5 Key Actions To Secure A Private Credit Role

Table of Contents

Master the Fundamentals of Private Credit Investing

A strong understanding of private credit markets is paramount for success. This goes beyond basic finance knowledge; you need a deep understanding of the nuances of private debt instruments and the intricacies of the market. This includes a comprehensive grasp of different debt structures, credit analysis techniques, and the regulatory landscape.

- Deepen your knowledge of credit analysis techniques: Master the art of assessing credit risk, including financial statement analysis, cash flow projections, and sensitivity analysis. Familiarize yourself with various credit scoring models and their limitations.

- Understand different underwriting methodologies: Become proficient in evaluating the creditworthiness of borrowers, considering factors like collateral, covenants, and industry trends. Learn about different types of loan structures, including senior secured loans, subordinated debt, mezzanine financing, and unitranche loans.

- Familiarize yourself with the legal and regulatory aspects of private credit: Understanding legal documents, compliance requirements, and regulatory changes is crucial. Keep up-to-date with relevant legislation impacting the private credit industry.

- Study various investment strategies within private credit: Explore different approaches, such as direct lending, fund investing, and special situations investing. Each approach demands a unique skillset and understanding of the market dynamics.

- Network with professionals in the field to gain insights: Attend industry events and conferences, join relevant professional organizations, and engage with experienced private credit professionals on platforms like LinkedIn. Informational interviews are invaluable in understanding the realities of a private credit role.

Build a Compelling Resume and LinkedIn Profile

Your resume and LinkedIn profile are your first impression. They must effectively showcase your skills and experience, tailored to attract recruiters and hiring managers in the private credit industry. Use keywords strategically and quantify your achievements whenever possible.

- Use keywords relevant to private credit: Incorporate terms like "credit analysis," "underwriting," "portfolio management," "due diligence," "financial modeling," "valuation," "leveraged finance," and "distressed debt" throughout your resume and LinkedIn profile.

- Quantify achievements whenever possible: Instead of simply stating your responsibilities, showcase your impact. For example, instead of "Managed a portfolio of loans," write "Managed a $50 million loan portfolio, achieving a 12% annualized return."

- Showcase relevant certifications: Highlight certifications like CFA, CAIA, and CPA, as these demonstrate your commitment to the field and your professional expertise.

- Highlight any experience in financial modeling, valuation, or accounting: These skills are essential for private credit professionals. Emphasize your proficiency in tools like Excel, Bloomberg Terminal, and specialized financial modeling software.

- Ensure your LinkedIn profile is complete and professional: Use a professional headshot, write a compelling summary highlighting your skills and aspirations, and connect with individuals in the private credit industry.

Network Strategically Within the Private Credit Industry

Networking is crucial for uncovering hidden job opportunities and building valuable relationships. Don't underestimate the power of personal connections in this competitive field.

- Attend industry conferences and events: These events provide opportunities to meet professionals, learn about new trends, and expand your network.

- Join relevant professional organizations: Membership in organizations like the CFA Institute or associations focused on private credit can provide networking opportunities and access to industry insights.

- Connect with recruiters specializing in private credit placements: Recruiters have access to unadvertised jobs and can provide valuable guidance throughout the job search process.

- Reach out to professionals on LinkedIn: Don't hesitate to connect with individuals working in private credit and initiate conversations. Informational interviews are extremely valuable.

- Informational interviews are crucial: Schedule informational interviews to learn more about different roles, firms, and career paths within the private credit industry.

Ace the Private Credit Interview Process

The interview process is your chance to showcase your knowledge, skills, and personality. Thorough preparation is essential for success.

- Practice your responses to common interview questions: Prepare answers to behavioral questions (e.g., "Tell me about a time you failed"), technical questions related to private credit (e.g., "Explain the difference between senior secured and subordinated debt"), and case studies.

- Prepare case studies showcasing your analytical and problem-solving skills: Be ready to analyze a hypothetical investment opportunity, demonstrating your understanding of credit analysis, valuation, and risk assessment.

- Research the firm and the interviewers thoroughly: Show your genuine interest by demonstrating knowledge of the firm's investment strategy, recent transactions, and the interviewers' backgrounds.

- Demonstrate your passion for private credit: Enthusiasm is contagious. Show your genuine interest in the field and your commitment to a career in private credit.

- Ask insightful questions: Asking well-prepared questions demonstrates your interest and engagement, allowing you to learn more about the role and the firm.

Negotiate Your Private Credit Job Offer Effectively

Once you receive a job offer, be prepared to negotiate effectively. Know your worth and be confident in your abilities.

- Research industry salary benchmarks: Understand the typical salary range for similar roles in your location and with your experience level. Sites like Glassdoor and Salary.com can be helpful resources.

- Know your worth and be confident in your negotiations: Don't undervalue yourself. Know what you're bringing to the table and negotiate accordingly.

- Consider the entire compensation package (not just salary): Think about benefits like health insurance, retirement plans, bonuses, and vacation time.

- Be prepared to walk away if the offer isn't satisfactory: While a job offer is exciting, it's crucial to ensure the compensation and overall package align with your expectations and career goals.

- Maintain a professional and respectful demeanor throughout the process: Regardless of the outcome, maintain professionalism and respect for the hiring team.

Conclusion

Securing a private credit role requires dedication, preparation, and a strategic approach. By mastering the fundamentals of private credit investing, building a strong professional profile, networking effectively, acing the interview process, and negotiating confidently, you’ll significantly improve your chances of landing your dream job. Don't delay – start taking action today to secure your ideal private credit role and begin your journey in this dynamic and rewarding field. Remember to continuously update your skills and knowledge within the private credit space to remain competitive. Your commitment to professional development within the private credit sector will make you a highly sought-after candidate.

Featured Posts

-

Will Google Be Broken Up Analyzing The Current Threats

Apr 22, 2025

Will Google Be Broken Up Analyzing The Current Threats

Apr 22, 2025 -

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 22, 2025

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 22, 2025 -

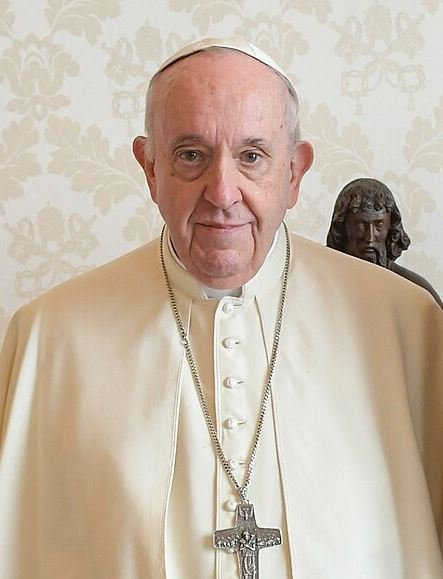

Conclave 2023 Evaluating Pope Franciss Impact

Apr 22, 2025

Conclave 2023 Evaluating Pope Franciss Impact

Apr 22, 2025 -

Understanding Papal Conclaves History Process And Secrecy

Apr 22, 2025

Understanding Papal Conclaves History Process And Secrecy

Apr 22, 2025 -

Who Pays For Trumps Economic Growth

Apr 22, 2025

Who Pays For Trumps Economic Growth

Apr 22, 2025