Trump's Trade War: IMF Warns Of Systemic Financial Risk

Table of Contents

The IMF's Assessment of the Trade War's Impact

The IMF has consistently issued reports and statements highlighting the negative consequences of the Trump-era trade war. These warnings emphasize the significant threat to global economic stability and the potential for a deeper, more widespread crisis. The organization's analysis reveals a concerning trend of decreased global growth and increased uncertainty, impacting businesses and consumers worldwide.

-

Decreased global trade growth projections due to tariffs: The IMF has repeatedly lowered its global growth forecasts, directly attributing the slowdown to the imposition of tariffs and retaliatory measures. These tariffs increase the cost of goods, impacting both consumers and businesses.

-

Increased uncertainty impacting investment decisions: The unpredictable nature of the trade war has created significant uncertainty, causing businesses to delay or cancel investment plans. This hesitancy stifles economic growth and job creation.

-

Negative effects on supply chains and global value chains: The disruption of established supply chains due to tariffs and trade restrictions has led to increased costs and delays, affecting various industries. This disruption highlights the interconnectedness of the global economy.

-

Potential for escalation and further economic damage: The IMF has repeatedly warned of the potential for further escalation, with retaliatory measures leading to a self-perpetuating cycle of economic damage.

-

Specific IMF reports and publications: The IMF's World Economic Outlook reports and various staff papers provide detailed analyses of the trade war's impact. Referencing these publications offers deeper insights into the IMF's concerns.

Specific Sectors Hardest Hit by the Trade War

Several key sectors have been disproportionately impacted by the tariffs and trade restrictions imposed during the trade war. The effects are far-reaching and have ripple effects across the global economy.

-

Agriculture (soybeans, etc.) and its impact on farmers and rural economies: American farmers, particularly soybean producers, faced significant losses due to retaliatory tariffs imposed by China. This had a devastating effect on rural economies reliant on agricultural exports.

-

Manufacturing (steel, aluminum, etc.) and job losses/shifts: Tariffs on steel and aluminum, while intended to protect domestic industries, led to increased costs for manufacturers reliant on these materials, impacting competitiveness and potentially leading to job losses or shifts in production.

-

Technology sector and the implications for innovation and global competition: The trade war exacerbated tensions between the US and China, significantly impacting the technology sector. Restrictions on technology transfer and investment hampered innovation and global competition.

-

Consumer goods and the impact on prices and consumer spending: Consumers faced higher prices for various imported goods due to tariffs, impacting consumer spending and potentially slowing economic growth.

The Ripple Effect: Global Economic Contagion

The consequences of the trade war extended far beyond the directly targeted industries and countries. The ripple effect created significant global economic instability.

-

Increased inflation in importing countries: Tariffs increased the cost of imported goods, contributing to inflation in importing countries, eroding purchasing power.

-

Reduced consumer confidence and spending: Uncertainty surrounding the trade war negatively impacted consumer confidence, leading to reduced spending and slowing economic growth.

-

Currency fluctuations and exchange rate volatility: The trade war contributed to significant currency fluctuations and exchange rate volatility, creating further uncertainty in global markets.

-

Potential for trade wars to escalate into broader geopolitical conflicts: The trade war heightened geopolitical tensions, raising concerns about the potential for the conflict to escalate into broader conflicts.

Systemic Financial Risks Identified by the IMF

The IMF identified several systemic financial risks associated with the trade war, emphasizing the potential for instability in global financial markets.

-

Increased corporate debt and vulnerabilities: Businesses faced increased debt burdens due to higher input costs and reduced revenues, increasing their vulnerability to economic shocks.

-

Potential for banking sector stress due to loan defaults: The increased corporate debt levels raised concerns about potential loan defaults, leading to stress within the banking sector.

-

Market volatility and potential for financial crises: The uncertainty surrounding the trade war created significant market volatility, increasing the risk of financial crises.

-

Impact on emerging markets and developing economies: Emerging markets and developing economies were particularly vulnerable to the negative consequences of the trade war, facing reduced export demand and capital outflows.

-

Discussion of the interconnectedness of global financial markets: The interconnectedness of global financial markets amplified the impact of the trade war, with negative effects quickly spreading across borders.

Potential Mitigation Strategies and Policy Responses

Addressing the negative consequences of the trade war requires a multifaceted approach involving international cooperation and responsible policy adjustments.

-

International cooperation and diplomatic solutions: Negotiated settlements and de-escalation of trade tensions through diplomacy are crucial for mitigating the negative impacts of the trade war.

-

Reforms to global trade governance and institutions (WTO): Strengthening the World Trade Organization (WTO) and reforming its dispute settlement mechanism are important steps in promoting fairer and more predictable global trade.

-

Domestic policy adjustments to cushion the blow on affected sectors: Governments need to implement policies to support affected industries and workers, providing assistance to those facing job losses or economic hardship.

-

Focus on diversification of supply chains: Businesses should focus on diversifying their supply chains to reduce their dependence on single sources and mitigate the risk of disruptions.

Conclusion

The IMF's warnings regarding the systemic financial risk posed by Trump's trade war are a serious call to action. The escalating trade conflict has already had demonstrable negative impacts on global trade, economic growth, and financial stability. The potential for further escalation and the interconnected nature of global markets demand immediate attention and concerted efforts to mitigate these risks. Understanding the consequences of this trade war is crucial for policymakers, businesses, and individuals alike. We must actively advocate for diplomatic solutions and responsible trade policies to prevent a deeper economic crisis. Let's work together to overcome the challenges posed by the Trump-era trade war and build a more stable and prosperous global economy.

Featured Posts

-

Broadcoms V Mware Deal At And T Highlights Extreme 1 050 Cost Increase

Apr 23, 2025

Broadcoms V Mware Deal At And T Highlights Extreme 1 050 Cost Increase

Apr 23, 2025 -

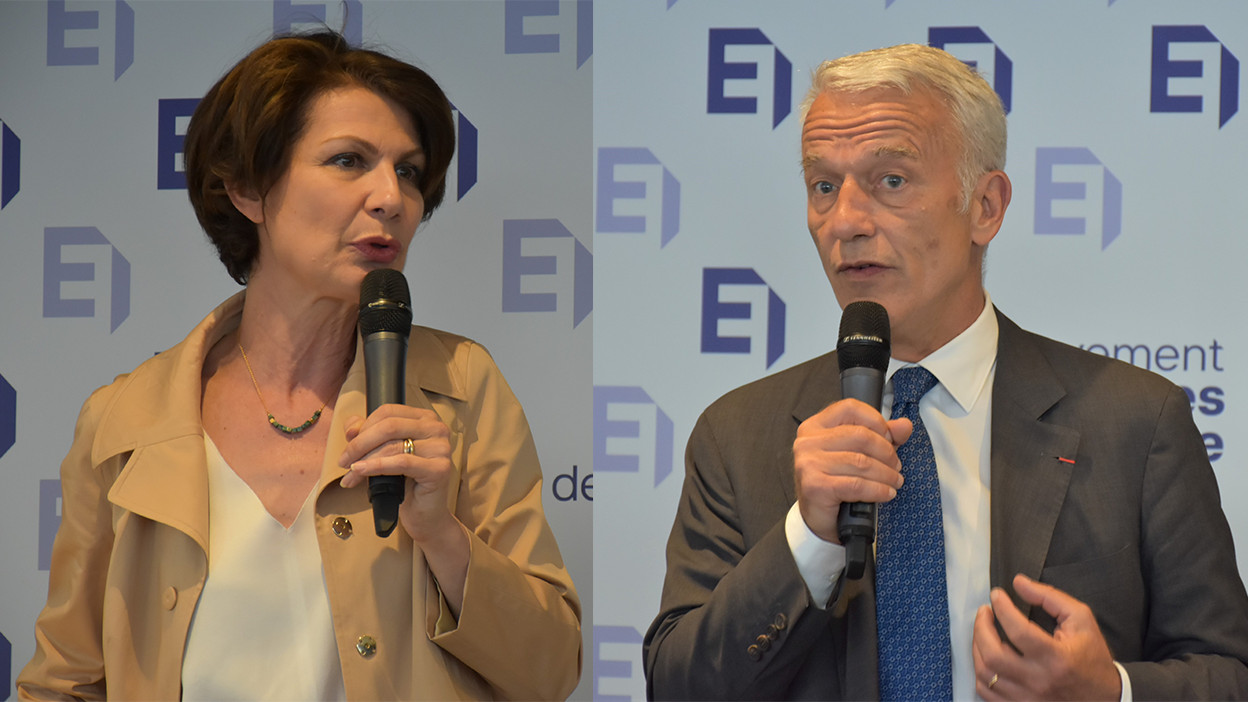

Dominique Carlach Et Sa Carte Blanche Parcours Et Influences

Apr 23, 2025

Dominique Carlach Et Sa Carte Blanche Parcours Et Influences

Apr 23, 2025 -

Analisis Jodoh Weton Jumat Wage Dan Senin Legi Perhitungan Dan Interpretasi

Apr 23, 2025

Analisis Jodoh Weton Jumat Wage Dan Senin Legi Perhitungan Dan Interpretasi

Apr 23, 2025 -

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025 -

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Plein Essor

Apr 23, 2025

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Plein Essor

Apr 23, 2025