US Stock Market Attracts Record Canadian Investment

Table of Contents

Why are Canadian Investors flocking to the US Stock Market?

Canadian investors are increasingly looking beyond their domestic market for investment opportunities, and the US offers compelling reasons for this shift.

Diversification and Risk Management

Diversification is a cornerstone of sound investment strategy, and the US market provides Canadian investors with a powerful tool for mitigating risk. By spreading their investments across a broader range of companies and sectors, Canadian investors reduce their dependence on the performance of the Canadian economy.

- Reduced dependence on the Canadian economy: Diversifying into the US market hedges against potential economic downturns or sector-specific challenges within Canada.

- Access to larger companies: The US boasts many multinational corporations and industry leaders not found, or less prevalent, in the Canadian market.

- Hedging against Canadian market volatility: The US market, while not immune to volatility, can offer a degree of insulation against fluctuations specific to the Canadian market.

Higher Potential Returns

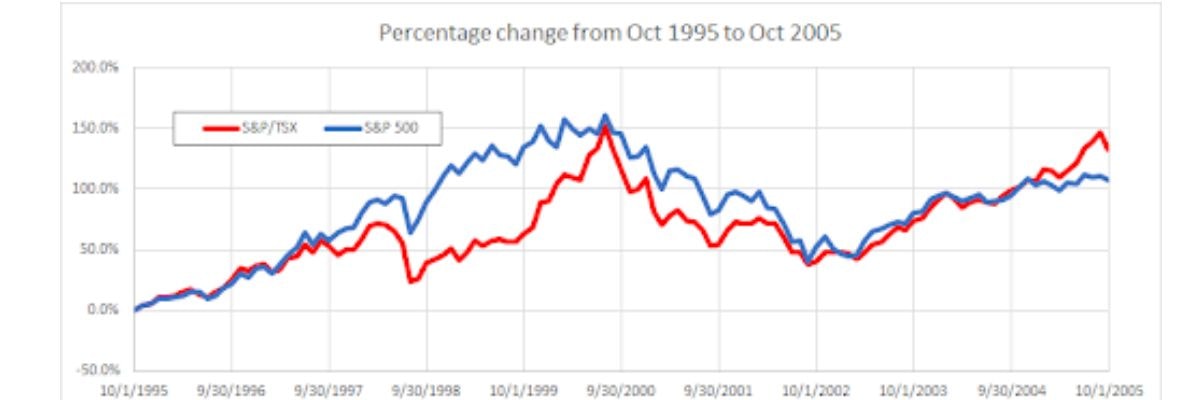

Historically, the US stock market has demonstrated higher potential returns compared to its Canadian counterpart, although this comes with increased risk. The sheer size and diversity of the US market, coupled with its innovation-driven economy, contribute to this potential for growth.

- Growth potential in specific sectors: Access to high-growth sectors like technology, biotechnology, and renewable energy, often more mature and developed in the US, provides exciting opportunities for Canadian investors.

- Potential for capital appreciation: Exposure to larger, more established US companies can lead to significant capital appreciation over the long term.

- Higher dividend yields in certain US stocks: Certain US companies offer attractive dividend yields, providing a steady stream of income for investors.

Favorable Exchange Rates (Past and Present)

Fluctuations in the Canadian dollar (CAD) against the US dollar (USD) significantly impact investment returns. Historically, periods of a weaker CAD have boosted returns for Canadian investors in US equities when converting USD back to CAD. The current exchange rate and its predicted trajectory remain a crucial factor in investment decisions.

- Impact of currency fluctuations on investment gains: A weaker CAD against the USD enhances the value of USD-denominated assets upon conversion back to CAD.

- Strategies for managing exchange rate risk: Investors can employ hedging strategies to mitigate potential losses from adverse currency fluctuations. These strategies involve purchasing currency forwards or options contracts to lock in a specific exchange rate.

Popular US Investment Vehicles for Canadians

Canadian investors have several avenues for accessing the US stock market, each with its own set of advantages and disadvantages.

Direct Stock Purchases

Buying individual US stocks directly offers maximum control and potential for high returns, but requires considerable research and understanding of the market. Canadian brokerage accounts typically facilitate these transactions.

- Benefits and drawbacks of direct stock investing: High potential returns, but requires in-depth market knowledge and higher risk.

- Suitable for investors with experience and time: Direct investing is best suited for experienced investors with time to research and manage their portfolios actively.

- Costs and considerations: Factors such as currency conversion fees and US withholding taxes must be factored into the investment strategy.

Exchange-Traded Funds (ETFs)

ETFs provide a diversified and cost-effective way to gain exposure to the US market. They track specific indices or sectors, offering a convenient and simple investment approach.

- Low cost: ETFs typically have lower expense ratios compared to actively managed mutual funds.

- Diversification across sectors: ETFs offer broad diversification, reducing the risk associated with investing in individual stocks.

- Ease of access: ETFs trade like individual stocks on major exchanges, making them easily accessible to investors.

Mutual Funds

Mutual funds offer professionally managed diversification across a range of US companies. They provide a hands-off approach for investors seeking professional expertise.

- Professional management: Mutual funds are managed by experienced investment professionals who make investment decisions on behalf of investors.

- Diversification benefits: Similar to ETFs, mutual funds offer diversification across various sectors and companies.

- Suitability for various risk tolerances: Mutual funds cater to diverse risk tolerances, offering options from conservative to aggressive investment strategies.

Challenges and Considerations for Canadian Investors

While investing in the US market presents significant opportunities, Canadian investors must be mindful of several challenges and considerations.

Currency Risk

Fluctuations in the CAD/USD exchange rate are a significant factor impacting returns. A weakening CAD reduces the value of USD-denominated gains when converted back to Canadian currency.

- Hedging strategies: Employing hedging strategies can help mitigate currency risk.

- Currency conversion fees: These fees can eat into investment gains; choosing brokers with competitive rates is crucial.

- Timing of investments: Careful consideration of exchange rate movements can influence the timing of investments.

Tax Implications

Investing in the US market involves US withholding taxes and reporting requirements. Navigating these tax complexities is crucial for maximizing after-tax returns.

- Tax treaties: Understanding the provisions of the Canada-US tax treaty is essential for optimizing tax efficiency.

- Reporting requirements: Accurate reporting of US investment income on Canadian tax returns is mandatory.

- Optimizing tax efficiency: Seeking advice from a qualified tax professional is recommended to ensure compliance and minimize tax liabilities.

Regulatory Differences

Differences in regulatory environments between Canada and the US require careful consideration. Understanding these differences ensures compliance and investor protection.

- Investment protection: Familiarizing oneself with investor protection mechanisms in both countries is crucial.

- Investor rights: Understanding investor rights and recourse options in both jurisdictions is essential.

- Understanding disclosure requirements: Canadian investors must be aware of US disclosure requirements for investments.

Conclusion

The record-breaking Canadian investment in the US stock market demonstrates a strategic move toward diversification and potentially higher returns. While the potential benefits are significant, a thorough understanding of currency risk, tax implications, and regulatory differences is paramount. By carefully considering these factors and leveraging appropriate investment vehicles like ETFs and mutual funds, Canadian investors can effectively participate in the growth of the US market. To learn more about maximizing your returns through strategic US Stock Market investments, consult a financial advisor today. Start exploring the opportunities presented by the booming US Stock Market for Canadian investors.

Featured Posts

-

Caat Pension Plan Expands Canadian Private Investment Portfolio

Apr 23, 2025

Caat Pension Plan Expands Canadian Private Investment Portfolio

Apr 23, 2025 -

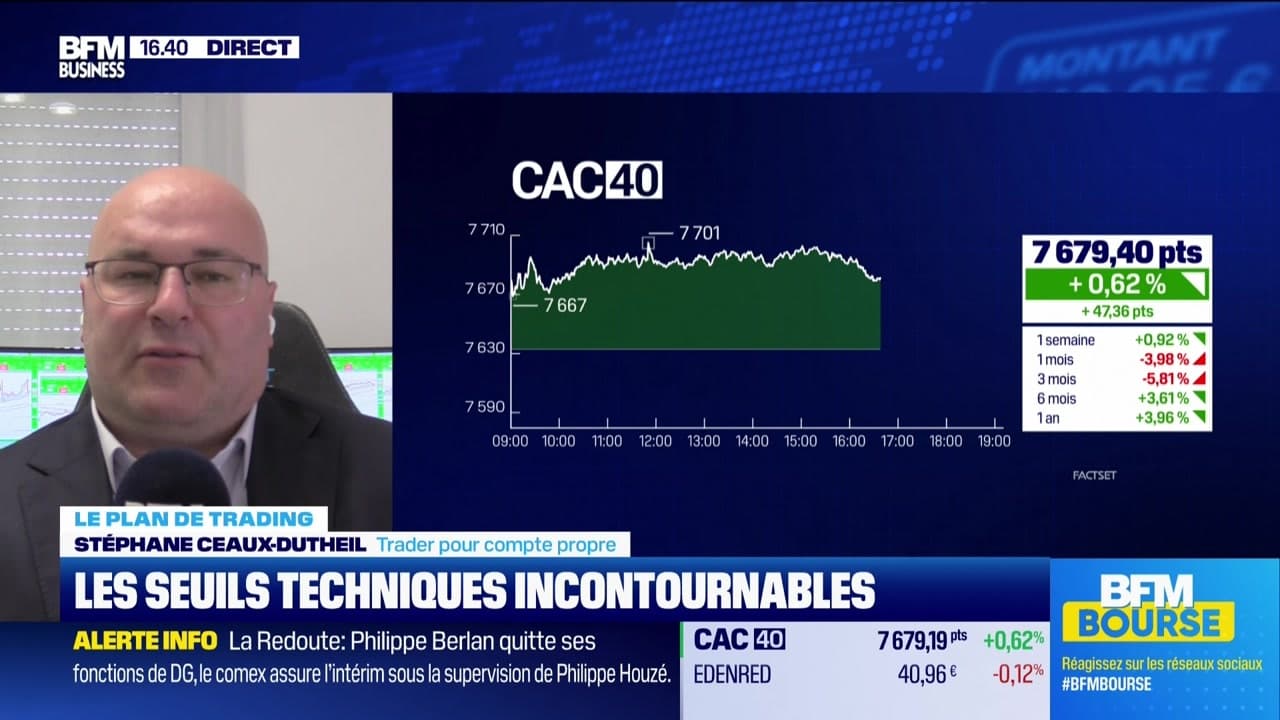

Les Meilleurs Seuils Techniques Pour Une Alerte Trader Efficace

Apr 23, 2025

Les Meilleurs Seuils Techniques Pour Une Alerte Trader Efficace

Apr 23, 2025 -

Trumps Fda And The Biotech Boom A Bullish Signal Analyzed

Apr 23, 2025

Trumps Fda And The Biotech Boom A Bullish Signal Analyzed

Apr 23, 2025 -

Christian Yelichs First Homer Since Back Surgery A Milestone Achieved

Apr 23, 2025

Christian Yelichs First Homer Since Back Surgery A Milestone Achieved

Apr 23, 2025 -

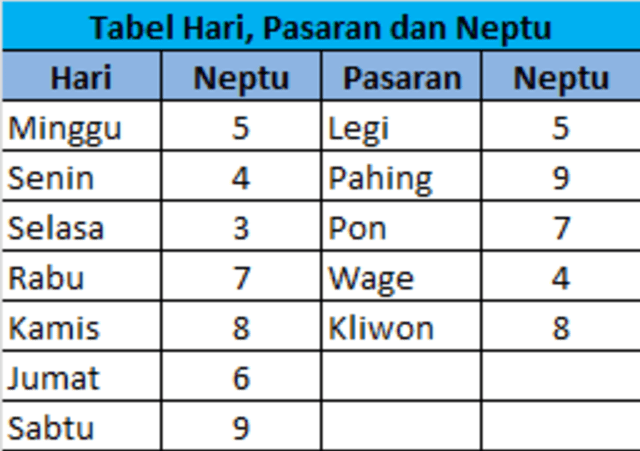

Jumat Wage And Senin Legi Apakah Weton Ini Cocok Berdasarkan Primbon Jawa

Apr 23, 2025

Jumat Wage And Senin Legi Apakah Weton Ini Cocok Berdasarkan Primbon Jawa

Apr 23, 2025