Who Pays For Trump's Economic Growth?

Table of Contents

The Tax Cuts and Jobs Act of 2017: Winners and Losers

The Tax Cuts and Jobs Act (TCJA) of 2017, a cornerstone of Trump's economic agenda, significantly altered the US tax code. Understanding its impact on income inequality requires examining its effects on both corporate and individual tax rates. Key elements include:

-

Significant Reduction in Corporate Tax Rates: The TCJA slashed the federal corporate tax rate from 35% to 21%. Proponents argued this would stimulate business investment and job creation, leading to broader economic growth through "trickle-down economics." Critics, however, pointed to the potential for increased corporate profits without a corresponding increase in wages or job creation, exacerbating income inequality.

-

Mixed Impact on Individual Tax Rates: While the TCJA reduced individual income tax rates across the board, the benefits were not evenly distributed. Higher-income earners generally received a larger tax cut, both in absolute terms and as a percentage of their income. This led to concerns about increased wealth concentration and a widening of the income gap.

-

Increased National Debt: The substantial tax cuts, coupled with increased government spending, led to a significant increase in the national debt. This raises long-term economic concerns, particularly regarding the burden on future generations.

The TCJA's impact on income inequality remains a subject of ongoing debate. While proponents highlight the potential for increased economic growth, critics emphasize the disproportionate benefits to high-income earners and the potential for increased long-term economic instability due to the ballooning national debt. The long-term effects are still unfolding, and further research is necessary to fully understand the long-term consequences of this significant legislative change.

Deregulation and its Impact on Economic Inequality

The Trump administration pursued a significant deregulation agenda, impacting various sectors from environmental protection to financial regulation and labor laws. The consequences for economic inequality are complex and multifaceted:

-

Reduced Environmental Protections: Weakening environmental regulations often disproportionately affects low-income communities and minority groups, who are more likely to live near polluting industries and lack the resources to mitigate environmental risks. This creates further economic disparities, impacting health, property values, and overall well-being.

-

Easing of Financial Regulations: Relaxing financial regulations, while potentially stimulating short-term economic activity, can increase the risk of financial instability. This risk disproportionately affects those with less financial security, who are more vulnerable to economic downturns and financial crises.

-

Impact of Weakened Labor Laws: Reductions in worker protections, such as minimum wage increases and unionization efforts, can depress wages and benefits for low- and middle-income workers, contributing to income inequality and reducing the overall standard of living for a significant portion of the population.

-

Wealth Concentration: Deregulation, particularly in the financial sector, has often been linked to increased wealth concentration. Reduced oversight can allow for practices that benefit those at the top while potentially jeopardizing the financial security of others.

Trade Wars and Their Economic Consequences

Trump's administration initiated several trade wars, imposing tariffs on goods from various countries. These actions had complex and often unpredictable economic consequences:

-

Impact of Tariffs on Consumer Prices: Tariffs increase the price of imported goods, directly impacting consumers. This cost increase disproportionately affects lower-income households, who spend a larger percentage of their income on essential goods and services.

-

Disproportionate Impact on Specific Industries: Certain sectors, such as agriculture, were particularly hard-hit by retaliatory tariffs imposed by other countries. Farmers faced reduced export opportunities and lower prices, leading to economic hardship and job losses.

-

Retaliatory Tariffs and Economic Consequences: The imposition of tariffs often led to retaliatory measures from other countries, creating a cycle of escalating trade barriers and harming both domestic and international economic activity.

-

The Debate Surrounding Protectionist Trade Policies: The effectiveness of protectionist trade policies remains a subject of ongoing debate. While proponents argue for protecting domestic industries, critics point to the potential for higher prices for consumers, reduced economic efficiency, and disruptions to global trade relationships.

Conclusion

Understanding who pays for Trump's economic growth requires a nuanced analysis of the distributional effects of his administration's policies. The Tax Cuts and Jobs Act, while boosting overall growth for a time, disproportionately benefited high-income earners and increased the national debt. Deregulation, while aiming to stimulate the economy, carried significant risks, particularly for vulnerable populations and the long-term economic health of the country. Finally, the trade wars resulted in increased costs for consumers and harmed specific sectors, particularly agriculture. The long-term impacts of these policies continue to unfold, and further research is crucial to fully comprehend their complex and lasting consequences. Continuing to explore the complexities of Trump's economic legacy and its distributional consequences is essential to fostering a more informed understanding of economic policy and its impact on society. Further investigation into the lasting effects of Trump's economic policies on wealth and income distribution is crucial to inform future economic decision-making.

Featured Posts

-

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025 -

South Sudan And The Us To Coordinate Repatriation Of Deportees

Apr 22, 2025

South Sudan And The Us To Coordinate Repatriation Of Deportees

Apr 22, 2025 -

Harvards Funding Future Uncertain Trump Administrations 1 Billion Dispute

Apr 22, 2025

Harvards Funding Future Uncertain Trump Administrations 1 Billion Dispute

Apr 22, 2025 -

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 22, 2025

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 22, 2025 -

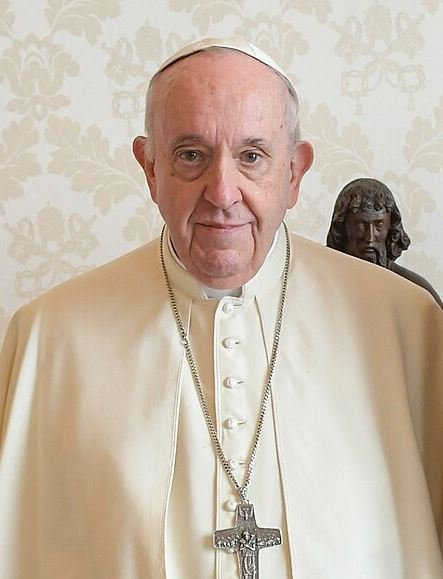

Understanding Papal Conclaves History Process And Secrecy

Apr 22, 2025

Understanding Papal Conclaves History Process And Secrecy

Apr 22, 2025