Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Rationale: Understanding the Underlying Economic Factors

BofA's assessment of the current high stock market valuations rests on several key economic factors. Their analysis suggests that these high valuations are, to a significant extent, justified by underlying strength in the economy and corporate performance.

Strong Corporate Earnings and Profitability

BofA's research highlights robust corporate earnings and profit growth as a primary driver of current valuations. Their analysis considers key metrics like earnings per share (EPS) growth and revenue growth.

- Robust EPS Growth: Many companies are experiencing significant year-over-year increases in EPS, indicating strong profitability and efficient management.

- Expanding Revenue Streams: BofA observes that diverse revenue streams, driven by innovation and market expansion, are contributing to sustained profit margins for numerous companies.

- Healthy Profit Margins: Despite inflationary pressures, many companies maintain healthy profit margins, demonstrating resilience and pricing power.

These strong fundamentals, according to BofA, provide a solid foundation for the current market valuations. Higher earnings generally justify higher price-to-earnings (P/E) ratios, a common valuation metric.

Low Interest Rates and Monetary Policy

Low interest rates play a significant role in influencing stock valuations. BofA acknowledges the impact of the current monetary policy environment, characterized by low interest rates and, historically, quantitative easing.

- Lower Discount Rates: Low interest rates lower the discount rate used in discounted cash flow (DCF) models, a common valuation technique. This results in higher present values for future earnings, thus supporting higher stock prices.

- Increased Investment: Easy access to capital encourages investment and business expansion, further fueling corporate earnings and justifying higher valuations.

- BofA's Assessment of Sustainability: While BofA acknowledges the potential for interest rate increases, their current analysis suggests that the low interest rate environment is likely to persist for some time.

However, investors need to carefully consider BofA's assessment of the sustainability of this environment and its potential shifts.

Technological Innovation and Long-Term Growth Potential

Technological innovation is another crucial factor in BofA's perspective. Disruptive technologies are transforming numerous industries, creating new opportunities and driving growth for innovative companies.

- Disruptive Technologies: Sectors such as artificial intelligence, biotechnology, and renewable energy are experiencing rapid growth, attracting significant investment and contributing to higher valuations.

- Growth Sectors: BofA's analysis identifies specific growth sectors exhibiting strong long-term potential, which command higher valuations due to their anticipated future earnings.

- Future-Proof Businesses: Companies that are successfully adapting to technological change and building future-proof business models are generally viewed favorably by investors, driving up their valuations.

BofA incorporates these long-term growth prospects into their valuation models, acknowledging the premium placed on companies with strong innovation and future potential.

Addressing Common Investor Concerns about High Stock Market Valuations

Despite BofA's positive outlook, concerns remain. Let's address some common anxieties.

The Myth of an Inevitable Market Crash

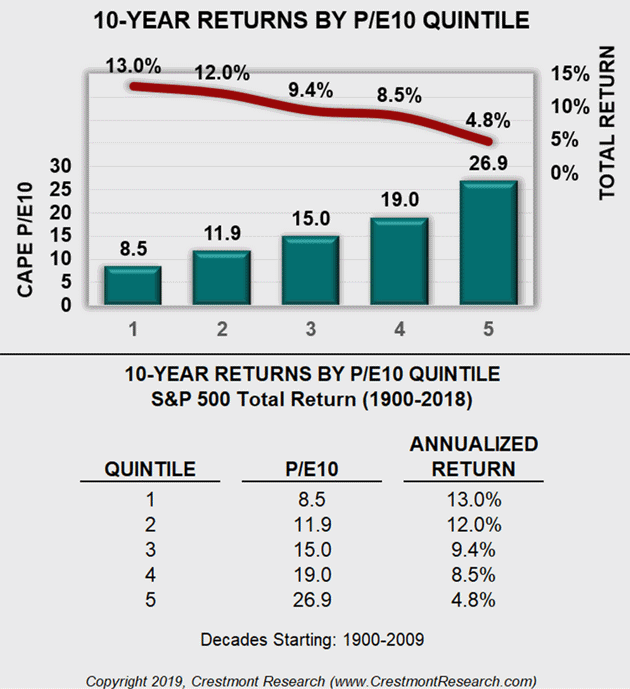

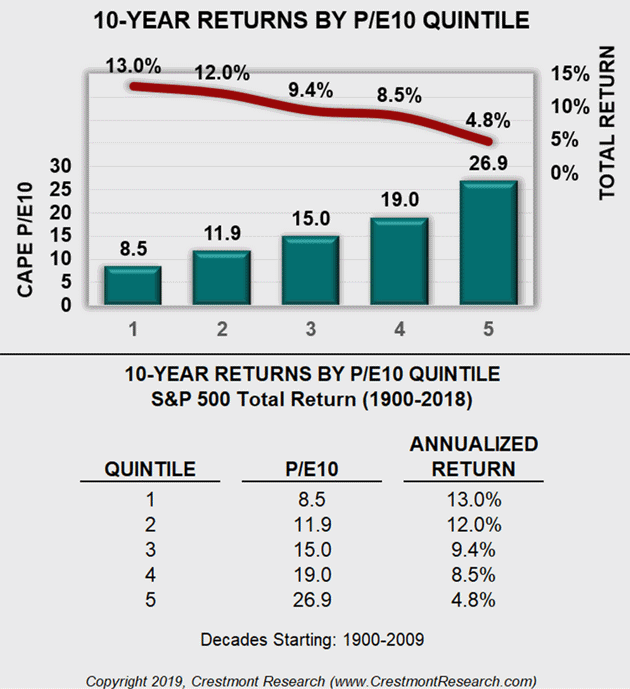

Many believe that high valuations inevitably precede a market crash. BofA counters this with data-driven analysis, arguing that while market corrections are normal, high valuations alone don't guarantee a crash.

- Market Corrections are Normal: The market experiences fluctuations and corrections periodically. High valuations don't automatically trigger a catastrophic crash.

- Risk Management is Key: BofA emphasizes the importance of risk management and diversification to mitigate losses during periods of market volatility.

- Historical Perspective: BofA's research analyzes historical data to show that periods of high valuations have not always been followed by immediate or significant market downturns.

Responsible investing strategies, including careful portfolio construction and diversification, are crucial to navigate market volatility.

The Importance of Long-Term Investment Strategies

BofA strongly advocates for long-term investment strategies. This approach reduces the impact of short-term market fluctuations.

- Long-Term Growth Focus: Focusing on long-term growth prospects helps investors weather short-term market volatility.

- Diversification Strategy: Diversification across different asset classes (stocks, bonds, real estate, etc.) is crucial to reduce overall portfolio risk.

- Asset Allocation: BofA recommends carefully managing asset allocation based on individual risk tolerance and investment goals.

Adjusting investment portfolios based on market conditions, taking into account BofA's analysis, is a crucial part of a successful long-term strategy.

Identifying Undervalued Opportunities within a High Valuation Market

Even in a seemingly overvalued market, BofA believes there are still opportunities to find undervalued companies.

- Fundamental Analysis: BofA emphasizes fundamental analysis, focusing on a company's intrinsic value and comparing it to its market price.

- Stock Picking: Careful stock picking is vital, focusing on companies with strong fundamentals, sustainable competitive advantages, and long-term growth potential.

- Value Investing: By focusing on value investing principles, investors can identify companies whose stock prices are below their intrinsic worth.

BofA's research provides insights into identifying such undervalued opportunities.

Conclusion: Investing Wisely Despite High Stock Market Valuations – BofA's Perspective

BofA's analysis suggests that high stock market valuations, while a concern, are not necessarily a reason for panic. Strong corporate earnings, low interest rates, and technological innovation contribute to justifying current valuations. However, investors must remain prudent. Focusing on long-term strategies, diversification, and thorough research – informed by insights from reputable sources like BofA – is key.

Call to Action: Consult with a qualified financial advisor, conduct thorough research on individual companies and the overall market, and build a well-diversified investment portfolio tailored to your risk tolerance and investment goals. Consider exploring BofA's research publications and investment strategies for additional insights on navigating high stock market valuations. Remember, a balanced and informed approach to investing, informed by sources like BofA, can help you successfully manage even periods of high stock market valuations.

Featured Posts

-

Tariff Worries Prompt Meeting Between Trump And Retail Giants Walmart And Target

Apr 23, 2025

Tariff Worries Prompt Meeting Between Trump And Retail Giants Walmart And Target

Apr 23, 2025 -

Cy Young Winners 9 Run Lead April Game A Deep Dive Into The Dominant Performance And Strikeouts

Apr 23, 2025

Cy Young Winners 9 Run Lead April Game A Deep Dive Into The Dominant Performance And Strikeouts

Apr 23, 2025 -

Brewers Humiliate Athletics In Historic Win

Apr 23, 2025

Brewers Humiliate Athletics In Historic Win

Apr 23, 2025 -

Ices Denial Of Release Prevents Mahmoud Khalil From Meeting His Son

Apr 23, 2025

Ices Denial Of Release Prevents Mahmoud Khalil From Meeting His Son

Apr 23, 2025 -

Addressing Stock Market Valuation Concerns Insights From Bof A

Apr 23, 2025

Addressing Stock Market Valuation Concerns Insights From Bof A

Apr 23, 2025