Warren Buffett's Apple Decision: Was It The Right Move?

Table of Contents

The Rationale Behind Buffett's Apple Investment

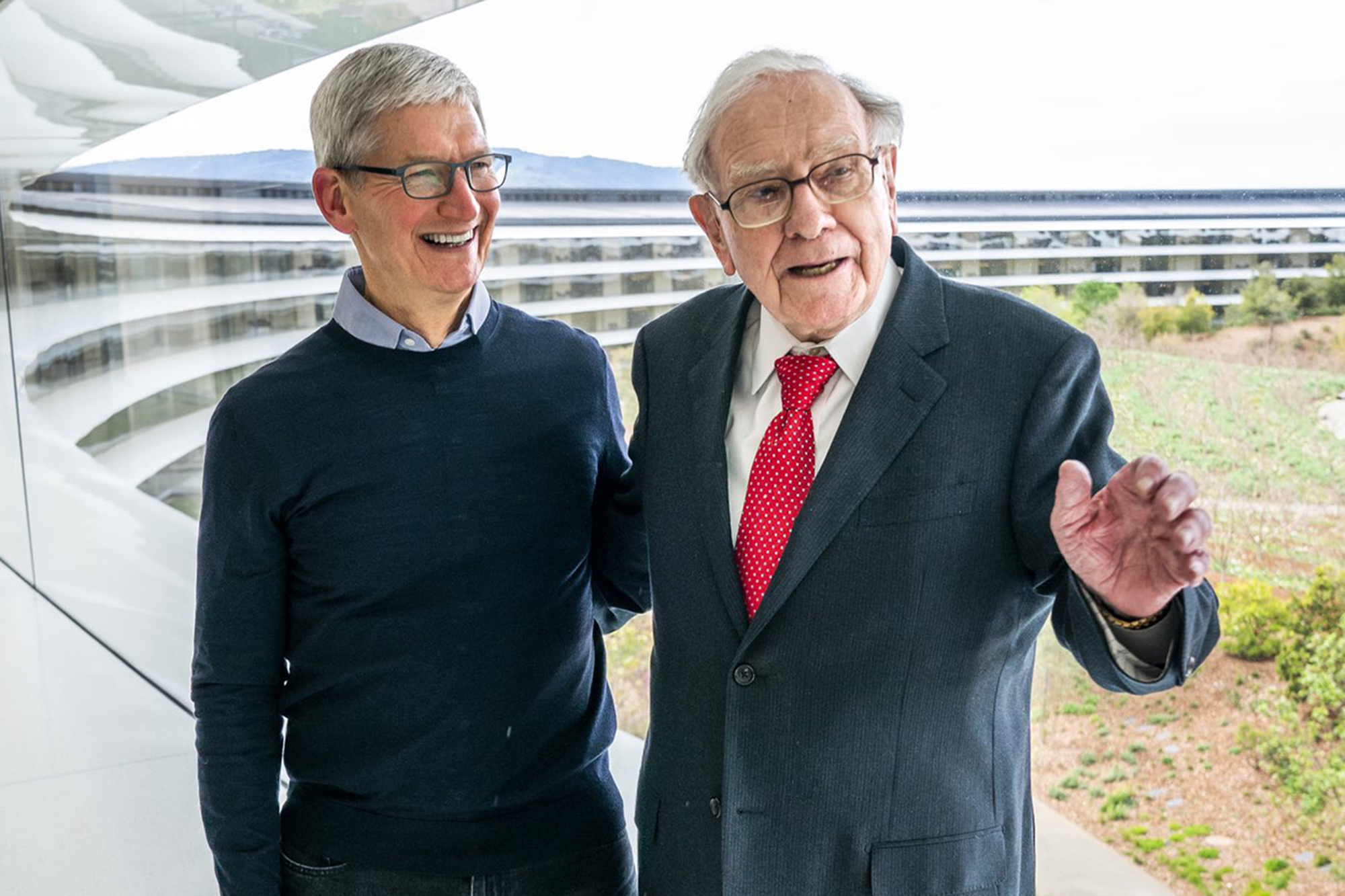

Warren Buffett, the renowned CEO of Berkshire Hathaway, is known for his value investing approach, favoring companies with strong fundamentals and durable competitive advantages. His shift towards a significant technology investment in Apple, however, marked a notable departure from his traditional focus on established businesses. Several factors contributed to this decision. Buffett recognized Apple's unparalleled brand loyalty and customer stickiness. Apple users exhibit remarkable devotion to the ecosystem, repeatedly choosing Apple products and services. This "stickiness" ensures recurring revenue streams, a cornerstone of any successful long-term investment. Apple's robust ecosystem, encompassing hardware, software, and services (like the App Store and iCloud), further solidifies this recurring revenue model.

- Strong brand reputation and consumer trust: Apple enjoys unparalleled brand recognition and customer trust, leading to high customer lifetime value.

- Recurring revenue from services: Apple's services division provides a consistent and growing stream of revenue, reducing reliance on hardware sales alone.

- High profit margins and consistent growth: Apple consistently demonstrates high profit margins and steady revenue growth, making it an attractive investment.

- Loyal customer base ensuring repeat purchases: The high level of customer loyalty ensures repeat purchases and upgrades, contributing to long-term growth.

Financial Performance of the Apple Investment

Berkshire Hathaway's Apple investment has undeniably yielded substantial returns. The growth of Apple's stock price since Berkshire Hathaway's initial investment has been nothing short of spectacular. While precise figures fluctuate daily, the ROI (Return on Investment) has significantly outperformed many other investments in Berkshire's diverse portfolio. Apple's consistent dividend payouts have further enhanced the returns. A comparison of Apple's performance against market benchmarks like the S&P 500 clearly demonstrates its superior growth trajectory.

- Quantitative data on Berkshire Hathaway's ROI from Apple stock: Analyzing historical data reveals substantial profit generation from this investment.

- Graphs showcasing Apple's stock price growth: Visual representations clearly highlight the impressive growth trajectory of Apple's stock.

- Comparison of Apple's performance against market benchmarks: Apple's performance has significantly outpaced many market indices.

- Discussion of dividend payouts from Apple: The consistent dividend payouts from Apple have added another layer of profitability to Berkshire Hathaway's investment.

Potential Risks and Criticisms of the Apple Investment

Despite the undeniable success, the Apple investment isn't without its potential downsides. Concerns remain about Apple's reliance on iPhone sales for a significant portion of its revenue. A decline in iPhone sales could negatively impact overall performance. Furthermore, increasing competition from Android manufacturers and the potential for market saturation pose risks. The tech sector is also susceptible to market corrections, potentially leading to substantial price drops. Questions also arise about Apple's ability to continue innovating and diversify its product offerings to maintain its competitive edge.

- Risk of iPhone sales decline affecting overall performance: A decrease in iPhone sales could significantly impact Apple's financial results.

- Competition from Android and other smartphone manufacturers: The competitive landscape in the smartphone market is highly dynamic and poses a continuous threat.

- Potential for market corrections impacting tech stock prices: The tech sector is known for its volatility, making it susceptible to significant market corrections.

- Concerns about future innovation and product diversification: Maintaining a leading position requires continuous innovation and diversification.

Long-Term Implications and Buffett's Investment Philosophy

Buffett's Apple investment aligns perfectly with his overall investment philosophy. He seeks companies with wide "moats," meaning durable competitive advantages that protect them from competition. Apple's strong brand, loyal customer base, and robust ecosystem represent a significant moat. This investment reflects Buffett's focus on long-term value creation. The potential for Apple to continue growing in various markets, including services and wearables, supports the long-term outlook of this investment and its significant impact on Berkshire Hathaway's overall portfolio diversification.

- Alignment with Buffett's focus on strong brands and durable competitive advantages: The Apple investment epitomizes Buffett's focus on long-term, high-quality businesses.

- Discussion of Apple's "moat" – its strong brand and ecosystem: Apple's strong brand and ecosystem represent a significant barrier to entry for competitors.

- Long-term growth prospects for Apple in various markets: Apple's potential for growth extends beyond its core smartphone business.

- The impact of Apple's investment on Berkshire Hathaway's overall portfolio: The Apple investment has substantially increased the diversification and profitability of Berkshire Hathaway's portfolio.

Conclusion: The Verdict on Buffett's Apple Bet

The arguments for and against Warren Buffett's Apple investment are compelling. However, the overwhelming evidence suggests it was a remarkably successful decision. The financial performance, coupled with Apple's continued strength and alignment with Buffett's investment philosophy, paints a picture of a shrewd and lucrative bet. The significance of this investment extends far beyond Berkshire Hathaway, influencing investment strategies globally. Learn more about Warren Buffett's investment decisions and how to apply similar strategies to your portfolio. Analyze the success of Warren Buffett's Apple investment and understand the factors behind this monumental decision to refine your own investment approach.

Featured Posts

-

Valeur Ajoutee Infotel Pourquoi Les Clients L Apprecient

Apr 23, 2025

Valeur Ajoutee Infotel Pourquoi Les Clients L Apprecient

Apr 23, 2025 -

Attacco A Ristoranti Palestinesi 200 Manifestanti Denunciano Vetrine Spaccate

Apr 23, 2025

Attacco A Ristoranti Palestinesi 200 Manifestanti Denunciano Vetrine Spaccate

Apr 23, 2025 -

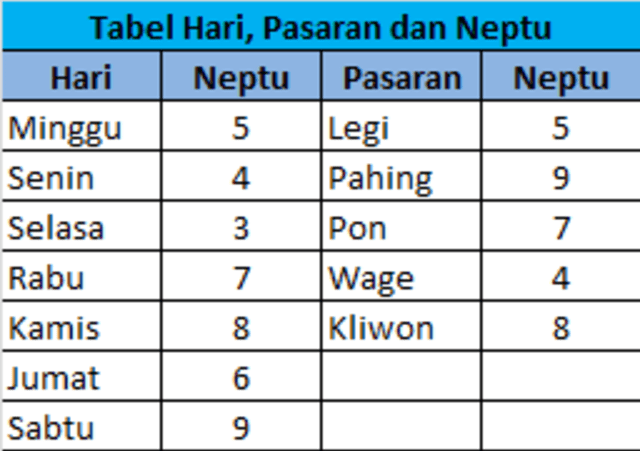

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025 -

Upl Dinamo Obolon Khto Peremig 18 Kvitnya

Apr 23, 2025

Upl Dinamo Obolon Khto Peremig 18 Kvitnya

Apr 23, 2025 -

Supreme Court To Hear Case On Parental Notification For Lgbtq Books In Elementary Schools

Apr 23, 2025

Supreme Court To Hear Case On Parental Notification For Lgbtq Books In Elementary Schools

Apr 23, 2025