Stock Market Live Updates: Dow Futures Rise, Gold At $3,500 On Tariff And Interest Rate Fears

Table of Contents

Dow Futures Surge Amidst Uncertainty

Analysis of Dow Futures Movement

The Dow futures experienced a notable surge this morning, increasing by X% (replace X with actual percentage). This represents a significant shift compared to yesterday's [mention yesterday's percentage change] and the previous week's trend of [mention the previous week's trend]. While this rise is significant, its sustainability remains uncertain.

- Positive Economic Data: Recent positive economic data releases, such as [mention specific data, e.g., strong employment figures or positive GDP growth], have contributed to investor optimism.

- Sector-Specific Easing of Trade Tensions: Easing of trade tensions in the [mention specific sector, e.g., technology] sector has also boosted investor confidence in specific companies.

- Strong Corporate Earnings: Several major corporations have reported better-than-expected earnings, further contributing to the Dow's upward movement.

- Contrasting Viewpoints: However, some market analysts remain cautious, predicting a potential correction based on [mention reasons for caution, e.g., lingering geopolitical uncertainties or overvalued market conditions]. They suggest this could be a temporary rally.

[Include a relevant chart or graph visualizing the Dow Futures movement].

Keywords: Dow Futures, Stock Market Index, Market Volatility, Economic Indicators, Trading Signals

Gold Prices Hit $3,500: Safe Haven Demand Intensifies

Factors Driving Gold Price Increase

Gold prices have reached an unprecedented $3,500 per ounce, a dramatic increase driven primarily by escalating tariff fears and anxieties surrounding interest rate hikes.

- Safe Haven Asset: Investors view gold as a traditional safe haven asset during times of economic uncertainty and geopolitical instability. The current climate is fueling this demand.

- Rising Interest Rates & Diminishing Returns: Rising interest rates erode the returns of other investments, making gold a more attractive alternative for preserving capital.

- Escalating Trade Disputes: Ongoing trade disputes create uncertainty, driving investors towards the perceived stability of gold as a hedge against potential economic downturn.

Keywords: Gold Prices, Safe Haven Asset, Inflation Hedge, Interest Rate Risk, Commodity Trading, Precious Metals

Tariff and Interest Rate Fears Fuel Market Volatility

Impact of Tariffs on Global Trade

The ongoing trade disputes are creating significant uncertainty in the global market. Tariffs imposed by [mention countries involved] on [mention specific goods or sectors] are disrupting supply chains and increasing production costs, impacting profitability for numerous businesses.

Interest Rate Hikes and their Effect on the Stock Market

Interest rate hikes by central banks, aiming to combat inflation, are increasing borrowing costs for businesses and consumers. This dampens economic activity and can negatively impact investor sentiment, leading to market corrections.

- Countries/Industries Affected: The technology sector, for instance, has been significantly affected by tariffs imposed on certain components and goods.

- Future Interest Rate Hikes: Predictions for future interest rate hikes vary, but most analysts anticipate [mention predicted increases] in the coming months.

- Long-Term Effects: The long-term effects of these factors remain to be seen, but the current volatility underscores the need for caution and informed decision-making.

Keywords: Trade Wars, Tariffs, Interest Rate Hikes, Monetary Policy, Economic Uncertainty, Global Trade

Conclusion

Today's Stock Market Live Updates reveal a volatile market driven by a surge in Dow futures, gold prices reaching a record $3,500, and underlying concerns about tariffs and interest rate hikes. The rise in gold reflects the increasing demand for safe haven assets amidst global economic uncertainty, while the Dow's fluctuation shows the market's sensitivity to these pressures.

Key Takeaways: Understanding these live market updates and their implications is crucial for developing effective investment strategies. The current volatility highlights the importance of staying informed and adapting your approach based on real-time data.

Call to Action: Stay ahead of the curve with our daily Stock Market Live Updates and make informed investment choices. Subscribe now to receive real-time market analysis and insights!

Featured Posts

-

Posthaste Impact Of Trumps Tariffs On Canadian Family Finances

Apr 23, 2025

Posthaste Impact Of Trumps Tariffs On Canadian Family Finances

Apr 23, 2025 -

La Carte Blanche De Marc Fiorentino Analyse Et Decryptage

Apr 23, 2025

La Carte Blanche De Marc Fiorentino Analyse Et Decryptage

Apr 23, 2025 -

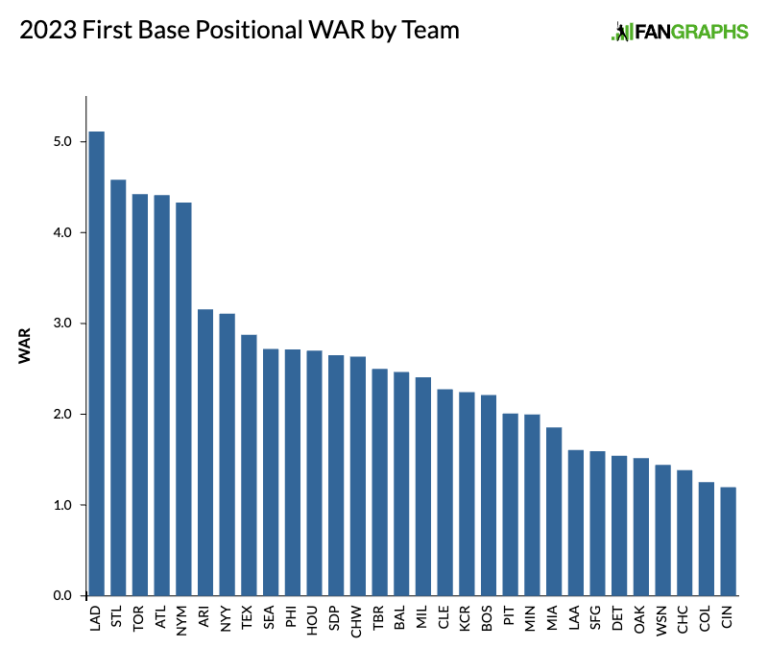

Analyzing The Fan Graphs Power Rankings March 27th To April 6th

Apr 23, 2025

Analyzing The Fan Graphs Power Rankings March 27th To April 6th

Apr 23, 2025 -

Kansas City Royals Bullpen Shuts Down Brewers Cole Ragans A Key Contributor

Apr 23, 2025

Kansas City Royals Bullpen Shuts Down Brewers Cole Ragans A Key Contributor

Apr 23, 2025 -

Whats Open And Closed On Easter In Prince Edward Island

Apr 23, 2025

Whats Open And Closed On Easter In Prince Edward Island

Apr 23, 2025