Trump's Economic Policies: Impact And Evidence

Table of Contents

Keywords: Trump's economic policies, economic impact, Trump administration, tax cuts, deregulation, trade wars, GDP growth, job creation, national debt, economic evidence.

Donald Trump's presidency (2017-2021) was marked by significant shifts in US economic policy. This article examines the key components of these policies, their stated goals, and the available evidence regarding their actual impact on the US economy. We will analyze the effects on key indicators like GDP growth, job creation, income inequality, and the national debt, offering a balanced perspective on the legacy of Trump's economic approach. Understanding the effects of Trump's economic policies is crucial for informed discussions about future economic strategies.

Tax Cuts and Jobs Act of 2017

Key Features: Significant Corporate and Individual Income Tax Reductions

The Tax Cuts and Jobs Act of 2017 (TCJA) was a cornerstone of Trump's economic agenda. Its key features included:

- Reduction of the corporate tax rate: from 35% to 21%, a significant decrease intended to boost corporate investment and competitiveness.

- Changes to individual tax brackets and deductions: These changes varied widely, with some individuals experiencing tax cuts while others saw their taxes increase.

- Intended to stimulate economic growth: Proponents argued the TCJA would stimulate economic growth through increased investment and job creation, leading to higher wages and improved living standards.

The arguments surrounding the TCJA are complex. Supporters pointed to increased corporate investment and a rise in GDP growth in the years following its implementation as evidence of its success. However, critics highlighted the substantial increase in the national debt as a major drawback. The impact on wage growth remains a subject of debate, with some studies showing modest increases while others found no significant effect. Furthermore, the distribution of the tax cuts' benefits was uneven, favoring corporations and high-income earners, potentially exacerbating income inequality. Analyzing data on corporate investment and job creation after the tax cuts requires careful consideration of other economic factors to isolate the TCJA's specific effect. Keywords like "corporate tax rate," "individual income tax," "fiscal stimulus," and "economic growth" are crucial for understanding this complex issue.

Deregulation Efforts

Target Sectors: Financial Services, Environmental Regulations, Healthcare

Trump's administration pursued significant deregulation across various sectors:

- Rollback of Dodd-Frank regulations: Aimed at reducing the regulatory burden on the financial services industry, critics argued this increased systemic risk.

- Relaxation of environmental protection standards: This led to concerns about environmental damage and a rollback of climate change mitigation efforts.

- Changes to the Affordable Care Act (ACA): These changes impacted healthcare access and affordability for millions of Americans.

The impact of deregulation varied significantly across sectors. In financial services, the rollback of Dodd-Frank led to increased lending and business activity for some, but also raised concerns about potential financial instability. Similarly, relaxed environmental regulations resulted in increased industrial activity in some sectors but came at the cost of potential environmental damage and increased pollution. The changes to the ACA had a complex and debated impact, affecting healthcare costs and access differently based on individual circumstances. The keyword phrases "regulatory burden," "deregulation impact," "environmental regulations," "financial deregulation," and "healthcare reform" are fundamental for researching the effects of these policy changes.

Trade Wars and Protectionism

Key Initiatives: Imposition of Tariffs on Imported Goods, Trade Disputes with China and Other Countries

Trump's administration initiated a series of trade wars, primarily with China:

- Tariffs on steel and aluminum: These tariffs aimed to protect domestic industries but also led to retaliatory tariffs from other countries.

- Trade disputes with China: These resulted in escalating tariffs on a wide range of goods, impacting both US businesses and consumers.

- Impact on US businesses and consumers: The trade wars disrupted global supply chains, increased prices for some goods, and hurt specific industries reliant on international trade.

The economic effects of the trade wars were multifaceted and debated. While some sectors benefited from increased domestic production due to protectionist measures, many others suffered from increased costs and reduced competitiveness. The trade wars contributed to inflation and uncertainty in global markets, disrupting supply chains and impacting businesses reliant on international trade. The keywords "trade tariffs," "trade war impact," "protectionism," "global trade," and "bilateral trade agreements" are essential in understanding these complex economic ramifications.

Overall Economic Performance under Trump

Key Indicators: GDP Growth, Job Creation, Inflation, National Debt

Assessing the overall economic performance under Trump requires considering several key indicators:

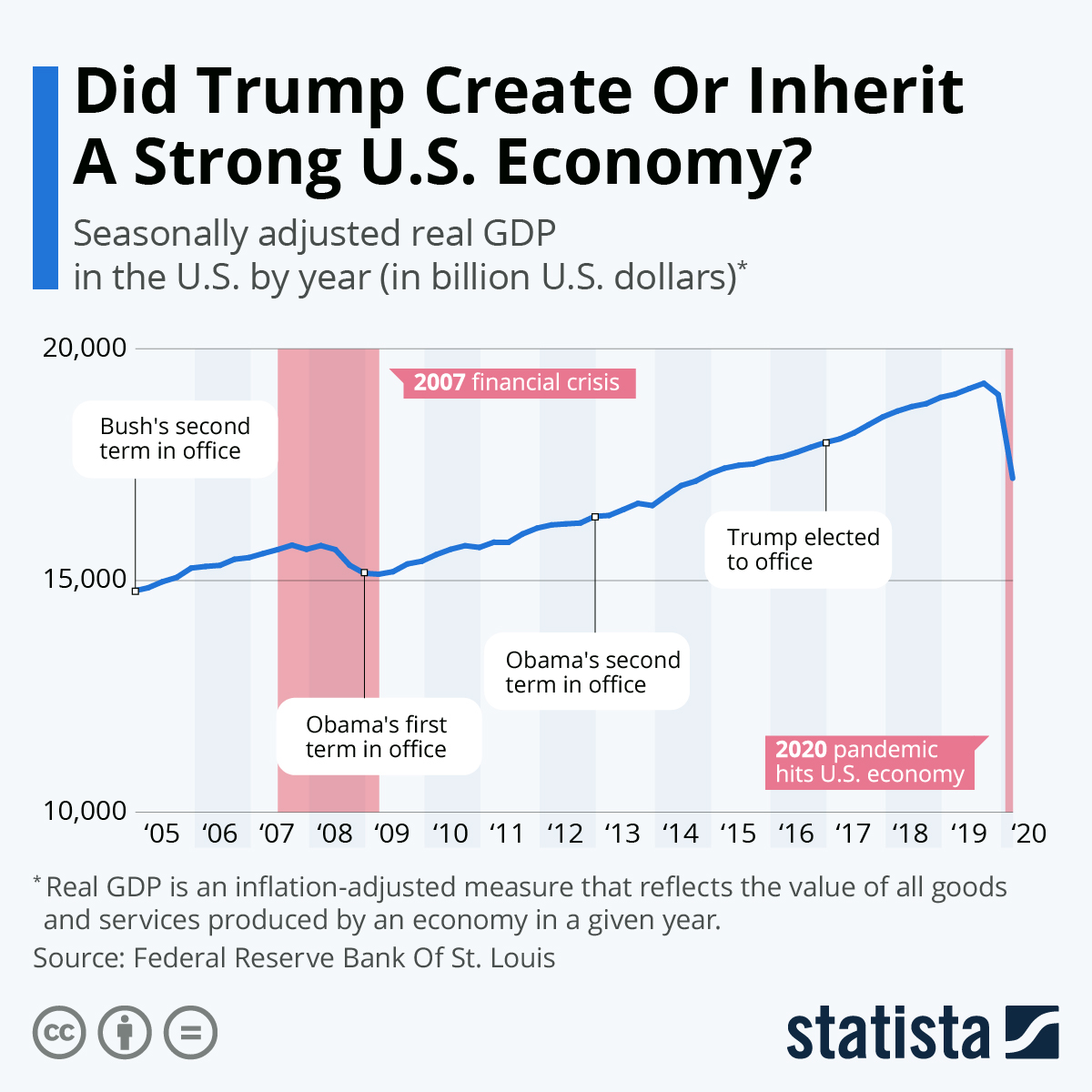

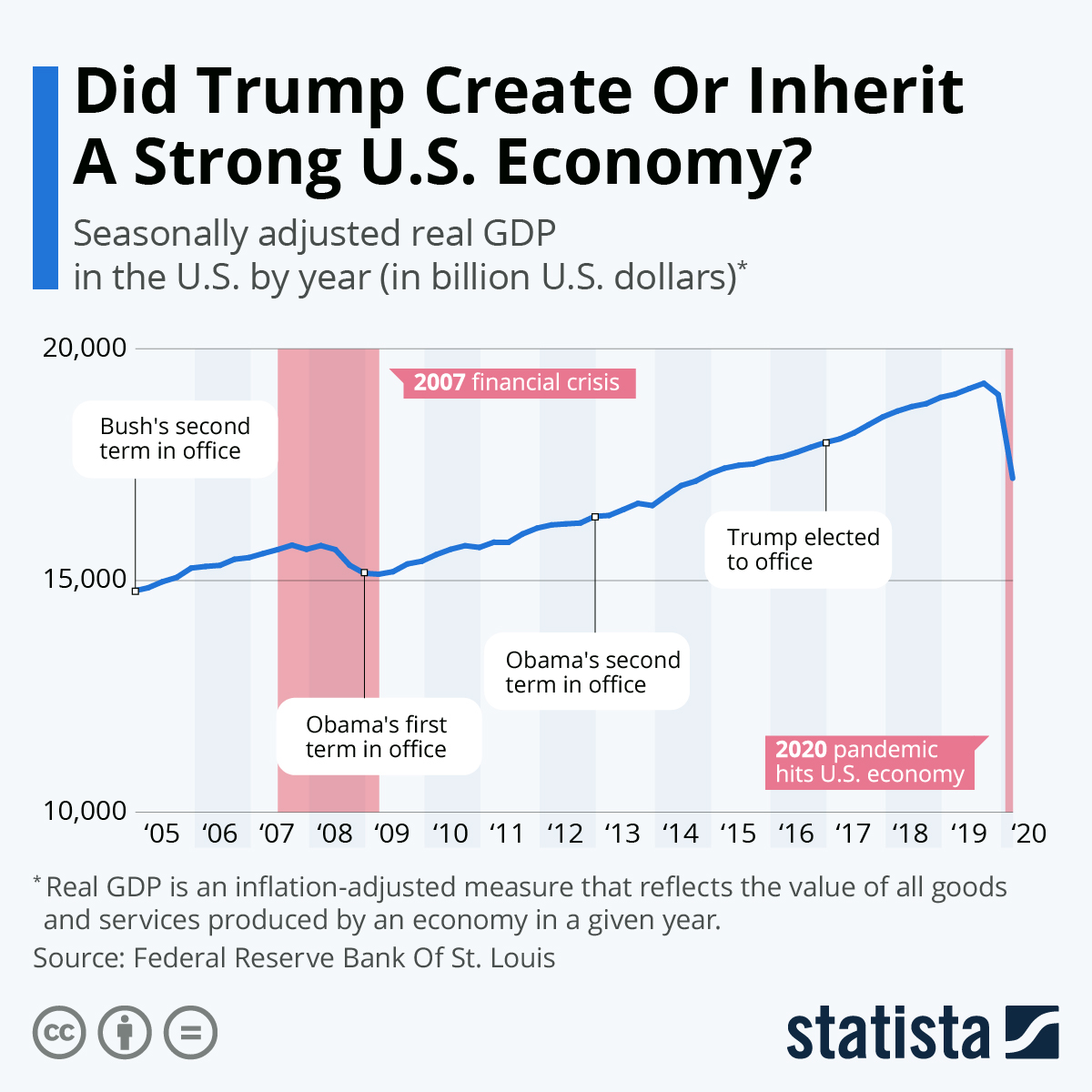

- GDP growth: GDP growth rates fluctuated during Trump's presidency, experiencing periods of both strong and moderate growth. Comparisons with previous administrations require careful consideration of external factors.

- Job creation: Job creation was generally positive during Trump's term, though it's crucial to consider whether this was a continuation of pre-existing trends or a direct result of his policies.

- Inflation: Inflation remained relatively low throughout most of Trump's presidency, but some increases were observed towards the end of his term.

- National Debt: The national debt increased significantly during Trump's presidency, largely due to the tax cuts and increased government spending.

A balanced assessment of Trump's economic performance requires comparing data to previous administrations and accounting for external factors such as global economic conditions. While some indicators, such as job creation, were positive, others, such as the national debt, showed a significant negative trend. Keywords such as "GDP growth rate," "job creation statistics," "inflation rate," "national debt increase," and "economic performance" are crucial for analyzing the complete economic picture.

Conclusion

Trump's economic policies had a mixed impact on the US economy. While the tax cuts stimulated some economic growth and job creation in certain sectors, they also led to a significant increase in the national debt. Deregulation efforts had varied consequences, boosting some industries but potentially harming the environment and increasing financial risk. The trade wars disrupted supply chains, increased prices for consumers, and negatively impacted some industries. A comprehensive analysis of Trump's economic legacy requires a nuanced understanding of these complex and interconnected effects. Further research into Trump's economic policies and their long-term effects is crucial for understanding their full impact on the US economy. Continue to analyze the data and engage in informed discussions about the effectiveness of these policies and their implications for future economic strategies. Consider the lasting effects of Trump's economic policies and their ongoing influence on the US and global economies. Understanding the impact of Trump's economic legacy is critical for shaping effective economic strategies for the future.

Featured Posts

-

The Role Of Ai In Protecting Endangered Species Opportunities And Risks

Apr 23, 2025

The Role Of Ai In Protecting Endangered Species Opportunities And Risks

Apr 23, 2025 -

Jackson Chourio Fuels Brewers Win With Homer And 5 Rbis Against Rockies

Apr 23, 2025

Jackson Chourio Fuels Brewers Win With Homer And 5 Rbis Against Rockies

Apr 23, 2025 -

The Reality Of Working As A Chalet Girl Responsibilities And Rewards

Apr 23, 2025

The Reality Of Working As A Chalet Girl Responsibilities And Rewards

Apr 23, 2025 -

Planirajte Svoju Uskrsnju Kupovinu Otvorene Trgovine

Apr 23, 2025

Planirajte Svoju Uskrsnju Kupovinu Otvorene Trgovine

Apr 23, 2025 -

Portefeuille Bfm Revue Hebdomadaire De L Arbitrage 17 02

Apr 23, 2025

Portefeuille Bfm Revue Hebdomadaire De L Arbitrage 17 02

Apr 23, 2025