Sharp Drop In Tesla Q1 Profits: Analyzing The Musk Factor

Table of Contents

The Impact of Price Cuts on Tesla's Profitability

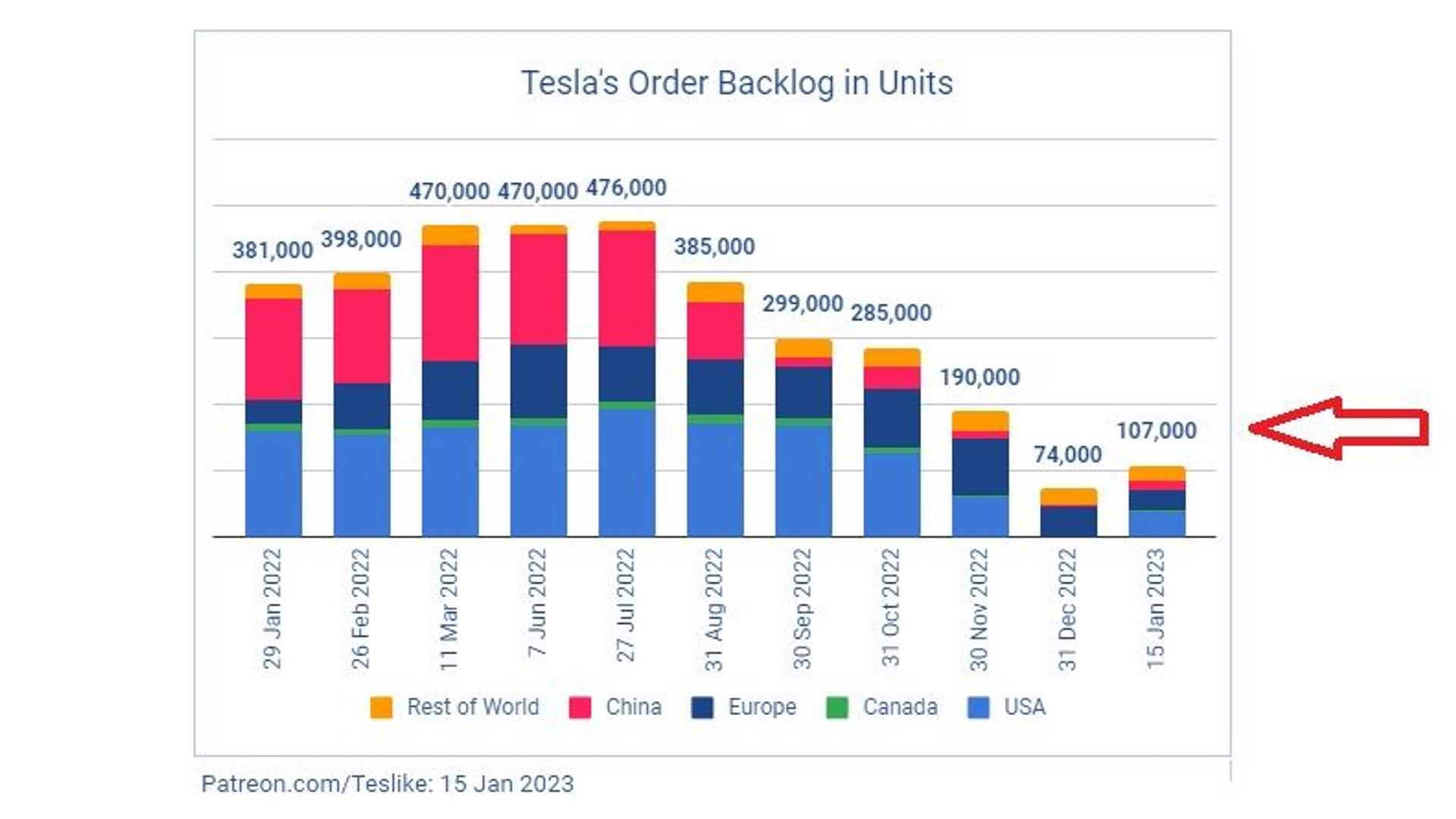

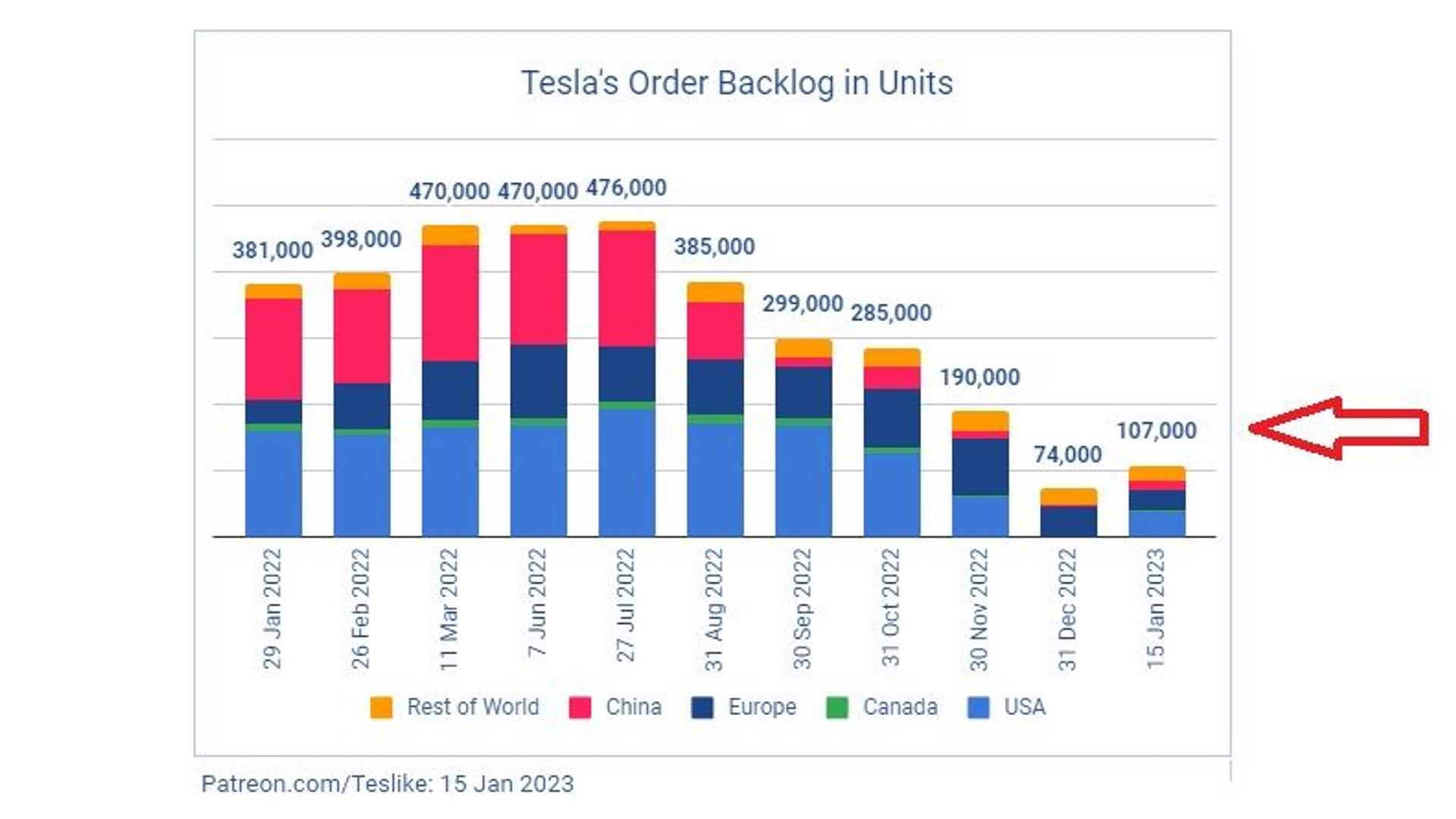

Tesla's aggressive price cuts across its vehicle lineup are a major contributor to the reduced Q1 profits. This Tesla price war strategy, while aiming to boost sales volume and market share in the increasingly competitive electric vehicle market, significantly impacted profit margins.

-

Aggressive Pricing Strategy: Tesla implemented substantial price reductions globally, aiming to maintain its competitive edge and stimulate demand. This strategy, however, directly impacted the profit earned per vehicle.

-

Impact on Profit Margins: While precise figures vary depending on the model and region, analysts have reported a considerable decrease in Tesla's profit margins. The company's focus shifted from maximizing profit per unit to increasing overall sales volume.

-

Competitive Landscape and Market Share: Tesla's price cuts triggered a response from competitors, intensifying the EV price war. While the price cuts likely increased sales volume, the extent to which this compensated for reduced per-unit profits remains a key question. This aggressive pricing strategy also impacted the company’s ability to maintain its high profit margins, a key factor in its previous market valuation.

-

Sales Volume vs. Profitability: The crucial question remains whether the increase in Tesla sales volume, driven by the price cuts, successfully offset the reduced profit margin per vehicle. Early data suggests a mixed outcome, with increased sales not entirely making up for the lower profit margins.

Production Challenges and Supply Chain Issues

Beyond pricing, Tesla faced production challenges and supply chain disruptions that contributed to the decline in Q1 profits. These issues impacted both production capacity and overall manufacturing costs.

-

Gigafactory Output: While Tesla's Gigafactories continue to expand, reported bottlenecks and temporary production slowdowns in Q1 impacted overall output, resulting in fewer vehicles produced than initially projected.

-

Supply Chain Disruptions: The ongoing global supply chain instability caused delays in receiving crucial components, leading to increased costs and production delays. This exacerbated the already challenging production environment.

-

Raw Material Costs: Rising raw material costs, particularly for battery components, significantly impacted Tesla's manufacturing expenses. This cost pressure further compressed profit margins.

-

Manufacturing Efficiency: Optimizing manufacturing efficiency across its Gigafactories remains a key priority for Tesla. Addressing production bottlenecks and streamlining the manufacturing process will be crucial in improving profitability moving forward.

The Elon Musk Factor: Leadership Decisions and Market Sentiment

Elon Musk's leadership style and business decisions significantly influence Tesla's market perception and investor confidence. His actions, both within and outside Tesla, directly impact the company's stock price and overall market valuation.

-

Impact of External Activities: The Twitter acquisition, and subsequent management changes, significantly distracted from Tesla's core business and arguably impacted investor confidence.

-

Investor Sentiment and Stock Volatility: Musk's public statements and actions often trigger significant volatility in Tesla's stock price. The correlation between his actions and market reactions is undeniable, highlighting the significant "Musk factor" at play.

-

Leadership Style and Long-Term Impact: Musk's unconventional leadership style, while often praised for its innovation, also presents risks. His unpredictable actions can create uncertainty among investors, leading to market fluctuations and affecting the company's long-term strategic direction.

Diversification and Future Strategies

Tesla's long-term success hinges on its ability to diversify its revenue streams and successfully develop and integrate future technologies.

-

Tesla Energy and Renewable Energy: The expansion of Tesla's energy business, including solar and energy storage solutions, presents a significant opportunity to diversify revenue beyond electric vehicles.

-

Autonomous Driving Technology: The successful development and market adoption of full self-driving capabilities represent a potential game-changer for Tesla's profitability. However, the technical challenges and regulatory hurdles remain significant.

-

Future Technologies and Long-Term Growth: Tesla's ongoing investments in research and development, focusing on battery technology, autonomous driving, and other innovative solutions, are critical for its long-term growth and sustainability in the competitive EV market. These future technologies will be a significant driver of long-term profitability.

Conclusion

The sharp drop in Tesla's Q1 profits reveals a complex interplay of factors. Aggressive price cuts, production challenges, and the undeniable influence of Elon Musk's leadership all played significant roles. The analysis suggests that while increased sales volume partially offset reduced margins, the overall impact on profitability is undeniably negative. The long-term implications remain uncertain, necessitating continued observation of market trends and company performance. Understanding the factors impacting Tesla's profitability is crucial for investors and industry observers alike. Stay informed about the evolving dynamics in the electric vehicle market and the ongoing impact of the "Musk factor" on Tesla's future performance by regularly checking for updates and analysis on Tesla Q1 profits and the broader EV sector.

Featured Posts

-

Bitcoin Price Surge Trumps Actions Ease Market Fears

Apr 24, 2025

Bitcoin Price Surge Trumps Actions Ease Market Fears

Apr 24, 2025 -

Spot Market For Russian Gas Eu Debates Phaseout Strategy

Apr 24, 2025

Spot Market For Russian Gas Eu Debates Phaseout Strategy

Apr 24, 2025 -

Instagram Launches Rival Video App To Attract Tik Tok Creators

Apr 24, 2025

Instagram Launches Rival Video App To Attract Tik Tok Creators

Apr 24, 2025 -

California Wildfires Celebrity Home Losses In The Palisades Complete Report

Apr 24, 2025

California Wildfires Celebrity Home Losses In The Palisades Complete Report

Apr 24, 2025 -

Activision Blizzard Acquisition Ftcs Appeal Against Court Decision

Apr 24, 2025

Activision Blizzard Acquisition Ftcs Appeal Against Court Decision

Apr 24, 2025