Stock Market Today: Dow Jumps 1000 Points, Nasdaq & S&P 500 Surge On Tariff Hopes

Table of Contents

Dow Jones Industrial Average Soars 1000 Points – A Deep Dive

The 1000-point jump in the Dow Jones Industrial Average represents a truly significant event. This massive increase signifies a substantial surge in investor confidence and showcases the market's powerful reaction to positive economic news. The percentage increase, while impressive, needs to be considered within the context of the overall market value. The closing values will be closely scrutinized by analysts for further insights.

- Analysis of individual Dow component performances: Technology and financial stocks were among the top performers, contributing significantly to the overall surge. Specific companies within these sectors saw massive gains.

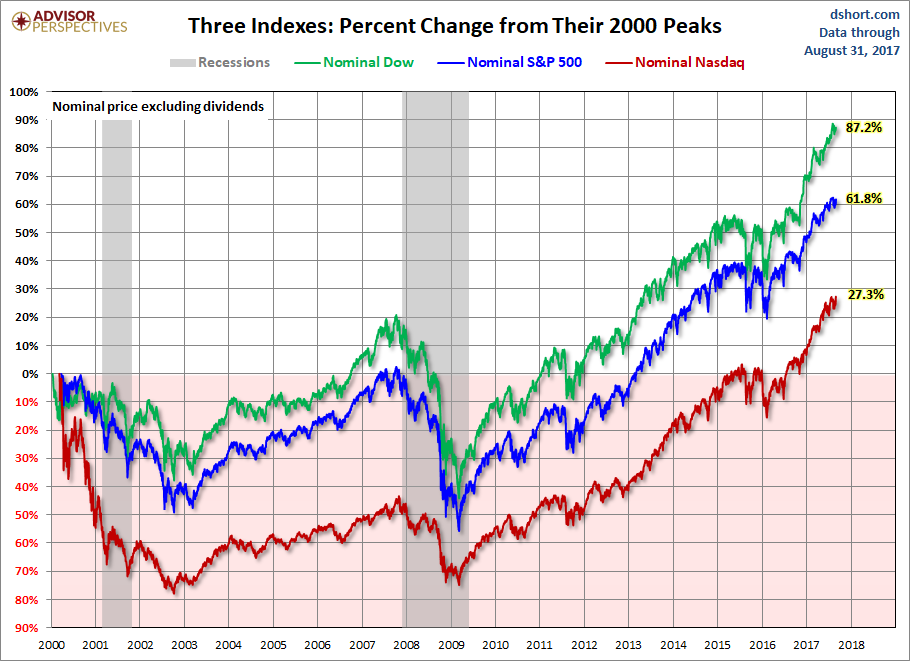

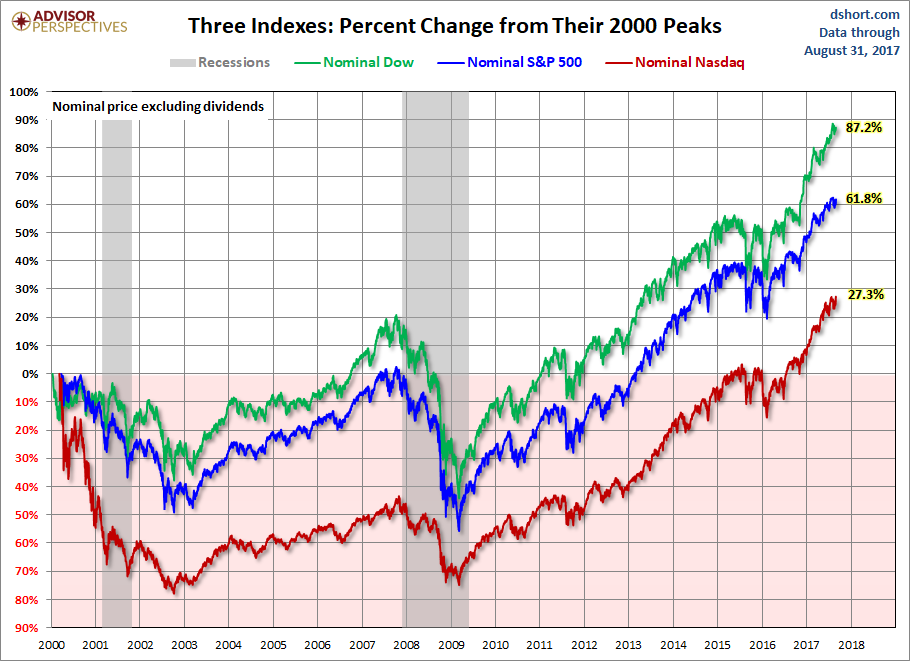

- Comparison to previous market rallies: This rally's magnitude needs to be compared to similar historical events to determine its significance and potential long-term impact. The speed and scale of the increase are key factors to consider.

- Expert opinions on the Dow's performance: Leading financial experts are analyzing the Dow's performance, providing valuable insights into the potential drivers and the likely near-term outlook. These opinions offer valuable context to the events of the day.

Nasdaq and S&P 500 Follow Suit – Significant Gains Across the Board

The Nasdaq and S&P 500 mirrored the Dow's impressive performance, registering significant percentage increases. This strong correlation between the three major indices points to a broad-based market rally driven by a shared underlying catalyst. However, subtle discrepancies between the indices highlight sector-specific drivers and variations in investor sentiment across different market segments.

- Key sectors driving Nasdaq's growth: Technology and biotech stocks experienced particularly strong gains within the Nasdaq, reflecting investor optimism in these growth-oriented sectors.

- Analysis of S&P 500 sector performance: Analyzing the performance across various sectors within the S&P 500 provides a clearer picture of the breadth and depth of today's market surge.

- Impact on investor sentiment: The surge has undeniably boosted investor sentiment, fostering a sense of optimism and encouraging further investment. However, caution is advised, as markets are inherently volatile.

Tariff Hopes Fuel Market Rally – Understanding the Catalyst

The primary catalyst for today's remarkable market rally is renewed hope regarding international trade tariffs. Specific news regarding potential breakthroughs in negotiations or indications of a more conciliatory approach from involved parties likely fueled the positive market reaction.

- Explanation of the current trade climate and its impact: The current global trade landscape significantly impacts investor confidence and market volatility. Easing tensions lead to increased optimism.

- Discussion of investor confidence and risk appetite: The market's response reflects the strong link between investor confidence and risk appetite. Positive developments often increase risk appetite, driving investment in higher-risk assets.

- Potential long-term implications of tariff developments: The long-term implications of any significant changes in tariff policies will be crucial to monitor. These changes influence various sectors differently.

Investor Reaction and Market Volatility – A Cautious Optimism?

The immediate investor reaction to the market surge has been a mix of buying and holding, reflecting a cautious optimism. While the surge is impressive, investors are keenly aware of the market's inherent volatility. Concerns remain about the sustainability of this positive trend.

- Analysis of trading volume: High trading volume indicates strong participation and underscores the significance of today's market movements.

- Discussion of potential future market triggers: Several factors could influence future market trends, including further developments in trade negotiations, economic data releases, and geopolitical events.

- Expert predictions on short-term and long-term market outlook: Analysts are closely monitoring the situation and offering various short-term and long-term market forecasts, providing investors with guidance.

Conclusion: Stock Market Today's Surge – What's Next?

Today’s stock market witnessed a dramatic surge, with the Dow, Nasdaq, and S&P 500 all posting impressive gains. This rally was primarily driven by renewed optimism surrounding tariff negotiations. While the gains are significant, a cautious outlook remains prudent, given the market's inherent volatility. The sustainability of this trend will depend on several factors. To stay updated on today's stock market and current stock market trends, subscribe to our newsletter for regular updates and analysis. Stay informed about the stock market today and navigate the ever-changing market landscape effectively.

Featured Posts

-

Bold And The Beautiful Spoilers February 20th Liams Loneliness Finns Warning

Apr 24, 2025

Bold And The Beautiful Spoilers February 20th Liams Loneliness Finns Warning

Apr 24, 2025 -

Trump Administration Open To Talks Following Harvards Legal Challenge

Apr 24, 2025

Trump Administration Open To Talks Following Harvards Legal Challenge

Apr 24, 2025 -

Elon Musks Dogecoin Strategy Following Epa Actions Against Tesla And Space X

Apr 24, 2025

Elon Musks Dogecoin Strategy Following Epa Actions Against Tesla And Space X

Apr 24, 2025 -

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025 -

Optimus Robot Production Tesla Navigates Challenges From Chinas Rare Earth Export Controls

Apr 24, 2025

Optimus Robot Production Tesla Navigates Challenges From Chinas Rare Earth Export Controls

Apr 24, 2025