Why Current Stock Market Valuations Shouldn't Deter Investors (BofA)

Table of Contents

The Importance of Long-Term Investing Over Short-Term Fluctuations

The key to navigating market uncertainty lies in embracing a long-term investment strategy. Short-term market fluctuations, while unsettling, are a normal part of the economic cycle. Focusing solely on daily or weekly price changes often leads to emotional decision-making, resulting in poor investment outcomes. Instead, a long-term approach allows investors to ride out market corrections and benefit from the power of compounding returns.

- Historical Data: History consistently shows that despite numerous short-term market corrections, the stock market has delivered positive long-term returns. Decades of data support this, demonstrating resilience against temporary downturns.

- Riding Market Cycles: Long-term investing means accepting that market cycles—periods of growth followed by corrections—are inevitable. The focus should be on staying invested and letting your portfolio weather these storms.

- The Power of Compounding: Over the long term, the compounding effect of returns significantly amplifies your investment growth. Consistent contributions, even relatively small ones, can accumulate substantial wealth over time. This power is significantly diminished by frequent buying and selling based on short-term market noise.

Understanding Current Stock Market Valuations in Context

Current stock market valuations are influenced by several intertwined factors. Interest rates, inflation, economic growth projections, and geopolitical events all play a role in shaping stock prices. It's crucial to analyze these factors in context to understand the current market environment rather than reacting solely to headline numbers.

- Economic Indicators: Analyzing key economic indicators such as GDP growth, inflation rates, and unemployment figures provides valuable insights into the overall health of the economy and its likely impact on stock prices.

- Valuation Multiples in Historical Context: Comparing current valuation multiples (like the Price-to-Earnings ratio or P/E ratio) to historical averages helps determine whether current valuations are exceptionally high or within a reasonable range considering long-term growth projections.

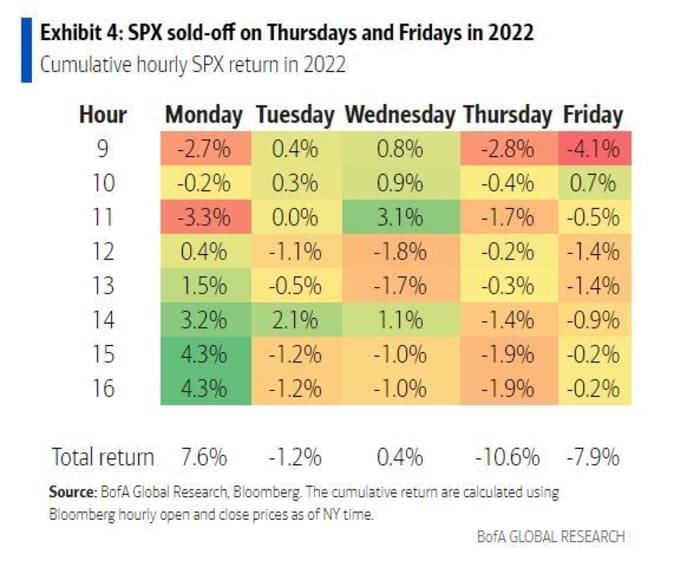

- BofA's Market Outlook: While specific insights require access to their research, BofA generally emphasizes the importance of considering long-term growth potential and not solely reacting to short-term valuations. Their analysts often provide context regarding economic forecasts and their impact on various sectors.

Identifying Undervalued Opportunities Within the Current Market

Even in a market with seemingly high valuations, opportunities exist to identify potentially undervalued stocks. Thorough analysis is key to finding companies that are poised for growth despite broader market concerns.

- Fundamental Analysis: Using fundamental analysis techniques, such as examining a company's financial statements (income statement, balance sheet, cash flow statement), calculating key ratios (like P/E ratio, dividend yield, and return on equity), and assessing its competitive landscape, helps identify undervalued companies with strong fundamentals.

- Sector Analysis: Focusing on specific sectors expected to experience significant growth despite overall market conditions can offer attractive investment opportunities. Technological advancements and shifts in consumer behavior are key factors to consider in this analysis.

- Portfolio Diversification: To mitigate risk, diversify your investment portfolio across different sectors and asset classes. This approach reduces the impact of any single investment underperforming.

The Role of Professional Financial Advice

Navigating complex market conditions and making sound investment decisions is challenging. Seeking guidance from a qualified financial advisor is crucial, particularly when dealing with current stock market valuations.

- Personalized Investment Plans: A financial advisor will work with you to create a personalized investment plan aligned with your risk tolerance, financial goals, and time horizon.

- Expert Guidance: They can offer expert insights into market trends, economic forecasts, and help interpret the meaning of current stock market valuations within the broader context of your individual circumstances.

- Tailored Strategies: Your advisor can help you develop a tailored investment strategy that accounts for current market conditions while staying focused on your long-term goals.

Conclusion: Don't Let Current Stock Market Valuations Deter Your Investment Journey

In conclusion, while current stock market valuations may appear high, a long-term investment perspective combined with a strategic approach remains crucial for achieving financial success. Understanding market context, identifying undervalued opportunities through thorough analysis, and seeking expert advice are essential elements for navigating the complexities of the market. Don’t let fear dictate your investment decisions; instead, invest wisely despite current stock market valuations. Take control of your financial future and start planning your long-term investment strategy today.

Featured Posts

-

Abwzby Tstdyf Mntda Rayda Llabtkar Fy Tb Alhyat Alshyt Almdydt

Apr 28, 2025

Abwzby Tstdyf Mntda Rayda Llabtkar Fy Tb Alhyat Alshyt Almdydt

Apr 28, 2025 -

Mets Competitor Exceptional Performance From A Starting Pitcher

Apr 28, 2025

Mets Competitor Exceptional Performance From A Starting Pitcher

Apr 28, 2025 -

Red Sox And Blue Jays Game Preview Lineups Buehlers Role And Key Players

Apr 28, 2025

Red Sox And Blue Jays Game Preview Lineups Buehlers Role And Key Players

Apr 28, 2025 -

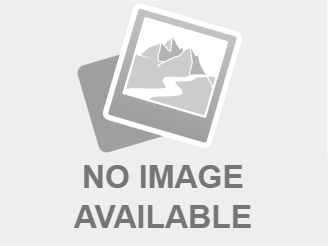

Orioles Announcers Jinx Snapped 160 Game Hitting Streak Over

Apr 28, 2025

Orioles Announcers Jinx Snapped 160 Game Hitting Streak Over

Apr 28, 2025 -

Profitable Nascar Jack Link 500 Prop Bets Talladega 2025 Strategy

Apr 28, 2025

Profitable Nascar Jack Link 500 Prop Bets Talladega 2025 Strategy

Apr 28, 2025