Stock Market Valuations: BofA Assures Investors, Dispelling Valuation Concerns

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's report counters prevailing concerns about overvaluation by focusing on several key factors. Their analysis suggests that current valuations are justifiable given projected earnings growth, the interest rate environment, and long-term growth opportunities.

Earnings Growth Projections

BofA forecasts robust corporate earnings growth in the coming years. This positive outlook significantly impacts Price-to-Earnings (P/E) ratios, a key metric for assessing stock market valuations. Their projections include:

- Technology: High single-digit earnings growth driven by AI and cloud computing advancements.

- Healthcare: Solid growth fueled by an aging population and pharmaceutical innovations.

- Financials: Moderate growth, contingent on interest rate movements and economic conditions.

These projections, coupled with interest rate expectations, contribute to a more favorable P/E ratio compared to historical averages. For instance, while current P/E ratios might seem high compared to the past decade's averages, they appear less alarming when considered alongside the projected earnings growth.

Interest Rate Environment and its Impact

BofA's assessment of the interest rate environment plays a crucial role in their valuation analysis. Interest rates directly influence discounted cash flow valuations, a key method used to determine a company's intrinsic value. BofA predicts:

- A gradual increase in interest rates over the next year.

- A plateauing of interest rates thereafter, avoiding a drastic increase that could negatively impact stock valuations.

While higher interest rates typically increase borrowing costs for companies, impacting profitability, BofA anticipates the effect will be manageable, allowing for continued earnings growth. Furthermore, the predicted increase in interest rates will likely be offset by the corresponding increase in bond yields, making stocks relatively more attractive to investors.

Long-Term Growth Opportunities

BofA identifies several key long-term growth drivers that support their positive outlook on stock market valuations:

- The continued expansion of the global digital economy.

- Breakthroughs in renewable energy technologies.

- The ongoing development of artificial intelligence and machine learning.

These factors contribute to a positive long-term outlook, justifying higher valuations compared to historical norms. Even considering geopolitical risks, BofA suggests these long-term growth opportunities outweigh the near-term uncertainties.

Counterarguments and Potential Risks

While BofA presents a reassuring outlook, it's crucial to acknowledge potential counterarguments and risks.

Inflationary Pressures

Persistent inflationary pressures pose a significant risk. High inflation can erode corporate profitability and negatively impact investor sentiment, leading to lower stock valuations. Furthermore, aggressive interest rate hikes by central banks to combat inflation could trigger a recession, impacting earnings growth and potentially leading to a market correction.

Geopolitical Uncertainty

Geopolitical events, such as the ongoing conflict in Ukraine and rising tensions in other regions, introduce significant uncertainty. These events can cause market volatility and negatively impact investor confidence, leading to lower valuations. BofA's analysis may not fully account for the unpredictable nature of these events.

Market Volatility and Correction Potential

Despite BofA's positive outlook, the possibility of a market correction remains. Historical data shows that markets experience periodic corrections, often driven by unforeseen events or a reassessment of valuations. While BofA's analysis suggests the market is not drastically overvalued, the possibility of a correction cannot be dismissed.

Investing Strategies Based on BofA's Assessment

BofA's assessment allows for the formulation of informed investment strategies.

Sector-Specific Opportunities

BofA's sector-specific earnings projections highlight potential investment opportunities. Sectors with strong growth prospects, such as technology and healthcare, might offer attractive investment opportunities, though appropriate diversification remains crucial to mitigate risk.

Long-Term vs. Short-Term Investment Horizons

BofA's analysis favors a long-term investment horizon. For long-term investors, the projected earnings growth and long-term growth opportunities outweigh the short-term risks. Short-term investors, however, might adopt a more cautious approach, potentially focusing on defensive sectors less susceptible to market volatility.

Conclusion: Navigating Stock Market Valuations with Confidence

BofA's analysis suggests that while risks exist, current stock market valuations are not necessarily excessive given projected earnings growth, the interest rate environment, and long-term growth opportunities. However, inflationary pressures, geopolitical uncertainty, and the potential for market corrections should not be disregarded. Investors should consider these factors when formulating their investment strategies. Understanding stock market valuations is crucial for making sound investment decisions. Continue your research and develop a robust investment strategy to navigate the market effectively, aligning your approach with your risk tolerance and long-term investment goals.

Featured Posts

-

The Destruction Of Pope Francis Ring A Papal Tradition

Apr 23, 2025

The Destruction Of Pope Francis Ring A Papal Tradition

Apr 23, 2025 -

Asear Alktakyt Fy Msr Alywm Alathnyn 14 Abryl 2025 Tqryr Shaml

Apr 23, 2025

Asear Alktakyt Fy Msr Alywm Alathnyn 14 Abryl 2025 Tqryr Shaml

Apr 23, 2025 -

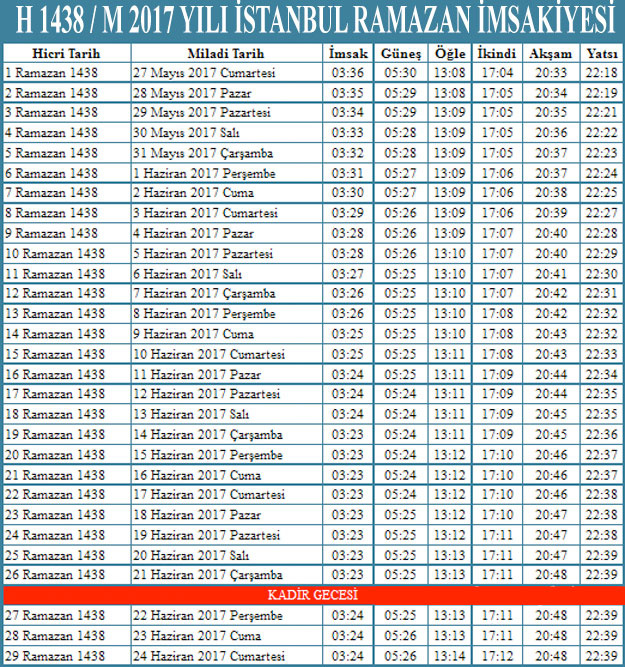

Istanbul Da 3 Mart Pazartesi Guenue Iftar Ve Sahur Saatleri

Apr 23, 2025

Istanbul Da 3 Mart Pazartesi Guenue Iftar Ve Sahur Saatleri

Apr 23, 2025 -

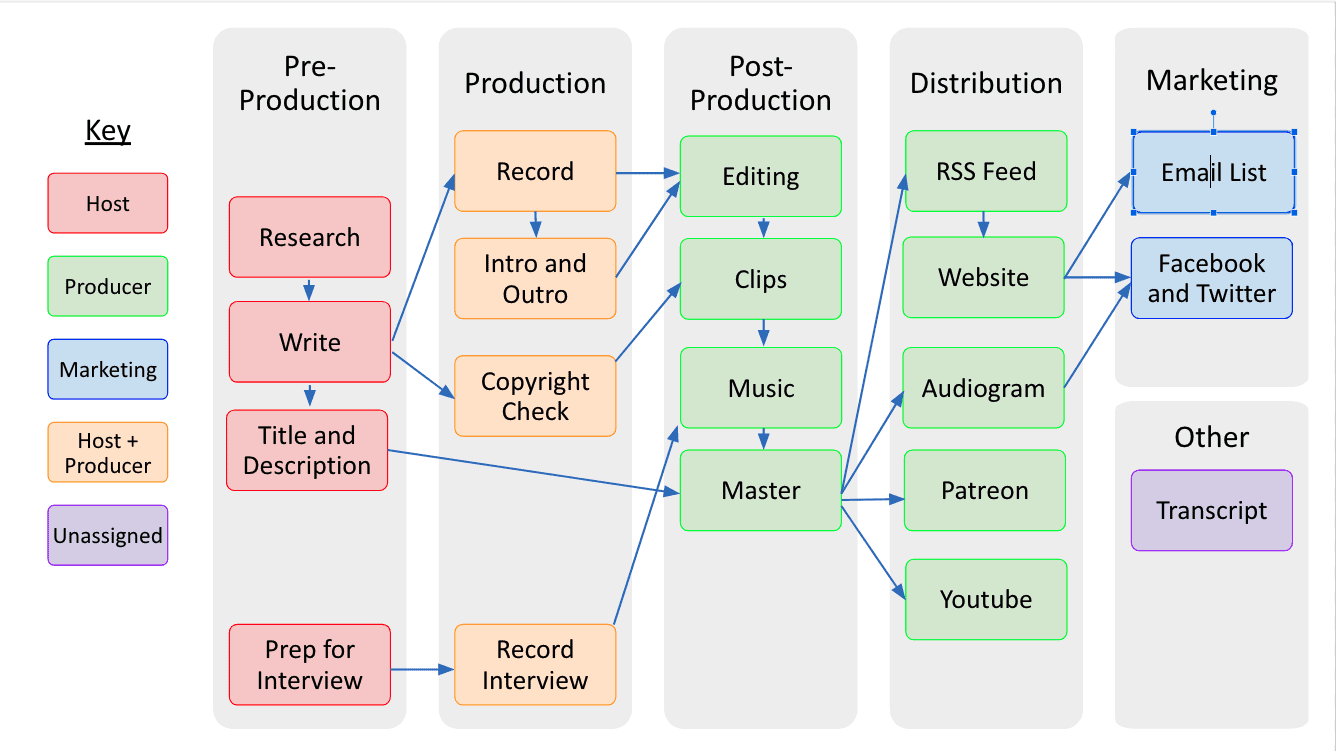

From Scatological Data To Podcast Gold The Power Of Ai

Apr 23, 2025

From Scatological Data To Podcast Gold The Power Of Ai

Apr 23, 2025 -

Arizona Diamondbacks Secure Walk Off Win With Five Run Ninth

Apr 23, 2025

Arizona Diamondbacks Secure Walk Off Win With Five Run Ninth

Apr 23, 2025