The Recent Market Dip: A Case Study In Professional Selling And Individual Buying

Table of Contents

Professional Selling Strategies During a Market Dip

The recent market dip demands a shift in sales strategies. Simply relying on past successful techniques may not suffice in this altered environment. Adaptability and a customer-centric approach are paramount.

Adapting Sales Techniques

Successfully selling during a market downturn requires a nuanced approach. Focusing solely on price is no longer effective; instead, prioritize building lasting relationships and emphasizing value.

- Building Trust and Relationships: Invest time in understanding client needs and concerns. Transparency and open communication build trust, crucial in times of uncertainty.

- Highlighting Long-Term Value: Shift the focus from short-term gains to the long-term benefits and ROI your product or service offers. Showcase how your offering provides lasting value and mitigates risks.

- Emphasizing Unique Selling Propositions (USPs): Clearly articulate what sets your product or service apart from the competition. In a down market, differentiation is key.

- Offering Flexible Payment Options: Consider offering flexible payment plans, financing options, or incentives to make your product or service more accessible to potential buyers.

- Leveraging Data and Analytics: Utilize market data and analytics to identify emerging trends and adjust your sales approach accordingly. This allows for proactive adaptation to changing market demands.

Mastering Negotiation in a Down Market

Negotiation skills become even more crucial during a market dip. A win-win approach is essential to reach mutually beneficial agreements.

- Creative Negotiation: Be prepared to explore creative solutions, considering factors beyond just price, such as extended warranties or service packages.

- Understanding Buyer Motivation: Understand the specific needs and motivations driving the buyer's decision-making process. Tailor your approach to address their individual concerns.

- Flexibility and Compromise: Demonstrate a willingness to compromise while still protecting your interests. Flexibility can be a key differentiator in securing a deal.

- Long-Term Relationship Focus: Prioritize building long-term relationships with clients even if immediate profits are lower. This approach pays off in the long run.

- Clear Contract Documentation: Meticulously document all agreements to avoid misunderstandings and disputes. Legal counsel can be invaluable during this process.

Smart Buying Strategies During a Recent Market Dip

A market dip creates opportunities for savvy buyers. However, careful planning and risk mitigation are essential.

Identifying Opportunities in a Down Market

The recent market dip presents a chance to acquire undervalued assets at attractive prices. However, thorough research and due diligence are paramount.

- Thorough Research: Conduct extensive research to identify undervalued assets that align with your investment goals and risk tolerance.

- Aggressive Negotiation: Leverage the seller's potential urgency to negotiate favorable terms and prices. Be prepared to walk away if the deal isn't right.

- Expert Advice: Seek advice from financial advisors, real estate professionals (if applicable), and other relevant experts to make informed decisions.

- Contract Review: Carefully review all contracts and seek legal counsel if needed to protect your interests.

- Long-Term Investment: Consider the long-term potential of the investment, focusing on its future value rather than solely on short-term gains.

Protecting Yourself from Risks

Navigating a down market requires a cautious approach to minimize potential risks. Thorough due diligence is crucial.

- Due Diligence: Conduct comprehensive due diligence before committing to any significant purchase. Verify all information and assess potential risks.

- Understanding Market Risks: Acknowledge and understand the inherent risks associated with the current market conditions. Don't underestimate potential downsides.

- Investment Diversification: Diversify your investments to mitigate potential losses. Don't put all your eggs in one basket.

- Appropriate Financing and Insurance: Secure appropriate financing and insurance to protect yourself against unforeseen circumstances.

- Professional Consultation: Consult with professionals before making any significant financial commitments. Their expertise can prevent costly mistakes.

Conclusion

The recent market dip presents both challenges and opportunities. Sellers who adapt their sales techniques and negotiation strategies can maintain a successful sales pipeline, while buyers can leverage the downturn to acquire undervalued assets. By understanding and implementing the strategies outlined above, both buyers and sellers can navigate this volatile market effectively.

Whether you're navigating the complexities of selling or buying during this recent market dip, understanding the strategies outlined above is crucial for success. Learn more about adapting to market fluctuations and optimizing your approach by [link to relevant resource/further reading]. Successfully navigating the recent market dip requires careful planning and strategic decision-making.

Featured Posts

-

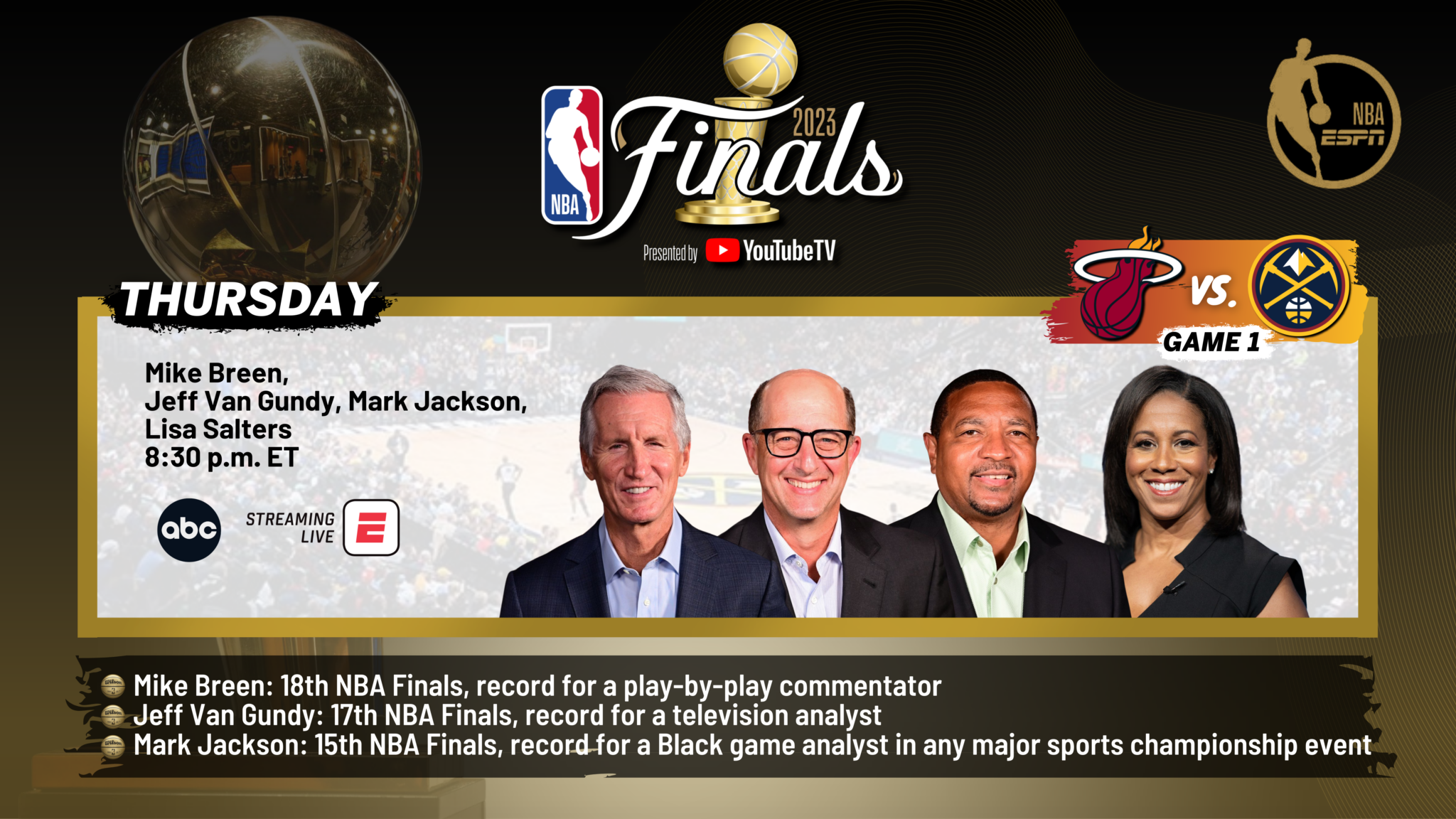

Richard Jeffersons New Espn Role Nba Finals Booth Still Undecided

Apr 28, 2025

Richard Jeffersons New Espn Role Nba Finals Booth Still Undecided

Apr 28, 2025 -

Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela Red Sox Injury Report

Apr 28, 2025

Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela Red Sox Injury Report

Apr 28, 2025 -

Analysis Bubba Wallaces Second Place Loss At Martinsvilles Final Restart

Apr 28, 2025

Analysis Bubba Wallaces Second Place Loss At Martinsvilles Final Restart

Apr 28, 2025 -

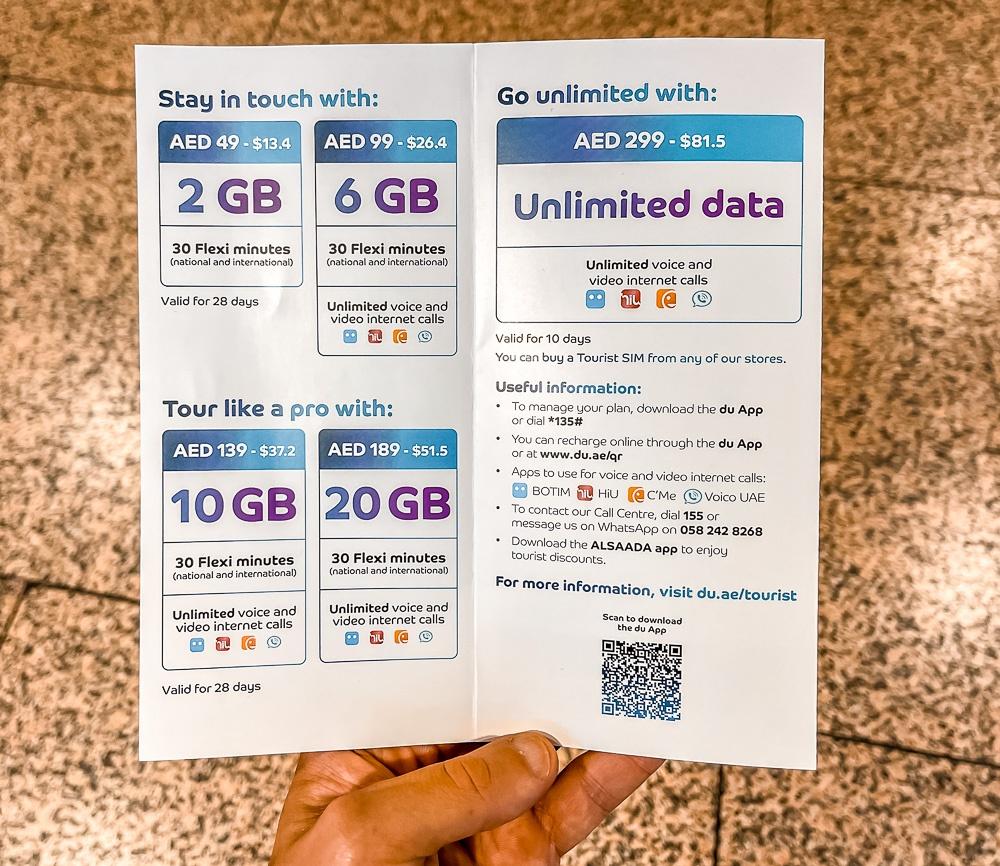

Uae Travel Sim 10 Gb Data Abu Dhabi Pass Discounts

Apr 28, 2025

Uae Travel Sim 10 Gb Data Abu Dhabi Pass Discounts

Apr 28, 2025 -

Blue Jays Vs Red Sox Complete Lineups Featuring Buehler And Returning Outfielder

Apr 28, 2025

Blue Jays Vs Red Sox Complete Lineups Featuring Buehler And Returning Outfielder

Apr 28, 2025