Private Credit Jobs: 5 Do's And Don'ts For Success

Table of Contents

5 DO's for Success in Private Credit Jobs

Do 1: Network Strategically

Networking is paramount in the private credit industry. It's not just about handing out resumes; it's about building genuine relationships.

- Attend industry events and conferences: These provide invaluable opportunities to meet professionals, learn about current trends in private debt, and make connections.

- Leverage LinkedIn: Optimize your profile to showcase your expertise in areas like financial modeling and credit analysis. Actively connect with people working in private credit funds and related investment banking roles.

- Informational interviews: Reach out to professionals for informational interviews to learn about their career paths and gain insights into the industry. Target specific firms and individuals whose work aligns with your interests.

- Utilize alumni networks: If you're an alumnus of a reputable university, tap into your school's network to connect with graduates working in private credit.

- Join professional organizations: Organizations like the CFA Institute and industry-specific associations offer networking opportunities and access to valuable resources.

Do 2: Master Financial Modeling and Analysis

Proficiency in financial modeling and credit analysis is non-negotiable for private credit jobs.

- Excel proficiency: Master advanced Excel functions, including financial modeling techniques crucial for private debt valuation.

- Bloomberg Terminal: Familiarize yourself with this essential tool for financial data and analysis in the investment banking and private equity worlds.

- Develop a portfolio: Showcase your skills through personal projects, case studies, or even by analyzing publicly available financial information of companies in the private debt market. This demonstrates your proficiency in analyzing key financial metrics and ratios for private credit investments.

- Stay updated: The financial world is constantly evolving. Continuously learn about new methodologies and trends in financial modeling relevant to alternative credit and private equity.

Do 3: Tailor Your Resume and Cover Letter

Generic applications rarely impress. Each application must showcase your understanding of the specific firm and role.

- Keyword optimization: Use keywords from the job description to optimize your resume and cover letter for Applicant Tracking Systems (ATS) and human recruiters.

- Quantify achievements: Instead of simply stating your responsibilities, quantify your achievements with numbers and metrics to demonstrate your impact.

- Highlight relevant skills: Focus on skills and experience directly relevant to the specific job description, such as experience in credit underwriting, due diligence, or portfolio management within private debt strategies.

- Showcase soft skills: Emphasize strong communication, interpersonal, and teamwork skills, which are vital in collaborative environments such as private credit firms.

Do 4: Prepare for Behavioral and Technical Interviews

Private credit interviews are rigorous. Thorough preparation is crucial for success.

- Behavioral interview practice: Practice answering common behavioral questions, focusing on your strengths, weaknesses, problem-solving, and teamwork abilities.

- Technical interview preparation: Prepare for in-depth questions on financial modeling, valuation techniques for private debt, credit analysis, and relevant industry knowledge.

- Research the firm: Understand the firm's investment strategy, recent deals, and culture. Prepare insightful questions to ask the interviewer, demonstrating your genuine interest.

- Practice your presentation: If the interview involves presenting a case study, practice your delivery and ensure a clear, concise presentation.

Do 5: Follow Up and Stay Persistent

Persistence pays off. Don't let setbacks discourage you.

- Send thank-you notes: After each interview, send a personalized thank-you note reiterating your interest and highlighting key discussion points.

- Follow up strategically: Follow up with recruiters and hiring managers at appropriate intervals, but avoid being overly persistent.

- Maintain a positive attitude: Even in the face of rejections, maintain a professional and positive attitude. Each rejection is a learning opportunity.

5 DON'Ts for Success in Private Credit Jobs

Don't 1: Neglect Networking

Don't underestimate the power of networking. It's a crucial element in securing a private credit job. Don't rely solely on online job boards.

Don't 2: Underestimate the Importance of Technical Skills

Don't apply for private credit jobs without a solid foundation in financial modeling, credit analysis, and valuation. Continuous learning and skill development are essential.

Don't 3: Submit Generic Applications

Don't waste your time submitting generic applications. Tailor each application to the specific firm and role.

Don't 4: Underprepare for Interviews

Don't go into an interview unprepared. Practice your answers and research the firm thoroughly.

Don't 5: Give Up Easily

The job search can be challenging. Don't give up easily. Persistence and a positive attitude are key to success.

Conclusion

Securing a successful career in private credit requires a multifaceted approach. By following these five "Do's" and avoiding the five "Don'ts," you can significantly increase your chances of landing your dream job. Ready to take control of your private credit job search? Use these guidelines as your roadmap to success and start building your dream career in private credit today! Begin your journey by networking strategically and mastering the essential skills of financial modeling and credit analysis. Don't delay – your future in private credit awaits!

Featured Posts

-

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025 -

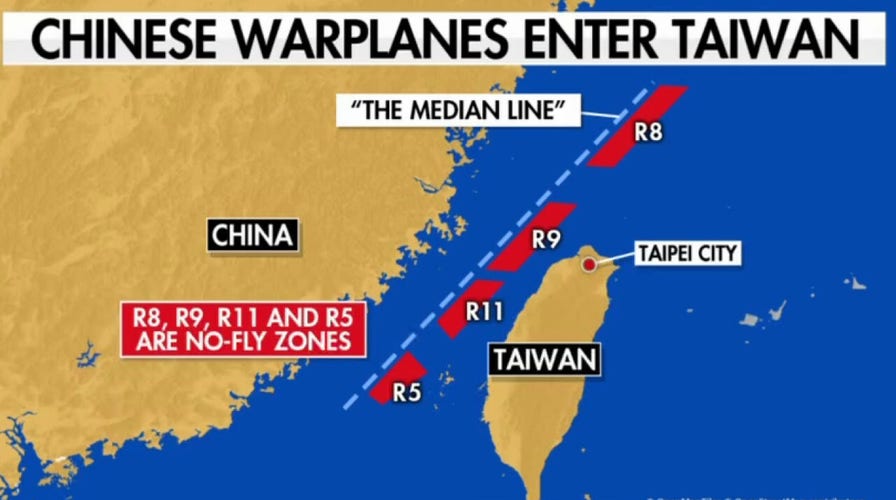

Analyzing The Us China Conflict The Role Of A Pivotal Military Base

Apr 26, 2025

Analyzing The Us China Conflict The Role Of A Pivotal Military Base

Apr 26, 2025 -

Following The Karen Read Case A Detailed Timeline Of Events

Apr 26, 2025

Following The Karen Read Case A Detailed Timeline Of Events

Apr 26, 2025 -

White House Cocaine Incident Secret Service Investigation Update

Apr 26, 2025

White House Cocaine Incident Secret Service Investigation Update

Apr 26, 2025 -

The Long Shot Ahmed Hassaneins Bid For An Nfl Draft Spot

Apr 26, 2025

The Long Shot Ahmed Hassaneins Bid For An Nfl Draft Spot

Apr 26, 2025