Understanding Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Key Valuation Arguments

BofA's message to investors centers around a long-term outlook and a rigorous analysis of various factors influencing stock market valuations. Their approach isn't about ignoring the current volatility, but rather about placing it within a broader context of economic and market trends.

Focus on Long-Term Growth

BofA emphasizes the importance of considering long-term growth prospects over short-term market noise. Their analysis likely emphasizes the resilience of the underlying economy and the potential for sustained earnings growth in various sectors.

- They highlight the potential for sustained earnings growth in specific sectors. Certain sectors, like technology and healthcare, are often seen as having strong long-term growth potential, even amidst short-term economic challenges. BofA’s analysis likely identifies these sectors and supports their assessment with robust data.

- Their analysis emphasizes the resilience of the overall economy despite current challenges. While acknowledging current headwinds, BofA’s assessment likely points to underlying economic strengths that support continued growth. This could include factors like strong consumer spending or innovation driving productivity gains.

- They suggest focusing on companies with strong fundamentals and a proven track record. BofA likely encourages investors to focus on companies with consistent earnings growth, healthy balance sheets, and a history of navigating economic downturns. This fundamental analysis forms a crucial component of their valuation strategy.

Analyzing Valuation Metrics

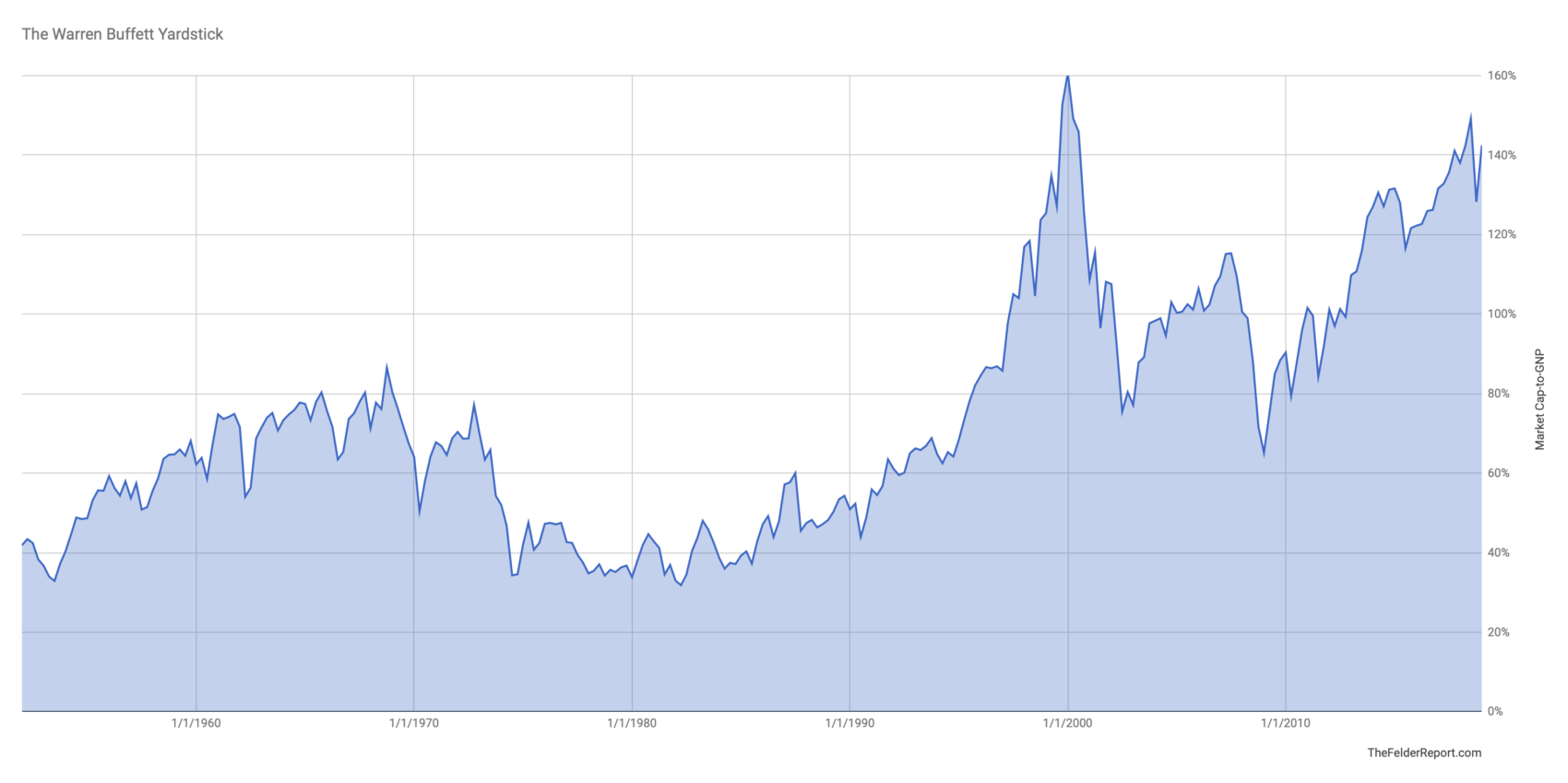

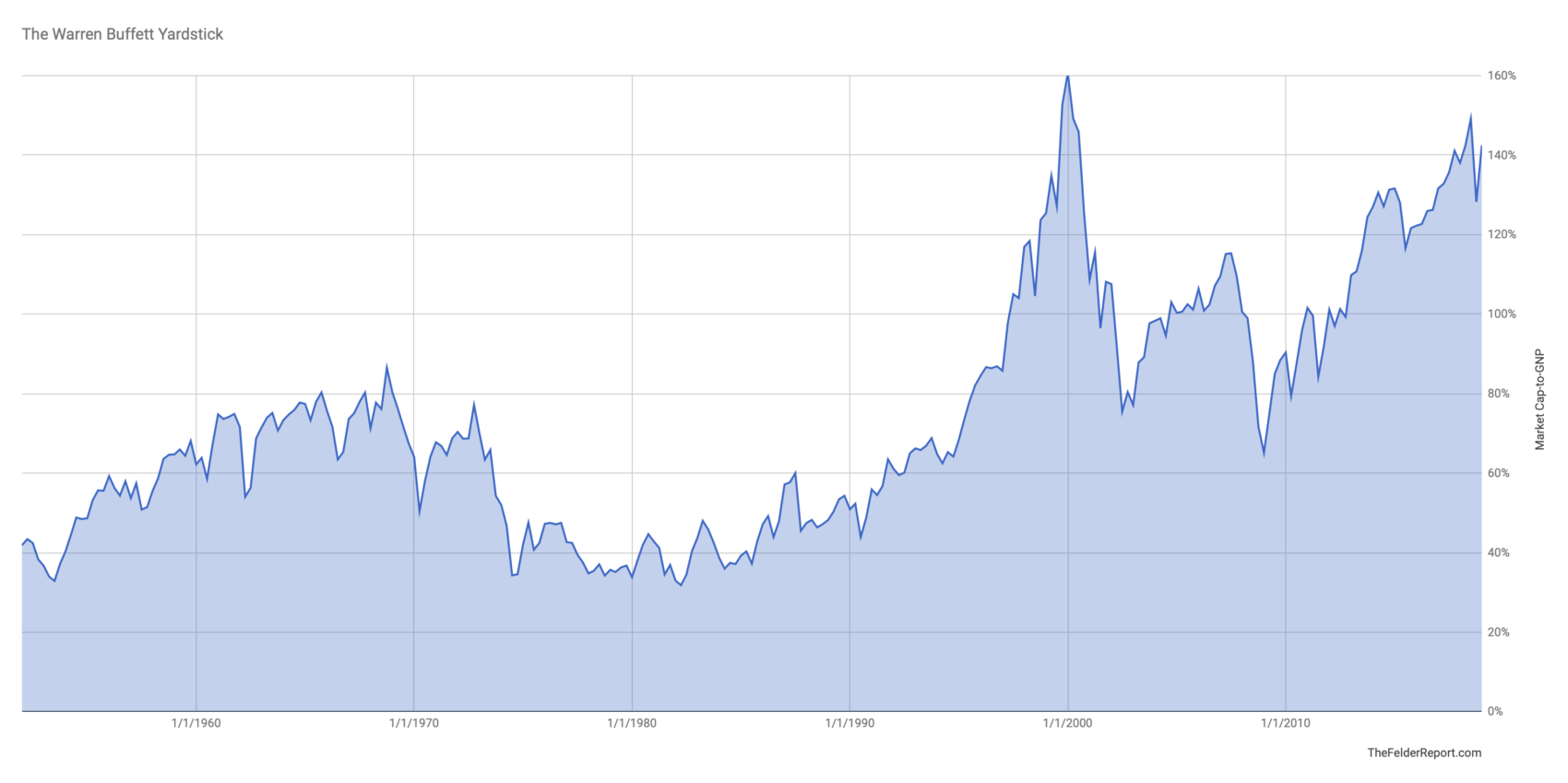

BofA likely employs a range of valuation metrics to assess the market's overall health and individual stock valuations. These metrics provide a quantitative framework for understanding whether the market is fairly valued, undervalued, or overvalued.

- Discussion of Price-to-Earnings (P/E) ratios and their interpretation within the current context. P/E ratios are a widely used metric comparing a company's stock price to its earnings per share. BofA likely analyzes these ratios across different sectors and compares them to historical averages to gauge potential overvaluation or undervaluation.

- Mention of other relevant metrics like Price-to-Sales (P/S) or Price-to-Book (P/B) ratios. These alternative metrics provide further insights, especially for companies with negative earnings or those in rapidly growing sectors where P/E ratios may be less informative.

- Explanation of how these metrics help determine whether the market is overvalued or undervalued. By comparing current valuation metrics to historical data and industry averages, BofA likely aims to provide a balanced view, differentiating between short-term fluctuations and underlying valuation trends.

Considering Macroeconomic Factors

BofA's perspective incorporates a wide array of macroeconomic factors influencing valuations. Understanding these factors is crucial for a comprehensive stock market analysis.

- Analysis of interest rate hikes and their impact on stock prices. Interest rate increases generally impact stock valuations by increasing borrowing costs for companies and potentially reducing future earnings. BofA's analysis would likely assess the extent of this impact and its variation across different sectors.

- Assessment of inflation's role in shaping investor expectations. Inflation erodes purchasing power and can influence investor sentiment, potentially impacting future earnings forecasts. BofA's analysis would assess the impact of inflation on company profitability and consumer spending.

- Examination of geopolitical risks and their potential effects on equity markets. Geopolitical events, such as wars or trade disputes, can significantly influence market sentiment and stock prices. BofA’s analysis would account for the potential impact of these risks on various sectors and the overall market.

Addressing Investor Concerns

BofA likely addresses common investor anxieties stemming from current market conditions and macroeconomic uncertainties. Understanding and addressing these concerns is essential for maintaining investor confidence.

Concerns about High Inflation

High inflation is a significant concern for investors, as it erodes purchasing power and can affect company profitability.

- Discussion of inflation hedging strategies. BofA likely suggests strategies to mitigate the impact of inflation, such as investing in inflation-protected securities or companies with pricing power.

- Analysis of companies' ability to pass on increased costs to consumers. Some companies can pass increased costs onto consumers, while others cannot. BofA's analysis would likely identify companies better positioned to manage inflationary pressures.

Fear of a Recession

Recessionary fears are frequently a significant driver of market volatility.

- BofA's assessment of recession probabilities and their impact on specific sectors. BofA likely provides a probabilistic assessment of a recession and its potential severity, along with sector-specific analyses of its impact.

- Discussion of defensive investment strategies during potential economic downturns. Defensive investment strategies, such as investing in less cyclical sectors, can help mitigate risk during an economic downturn. BofA likely recommends these strategies as a part of a diversified portfolio.

Geopolitical Instability

Geopolitical instability creates uncertainty and can significantly affect market sentiment.

- Analysis of the impact of specific geopolitical events on market sentiment. BofA's analysis would likely include specific geopolitical events and their potential impact on various market segments.

- Strategies for mitigating geopolitical risk in an investment portfolio. Diversification and hedging strategies can help reduce the portfolio's exposure to specific geopolitical risks.

Conclusion

Understanding stock market valuations is key to making informed investment decisions. BofA's rationale for investor calm rests on a long-term perspective, a meticulous analysis of valuation metrics, and a comprehensive assessment of macroeconomic factors. While acknowledging inherent risks like inflation, recessionary fears, and geopolitical instability, BofA likely suggests a balanced approach emphasizing strong fundamentals and long-term growth potential. Don't let market volatility dictate your investment strategy. Learn more about effective stock market valuation techniques and develop a robust investment plan by researching further into BofA's analysis and other expert opinions on stock market valuations.

Featured Posts

-

The Tik Tok Effect Strategies To Bypass Trump Tariffs

Apr 22, 2025

The Tik Tok Effect Strategies To Bypass Trump Tariffs

Apr 22, 2025 -

Chronology Of Karen Reads Court Proceedings

Apr 22, 2025

Chronology Of Karen Reads Court Proceedings

Apr 22, 2025 -

Returning To Classes At Fsu The Aftermath Of The Deadly Campus Shooting

Apr 22, 2025

Returning To Classes At Fsu The Aftermath Of The Deadly Campus Shooting

Apr 22, 2025 -

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 22, 2025

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 22, 2025 -

National Protests Against Trump A Cnn Politics Report

Apr 22, 2025

National Protests Against Trump A Cnn Politics Report

Apr 22, 2025