The Warren Buffett Apple Sale: Lessons For Long-Term Investors

Table of Contents

Understanding Berkshire Hathaway's Apple Investment

Berkshire Hathaway's Apple investment represents one of the most significant and successful stock positions in the history of investing. The company began accumulating Apple shares in 2016, gradually increasing its holdings over several years. This investment yielded substantial gains, transforming Apple into a cornerstone of Berkshire's vast portfolio. At its peak, Apple represented a significant percentage of Berkshire Hathaway's total holdings, making it a key driver of the conglomerate's overall performance.

- Timeline of Berkshire's Apple investment: The initial purchases began in 2016, with significant increases in holdings throughout 2017 and beyond.

- Peak Apple holdings and their value: At its height, Berkshire Hathaway held billions of dollars worth of Apple stock, representing a substantial portion of its overall portfolio value. The precise peak value fluctuated with Apple's stock price.

- Reasons cited (or speculated) for the initial investment: While never explicitly stated, analysts speculated that Buffett was drawn to Apple's strong brand, loyal customer base, significant cash reserves, and consistent revenue streams, aligning with his value investing philosophy.

Analyzing the Reasons Behind the Apple Sale

The partial divestiture of Apple stock by Berkshire Hathaway has sparked much debate. Several factors could have contributed to this decision. One prominent consideration is the overall macroeconomic environment. Concerns about inflation, rising interest rates, and potential recessionary pressures could have prompted a reassessment of the portfolio's risk profile.

- Market fluctuations and their impact: The recent volatility in the tech sector, and the broader market, may have influenced Buffett's decision. Reducing exposure to a single, albeit large, position could be a risk-mitigation strategy.

- Berkshire's overall portfolio strategy and adjustments: Buffett's approach to investing emphasizes diversification, even with historically successful investments. The Apple sale could reflect an effort to rebalance the portfolio and reduce concentration risk.

- Potential re-allocation of funds to other sectors: Proceeds from the Apple sale may be allocated to other promising investments that Berkshire Hathaway's investment team has identified as undervalued or poised for growth.

- Any official statements released by Berkshire Hathaway: While Berkshire Hathaway hasn't provided a specific reason for the sale, their filings and any comments from Warren Buffett himself offer potential insights.

Implications for Long-Term Investment Strategies

The Warren Buffett Apple sale underscores crucial aspects of long-term investment strategies. Even for seemingly invincible companies like Apple, the reality is that stock prices are inherently volatile.

- The risk of over-concentration in any single stock: The substantial gains made from Apple's success highlight the risk of concentrating a significant portion of the portfolio in one stock, no matter how strong the company appears.

- Strategies for mitigating risk in a volatile market: Diversification across different asset classes and sectors is crucial for managing risk and smoothing out the ups and downs of the market. Regular portfolio rebalancing is an essential part of this strategy.

- Importance of fundamental analysis in investment decisions: Thoroughly understanding a company's financial health, competitive landscape, and future prospects is essential for making sound investment decisions. Don't rely solely on past performance.

- The role of market timing versus long-term value investing: While market timing can be tempting, Buffett's approach emphasizes the importance of long-term value investing, focusing on the intrinsic value of a company rather than short-term market fluctuations.

Lessons Learned from Warren Buffett's Actions

The Warren Buffett Apple sale, despite being a partial reduction and not a complete sell-off, demonstrates the adaptability and resilience of even the most successful investors.

- Buffett's emphasis on intrinsic value: Even with a stock that has historically performed well, a reevaluation of the company's intrinsic value in relation to its current market price may warrant adjustments.

- His approach to risk management: The sale underscores the ongoing importance of risk management, even with well-established and successful positions.

- His historical track record and its relevance: Despite this move, Buffett’s long history of successful investing remains a testament to his ability to adjust strategies over time and capitalize on new opportunities.

Conclusion

The Warren Buffett Apple sale provides a compelling case study for long-term investors. While the exact reasons behind the decision remain open to interpretation, it underscores the importance of diversification, continuous portfolio evaluation, and a thorough understanding of the underlying fundamentals of any investment. Don’t solely rely on past successes; adapt your strategy as the market evolves. By learning from the actions of legendary investors like Warren Buffett, you can refine your own approach to long-term investing and make more informed decisions. Take the lessons from the Warren Buffett Apple sale to heart and build a more resilient investment portfolio today.

Featured Posts

-

Ftc Probe Into Open Ai Implications For The Future Of Ai Development

Apr 23, 2025

Ftc Probe Into Open Ai Implications For The Future Of Ai Development

Apr 23, 2025 -

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 23, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 23, 2025 -

Illness Keeps Francona From Brewers Game

Apr 23, 2025

Illness Keeps Francona From Brewers Game

Apr 23, 2025 -

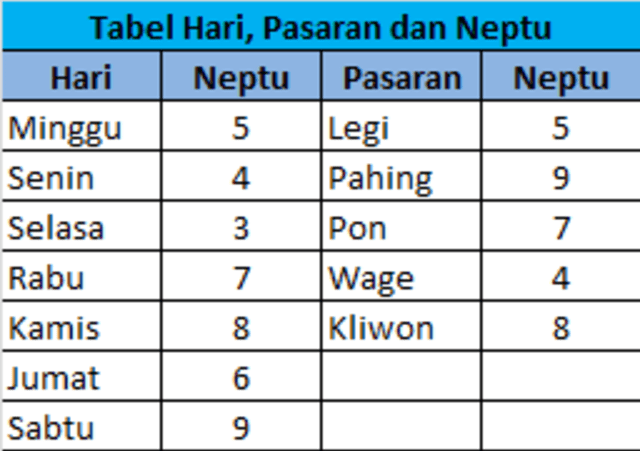

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025 -

Pascal Boulanger A La Tete De La Federation Des Promoteurs Immobiliers Fpi

Apr 23, 2025

Pascal Boulanger A La Tete De La Federation Des Promoteurs Immobiliers Fpi

Apr 23, 2025