Record Gold Prices: The Relationship Between Trade Wars And Bullion Investment

Table of Contents

H2: The Safe Haven Effect of Gold During Trade Wars

Gold has long been recognized as a safe haven asset, a store of value that holds its worth during times of economic and geopolitical uncertainty. This characteristic becomes particularly pronounced during periods of heightened trade tensions and escalating trade wars. The inherent volatility of stock markets, exacerbated by trade disputes, drives investors to seek refuge in more stable assets.

-

Increased volatility in stock markets due to trade wars: Trade wars introduce uncertainty, impacting investor confidence and leading to market fluctuations. The fear of decreased profits and potential losses prompts a flight to safety, boosting demand for gold.

-

Gold's historical performance as a hedge against inflation and geopolitical risks: Historically, gold has demonstrated its resilience against inflation and various geopolitical upheavals. When fiat currencies weaken due to trade conflicts, gold's value tends to appreciate, offering protection against economic instability. Numerous studies and historical data support this observation.

-

Diversification benefits of including gold in an investment portfolio during trade disputes: Diversification is a cornerstone of sound investment strategy. Including gold in a portfolio helps to mitigate risks associated with trade wars, creating a balance against potentially volatile stocks and bonds.

-

Decreased investor confidence in fiat currencies during trade conflicts: Trade wars often lead to currency devaluations and increased uncertainty about the future value of national currencies. This decreased confidence makes gold, a tangible and historically stable asset, a more attractive option for investors.

Detailed Explanation: The safe haven effect is clearly illustrated in numerous historical instances. For example, during the 2018-2020 US-China trade war, we saw a significant rise in gold prices as investors sought refuge from the market uncertainty. Analyzing gold price charts from this period reveals a strong correlation between escalating trade tensions and price increases. Experts, including economists and financial analysts, frequently cite gold's performance during such times as evidence of its safe haven properties.

H2: Impact of Currency Devaluation on Record Gold Prices

Trade wars often lead to currency fluctuations and devaluation. The imposition of tariffs and other trade restrictions can disrupt international trade flows, impacting exchange rates.

-

Trade tariffs and their effect on exchange rates: Tariffs can trigger retaliatory measures, creating a cycle of protectionism that negatively impacts global trade and influences currency values.

-

Weakening of currencies as a result of trade disputes: Uncertainty stemming from trade conflicts erodes investor confidence, weakening a country's currency. This devaluation makes imports more expensive, potentially leading to inflation, further fueling demand for gold as a hedge.

-

Gold's pricing in US dollars and the impact of dollar strength/weakness on gold's price: Gold is primarily priced in US dollars. A weakening dollar makes gold cheaper for buyers using other currencies, increasing global demand and pushing prices upward.

-

How currency devaluation increases the demand for gold as a store of value: When a currency loses value, people seek alternative stores of value. Gold, with its intrinsic value and historical stability, becomes a preferred choice, thereby increasing demand and driving up prices.

Detailed Explanation: The 2014 Russian ruble crisis, partly exacerbated by international sanctions and trade tensions, offers a clear example of currency devaluation impacting gold prices. As the ruble plummeted, demand for gold soared among Russian investors as they sought to preserve their wealth. Similar dynamics have been observed in other countries facing trade-related economic difficulties.

H2: Increased Demand for Bullion Investment During Uncertainty

The anxiety surrounding trade wars directly translates into a surge in investment in gold bullion. Both institutional and retail investors flock to this safe haven asset.

-

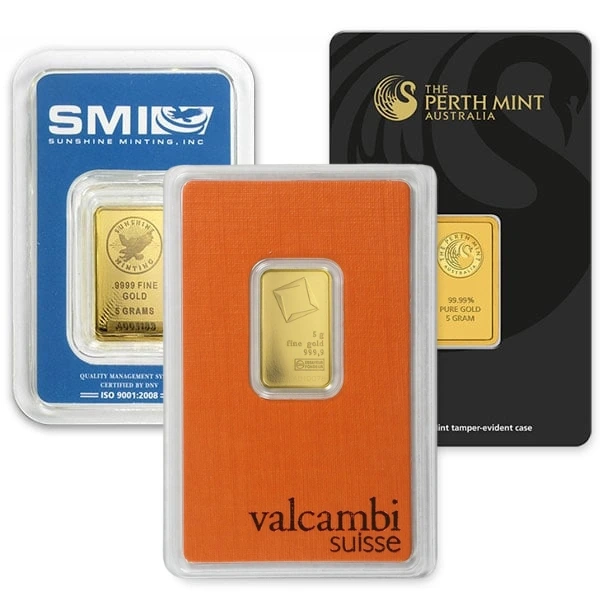

Increased purchases of gold bars and coins by both institutional and retail investors: Individual investors, seeking protection for their savings, and institutional investors, aiming to hedge their portfolios, increase their holdings in physical gold.

-

Growth in gold exchange-traded funds (ETFs) during periods of trade conflict: Gold ETFs provide a convenient and accessible way to invest in gold, and their assets under management often increase significantly during times of economic instability caused by trade disputes.

-

The role of central banks in accumulating gold reserves as a safeguard against economic shocks: Central banks worldwide view gold as a strategic asset, increasing their gold reserves as a buffer against economic shocks, including those stemming from trade wars.

-

Psychological factors influencing investor behavior during trade wars and their impact on gold demand: Fear and uncertainty are powerful drivers of investment decisions. During trade wars, the perceived safety of gold leads to increased demand, regardless of other market indicators.

Detailed Explanation: Data on gold ETF holdings, such as the SPDR Gold Shares (GLD), clearly demonstrate the increased demand for gold during periods of trade uncertainty. Reports from the World Gold Council highlight the growth in central bank gold reserves and provide insights into investor sentiment.

H3: Analyzing Specific Trade Wars and their Correlation with Gold Prices

The US-China trade war, initiated in 2018, provides a compelling case study. The imposition of tariffs and counter-tariffs led to significant market volatility, and gold prices rose considerably during this period. Charts illustrating the correlation between specific trade events, like tariff announcements, and subsequent gold price movements would visually underscore this relationship. Similar analyses can be conducted for other historical trade disputes.

3. Conclusion

This article has demonstrated the strong correlation between escalating trade wars and record gold prices. The safe haven nature of gold, its sensitivity to currency fluctuations, and the consequent increased demand for bullion investments during times of economic uncertainty are all key takeaways. Gold's value as a hedge against the risks associated with global trade conflicts is undeniable.

Key Takeaways: Protect your portfolio against trade war uncertainty with gold. Diversifying your investments with gold can provide a vital buffer during times of economic instability. Record gold prices often reflect the heightened anxiety and uncertainty in global markets.

Call to Action: Learn more about investing in gold during record gold prices. Consider adding physical gold or gold ETFs to your portfolio as a prudent measure to mitigate the risks associated with global trade wars. Consult with a financial advisor to determine the optimal strategy for your individual circumstances.

Featured Posts

-

The American Battleground Exposing Corruption And Power Plays Of The Worlds Richest

Apr 26, 2025

The American Battleground Exposing Corruption And Power Plays Of The Worlds Richest

Apr 26, 2025 -

Los Angeles Wildfires And The Ethics Of Disaster Betting

Apr 26, 2025

Los Angeles Wildfires And The Ethics Of Disaster Betting

Apr 26, 2025 -

Blue Origin Postpones Launch Investigation Into Subsystem Issue

Apr 26, 2025

Blue Origin Postpones Launch Investigation Into Subsystem Issue

Apr 26, 2025 -

American Battleground A David Vs Goliath Struggle For Power

Apr 26, 2025

American Battleground A David Vs Goliath Struggle For Power

Apr 26, 2025 -

White House Cocaine Found Secret Service Investigation Concludes

Apr 26, 2025

White House Cocaine Found Secret Service Investigation Concludes

Apr 26, 2025