Wall Street's New Safe Harbor: Netflix Navigates The Tech Downturn

Table of Contents

Netflix's Diversification Strategy as a Hedge Against Market Volatility

Netflix's remarkable performance isn't just luck; it's a result of a carefully crafted diversification strategy that mitigates risk and enhances market resilience. This strategy extends far beyond its core streaming service.

Expanding Beyond Streaming:

Netflix understands the importance of revenue diversification. Its strategic expansion into new avenues is a crucial factor in its ability to withstand economic headwinds. This diversification includes:

- Successful Game Releases: Netflix has invested significantly in mobile gaming, releasing titles like Stranger Things: 1984 and Oxenfree II: Lost Signals, demonstrating a commitment to broadening its entertainment offerings and attracting a wider user base. This diversification offers a new revenue stream and deepens engagement with existing subscribers.

- Interactive Content: The platform has successfully incorporated interactive specials, allowing viewers to influence the narrative, creating a unique and engaging viewing experience. This innovation keeps users hooked and attracts new audiences interested in personalized entertainment.

- Potential Future Diversification: Future strategies might include further expansions into virtual reality (VR) experiences, live events, or even merchandise, solidifying its position as a comprehensive entertainment company rather than just a streaming service. This broad approach enhances its overall market resilience.

International Growth as a Buffer:

Netflix's global reach is another significant contributor to its stability. Its international growth provides a crucial buffer against potential slowdowns in any single market.

- Strong Growth in Asia-Pacific: Regions like Asia-Pacific are showing substantial growth in Netflix subscribers, demonstrating the platform's ability to adapt to diverse cultural contexts and preferences. This global expansion strategy minimizes dependence on any single market and assures consistent revenue streams.

- Strategic Localization: Netflix understands the importance of localization and adaptation. By offering content in multiple languages and tailoring recommendations to local preferences, it is able to tap into new markets effectively and increase its global subscriber base. This targeted approach boosts market penetration and strengthens its international position.

The Power of Original Content in a Competitive Landscape

In the crowded streaming market, Netflix maintains its competitive edge through its commitment to high-quality original content. This focus on original programming is crucial in retaining subscribers and attracting new ones, even during times of economic uncertainty.

High-Quality Programming Attracts and Retains Subscribers:

Netflix's investment in original series and films is a major driver of its success. The platform's commitment to diverse genres and target audiences ensures a broad appeal.

- Successful Series and Films: Hits such as Squid Game, Stranger Things, and The Crown are prime examples of its success in creating compelling, award-winning content that resonates globally. This high-quality programming fuels subscriber retention and attracts new users.

- Diverse Genres and Audiences: By offering a vast library of content across genres – from documentaries to comedies, dramas to action-adventure – Netflix caters to a broad spectrum of preferences, ensuring a diverse and engaged subscriber base. This content strategy is key to maintaining a competitive edge in the streaming market.

Brand Loyalty and Strong Consumer Base:

Netflix's established brand recognition and dedicated user base are invaluable assets in a volatile market. This strong customer base translates into consistent subscription revenue and provides stability during economic uncertainty.

- Subscription Models and Customer Engagement: Netflix's various subscription tiers offer flexibility, catering to diverse budgets and needs, thereby fostering customer engagement and loyalty.

- Strong Brand Equity: Years of producing quality entertainment and consistently improving its service have solidified Netflix's position as a trusted and reliable brand in the entertainment industry. This positive brand perception fuels subscriber loyalty.

Netflix's Financial Performance and Investor Confidence

Despite the broader tech downturn, Netflix's financial performance continues to impress, bolstering investor confidence.

Strong Financial Results Despite Economic Headwinds:

Recent financial reports demonstrate Netflix's ability to maintain revenue growth and profitability, even in a challenging economic environment.

- Consistent Revenue Growth: Despite market fluctuations, Netflix has consistently reported strong revenue growth, demonstrating its financial stability and resilience.

- Positive Subscriber Numbers: While subscriber growth may fluctuate, Netflix's overall subscriber numbers remain substantial, showcasing its ability to retain users and attract new ones. This ongoing subscriber growth speaks volumes about the service's inherent value proposition.

Analyst Ratings and Investor Sentiment:

Despite market volatility, analyst ratings and investor sentiment for Netflix remain largely positive compared to many other tech companies.

- Positive Analyst Forecasts: Many financial institutions maintain positive ratings for Netflix, highlighting the platform's long-term growth potential and its resilience in the face of economic headwinds.

- Strong Market Capitalization: Netflix's robust market capitalization indicates strong investor confidence in its long-term prospects and ability to navigate the evolving entertainment landscape.

Conclusion

Netflix's ability to navigate the tech downturn is a testament to its strategic diversification, commitment to high-quality original content, and strong financial performance. Its global reach, diverse revenue streams, and loyal subscriber base position it as a potential safe harbor for investors seeking stability in an uncertain market. The company's consistent adaptation and innovation make it a compelling investment opportunity in the streaming entertainment sector. Learn how Netflix is navigating the tech downturn and why it's becoming a Wall Street safe harbor. Invest in the future of entertainment—explore Netflix's strategy for success.

Featured Posts

-

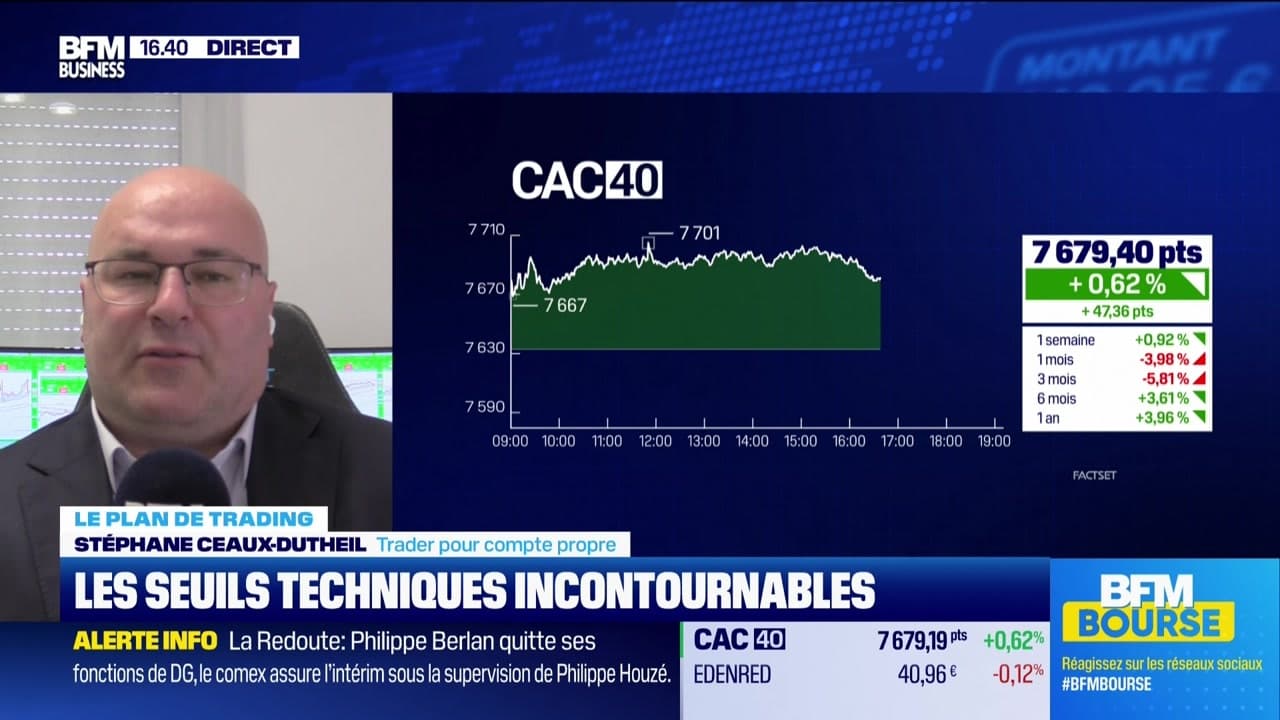

Les Meilleurs Seuils Techniques Pour Une Alerte Trader Efficace

Apr 23, 2025

Les Meilleurs Seuils Techniques Pour Une Alerte Trader Efficace

Apr 23, 2025 -

Activision Blizzard Acquisition Ftcs Appeal And The Road Ahead

Apr 23, 2025

Activision Blizzard Acquisition Ftcs Appeal And The Road Ahead

Apr 23, 2025 -

Aaron Judges Triple Home Run Power Yankees Record Breaking 9 Homer Game

Apr 23, 2025

Aaron Judges Triple Home Run Power Yankees Record Breaking 9 Homer Game

Apr 23, 2025 -

Ramalan Jodoh Weton Jumat Wage And Senin Legi Cocok Atau Tidak

Apr 23, 2025

Ramalan Jodoh Weton Jumat Wage And Senin Legi Cocok Atau Tidak

Apr 23, 2025 -

Reds On Three Game Skid After Another 1 0 Loss

Apr 23, 2025

Reds On Three Game Skid After Another 1 0 Loss

Apr 23, 2025