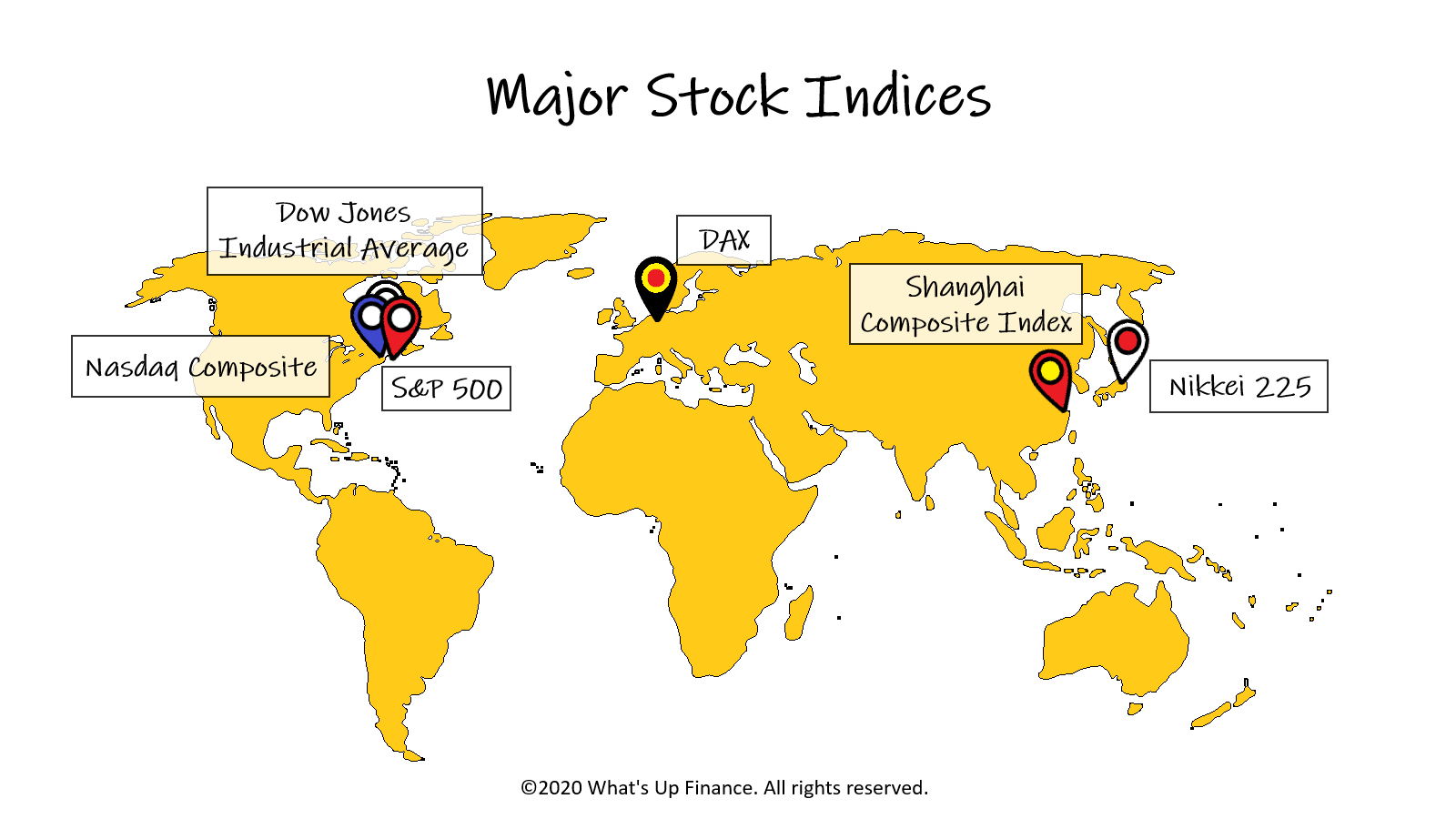

Stock Market Today Significant Gains Across Major Indices

Apr 24, 2025

Stock Market Today Significant Gains Across Major Indices

Apr 24, 2025