Point72 Trader Departure: Emerging Markets Fund Closure

Table of Contents

The Trader's Departure: Understanding the Impact

The departure of [Insert Name of Trader, if known, otherwise use "a senior portfolio manager"], a key figure within Point72's emerging markets team, has sent shockwaves through the financial community. While the exact reasons for their departure remain officially undisclosed, several possibilities warrant consideration. These include personal reasons, strategic disagreements with Point72's overall investment approach, or perhaps a more lucrative opportunity elsewhere.

Understanding the trader's impact requires examining their tenure at Point72. [Insert details about the trader’s experience, length of employment, and specific responsibilities]. Their contributions to the firm's emerging markets portfolio were significant, shaping investment strategies and potentially influencing overall performance.

- Key Achievements: [List specific achievements, such as successful investments in specific emerging markets, exceeding benchmark returns in particular years etc.]

- Potential Shortcomings: [Mention any instances of underperformance or controversial investment decisions if known and sourced from reputable news outlets.]

The departure of such a prominent figure will undoubtedly impact team morale and the overall strategic direction of Point72's emerging markets division. The loss of institutional knowledge and established relationships could pose significant challenges in the short term.

Emerging Markets Fund Closure: Reasons and Implications

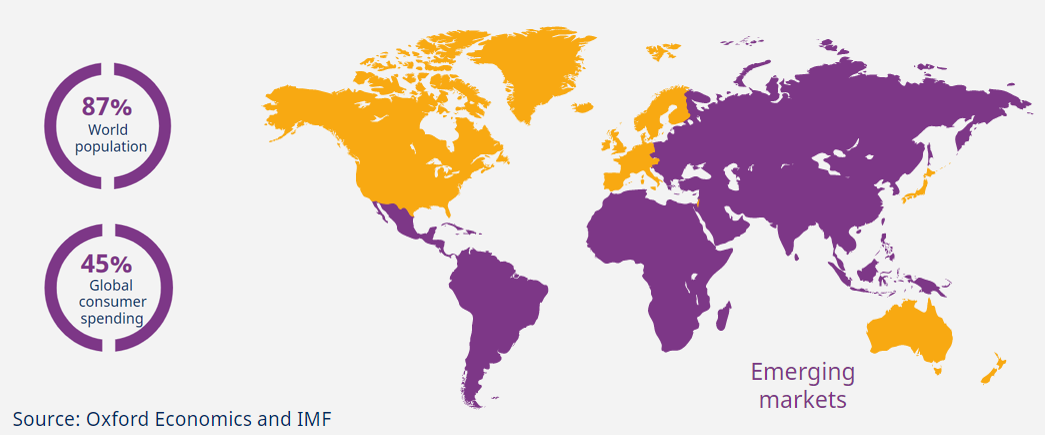

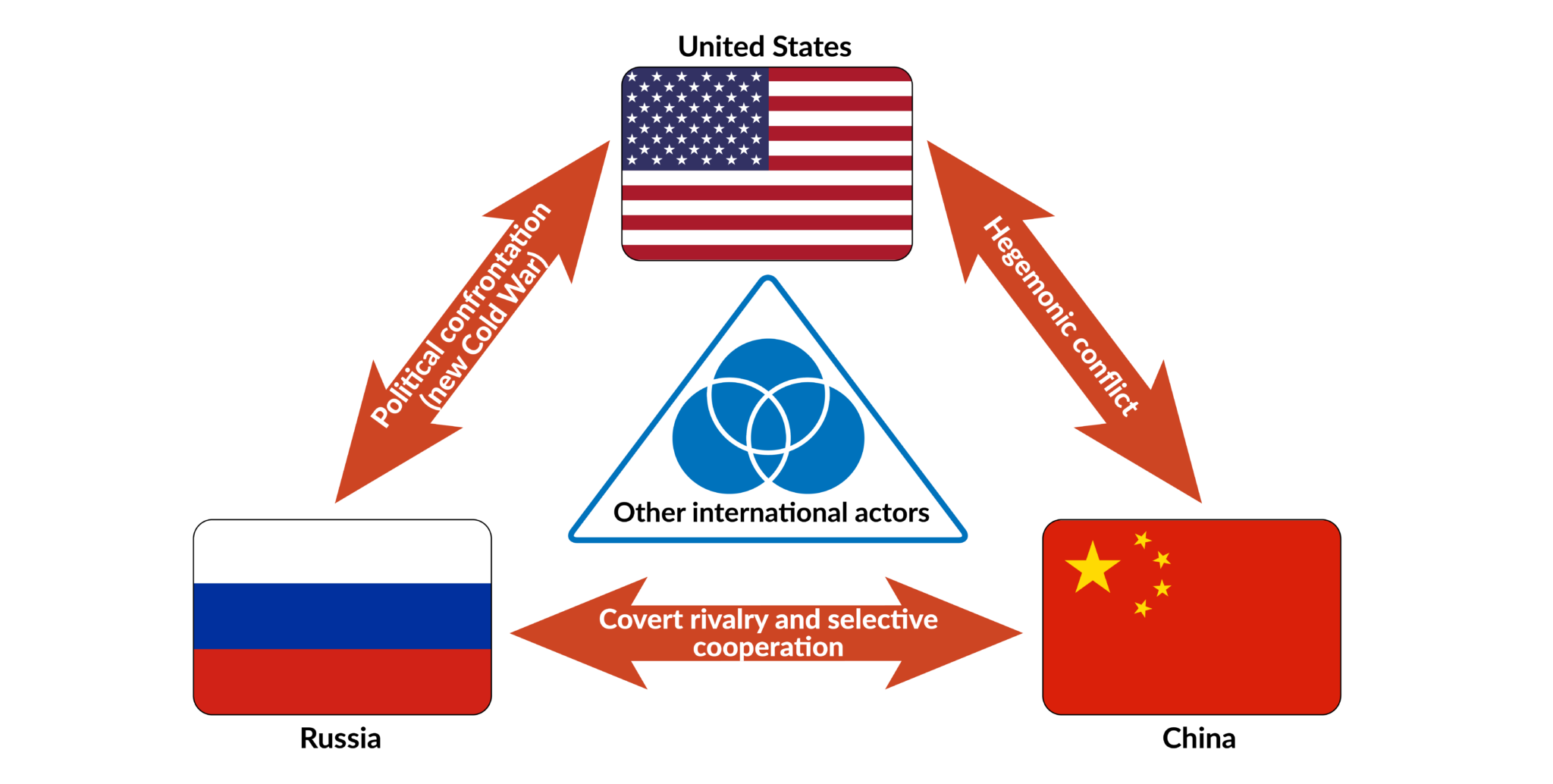

The closure of Point72's emerging markets fund is a direct consequence of the changing internal dynamics and potentially reflects broader market conditions. Several factors likely contributed to this decision:

-

Poor Performance: The fund's performance relative to benchmarks and competitor funds may have fallen below expectations. This could be attributed to several factors, impacting investor confidence and profitability.

-

Strategic Realignment: Point72 might be realigning its investment strategy, focusing resources on other sectors deemed more promising or less risky.

-

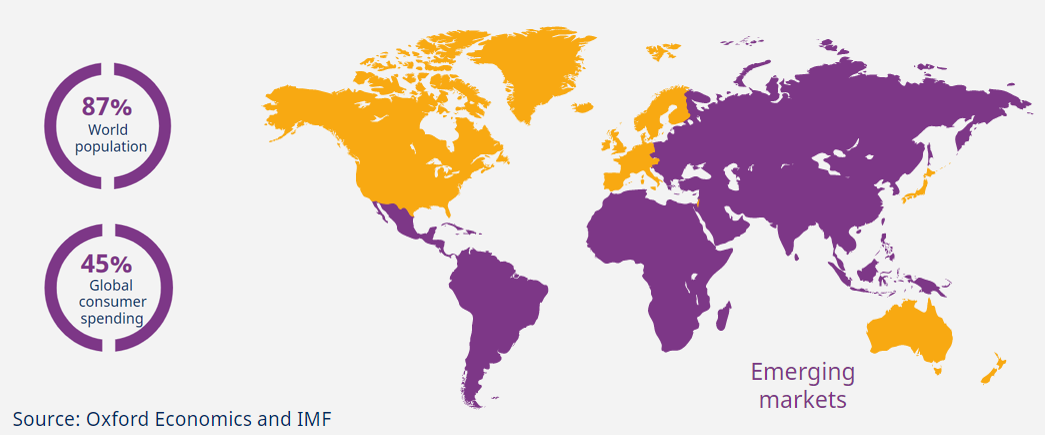

Market Conditions: Geopolitical instability, economic downturns in specific emerging markets, and overall market volatility can significantly impact fund performance and lead to strategic withdrawals.

-

Factors Contributing to Underperformance:

- Geopolitical risks in specific regions (e.g., political instability, conflicts).

- Economic downturns in key emerging markets (e.g., currency devaluation, inflation).

- Unexpected regulatory changes impacting investment strategies.

The closure of the fund carries significant financial implications for Point72 and its investors. The impact on Point72's overall profitability will depend on the fund's assets under management and its overall performance history. Investors will need to reassess their portfolios and consider the implications of this significant shift in Point72's strategy.

Point72's Future Strategy and Response to the Changes

Point72 has [Insert any official statements released by the firm regarding the departure and fund closure]. The firm's future strategy in emerging markets remains uncertain. While a complete withdrawal from the sector is possible, it's also plausible that Point72 might re-enter the market with a revised strategy and a restructured team. This could involve:

- Focusing on specific emerging markets: Concentrating investments in regions with more stable economic and political environments.

- Adopting a more cautious approach: Reducing risk exposure through diversification and stricter investment criteria.

- Partnering with other firms: Collaborating with local experts or established players in the emerging markets sector.

This event could affect Point72's overall reputation and investor confidence. Transparency and clear communication will be crucial in mitigating negative perception and maintaining investor trust.

Conclusion: Navigating the Aftermath of the Point72 Trader Departure and Fund Closure

The departure of a key portfolio manager and the closure of Point72's emerging markets fund mark a significant turning point for the firm. The reasons behind these events are complex and interwoven, encompassing individual decisions, internal strategic shifts, and external market forces. The long-term implications for Point72 and its investors remain to be seen, but understanding the factors involved is crucial for navigating the evolving landscape of emerging market investments.

Call to Action: Stay updated on the latest news regarding Point72's strategic moves and the evolving landscape of emerging market investments. Consult reputable financial news sources and Point72's investor relations page for further information.

Featured Posts

-

Cassidy Hutchinsons Memoir Key Jan 6th Witness Tells All This Fall

Apr 26, 2025

Cassidy Hutchinsons Memoir Key Jan 6th Witness Tells All This Fall

Apr 26, 2025 -

Us China Competition A Military Bases Strategic Importance

Apr 26, 2025

Us China Competition A Military Bases Strategic Importance

Apr 26, 2025 -

I Secured My Nintendo Switch 2 Preorder The Game Stop Line Experience

Apr 26, 2025

I Secured My Nintendo Switch 2 Preorder The Game Stop Line Experience

Apr 26, 2025 -

Pandemic Era Covid Test Fraud Lab Owners Guilty Plea

Apr 26, 2025

Pandemic Era Covid Test Fraud Lab Owners Guilty Plea

Apr 26, 2025 -

Anchor Brewing Company Closing After 127 Years The End Of An Era

Apr 26, 2025

Anchor Brewing Company Closing After 127 Years The End Of An Era

Apr 26, 2025