Private Credit Market Cracks: A Weekly Analysis Of Recent Turmoil

Table of Contents

Rising Interest Rates and their Impact on Private Credit

Higher interest rates are significantly impacting the private credit market, creating a ripple effect throughout the financial ecosystem. This impact manifests in two primary ways: increased borrowing costs and reduced investor appetite.

Increased Borrowing Costs

Higher interest rates directly increase the cost of servicing private debt, making it harder for borrowers to meet their obligations. This leads to a heightened default risk and makes refinancing existing loans significantly more challenging.

- Increased refinancing challenges: Companies with maturing loans face difficulties securing new financing at affordable rates.

- Higher cost of capital impacting leveraged buyouts: The cost of acquiring companies through leveraged buyouts (LBOs) has risen substantially, making these transactions less attractive.

- Strain on borrowers with high debt-to-equity ratios: Highly leveraged companies are particularly vulnerable, as their ability to service debt is directly tied to interest rate fluctuations. The increased burden can push them closer to insolvency.

Reduced Investor Appetite

As interest rates rise, alternative investments, such as government bonds, become more appealing. This shift in investor preference leads to a reduction in capital available for private credit.

- Flight to safety: Investors are moving away from riskier assets, including private credit, and seeking the perceived safety of government bonds.

- Reduced fund inflows into private credit funds: The flow of new capital into private credit funds has slowed considerably as investors become more cautious.

- Increased selectivity among investors: Investors are now more discerning in their choices, focusing on borrowers with strong credit profiles and lower risk profiles.

The Role of Leveraged Lending and Risk Appetite

The recent turmoil in the private credit market is significantly linked to the prevalence of leveraged lending and the associated risk appetite.

Over-Leveraging and Vulnerable Companies

A substantial portion of private credit is channeled into highly leveraged transactions. This strategy, while potentially lucrative in favorable economic conditions, amplifies vulnerability during economic downturns and interest rate hikes.

- Increased defaults among lower-rated borrowers: Companies with weak credit ratings and high debt levels are more susceptible to defaults.

- Concentration risk in certain sectors: Over-reliance on specific sectors intensifies the risk, as a downturn in a single sector can trigger widespread defaults.

- Exposure to cyclical industries: Businesses operating in cyclical industries (e.g., construction, manufacturing) are particularly vulnerable to economic fluctuations and higher interest rates.

Changes in Risk Assessment and Due Diligence

The current environment demands a more cautious approach to credit risk assessment and due diligence. Lenders are reassessing their risk tolerance and implementing stricter standards.

- More stringent underwriting standards: Lenders are implementing more rigorous underwriting processes, scrutinizing borrowers' financial health more thoroughly.

- Increased focus on covenant compliance: Lenders are paying closer attention to compliance with loan covenants to mitigate potential losses.

- Enhanced stress testing methodologies: Sophisticated stress testing models are employed to better assess the resilience of borrowers under various economic scenarios.

Impact on Various Market Participants

The current turmoil in the private credit market is impacting various market participants, including private equity firms, debt funds, investors, and the broader economy.

Private Equity Firms

Private equity firms, significant players in the leveraged buyout market, are facing considerable challenges.

- Decreased deal activity: The higher cost of debt is reducing the number of leveraged buyouts.

- Potential fire sales of assets: Some firms may be forced to sell assets at discounted prices to meet their financial obligations.

- Pressure on fund performance: Reduced deal flow and potential losses are putting pressure on fund performance and investor returns.

Debt Funds and Investors

Debt funds and their investors are directly impacted by the market volatility.

- Mark-to-market losses: Fluctuations in market values lead to mark-to-market losses for debt funds.

- Increased volatility in fund valuations: Fund valuations are experiencing increased volatility, impacting investor confidence.

- Potential for investor redemptions: Investors may seek to redeem their investments, putting further pressure on debt funds.

The Broader Economy

The instability in the private credit market has potential spillover effects on the broader economy.

- Reduced lending activity: The increased risk aversion among lenders could lead to a reduction in overall lending activity.

- Potential for credit crunch: A credit crunch, characterized by a shortage of available credit, could hinder economic growth.

- Impact on economic growth: Reduced lending and investment activity could negatively impact economic growth and job creation.

Navigating the Turmoil: Strategies for Investors

For investors in the private credit market, navigating the current turbulence requires a proactive and strategic approach.

Diversification and Risk Management

Diversification and robust risk management are critical for mitigating the risks associated with private credit investments.

- Strategic allocation: Diversify investments across various asset classes to reduce exposure to any single sector or risk factor.

- Stress testing portfolios: Conduct regular stress tests to assess the resilience of the portfolio under different economic scenarios.

- Hedging against interest rate risk: Employ hedging strategies to mitigate the impact of interest rate fluctuations.

Due Diligence and Credit Selection

Thorough due diligence and careful credit selection are more crucial than ever before.

- Detailed financial analysis: Conduct comprehensive financial analyses to assess the financial health and stability of potential borrowers.

- Assessment of management quality: Evaluate the management team's experience, expertise, and ability to navigate challenging economic conditions.

- Review of collateral and security: Thoroughly assess the collateral supporting the loan and ensure its adequacy.

Conclusion

The recent turmoil in the private credit market underscores the inherent risks associated with private debt investments, particularly in a rising interest rate environment. Understanding the factors driving this instability—including higher borrowing costs, reduced investor appetite, and increased leverage—is critical for navigating these challenges. Investors need to prioritize diversification, robust risk management, and meticulous due diligence when considering private credit market investments. Staying informed on weekly developments and adapting strategies accordingly is critical to mitigating risks and capitalizing on opportunities within the evolving landscape of the private credit market. Regularly review your exposure to private debt and consider consulting with financial professionals to develop a robust approach to private credit market investment.

Featured Posts

-

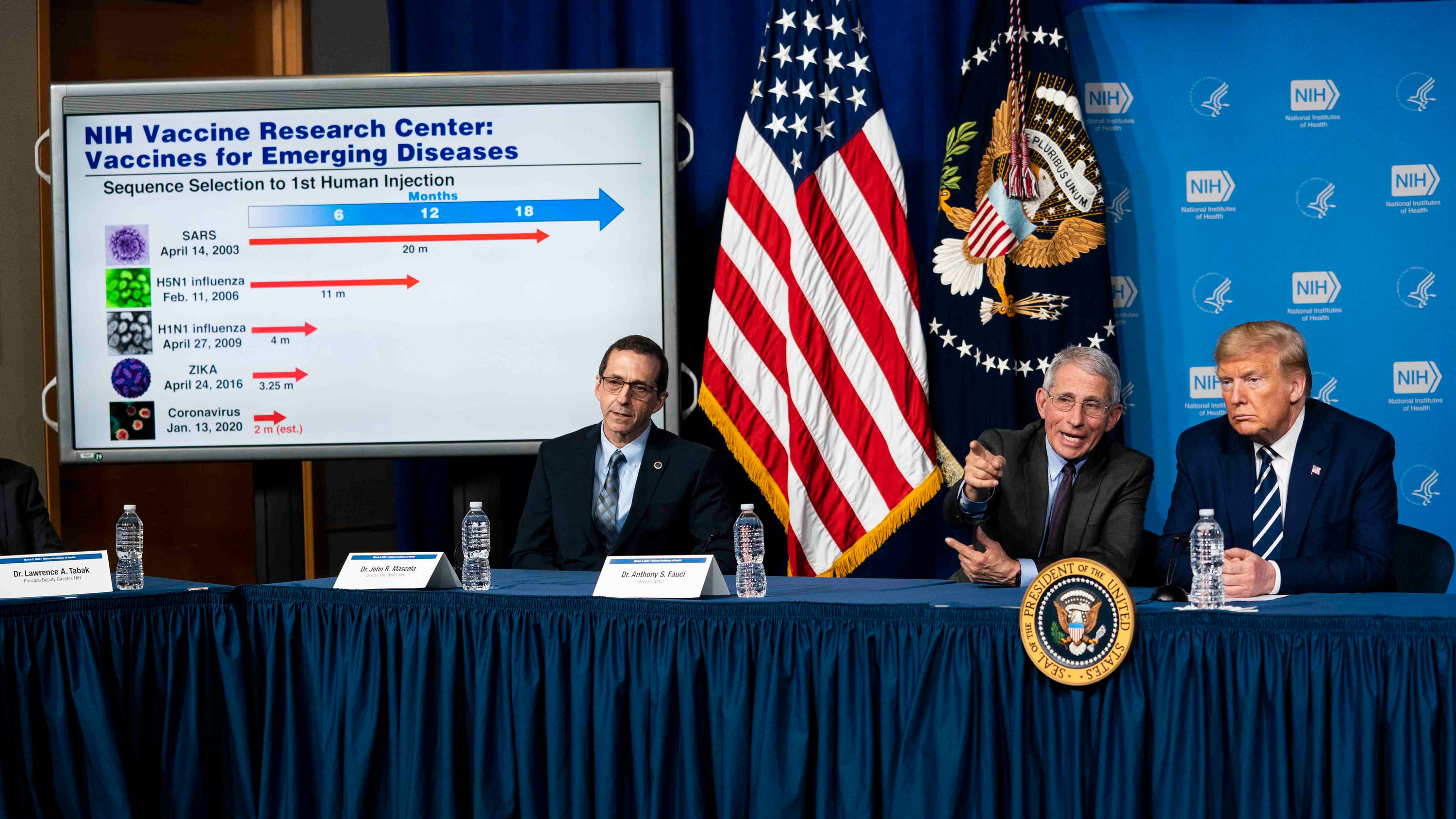

Controversial Appointment Vaccine Skeptic To Head Immunization Autism Research

Apr 27, 2025

Controversial Appointment Vaccine Skeptic To Head Immunization Autism Research

Apr 27, 2025 -

La Wta Lidera Pago Por Licencia De Maternidad Para Tenistas

Apr 27, 2025

La Wta Lidera Pago Por Licencia De Maternidad Para Tenistas

Apr 27, 2025 -

Trumps Tariff Threat Inevitable Job Cuts In Canadas Auto Industry

Apr 27, 2025

Trumps Tariff Threat Inevitable Job Cuts In Canadas Auto Industry

Apr 27, 2025 -

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025 -

Gensol Engineering Faces Pfc Complaint Over Alleged Falsified Documents

Apr 27, 2025

Gensol Engineering Faces Pfc Complaint Over Alleged Falsified Documents

Apr 27, 2025